The heat is on while the Fed stays cool on interest rates

Before jumping into our energy-focused calls for this week, we must first take a look at the Fed’s stand-pat announcement on rates yesterday and how we see it impacting things for us investors in the near-term.

After yet another two-day Federal Open Market Committee meeting, the Federal Reserve has again opted to leave interest rates unchanged, compared with earlier expectations for four hikes in 2016.

In digesting the Fed’s July press release, my initial view is that it was stitched together from previous ones because, by and large, the commentary was very much the same as we’ve seen over the last few months. Words like “moderate,” “some increase,” “run below,” “remain low,” and “little changed in recent months” tell me that despite the very recent improvement in domestic economic data (which has led to an increase in the Citi Economic Surprise Index), the Fed is keeping one eye out for more data confirmation on the strength (or weakness) in the economy, while keeping another eye on what is happening outside the US.

There are still ample unanswered questions regarding the implementation and impact of Brexit, as well as other issues, including the UK’s July drop into economic contraction territory, continued weakness in the Chinese and Japanese economies and Friday’s Italian bank stress tests. From what my Cocktail Investing co-author Lenore Hawkins is seeing with her proximity to economic problems in Italy, there is little indication that some sort of solution for the troubled banks is in the works, which could mean market fireworks in the near future. This is certainly not the time to get long the iShares MSCI Italy Capped ETF (EWI).

In addition, commentary during the current earnings season from companies ranging from Caterpillar (CAT) to Honeywell (HON), as well as industry data from the trucking and rail industries, continues to paint a tepid global economic picture. In terms of risk vs. reward, the Fed opted to err on the side of easy monetary policy lest it choke the burgeoning flame of the domestic economy.

The market’s reaction was pretty much a loud and resounding “meh” on the Fed news, which tells us this is what everyone expected — they must all be reading the Monday Morning Kickoff! The fact that there was no scheduled press conference following the decision was a likely tip-off. We doubt the Fed would act without explaining its reasons for doing so.

With the next FOMC scheduled for Sept. 20-21, we are again in data-dependent mode when it comes to monitoring the economy and speculating on Fed timing. The fact that it is an election year, and a contentious one at that, paired with little business investment occurring (no surprise again because it is an election year), odds are the economy will remain on the same flight path. In other words, 2 percent to 2.5 percent GDP growth in the back half of 2016 could lead some folks to further revisit earnings expectations for the back half of 2016.

The realization the Fed is not going to boost interest rates near term weighed on PowerShares DB US Dollar Bullish ETF (UUP). Even though our PowerShares DB US Dollar Bullish ETF (UUP) August 2016 $25 calls (UUP160819C00025000) were still above the strike price, the move lower in UUP shares led to our being stopped out of the position.

The Heat is On

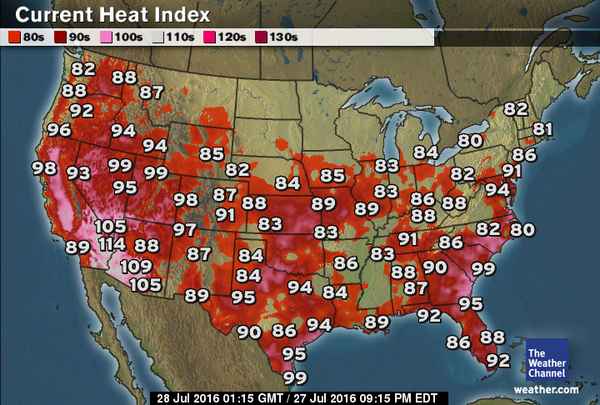

In our opening comments to yesterday’s Tematica Investing we commiserated with you over the summer heat. While we’re not weathermen, we know we’ve had to put our air conditioning to the test in what The Weather Channel has called a stretch of oppressive heat and humidity across from the Plains and Midwest into the East. Heat alerts had been issued for more than a dozen states from Louisiana to Minnesota. Heat advisories were extended to cover parts of Michigan, Indiana and northwest Ohio, and Kentucky, and in larger areas of states already under watch. Excessive heat warnings were in place for all of Iowa and large parts of Nebraska, the Dakotas and Illinois.

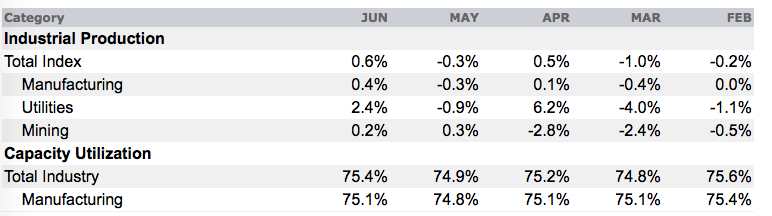

To combat the heat, we’ve seen a pick up in Utility production in the reported monthly Industrial Production figures. Even the Federal Reserve recognized that warmer weather in June boosted air conditioning demand, which fueled the strong uptick in utilities output (see table). Odds are high we will see them move even higher in the July data when it’s published in a few weeks.

Given those strong prospects we are adding the Utilities Select Sector SPDR ETF (XLU) September $53 calls (XLU160916C00053000) that closed last night at 0.57. We’re opting to trade the September calls because the strike date shoed capture the August Industrial Production data. We would add the XLU September $53 calls up to $0.65, and we are putting a protective stop in at 0.35 to manage downside risk.

We are also adding the Southern Company (SO) September $55 calls (SO160819C00055000) following a sharp pullback yesterday to 0.19 from 0.44 the day before. This Atlanta, Georgia-based company is one of the largest utilities in the US Through its eleven electric and natural gas distribution units in nine states, Southern Company serves approximately nine million customers. We would not chase the SO calls beyond $0.25, and we are setting a protective stop at 0.12.

Stopped out of AT&T calls

Earlier this week, AT&T (T) shares got dinged on the news that Verizon Communications (VZ) won the bid for Yahoo! (YHOO). We shared our views on why not getting Yahoo! is actually a positive for AT&T, and while we think the market will once again come around to our way of thinking, the drop caused us to be stopped out of our AT&T September 2016 $44 calls (T160916C00044000) when the fell to 0.24. Our losses were limited thanks to our protective stop loss at 0.30, bitter sweet for sure, but far better than what could have been.

Recap of Actions from this week:

- Issuing a Buy on Utilities Select Sector SPDR ETF (XLU) September $53 calls (XLU160916C00053000). Calls closed last night at 0.57 and we would add the calls up to $0.65, while adding a protective stop in at 0.35.

- Issuing a Buy on Southern Company (SO) September $55 calls (SO160819C00055000). We would not chase the calls beyond $0.25, and we are setting a protective stop at 0.12.

- We were stopped out of both our PowerShares DB US Dollar Bullish ETF (UUP) August 2016 $25 calls (UUP160819C00025000) and our AT&T September 2016 $44 calls (T160916C00044000) earlier this week.