Has the Market Overreacted to the Potential of Trump’s “Phenomenal” Tax Plan?

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

With little in the way of economic data last week amid the continued earnings announcements maelstrom, the driver of the market’s climb was more political than fundamental. On Thursday, President Donald Trump said that in the coming weeks he would announce something “phenomenal” in terms of tax, although he offered no further details.

We are all for tax reform here at Tematica and the freeing up of capital that would get businesses to invest and help put more disposable income dollars into consumer pockets. With the consumer accounting for a purported two-thirds of the country’s economic engine, such actions could go a long way to helping the economy break out to the 2 to 2.5 percent GDP doldrums it’s been trapped in over the last several years.

In many ways, Trump’s tax comments were the second or third wave of the Trump Bump. This latest wave not only pushed all the major stock market indices higher last week, it also put them back in record territory. As investors, we’ve seen a number of times when the market gets ahead of itself, which often tends to be in lockstep with one of Wall Street’s favored sayings — “buy the rumor, sell the news.”

Getting back to Trump’s tax overhaul strategy, it appears the current administration is looking to decouple the tax reform issues into two buckets — corporate and individual — which we think is a smart move.

In our view, there is a better chance of passing corporate tax reform on a standalone basis than if it were tied to overhauling the individual tax code. As you know we largely stay out of the political fray here at Tematica, but even we can hear the faint chant of “fat cat” as Washington looks to overhaul the individual tax code, which means it is bound to be a larger fight. Color us pessimistic, but we’d be remiss if we didn’t consider any potential risks. When we do, the two we see are timing and magnitude — the timing of business-friendly tax cuts and the degree of the cuts vs. existing corporate tax rates.

Building on those two concerns, as much as we like to see the stock market moving higher, it appears the overall breadth of the market move has been rather narrow.

