Weekly Issue: Jumping on Several Tech Calls as the Sector Falls Out of Favor

We are adding the following three call option positions to the Tematica Options+ Select List:

- Applied Materials (AMAT) January 2018 $55 calls (AMAT180119C00055000) that closed last night at 0.86 with a stop loss of $0.40;

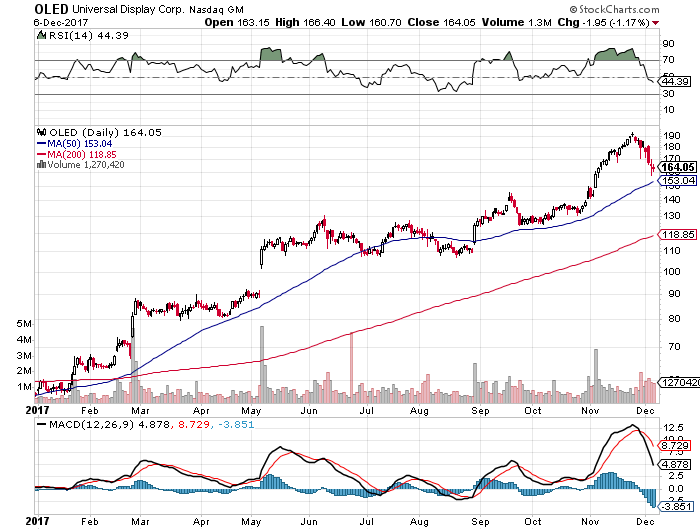

- Universal Displays (OLED) January 2018 $170 calls (OLED180119C00170000) that closed last night at 8.30 with a stop loss at 5.00

- Amazon (AMZN) January 2018 1200 calls (AMZN180119C01200000) that closed last night at 16.99 with a stop loss at 8.00

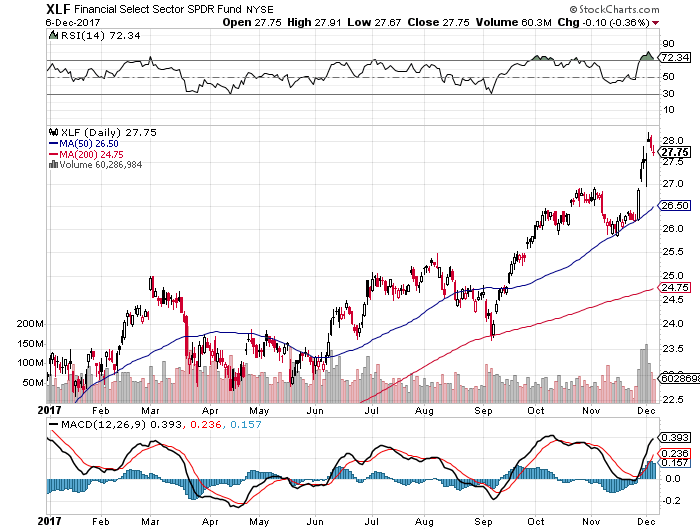

Over the last week, technology stocks have taken a number of lumps as investors have shed the shares and flocked to companies that are seemingly better positioned under potential tax reform. Hard to argue, but it’s also led to a sharp move higher in financial stocks, despite a relatively flat yield curve and prospects for a double-digit drop in trading volume vs. year-ago levels according to Bank of America (BAC) and JPMorgan (JPM).

