Q1 Dissapointed, Q2 to repeat?

After the disappointing growth in the first quarter of 2011, many economists believed that the economy would pick up in the second quarter. At Meritas we looked at the trends in housing (still dropping), employment (fewer employed today than in 2000), income (declining real wages) the credit markets (little expansion), and government spending (fiscal stimulus to decline) and just couldn’t see how the math could possibly work to generate a robust second quarter. Looks like the economists were wrong, as well an many of the big banks.

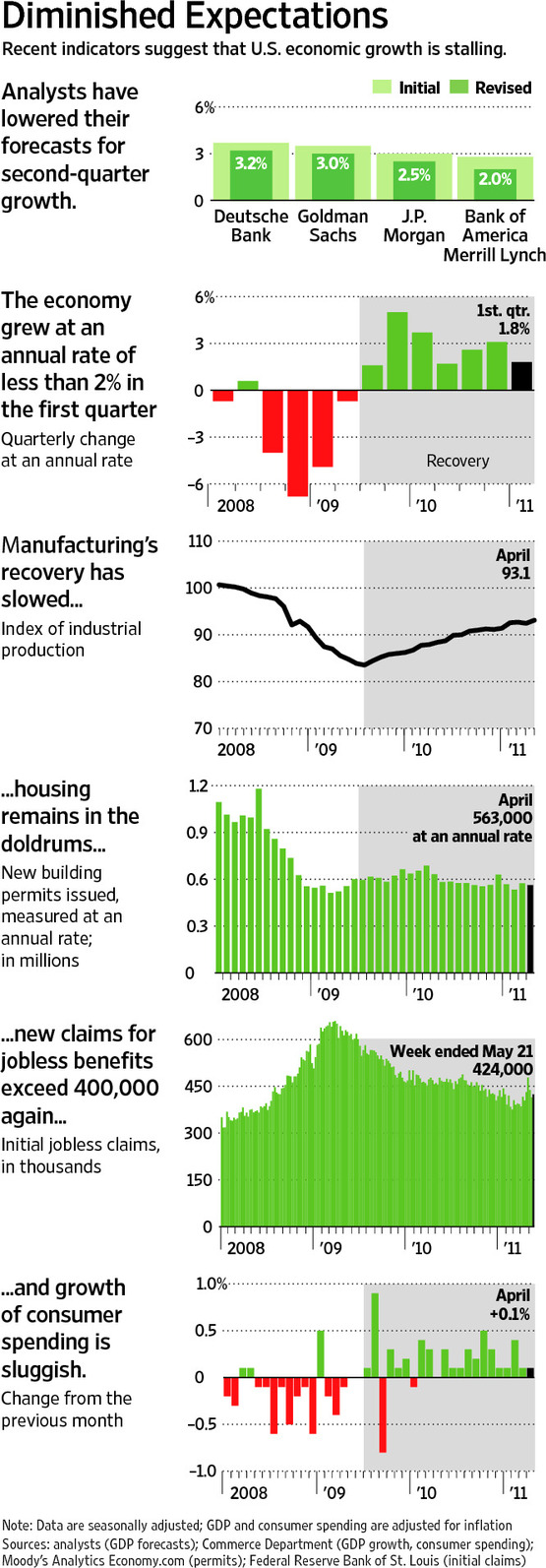

JPMorgan revised down their estimate to a 2.5% GDP growth rate from 3%, while Bank of America Merrill Lynch cut theirs to 2% from 2.8%. Deutsche Bank also cut its forecast to 3.2% from 3.7%.

According to the study by Carmen Reinhart and Kennneth Rogoff, “This Time is Different,” growth rates are typically subdued after a financial crisis versus a recession induced by other factors. In addition, when countries reach high levels of debt to GDP ratio, near the 1:1 level as exists in the U.S. and most of the developed countries, GDP growth suffers.

Until employment and housing show significant improvements (and the two are clearly related), we don’t expect to see consistently strengthening growth rates.