The Cashstrapped Consumer looking more and more like the new normal

While politicians in Washington, DC will argue the US economy is “fine,” despite the disaster that was the initial 2Q 2016 GDP print of 1.2 percent, consumers are still wary of the US economy. Even though they feel more secure in their jobs, they remain hesitant to return to their “spend with abandonment” attitude that was so rampant a decade ago.

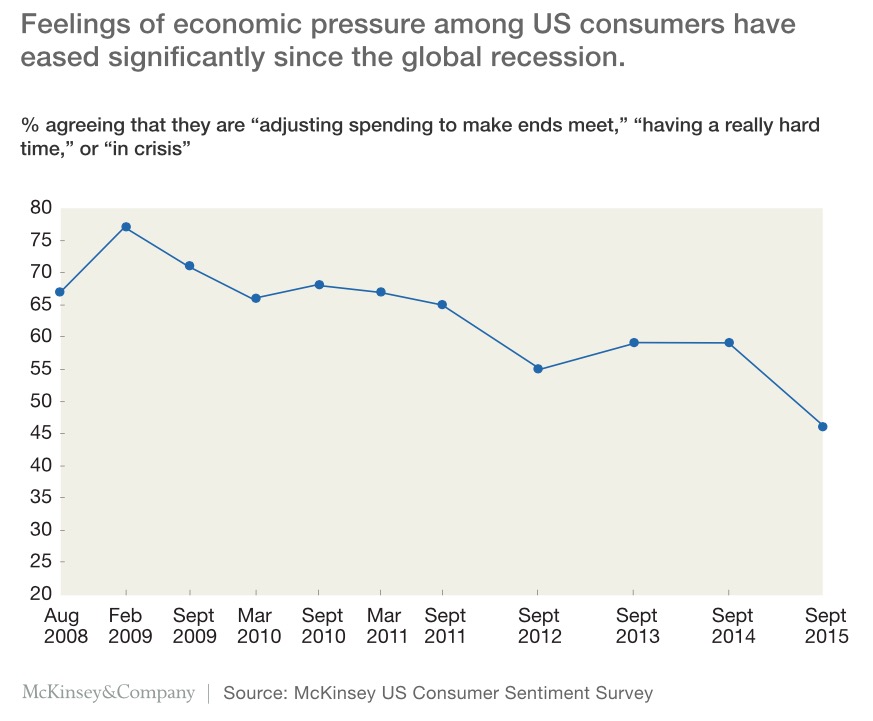

Findings from a new McKinsey survey show “only 23 percent of survey respondents, down from a high of 48 percent in 2009, said they are finding it harder to make ends meet than they did a year ago.” However, despite that drop, “more than 30 percent of Americans said they’re cutting back on spending or delaying purchases.”

Findings from a new McKinsey survey show “only 23 percent of survey respondents, down from a high of 48 percent in 2009, said they are finding it harder to make ends meet than they did a year ago.” However, despite that drop, “more than 30 percent of Americans said they’re cutting back on spending or delaying purchases.”

Not good for an economy in which consumer spending is the main driver.

Why is this important?

We’ve known for some time now that US citizens have been woefully under-saving for retirement, with nearly a third lacking any retirement savings at all. What we’re seeing is a shift in consumer mindset that meshes with our Cash-strapped Consumer theme and Aging of the Population theme. We say this given the fact that “Consumers said that if their incomes were to rise by 10 percent, they’d spend only about 21 cents out of every dollar of that extra money; the rest would go into savings and toward paying off debt.”

Perhaps consumers are feeling the pinch of higher monthly payments given the rise in auto loans and credit card debt that led U.S. household debt to hit $12.29 trillion in 2Q 2016, up $434 billion from a year earlier per the Federal Reserve Bank of New York. But also as the largest generation in history is moving into their retirement years, the reality of living on a fixed-income is setting in for more and more households, and thus having to make hard spending decisions around things like healthcare, financial services and housing (all part of our Aging of the Population theme).

Riding the Thematic Wave

While fewer consumers report trading down, they have shifted where and how they are purchasing, we’re still Americans after all! US consumers claimed to have shifted as much as one-fifth of their spending toward each of three channels: online pure-play retailers, such as Amazon (AMZN); hard discounters, such as Walmart (WMT); and club stores like Costco Wholesale (COST). We’ve seen these shifts in comparing monthly retail sales data vs. reported metrics by Costco, and non-retail stores figures vs. overall monthly retail sales figures.

It’s no secret that Walmart’s top-line sales have suffered as it, and other retailers, have faltered on the shift to online shopping. Even Walmart CEO Doug Mcmillon admitted the company’s e-commerce growth “is too slow,” so the discount retailer’s move to acquire online retailer Jet. com came as little surprise. This point is illustrated in the sizable gap between Walmart’s online sales of $14 billion (roughly 3 percent of the company’s 2015 revenue) vs. Amazon’s 2015 retail revenue of $99 billion.

Jet.com claims to offer lower prices than Amazon and other retailers through a complex pricing model whereby customers enjoy discounts when items purchased are at distribution centers near the customer’s location or when buying in bulk, waiving the ability to return items, and by using a debit card rather than a credit card. All that sounds great until you get to the part where the company expects to spend hundreds of millions on advertising over the next three years and has no clear path to profitability. On top of that, the company recently removed the annual membership fee, which was expected to have gone a long way toward helping reduce the company’s losses.

Jet.com claims to offer lower prices than Amazon and other retailers through a complex pricing model whereby customers enjoy discounts when items purchased are at distribution centers near the customer’s location or when buying in bulk, waiving the ability to return items, and by using a debit card rather than a credit card. All that sounds great until you get to the part where the company expects to spend hundreds of millions on advertising over the next three years and has no clear path to profitability. On top of that, the company recently removed the annual membership fee, which was expected to have gone a long way toward helping reduce the company’s losses.

The Walmart – Jet deal is expected to be in the $3 billion range, which would be the largest acquisition by Walmart in over five years, and given the level of losses at the company, this isn’t an immediately accretive move for Walmart. Clearly, that advertising spend will look a bit different when merged in with Walmart’s other efforts, but to us, this looks like a rather desperate move for a company that has been unable to drive sufficient online business organically.

Walmart has a long road ahead of itself if it wants to catch up to not only the number of items that Amazon offers but also the compressed time to the customer. Both are hallmarks of Amazon’s Prime service. In our opinion, while Walmart is likely to improve its digital commerce position with the purchase of Jet, it will take much time, money and effort by Walmart to challenge the degree of consumer affinity that Amazon enjoys.

Meanwhile, Amazon continues to invest ahead of the 2016 holiday shopping season, which likely means Walmart will have a tough time hitting a moving target as Amazon continues to invest in growing its offerings and delight its customers as it compresses delivery time to them, which United Parcel Service (UPS) and its local UPS Stores are playing more and more of a critical role in its success.

Hitting the Thematic Wall

As the McKinsey report notes, the one area that has yet to catch fire with regard to online sales is grocery. Amazon’s expanding footprint and Walmart’s partnering with Uber and Lyft for online grocery delivery as well as Walmart continued geographic expansion of the service bear watching with regard to Kroger (KR) and other traditional grocery chains. With grocery yet to feel the pain, perhaps this helps explain why SuperValu (SVU) is looking to spin Save-A-Lot out in what looks to be a 60/40 split with the intention of SuperValu exiting its 40 percent stake within two years.

And notice we didn’t mention Target (TGT) once during this entire dialogue…. that’s because those shoppers are now heading in droves over to Amazon Prime!