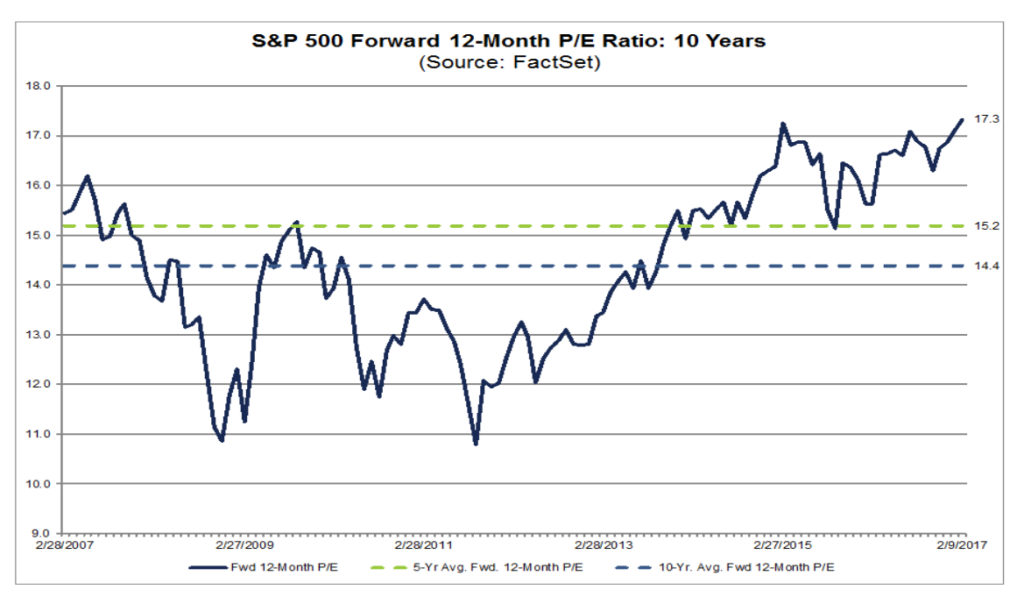

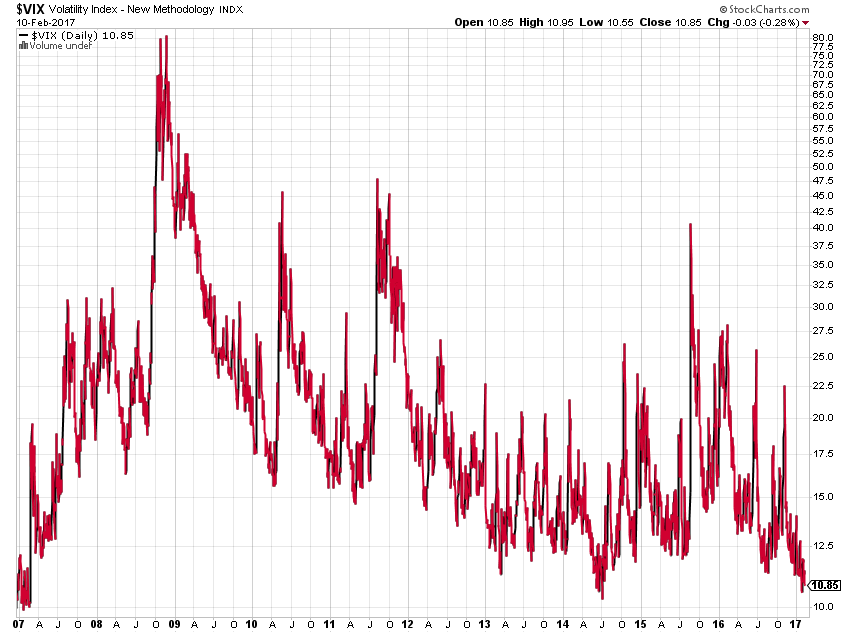

At the same time, given the move back into record territory valuations are once again stretched with the S&P 500 exiting the week at forward P/E ratio of 17.3, which is well above the 5-year average of 15.2 and the 10-year average of 14.4. It’s worth noting that, at least from a historical perspective, when valuations are stretched, breadth is narrow and complacency high, the stage tends to be set for pullbacks. And with that said, the Volatility Index (VIX) is near 10-year lows.

We suspect that combination is not only raising some hairs on the back of our collected necks but likely also on the necks of Wall Street traders.

Thematic Musing From Last Week’s Earnings Calls and More

While we tend to focus on both the Tematica Select List holdings and thematic signals each and every week, we also we dip our eyes and ears into other companies looking for data points and other useful commentaries. This week there were several nuggets to be had from company earnings calls:

“As I’ve said, I’ve always felt that 2017 would be a good year of building that foundation and see an improvement. I see a much stronger 2018 than I see 2017. But I see right now, based on what I’m seeing from the customer base, based on what I’m hearing from some of our customers and what they’re saying they’re going to spend on capital next year, overall, I think the pressure is upward.”

“I’m looking for clarity by late summer, early fall and that gives me time, as I get into execution later this year, early 2018 based on if I have to change anything.”

— Emerson Electric (EME:NYSE) CEO David Farr

Both of Farr’s comments are in sync with what we’ve been seeing in recent economic data, and our thoughts that the soonest we are likely to see Trump economic stimulus benefits is in the second half of 2017. That means our Economic Acceleration/Deceleration investing theme is likely to heat up in a good way come the back half of 2017.

Given the stock market is a forward-looking animal by roughly 6 months or so, we’ll be putting some Economic Acceleration / Deceleration contenders through the paces for the Tematica Select List. It’s not likely to be easy to find something as well positioned at an attractive valuation given the large move in iShares Dow Jones US Industrial ETF (IYJ), but nevertheless, we’ll use our thematic approach to turn over some stock rocks. As we do that, we’ll continue to let the data and political developments talk to us lest we get caught flat footed.

“I have not, from the experience around the world, seen a single country where the adoption of digital technology is at a higher level than China. It’s extraordinary how people’s lives revolve around digital technology. And particularly impressive is the transition of almost over two years from zero credit card or anything other than cash to suddenly, in some stores, cashless payment being a majority of our sales…you go to stores in China now and regularly, you will see people paying with their cell phones in a variety of retail formats.”

— Yum China (YUMC) CEO Micky Pant

Pant’s comments are rather confirming for our Cashless Consumption investing theme, reminding us in the process that our themes are not only global in nature, but some thematic tailwinds may be blowing strong outside the US than in.

“it seems like we’re on the cusp of some significant growth for new entrants in the multi-channel marketplace. And what we like about them is they are mobile friendly or mobile first, their user interfaces tend to be very strong, and their pricing is priced substantially lower than the expanded basic bundle that most of the MVPDs are offering…we think that this wave that we’re seeing is really a signal of what is to come and what the future will be”

— The Walt Disney Co (DIS) CEO Bob Iger (Media)

When Content is King company Walt Disney (DIS) speaks on the evolving media landscape, it pays to listen. Key words include mobile, interface, and multi-channel marketplace. When we toss all of that into our decoder rings, it tells us Disney is examining alternative strategies to broadcast TV, strategies that are in line with our Connected Society investing theme. Given the psychographic behavior associated with video consumption as well as the addictive nature of smartphones, it makes perfects sense.

