A Sobering Week for Stocks Ahead of the Santa Claus Rally

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

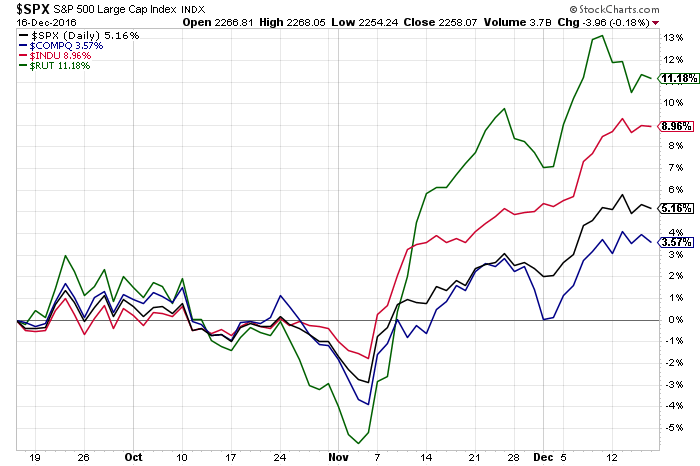

After what appears to have been a jetliner takeoff-like climb in the market since the election, the stock market leveled off last week to a comfortable cruising altitude to continue the metaphor. The Dow Jones Industrial Average did manage to tick a bit higher last week, while both the S&P 500 and the Nasdaq Composite Index finished the week relatively unchanged. We’d point out the small-cap heavy Russell 2000 finished the week down more than 1 percent.

To be blunt, the stock market started the week off on strong footing, but as things progressed, investors were reminded that all is not swimmingly well in the world. As the days ticked by and we were hit with a mixed bag of economic data, the reality came home that just because we have a new president-elect doesn’t mean all economic woes have all been erased.

Now, we’re not all “Debbie-Downers” here at Tematica— there were certainly some developments last week that have given us reason to be optimistic:

- Manufacturing conditions improved across the world in December, with the Eurozone coming in particularly strong.

- In the U.S. the Flash PMI was the highest in 21 months, with robust increases in new orders and job creation.

- Regional Fed manufacturing indices for both New York and Philadelphia came in stronger than expected.

We must, however, temper that enthusiasm with the following:

- We are seeing the highest level of subprime auto defaults since the summer of 2006.

- Retail sales growth has been flattish or contracting in 3 out of the 5 past months.

- We are seeing a decrease in commercial real estate credit — that is a late-cycle indicator and decidedly not inflationary with commercial and industrial loans contracted at a 2.8 percent annualized rate last month.

- Industrial Production is lower today than in was in March 2014 and the 12-month moving average for Industrial production has been negative for the past 15 months.

- Manufacturing capacity utilization rates fell to an 8-month low in November, coming in at 75 percent, well below the most recent 80.9 percent peak in November 2007. For reference, back in January 1967, it was 89.4 percent.

- We just saw average car purchase incentives reach a record 9.9 percent discount. That surpasses even the 2008 giveaways when the world was coming to an end and deflationary.

- While we are hearing a lot of talk about inflation and even suggestions that China could shift into an inflation exporter, but China’s corporate debt to GDP has exploded from 125 percent in 2008 to 250 percent today.

- In the U.S., non-financial corporate debt has grown from 229 percent in Q4 2007 to 313 at the end of Q3 2016.

- The U.S. Total Public Debt to GDP has skyrocketed from 62.8 percent in Q4 2007 to 104.9 percent.

Put it all together and we find more support than not for our view that the US stock market is ahead of itself. But wait… there’s more to be had on that.

The Fed gets too far out over its skis as it looks ahead to 2017

Also weighing on the market last week was the revelation that the Fed sees up to three interest rate moves higher in 2017, compared to the prior view calling for two. That news understandably overshadowed the widely telegraphed and certainly expected 25 basis point rate hike that was made a reality coming out of the Fed’s December FOMC meeting this past Wednesday.

With that bumped-up outlook, the Fed’s shared that it’s dovish bent remained intact and once again trotted out the much-used, if not often-abused “data dependent” phrasing when it comes to those follow-on rate increases. Let’s remember, over the last few years the Fed has often targeted raising rates, but did far less than it telegraphed for a variety of reasons. The message here is just because the Fed thinks it might raise rates, does not mean it eventually will raise rates.

Getting back to the Fed’s FOMC meeting, to us, it was the modest changes to the Fed’s 2016 and 2017 economic projection, issued alongside the FOMC statement, that was more interesting and in some way reaffirming to our current thoughts. The revised forecast showed a modest bump higher in both 2016 and 2017 GDP expectations to 1.9 percent and 2.1 percent, respectively, from the 1.8 percent and 2 percent forecast in September.

