As GDP Forecast Bob and Weave, the Overall Vector Has Moved Lower with Diminished Velocity

As we get closer to year-end and into 2018, we expect to see a number of price target and earnings forecasts for the major stock market indices, especially the Dow Jones Industrial Average and the S&P 500. From time to time, these can be all over the board as they are often subject to the forecasters own bullish or bearish tendencies. With that in mind, and to offer a somewhat sobering perspective on those forecasts, we’re sharing the following findings from Factset:

“Over the previous 15 years (2002-2016), the average difference between the bottom-up target price estimate at the beginning of the year (December 31) and the final price for the index for that same year has been 13.0%. In other words, industry analysts on average have overestimated the final price of the index by about 13.0% one year in advance during the previous 15 years.”

We’ll be keeping that in mind as we consider that Industry analysts in aggregate predict the S&P 500 will see a 7.7% increase in price over the next 12 months. If you thought you heard a bit of a smirk as I wrote this, well, you would be correct.

Turning our focus to the short-term, it is the week before the Christmas holiday, which has the market closed next Monday. Even so, we have all of 9 trading days left until we close the current quarter, which means that before the holiday and despite all the last minute holiday shopping to be done, we still have several companies reporting earnings and a number of economic data points that will factor into determining GDP for the current quarter. Unlike the last few weeks, there are no major investor conferences to be had, and odds are they will remain scant until after 4Q 2017 earnings season.

Now, let’s take a closer look at what’s on tap this week…

On the Economic Front

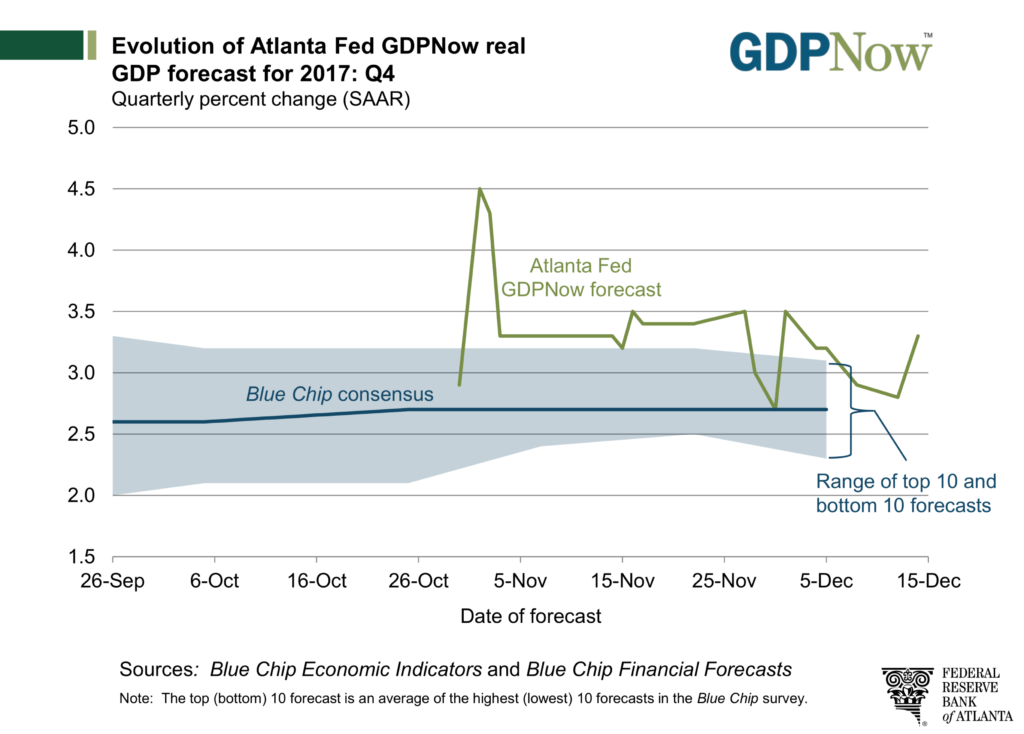

If you remember, last week’s Monday Morning Kickoff was titled, “Big Week Ahead Could Either Firm Up, Or Tear Down GDP Forecasts.” As we glance in the rearview mirror that was last week we saw there was indeed some movement in the Atlanta Fed’s GDPNow 4Q 2017 forecast.

Coming into December, the Atlanta Fed expected current quarter GDP to be 3.5%, down from its November 1 view of 4.5%. After the November Employment Report (Dec. 8), the regional Fed bank further reduced its outlook to 2.9%. Then last week, amidst the better than expected November Retail Sales report — which, by the way, was very confirming for out thesis on Amazon (AMZN) and United Parcel Service (UPS) on the Tematica Investing Select list — the Atlanta Fed boosted its GDP forecast back up to 3.3%.