At the same time, we’re also seeing online and mobile-centric companies like Amazon (AMZN) and Netflix (NFLX become more content-focused companies, and as we discussed in last week’s Cocktail Investing podcast, it looks like Facebook (FB) is poised to join that crew as it looks to target the $70 billion TV advertising market. Given Facebook’s user base and advertisers looking to connect with consumers, we expect to hear more on Facebook’s push into original programming and video streaming in the coming months. Much like Amazon, this could mean Facebook becomes a Connected Society and Content is King company, much the way Amazon is.

Turning to the Week Ahead

Looking over the coming days, we’ve got the return of a steady flow of economic data, more earnings announcements and the Fed on tap.

After a rather lite economic calendar last week, the data flow picks up with a slew of January data (PPI, CPI, Retail Sales, Industrial Production, Housing Starts) and some February data (Empire Manufacturing, Philly Fed Index) as well. Inside the January Retail Sales data, we’ll be looking for continued confirmation of the shift toward digital commerce, a key aspect of our Connected Society investing theme. When looking at the January Industrial Production report, it will be manufacturing capacity utilization that we’ll be examining to see if ample slack remains or if it looks like we’re due for a pick up in property, plant and equipment spending. Fodder for our Economic Acceleration/Deceleration investing theme.

On the earnings front, as you can see below in the Thematic Earnings Calendar it is a big, big week for our Cash-strapped Consumer, Fattening of the Population and Guilty Pleasure investing themes. As it relates to Cash-strapped Consumer we’ll be looking to see if other players are seeing the same pickup that Costco Wholesale’s (COST) did in its January same-store sales. That was a barn burner for Tematica Investing subscribers.

Inside Fattening of the Population, we’ll be looking for signs of a push to organic/natural products a well as product reformulation with an emphasis on reducing sugar. We’ve heard some of that from PepsiCo (PEP) and Coca-Cola (KO) already, and we’ve positioned the Tematica Select List to benefit from those initiatives. Given the pain point expressed by Coca-Cola — for 2016, sales volume of its carbonated beverages in North America was flat, as growth in Sprite, Fanta and energy drinks offset a decline in Diet Coke. Non-carbonated drinks rose 3 percent, boosted by Vitamin Water and Fairlife, its new dairy brand — odds are those companies have much more to go in meeting shifting consumer preferences.

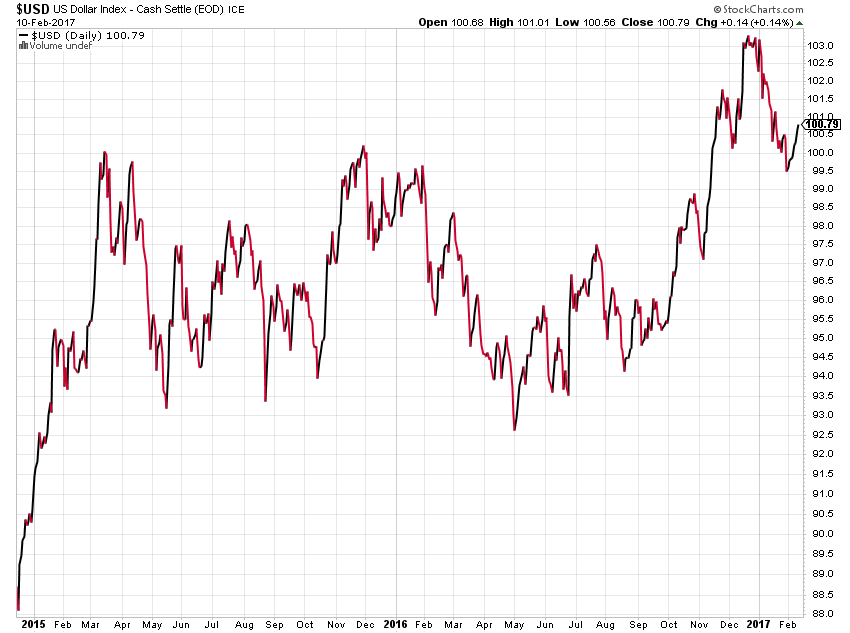

Within our Guilty Pleasure investing theme, we’ll be mindful of recent dollar strength and its impact on gaming volume as well as alcohol. Given comments by President Trump over potential border taxes, we’ll be listening to Molson Coors Brewing (TAP) and others on this subject to determine potential risks.

Adding the news flow this week, Fed Chairwoman Janet Yellen will give her semiannual monetary policy testimony before the Senate Banking Committee next Tuesday-Wednesday. Given comments that have started to bubble up over a potential March rate hike (the FOMC’s next monetary policy meeting), we expect the market to tune in and dissect Yellen’s economic commentary and rate hike language. As Yellen begins her second day of testimony, the Atlanta Fed issues its latest findings on Business Inflation Expectations.