Alongside those revisions, the Fed’s unemployment forecast also ticked lower compared to September expectations. For 2018, it still sees GDP at 2 percent, which suggests the Fed isn’t quite ready to forecast any increase in growth rates from the potential stimulus policies to be enacted by President-elect Trump just yet, even though the stock market has risen over the last six weeks.

It seems we are not alone in Kansas Toto.

The Almighty Dollar

Something we expect to hear much about in upcoming earnings calls

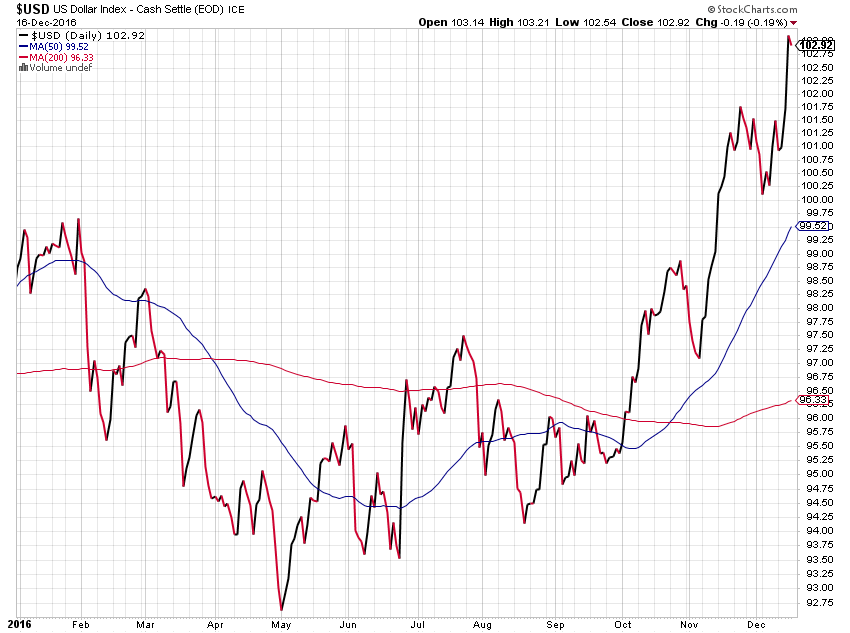

With the news that the Fed could, maybe, might, possibly boost interest rates three times in 2017 — compared to just two over the last year — the US dollar resumed its upward climb. Great for US travelers heading abroad, but as Adobe Systems (ADBE) shared last week during its quarterly earnings call, “the U.S. dollar has strengthened considerably” and if it continues, “FX rates will affect our ability to achieve the preliminary annual targets due to the impact in the second half of FY ’17.”

While corporate earnings are relatively light this time of year, we do expect the dollar and currency to be a meaningful topic when companies report their December quarter results and offer their first real hard look at how they see 2017 shaping up. We say this because from a sector perspective nearly 70 percent of the Technology sector revenue is derived from foreign operations with 50 percent of Materials and 33 percent of Energy and Industrials in the same boat.

Does This Post-Election Rally Have Legs?

Over the last several weeks, we’ve been experiencing the typical post-election rally that pushes equities up more dramatically when we see a material changing of the guard. As investors, we are certainly fans, but we also have to realize that just like the “recovery” of the last few years, things underlying the recent rally are also different this time:

- With the economy remaining well below long-term norms for GDP growth, it has led to more optimism than usual around the potential impact of President-elect Trump’s pending policy moves regarding regulation and taxation.

- Conventional wisdom is that tax rates will be lower in 2017 than in 2016, so investors are holding out until the New Year to sell any positions with gains, which leaves us with a market with very few sellers. Under those conditions, it doesn’t take much to move markets up and fast, just like we’ve seen of late.

- Rising inflation expectations have investors bailing out of bonds like a cat out of the bath, creating a tidal wave of money that has to go somewhere… and as we’ve seen it’s been into equities, especially US equities.

- In the past two months, the yield on the thirty-year U.S. Treasury bond has risen 66 basis points and we’ve got a heck of a lot more debt outstanding today that is getting more and more expensive as yields rise. This means that the government, businesses and many households are going to have more of their cash going towards paying for their debts rather than growing the economy. Regardless of what regulatory or tax policy reforms we see in the coming years, higher interest rates with that much debt serve as a serious drag on the economy.

As many an economics student realizes, rising interest rates are a likely headwind to homebuilders as they imply more expensive mortgages. You wouldn’t think that today, however, given that homebuilder confidence spiked 7 points in December, rising to the highest level since July 2005 and delivering the biggest one-month jump in 20 years. Quite the disconnect, but one that is explained by National Association of Homebuilders Chairman Ed Brandy. Per Brandy, this notable jump was driven by hopes that President-elect Trump will be able to, “…cut burdensome regulations that are harming small businesses and housing affordability…This is particularly important, given that a recent NAHB study shows that regulatory costs for homebuilding have increased 29 percent in the past five years.”

