Oil Creating a Bright Spot in the Energy Sector Market… For Now

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

Last Thursday when Tematica’s Chief Investment Officer Chris Versace appeared on America’s First News hosted by Matt Ray, one of the topics was what’s going in the oil market. One of the few bright spots when it comes to earnings picture is the energy sector, which his benefitting from higher oil prices in and easier comparisons to lower earnings in Q1 2016.Those higher oil prices reflect OPEC production cuts, but those same cuts have spurred US production back on line. As of March 24, data from Baker Hughes (BHI) put the total number of US rigs at 809, up 20 compared to the prior week and a staggering 345 compared to the same time last year.

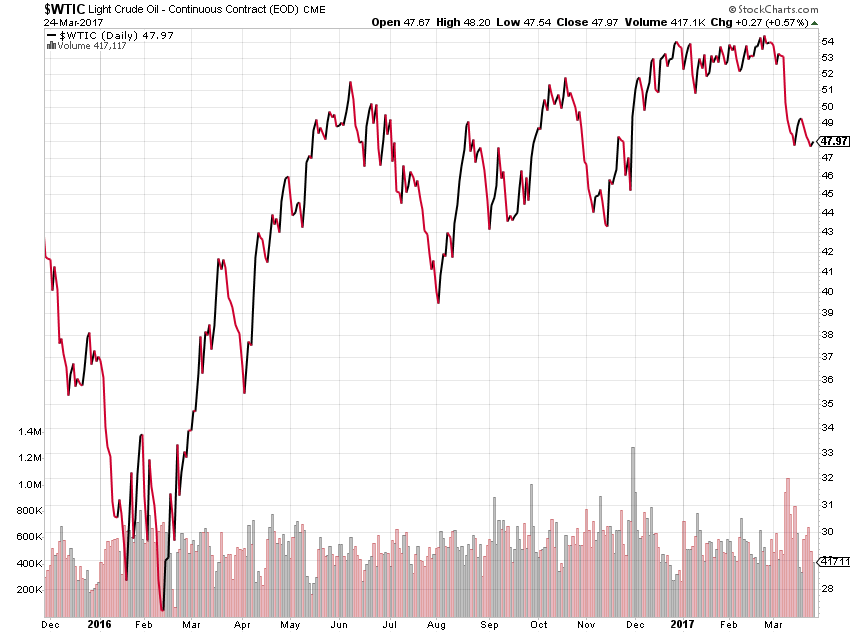

Despite the OPEC production cuts that have taken more than 1 million barrels per day off the oil market, the added US capacity and less than booming global economy have led to US crude oil inventories to swell. The result has been a reversal in oil prices from roughly $54 in February to just below $48 exiting last week.

In short, we have a situation in which shale output is surging too quickly before OPEC has had the chance to balance the market. Keep in mind too that technology refinements have likely lowered the breakeven cost for US shale producers and that could move even lower should industry regulations get dialed back under the Trump administration.

Interestingly enough is the Bank of Russia’s view on all of this as on Friday it updated its guidance that calls for oil to average $50 a barrel this year, but falling to $40 toward the end of 2017 and then staying near that level in 2018-2019. As we wait to see what’s next on the regulatory front, the next known catalyst will be the OPEC meeting on May 25 that will likely center on the current production cut and whether it should be extended. Given the continued glut, the growing view is the initial six-month product cut did little to restore balance to the oil market and this likely means OPEC is poised to extend those cuts into the back half of 2017. The growing view is if OPEC doesn’t extend its production cuts, oil is likely to tumble to $40. Should this come to pass, we could see more downside to be had in United States Oil Fund LP (USO) shares as well as those for Energy Select Sector SPDR ETF (XLE) and Vanguard Energy ETF (VDE), both of which have outsized positions in Exxon Mobil (XOM).

This means this aspect of our Scarce Resource investing theme is bound to get a little wobbly between now and late May. The positive in lower oil prices is consumers, especially Cash-strapped Consumers, are likely to see a less than seasonal move higher in gas prices this year as we switch over to summer gas blends that burn clean and result in lower vehicle emissions. Will consumers pocket the difference or look to spend it? We’ll be watching the data to see what’s what.