Weekly Wrap: The Sounds of Uncertainty

To paraphrase singer-songwriter duo Simon and Garfunkle,

Hello volatility, my old friend

I’ve come to talk with you again

Because presidential tweets softly creeping

Left its seeds while I was sleeping

And the stock market was filled

With uncertainty

That, in a nutshell, sums up the wide gyrations in the stock market this week as both President Trump and China engaged in a “mine is bigger than yours” round of tariff announcements. While the stock market attempted to shrug these off, the reality is additional rounds adds to what is likely to be tension filled talks as both sides look to claim victory while saving face. Now let’s get into the nitty-gritty of the past week …

Monday the markets and the northeast of the U.S.A. took it on the nose, with the region getting a whopper of a snow storm and NYC getting almost 6 inches. The S&P 500 fell 2.2% and closed below its 200-day moving average for the first time in 442 trading days, ending what had been the sixth-longest streak of consecutive closes above the 200-day on record. Monday’s close also marked the worst start to an April since 1929, not exactly a rosy year for stocks, and left the market down 3.5% for the year with ten of eleven sectors in the red for the year and just 17% of S&P 500 stocks above their 50-day moving average.

Tuesday saw Amazon (AMZN) shares spike almost 4% on reports that, contrary to the implications from Presidential tweets, the White House does not intend to pursue policies that would harm the company’s business model. After Monday’s thrashing, Tuesday saw all the major indices closing in the green. As we shared with our Tematica Research Premium Members, we were rather surprised that President Trump didn’t rail on how inept the U.S. Postal Service (USPS) was in dealing with Amazon. Then again, even we have to admit the Connected Society investment theme headwinds the USPS is dealing with are formidable.

Wednesday and Thursday the markets were in a more upbeat mood from Monday’s downturn, closing in positive territory. By Friday morning the markets were back in the red on renewed trade war concerns. China vowed that in response to the $100 billion in tariffs, “we will immediately fight back with a major response,” and that it will respond, “to the end and at any cost.” Frankly, anyone who thought that China would roll over and give up when presented with President Trump’s threat hasn’t read much about the history of China. It is a very proud nation who has throughout much of history been a major player on the global stage. The current leadership is looking to regain China’s place as a, if not the primary powerhouse in global affairs.

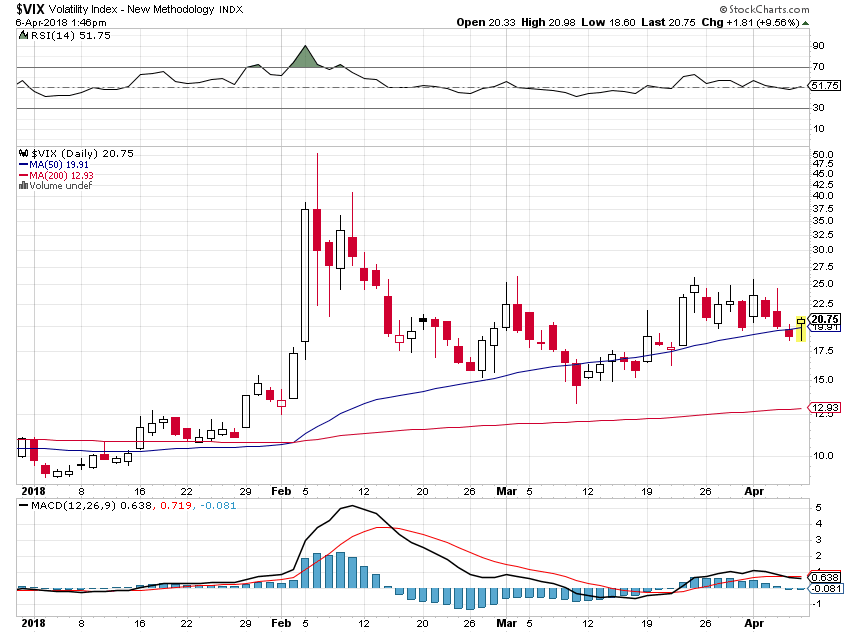

We are barely three months into the year and yet we have already had, as of Thursday’s close, 21 trading days in which the Dow traded in a 400 point or greater range versus just 1 day in 2017. The average number of sessions in a year with swings that great is all of 2 and the only time in history where we’ve seen such heightened volatility was between October 2008 and January 2009. The current run of 47 closes below all-time highs, (as of Thursday close) is the third-longest since the spring of 2013. The average for the VIX in 2018 is 17.6, 60% higher than in 2017 and just under what the saw in 2012 – a tough year for equities. For reference, the VIX average was right around this level back in 2007. This is most definitely a market in transition with a global political backdrop that is more volatile than we’ve experienced in years

Data, data – it’s all about the data

This week both the March ISM manufacturing and non-manufacturing results came in below expectations with the indices sitting at three-month lows as were orders at three-month lows. The manufacturing report was not only below expectations, but also below February’s number. The Prices Paid component saw a huge jump that was well above expectations and at a level we haven’t seen since 2011.

