A New Contrarian Position and Moving on from a Profitable One

Apple rebounds big time, so do our calls

The last few days have been strong in the market and, as expected, the chatter on new Apple ([stock_quote symbol=”AAPL”]) products has continued to intensify. This has led to an even stronger reversal in our Apple (AAPL) March $100 calls, which closed last night at $2.21 vs. my buy-in recommendation at $1.32 just a little over two weeks ago.

Market re-enters overbought territory

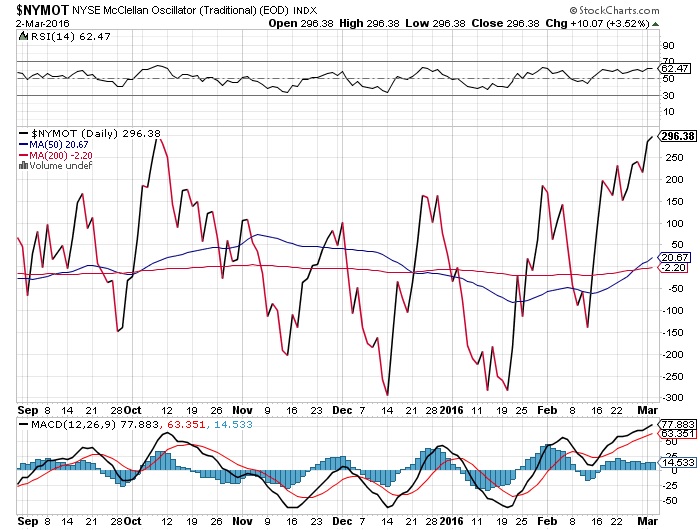

Stepping back a bit, the market, as measured by the S&P 500, has undergone a powerful rally. As of last night, it had climbed 8.6% from its Feb. 11 close. That welcome market rally pushed the NYSE McClellan Oscillator, (an indicator of market breadth based on the number of advancing and declining issues on the NYSE) back to levels from which we’ve seen pullbacks in the market.

In addition, as of last night, the S&P Capital IQ Short-Range Oscillator shows the market is now significantly overbought — two times overbought to be precise. Given data this week that showed the domestic and larger global economy slowed even further in February, it looks increasingly apparent that we are due for more gross domestic product (GDP) and earnings revisions — both in the downward direction.

Here’s our play today

To me, this situation signals the market is ripe to give up some ground on even modestly bad news. As such, we are issuing a “Sell” rating on the AAPL March $100 calls (AAPL160318C00100000) with a double-digit percentage gain since issuing our “Buy” recommendation. We are also recommending investors add some market protection with a “Buy” rating on the ProShares UltraShort S&P500 (SDS) April $22 calls (SDS160415C00022000) that last traded at $0.54 and expire on April 15. For those unfamiliar with SDS shares, this an inverse exchange-traded fund (ETF) that negatively reflects moves in the S&P 500. It is a levered ETF as well — meaning it seeks a return that is -2x the return of the S&P 500. As you make these trades, be sure to set a stop loss at $0.40 for the SDS April $22 calls, which will limit potential downside.