Our net view on this is while the GDP forecast has bobbed and weaved, the overall vector of projections over the course of the quarter has moved “lower” with a diminished velocity. This makes the coming data in the balance of the month and in early January essential when piecing the current speed of the economy together.

This week there are three key pieces of November data that will factor into the GDP equation – Housing Starts, Personal Income & Spending, and Durable Orders. In addition to these points, we’ll also be keeping close tabs on the PCE Price Index and what it means for inflation following back to back months in which the PCE Price Index rose 2.6% year over year.

And finally, unless you were trapped under a very large rock, you’ll remember that last week the Fed boosted interest rates by 0.25% and reiterated its plan for three more hikes in 2018. Needless to say, this week’s economic data will help shape the consensus view as to how soon we may see the next one.

On the Earnings Front

In the coming weeks, we’ll slide into the start of 4Q 2017 earnings season. With 4Q 2017 expected to generate the greatest piece of overall S&P 500 earnings for the year, we’ll be paying close attention to the companies reporting early in January as they will set the stage for what’s to come.

With regard to those companies reporting this week, results and guidance from FedEx (FDX) should offer an updated view of not only the 2017 holiday shopping season, but the company’s economic view for 2018. Given the boost to the Fed’s 2018 GDP forecast to 2.5%, we’ll be looking to see if FedEx or heavy truck and engine company Navistar (NAV), which is also reporting this week, see better or worse prospects for 2018.

Sticking with 2017 holiday shopping, additional color will be garnered from Bed Bath & Beyond (BBBY), Finish Line (FINL) and Nike (NKE). In particular with Nike, we’ll be interested to hear the company’s comments on its partnership with Connected Society company and Tematica Investing Select List resident Amazon (AMZN), and how it’s aiding its holiday sales this year.

Last week Campbell Soup (CPB) closed a $700 million purchase of Oregon-based Pacific Foods, a maker of organic broths and soups – see more below in Thematic Signals for more on this. As one publication put it, “This continues a growing trend of Big Food giants buying what are considered “authentic” brands to help stoke their own stale growth.” We see it as food companies looking to position themselves to ride our Food with Integrity investing theme. To get a pulse on if this buying spree will continue in 2018, and to check the overall shift toward food that is good for you food, we’ll be delving into quarterly results from General Mills (GIS) and ConAgra (CAG) this week.

Thematic Signals

Each week we look for data points pertaining to our 17 investment themes, or as we call them Thematic Signals. These signals can be confirming or they can serve to raise questions as to whether a theme’s tailwinds are strengthening or ebbing. Be sure to check out the Thematic Signals section of our website to read more about these stories and others we publish throughout the week. Here are some of the highlights we saw this week:

Food with Integrity

Campbell Soup acquires Pacific Foods in an attempt to ride Foods with Integrity theme

The biggest transaction of 2017 by all accounts was Amazon coming in and sweeping up Whole Foods, and in one move, forever transforming the natural/organic market space. But that was just but one move. Amidst a flurry of activity in the space in 2017, yet another acquisition of a company that falls within our “Foods with Integrity” investment theme was announced this week…Read More >>

Connected Society, Content is King, Disruptive Technology

Car Maker Renault Acquires . . . a Magazine Company?

We’ve spent our fair share of time looking into the future of autonomous vehicles — the technology behind them, the players that are making it happen and the implications this new technology could have on everything from the car manufacturers to parking systems to rental car companies.

One comment, in particular, stands out from our special podcast with Brad Stertz of Audi USA when he mentioned that one of the regular comments he hears from those that have ridden in their autonomous test vehicles is that after the first few minutes, it’s well, kind of boring. Which brings us to the news out of France…Read More >>

Connected Society, Content is King

Disney’s buying Fox has a Connected Society appeal

With consumers increasing shifting their content consumption to streaming services, be it online or via mobile, we are seeing a number of moves by companies to position themselves accordingly. AT&T (T) is looking to buy Time Warner (TWX), Alphabet (GOOGL) is expanding the reach of YouTubeTV and Apple (AAPL) is hiring programming talent. Amid all of this, Disney scooped up key content assets of Twenty-first Century Fox (FOXA) this week, a long-time strategy of the House of Mouse, but it also acquired the controlling interest in stream service Hulu.

That extra nugget could radically change and potentially accelerate Disney’s already announced plan to launch its own set of streaming services, one for Disney content and the other for ESPN. We see this as a potential gamechanger that also adds our Connected Society tailwind to the Content is King company that is Disney. Read More >>