Housing is Officially in a Double-Dip

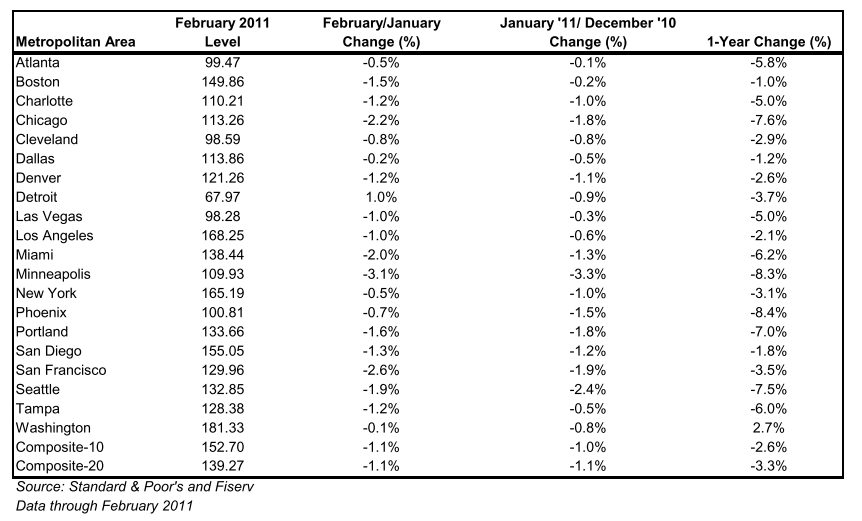

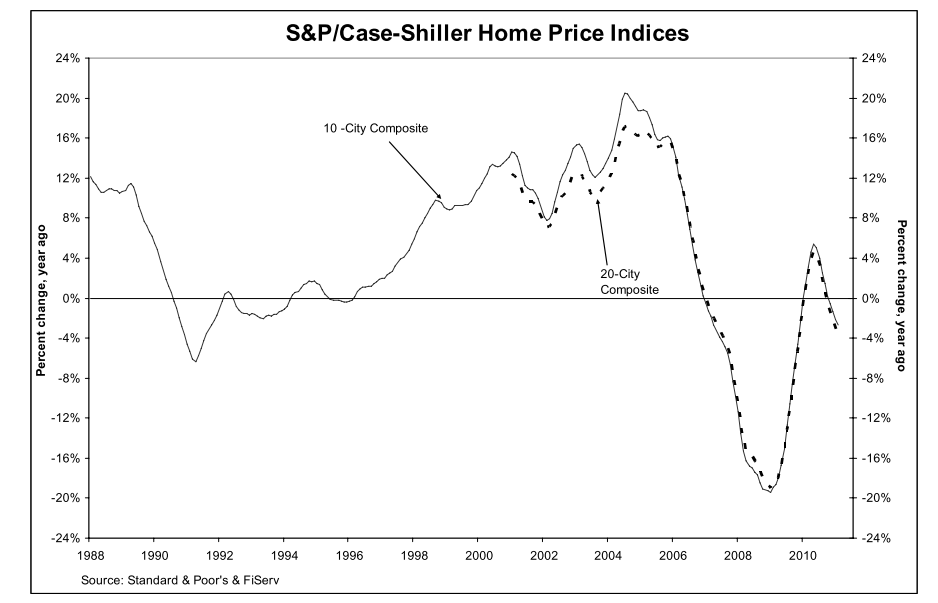

The most widely-followed home price index, the S&P/Case-Shiller index, just came out on 5/31 and showed that we are officially in a double dip. The report found that home prices in Q1 are now 2.9% below the previous quarterly bottom in Q1 of 2009. So much for that home buyer tax credit! All those gains have now been wiped out. Both the 20-City composite index and the 10-City Composite Index show housing prices are back to their summer 2003 levels.

Only Washington D.C. shows an improvement in housing year over year.

Only Washington D.C. shows an improvement in housing year over year.

Home prices have now fallen more than they did during the Great Depression. The drop in home values means also mean that the banks’ portfolio of loans is worth less. If this continues, banks will be forced to take further markdowns. The further prices fall, the more the banks stand to suffer, which could imply, according to Chris Whalen of Institutional Risk Analytics, solvency issues for firms like Bank of America, Wells Fargo, JPMorgan and Citigroup as well as big losses for the U.S. government and private investors.

This provides further reason to believe that the Fed will not be raising rates anytime soon.