Last week we pointed out rising prices in the ISM and Markit Economics January manufacturing data, and that will have us scoring the Atlanta Fed data for potential confirmation. Strong Chinese trade numbers on Friday added to a sense that inflationary pressures could be stirring. Rest assured, we’ll be keeping our eyes on the dollar over the next few days and assessing what it could mean for US exports.

Finally, it’s being reported that Greece’s finance minister and international creditors made “substantial progress” today in narrowing their differences over the bailout program that would keep the Greek economy afloat, amid renewed tensions about the country’s future in the euro. Along with that progress, Greek prime ministerAlexis Tsipras warned international lenders not to heap new burdens on a country he said had been “pillaged” with a population that had made “many sacrifices in the name of Europe.” What this tells us that while progress may have been made, the details of any bailout program will be the deciding factor.

Needless to say, we’ll be looking to see how things play out over the coming weeks for not only Greece but for Brexit and Frexit as well. We’ve seen a rash of surprises over the last few months, and yes that includes the New England Patriots coming back to win Super Bowl XI, and that means not assuming anything as it pertains to upcoming Eurozone elections and what it could mean for Grexit, Brexit and perhaps Italeave and Frexit.

As we close out this edition of our Monday Morning Kickoff, hopefully you’ve either got Valentine’s Day on Tuesday night covered or made alternative plans lest you be caught in the dog house. We’ve been there more than a few times, and trust us it’s not a place you want to be if you can avoid it.

Looking ahead to next week — February 20th — the market will be closed for the Presidents’ Day Holiday and thus we’ll be taking the week off for the Monday Morning Kickoff. Be sure to check out the News flow on our homepage at TematicaResearch.com and tune into our new podcast, Cocktail Investing, for insights and musings on the markets and economy from Chief Investment Officer Chris Versace and Chief Macro Strategist Lenore Elle Hawkins.

Enjoy the week!

Earnings on Tap This Week

The following are just some of the earnings announcements we’ll have our eye on for thematic confirmation data points:

Affordable Luxury

- Fossil (FOSL)

- Ruth’s Hospitality (RUTH)

- VF Corp. (VFC)

Aging of the Population

- AMN Healthcare (AMN)

- Express Scripts (ESRX)

- Brookdale Senior Living (BKD)

- Surgical Care Affiliates (SCAI)

Asset Lite Business Models

- Insperity (NSP)

- Shopify (SHOP)

Cashless Consumption

- Blackhawk Network (HAWK)

- First Data Corp. (FDC)

- Moneygram (MGI)

Cash-strapped Consumer

- Avon Products (AVP)

- Campbell Soup (CPB)

- JM Smucker (SJM)

- Groupon (GRPN)

- Lending Club (LC)

- RetailMeNot (SALE)

- Tanger Factory (SKT)

Connected Society

- Cisco Systems (CSCO)

- Digital Realty Trust (DLR)

- Equinix (EQIX)

- T-Mobile USA (TMUS)

- Tivo (TIVO)

Content is King

- CBS Inc. (CBS)

- Discovery (DISCA)

Disruptive Business Models

- Applied Materials (AMAT)

- Veeco Instruments (VECO)

Economic Acceleration/Deceleration

- CSW Industrials (CSWI)

- Martin Marietta (MLM)

Fattening of the Population

- Dean Foods (DF)

- Denny’s (DEN)

- Dr. Pepper Snapple (DPS)

- Flower Foods (FLO)

- Kraft Heinz (KHC)

- PepsiCo (PEP)

- Potbelly (PBPB)

- Restaurant Brands (QSR)

- SodaStream (SODA)

- Snyder’s Lance (LNCE)

- Wendy’s (WEN)

Foods with Integrity

Hain Celestial (HAIN)

Fountain of Youth

- Cutera (CUTR)

- GNC Holdings (GNC)

- Nu Skin Enterprises (NUS)

Guilty Pleasure

- Boyd Gaming (BYD)

- Caesars Entertainment (CZR)

- Cedar Fair (FUN)

- MGM Resorts (MGM)

- Molson Coors Brewing (TAP)

Rise & Fall of the Middle Class

- Avis Budget (CAR)

- Choice Hotels (CHH)

- International Flavors & Fragrances (IFF)

- Hyatt Hotels (H)

- Marriott (MAR)

- Valspar (VAL)

Safety & Security

- Guidance Software (GUID)

- Diebold Nixdorf (DBD)

- Flir Systems (FLIR)

- Vasco Data Security (VDSI)

Tooling & Re-tooling

- Capella Education (CPLA)

- Chegg (CHGG)

- Grand Canyon Education (LOPE)

- Strayer Education (STRA)