The Census report on manufacturer’s sales for February showed new orders and shipments for nondurable goods have slowed from their peak rates, but overall growth remains at a solid pace with durable goods shipments at a new year-over-year growth rate high. While inventories are rising, inventory-to-sales ratios have been trending lower.

Non-manufacturing business activity declined while employment rose -not a good sign for productivity which likely means margin compression thanks to decade low unemployment that is forcing companies to hire those with fewer skills than required. The National Federation of Independent Businesses confirms our assessment with 22% of small businesses citing labor quality as their number-one constraint, a 17-year high. The Ism non-manufacturing also reported that production bottlenecks are the worst since November 2005, backlogs up as were prices paid.

ADP private sector employment rose 241k in March, blowing away expectations for 210k and revised February’s gains up by 11k as well. This is roughly 2x the pace necessary to maintain the jobless rate and continues the streak of above 200K jobs per month that started in December. Jobless claims however spiked this week, up to 242k versus expectations for 219k, which put the figure in the upper range of its long-term downtrend channel – not cause for concern just yet, but we will be watching for any consistent moves over 250k. On a more positive note, the number of Americans claiming unemployment benefits dropped to the lowest level since the early 1970s in terms of raw numbers and as a percent of the labor force or even the population.

On the other hand, the Bureau of Labor Statistics on Friday reported that nonfarm payrolls rose by just 103k in March versus expectations for 193k. The average workweek remained unchanged during the month, but for the around 82% of the population in the production and nonsupervisory employee category, the workweek declined by 0.1 hours. Average hourly earnings for this cohort rose 2.4% year-over-year and 2.7% for all employees, once again raising concerns over inflation. Paired with the prices component of the March ISM Manufacturing Index, we suspect inflation hawks will once again soon be on the rise.

Bottom line is this year is all about change. We have very new fiscal policy, new leadership at the Federal Reserve, a new tone when it comes to trade and foreign policy and a market dynamic that is nothing like last year’s. Despite all the excitement around the impact of tax cuts on the economy, in the first two months of 2018 real U.S. consumer spending contracted at a 1.3% annual rate. That’s the weakest we’ve seen since October 2009. In fact, real retail sales have fallen at a 4.4% annual rate from November through to February. Despite all the talk of a tight housing market, builders aren’t exactly chomping at the bit with housing starts down 18% (annualized) over the past three months.

Keep in mind as well that as the Fed is in a rate hike cycle, the level of corporate bonds that need to be rolled over in the next several years is unprecedented. The replacement issuance will be at materially higher rates, unless the economy completely crashes before then, which means higher interest expense and thus compressed margins. We aren’t seeing that reflected anywhere in earnings estimates. Remember that as you read about how PE multiples have been compressing!

Turning to the Week Ahead: April 9-13, 2018

Coming off a week that was chock full of economic data with some 20 earnings reports mixed in, next week have several key pieces of economic data and a modest pickup in earnings reports. The 45 or so earnings announcements that we will have over this week and next will set the stage for expectations for the more than 200 earnings reports that hit during the week of April 16, with hundreds more announcements to be had in the following weeks. It’s going to get fast and furious, and that means dissecting what’s to come next week to get ready the coming onslaught.

On the economic data side of the equation, we have the March NFIB Small Business Index on deck, a barometer of small business and job creation, as well as the March readings for both the PPI and CPI. Given the pick up in inflation contained in the March ISM Manufacturing Index as the March Employment Report, we expect these two data points will be of keen interest and could re-ignite the talk of a potential fourth Fed rate hike this year. Adding to the prospects for that talk, next week also brings the FOMC minutes for Fed Chairman Powell’s first meeting. In addition, offering a better understanding as to how the committee weighed three vs. four rate hikes, we expect analysts will be comparing Powell’s press conference performance with what was said behind the Fed’s doors. Exiting next week, we get the February JOLTS report and that should add another layer of context to job creation following the mismatched March ADP Jobs Report and the March Employment Report.

On the earnings front, this week we have 27 companies reporting, which includes a host of financial service firms and banks ranging from Citigroup (C) to JPMorgan Chase (JPM) and Well Fargo (WFC). Inside these results, we’ll be looking at loan growth activity and credit card charge-off rates for clues on the true speed of the economy and the consumer. As a reminder, we have started to see a rise in credit charge-off rates at smaller banks, and we are looking to see how widespread this has become.

Adding to the assessment of the economy, commentary to be had from maintenance, repair and operations firm MSC Industrial (MSM) and Fastenal (FAST) should clue us in on manufacturing and industrial firm sentiment. In normal times, MSM’s comments and outlook would be important to monitor, but on the heels of escalating tariffs, MSC’s commentary should add another layer of insight for what’s to be said over the coming weeks.