‘Trump Bump’ for Dow Industrials Is Biggest Post-Inaugural Move Since FDR –

This morning I was on Varney and Company on Fox Business talking about the impressive run-up in U.S. stock indices. While we were on air, the U.S. markets opened and shortly thereafter the Dow broke to new highs at 20,700.

Only one other president in history has seen such remarkable gains since their election. After John F. Kennedy’s election, the S&P 500 gained 13.05 percent while post-Trump’s election we’ve seen a 9.7 percent gain. The post-election moves this time have been remarkably steady, as we’ve experienced 89 days without a 1 percent decline and the VIX has remained at multi-decade lows. Last Wednesday 8 percent of the S&P 500 saw new all-time highs.

An article in today’s Wall Street Journal declared,

“President Donald Trump has been doing a lot of bragging about the stock market rally lately. How does it measure up? By some measures, the rally that took place during Mr. Trump’s first 30 calendar days in office has been the largest since 1945. Since inauguration day on Jan. 20 through Friday, the Dow industrials climbed more than 4%.”

The strength in stocks hasn’t been just domestic, as the majority of the largest stock markets around the world are in overbought territory and not one of the thirty largest country-based ETFs is in oversold territory.

To put the U.S. gains in perspective, the Market Vector Russia ETF (RSX) has gained even more than the S&P 500, up 15.3 percent since the election versus 9.4 percent for the S&P 500 ETF (SPY).

Since President Trump’s inauguration, the iShares MSCI Mexico Capped ETF (EWW) has gained the most of any asset class, up 7.2 percent versus the S&P 500 (SPY) up 3.7 percent.

Pricing in the U.S., as we keep mentioning here, is at elevated levels, with the S&P 500 at the highest forward 12-month P/E/ ratio since 2004 at 17.6. This is well above historical norms as the 5-year average is 15.2, the 10-year is 14.4 and the 15-year is 15.2.

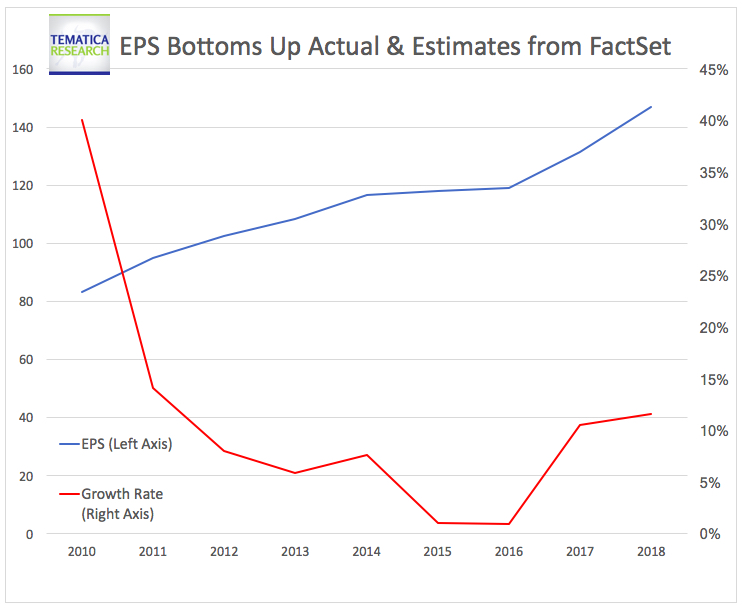

That forward P/E also assumes an exceedingly robust growth rate in EPS for the S&P 500 to be over 11% in the coming year, which is a profound change from what we’ve seen over the past 4 to 5 years. If we don’t get that kind of explosive growth, then today’s valuations are even more stretched.

Implicit in those assumptions is the impact of corporate tax and regulatory reforms on margins and the impact of individual tax reforms on spending. With the level of divisiveness in D.C. paired with 23 Democrats in the Senate up for reelection in 2018, Trump is facing an uphill battle to get his plans passed. Regardless of where one stands concerning the president, roughly half of the country is opposed to him, and those opposed are very vocal. House and Senate Democrats will be facing a lot of pressure from their constituents to not cross the isle and join the Republicans.

Implicit in those assumptions is the impact of corporate tax and regulatory reforms on margins and the impact of individual tax reforms on spending. With the level of divisiveness in D.C. paired with 23 Democrats in the Senate up for reelection in 2018, Trump is facing an uphill battle to get his plans passed. Regardless of where one stands concerning the president, roughly half of the country is opposed to him, and those opposed are very vocal. House and Senate Democrats will be facing a lot of pressure from their constituents to not cross the isle and join the Republicans.

That being said, the level of momentum we see in this market is irrefutable, so shorting it is a dangerous business. Those who hop in now need to understand that they are going in for momentum, as the likelihood that all these hopes and dreams don’t come through promptly is pretty high, which means better buying opportunities are likely in store later on.

Source: ‘Trump Bump’ for Dow Industrials Is Biggest Post-Inaugural Move Since FDR – MoneyBeat – WSJ