Lower regulations most likely means lower costs, and we can certainly see how homebuilders would like that when examining their P&L outlook.

Here too, it appears expectations have once again gotten a wee bit ahead of themselves. Offsetting that spike in homebuilder confidence, November Housing Starts fell nearly 19 percent to a seasonally adjusted annual rate of 1.090 million units, well below the consensus expectation of 1.225 million for the month. We’ll be looking to see if the Trump Bump trickles to the housing market with the December data, but the falloff in building permits suggests otherwise as we head into the seasonally slow part of the year for housing. Yep, some of us are all “here comes Santa Claus”, but the cold and winter tend to put a damper on homebuilding activity.

That’s not the only mismatch we’re seeing. There are conflicting perspectives in other surveys, revealing enthusiasm tempered by the awareness that uncertainty over the near term and most likely medium term remain. We still don’t know exactly how all of those lovely sounding Trump policies will shake out. For example, the NFIB’s Small Business Conditions report reveals that post-election small businesses report that they think now is a much better time to expand than prior to the election. But when asked about their own spending plans, they report that they actually will reign those in, relative to plans prior to the election. Turns out that “now is a good time for your someone ELSE to expand, while I wait to see what happens!”

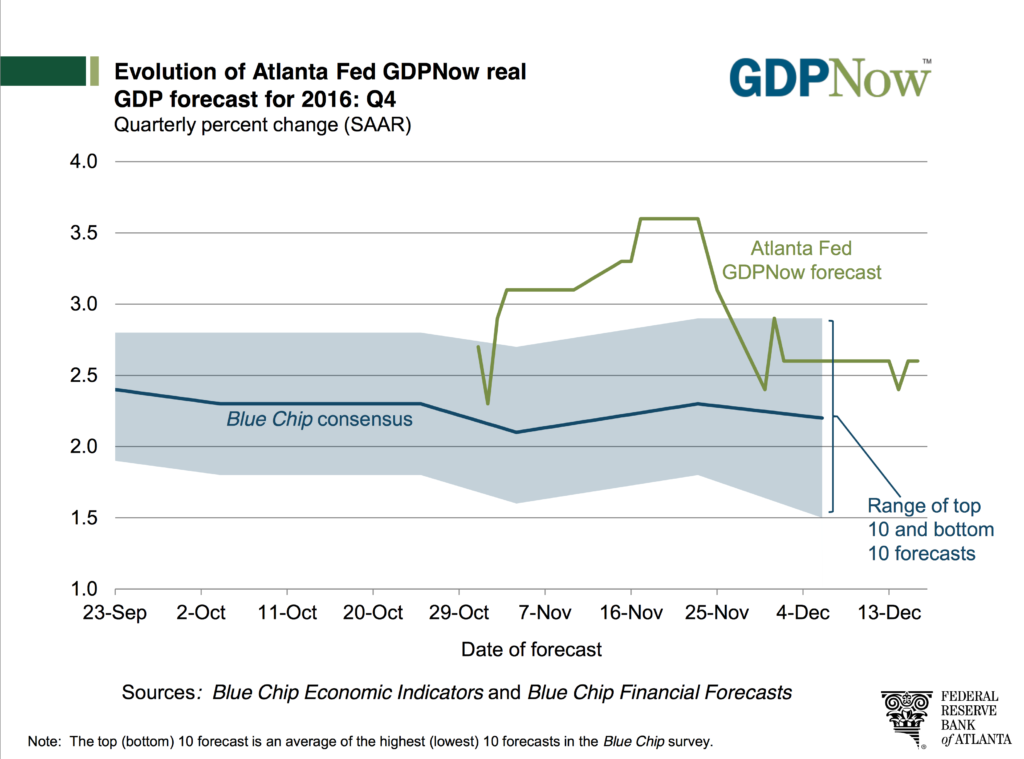

Finally, exiting last week the Atlanta Fed’s GDP Now forecasts GDP of 2.6 percent for the current quarter. In our view that seems a little ahead of itself, given the data, and we aren’t the only ones that are eyeing that data and seeing weakness. UBS (UBS) recently released its GDP estimate for 4Q at 1.7 percent with JP Morgan (JPM) calling for a whopping 1.5 percent. Even the Federal Reserve Bank’s Nowcast stands at 1.8 percent for the current quarter, with a downtick to 1.7 percent for 1Q 2017.

Is This a Good Time to Get Into the Market?

