Making thematic sense of the July Retail Sales report

Key points for this alert:

- Our price target on Amazon (AMZN) remains $2,250.

- Our price target on Costco Wholesale (COST) remains $230.

- Our price target on Habit Restaurant (HABT) is getting a boost to $17 from $16.

- We are also bumping our price target on McCormick & Co. (MKC) shares to $130 from $110 as we get ready for seasons eatings 2018.

Following on the heels of the July Retail Sales report we received Wednesday, this morning Walmart (WMT) reported stellar July quarter results led by stronger than expected same-store sales and a 40% year over year increase in its e-commerce sales. From our perch, we see both reports as positive for our positions in both Amazon (AMZN) and Costco Wholesale (COST) as well as Habit Restaurant (HABT) and McCormick & Co. (MKC) shares.

Digging into the better than expected July Retail Sales report that showed Retail up 0.4% month over month and 6.0% sequentially, top performers were Food Services & drinking places (up +9.7% year over year), Nonstore retailers (+8.7%) and Grocery Stores (+4.9%) year over year. In response to that report, as well as the news that China and the US are heading back to the trade negotiation tables, our Habit Restaurant shares continue to sizzle. That stellar showing in July for Food Services & drinking places brought the trailing 3-month comparison to up more than 8% year over year.

To me, this echoes the data we’ve seen of late that points to the rebound in monthly restaurant sales, which is due as much to price increases as it is to improving customer volume, particularly at Fast Casual restaurants like Habit. As evidenced by Habit’s recent blowout June quarter earnings report, the company continues to execute on the strategy that led us to add the shares to the portfolio back in May. On the heels of the July Retail Sales report, I find myself once again boosting our price target on HABT shares to $17 from $16 as the underlying strength is continuing into the current quarter.

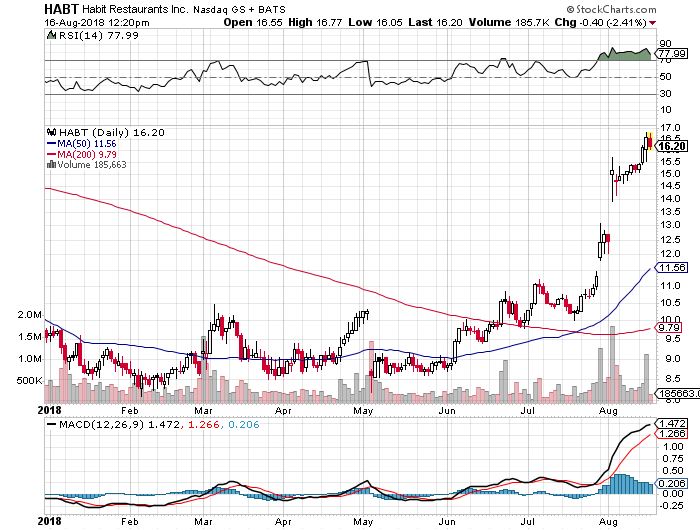

With just over 6% upside to our new price target for Habit, it’s not enough to commit fresh capital to the position. Given the surge in HABT shares – more than 80% since we added them to the Tematica Investing Select List this past May – as well as their current technical picture (see the chart below), I’m inclined to opportunistically use the position as a source of funds in the coming weeks.

While one might think those gains have come at the expense of grocery stores, and in turn, a potential blow to McCormick’s, the July figure for grocery was also the best in the last three months. What this tells us is people are likely paying more for food at the grocery store and at restaurants, which reflects the combination of higher food prices as well as the shift to food, drinks, and snacks that are healthier for the consumer (and a bit more expensive in general). On that strength and the forward view that will soon have us waist deep in season’s eatings, we are boosting our price target for MCK to $130 from $110. That includes some post-June quarter earnings catch up on our part for McCormick and its ability to grow its top line as part of our Clean Living and Rise of the New Middle Class investing themes, as well as wring out cost synergies associated with acquired businesses. In the coming months, I expect we will once again see this Dividend Dynamo boost its quarterly dividend, keeping MKC shares as one to own, not trade.

Getting back to the July Retail Sales report, the Nonstore retail July figure bodes very well for continued share gains at Amazon and other retailers that are embracing our Digital Lifestyle investing theme as we head into the holiday shopping season. Moreover, I see the e-commerce sales gains at Walmart – up +40% in the July quarter as well as those by Costco Wholesale, up 33% year to date — serving to confirm the accelerating shift by consumers to that modality of shopping as more alternatives become available. Helping Walmart is the addition of over 1,100 brands year to date including Zwilling J. A. Henckels cutlery and cookware, Therm-a-Rest outdoor products, O’Neill surf and water apparel, Shimano cycling products and the brands available on the dedicated Lord & Taylor shop, like Steve Madden footwear. Let’s remember too that Amazon continues to pull the lever that is private label products across a growing array of categories, and those margins are superior to those for its Fulfilled by Amazon efforts.

Speaking of Costco, its July sales figures showed a 6.6% year over year increase in same-store sales, which as we learned by comparing that with the July Retail Sales report was magnitudes stronger than General Merchandise stores (+3.3% year over year) and Department Stores (+0.3% year over year). Yes, Costco was helped by its fresh foods business, but even there it topped Grocery sales for the month. The clear message is that Costco continues to win consumer wallet share, and more of that is likely to be had in the coming months as consumers contend with the seasonal spending pickup.

The big loser in the July Retail Sales report was the Sporting goods, hobby, musical instrument, & bookstores category, which is more than likely seeing its lunch eaten by Amazon, Walmart, and Costco. All three of these companies are embracing the increasing digital lifestyle, targeting rising incomes in the emerging markets and helping cash-strapped consumers in the US stretch those dollars. As we have said many times before, the only thing better than the tailwinds of one of our investing themes is the combination of several and these companies are benefitting from our Digital Lifestyle, Rise of the New Middle Class and Middle-Class Squeeze investing themes.

All in all, the last 24 or so hours as very positive for our AMZN, COST, HABT and MKC shares on the Tematica Investing Select List.

- Our price target on Amazon (AMZN) remains $2,250.

- Our price target on Costco Wholesale (COST) remains $230.

- Our price target on Habit Restaurant (HABT) is getting a boost to $17 from $16.

- We are also bumping our price target on McCormick & Co. (MKC) shares to $130 from $110 as we get ready for seasons eatings 2018.