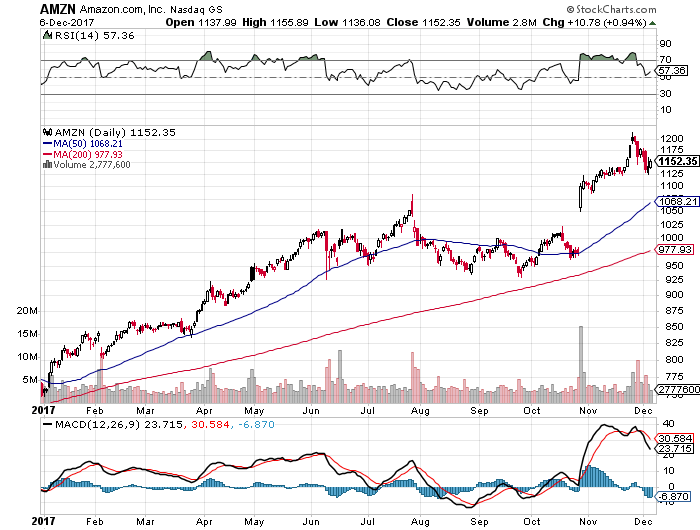

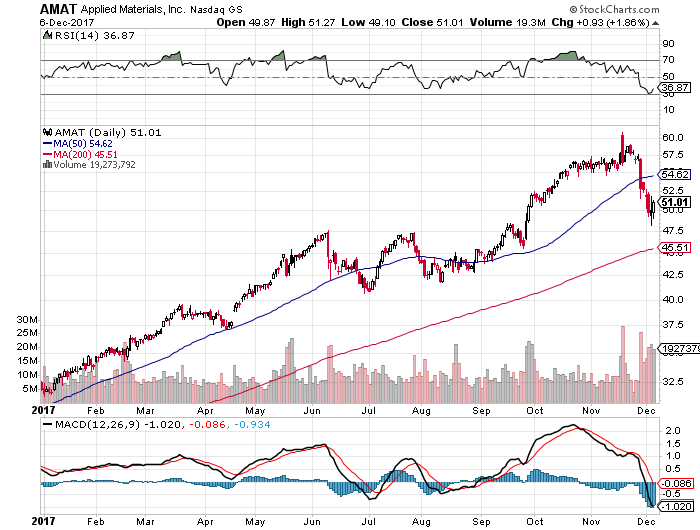

Over the last few days, shares of Financial Select Sector ETF (XLF) gapped up and currently reside in overbought territory. By comparison, well-positioned technology companies, such as Applied Materials (AMAT), Universal Display (OLED) and even Amazon (AMZN) have traded off sharply and in some cases are in or near oversold territory. For those that were thinking tech was a tad frothy, the last several days have taken that out of the market, and I suspect that before too long, investors will circle back to those with favorable fundamentals benefitting from thematic tailwinds.

I see that to be the case with each of those three companies that currently reside on the Tematica Investing Select List:

- Applied Materials (AMAT) continues to benefit from increasing chip demand across an expanding array of products as well as ramping demand for semi-cap equipment in China. Meanwhile, its Display business is seeing demand rise as companies migrate to organic light emitting diode displays for smartphones, TVs and other applications.

- As that ramp for organic light emitting diode display continues, Universal Display’s (OLED) chemical business should see demand pull through while its intellectual property licensing business is poised to address an expanding list of products and vendors.

- Despite being the market share gainer this holiday season as consumers buy more online and via smartphones, Amazon (AMZN) shares sold off some 1.4% over the past week. As we have said before, Amazon is the poster child for thematic investing and we have entered its seasonally strongest season. This combination recently led GBH Insights to forecast Amazon is accounting for “roughly half of all e-commerce holiday sales made in the United States this year.”

In each of these three cases, the underlying fundamentals remain favorable, as do the thematic tailwinds behind them. In my view, their respective pullbacks have offered us another bite at them. Therefore, we are adding the following call option positions, all of which have a January 2018 expiration date:

- Applied Materials (AMAT) January 2018 $55 calls (AMAT180119C00055000) that closed last night at 0.86 with a stop loss of $0.40;

- Universal Displays (OLED) January 2018 $170 calls (OLED180119C00170000) that closed last night at 8.30 with a stop loss at 5.00

- Amazon (AMZN) January 2018 1200 calls (AMZN180119C01200000) that closed last night at 16.99 with a stop loss at 8.00

I’ve chosen these time frames because it contains upcoming catalysts for each of the three positions. For example, in early January we have the annual Consumer Electronics Show that will show off the latest TV and other connected devices and appliances. We expect a bevy of announcements for devices using organic light emitting diode displays, RF semiconductors, artificial intelligence and augmented/virtual reality. Those announcements bode well for the businesses at Applied Materials and Universal Display. With regard to Amazon, the January expiration date will capture not only the fervor of the holiday shopping season but the post-holiday sales that are increasingly becoming important to digital as well as brick & mortar retailers.

I’m also setting these stop losses a bit wider than usual given the current market mood, and if we see continued weakness, I may advise scaling into these positions provided the fundamentals remain as expected.