Even after factoring the week’s moves in the stock market, all four indices were still well into the green on a quarter-to-date basis with the strongest performer being the Russell 2000 (up more than 9 percent) and the Nasdaq (up more than 2 percent) being the laggard. This prompted the logical question that Tematica’s Chief Macro Strategist Lenore Hawkins faced last Friday morning when she appeared on Fox Business with Stuart Varney, who asked, “Is this a good time to get into the market?”

Her response centered on the fact that we’ve only seen a stock market this expensive in 2007, 2000 and 1929, which means there is a lot more downside risk today than upside potential. After the New Year, some of these supports disappear so a pullback would be quite reasonable given the near-parabolic moves we’ve seen in some stocks and sectors post-election. That response led Varney to declare Hawkins the lone voice of reason that morning.

While we would love to see the economy really take off, the reality is too many economic fundamentals are not exactly pointing to inflation nor accelerating growth. As we said last week, “past a certain point the stock market’s valuation and expectations will have to contend with economic reality.” We would love nothing more than to see that optimism proven out, but we’re cognizant that the reforms the market has already priced in will take time.

While enthusiasm is running high for what’s to come in 2017, companies still have to contend with the final quarter of 2016 and likely the full first quarter of 2017 before any potential tax cuts, regulatory reform, infrastructure spending and other Trump stimulus plans actually hit the books. As far as those plans go, we have no track record for just how effective Trump will be operating in the DC political environment. In addition, the fundamental headwinds of aging demographics, elevated debt, a strong dollar and the later stages of the business cycle are not in his favor.

It looks like we aren’t the only ones concerned with the mismatch of expectations and economic reality that has accompanied lofty stock prices — according to InsiderScore, insiders in the Banking and Industrial sectors have been selling their shares at an unusually strong pace!

Our message as we get ready for the holidays is to tread carefully near-term. This has the inner value investor in us looking at the intersection of thematic tailwinds and stocks that have lagged the market. If we’re right, come January-February that potential pool of investment candidates is likely to get a lot bigger.

The Week Ahead

While we expect market activity to slow as this week progresses and we count down the days to the Christmas holiday and the end of 2016, we’ll still get a hefty dose of data.

On the economic front, we’ll get the third look at 3Q 2016 GDP, and so far expectations call for no real change from the last print of 3.2 percent. Granted that’s looking in the rear view mirror, and we’ll be looking at this week’s data — the November reports on Durable Orders, Existing Home Sales, Personal Income & Spending, Leading Indicators and New Homes Sales — to better gauge the expected GDP step down for the current quarter vs. the prior one that we mentioned above.

On the thematic investing front, we’ve got earnings reports across several or our investing themes and for those still clinging to sector-based investing, 13 S&P 500 companies (including 1 Dow 30 component) are scheduled to report results for the fourth quarter. Amid the last-minute holiday shopping, we’ll be tuning into to Rise & Fall of the Middle-Class investment theme company Nike (NKE) to hear the latest on footwear demand, but also to match its dollar comments and currency expectations against those shared by Adobe last week.

Carmax (KMX) should give some insight on the usage of auto incentives as well as the tone of new and used car demand — a Rise & Fall of the Middle-Class investment theme beacon if there was one. Blackberry (BBRY) — yes, we know it’s hard to believe that company is still around given the success of the iPhone and Android smartphones — should give a clue on current smartphone demand — a key lever for our Connected Society theme — even though we expect Blackberry itself to be a net market share loser once again.

Happy Holidays!

Much like many of you, we too at Tematica will be taking some much-needed time off between beginning late this week. We’ll be back in the saddle come the New Year, and we wish all of you and yours a happy holiday season, Merry Christmas and nothing but the best to kick off 2017!

Earnings on Tap This Week

The following are just some of the earnings announcements we’ll have our eye on for thematic confirmation data points:

Affordable Luxury

- BMW AG (BAMXF)

- Carnival Corp. (CCL)

Aging of the Population

- Rite Aid Corp. (RAD)

Asset Lite Business Models

- Accenture PLC (ACN)

Cash-strapped Consumer

- Bed, Bath & Beyond

Connected Society

- Blackberry Ltd. (BBRY)

- FedEx Corp. (FDX)

- CalAmp Corp. (CAMP)

Fattening of the Population

- Darden Restaurants (DRI)

- General Mills (GIS)

- Hostess Brands (TWNK)

- Cal-Maine Foods (CALM)

Rise & Fall of the Middle Class

- Lennar Corp. (LEN)

- Carmax Group (KMX)

- Nike (NKE)

- Valsapar Corp. (VAL)

- Finish Line (FINL)

Safety & Security

- VirnetX Holding Corporation (VHC)

Scarce Resources

- Arch Coal (ARCH)