April is looking like it will be even more turbulent than March for the stock market

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

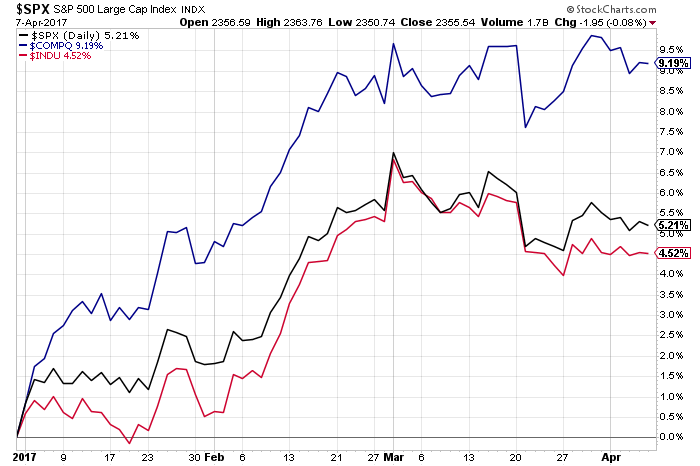

The first week of the second quarter started off very differently than that for 1Q 2017. While the start of 1Q 2017 was off to the races for the stock market, the majority of major US market indices finish the first week of 2Q 2017 in the red, with only the Dow Jones Industrial Average relatively unscathed for the week.

If we were to look at the week on its own, there was a smattering of economic data that confirmed what we’ve been saying here at Tematica — 1Q 2017 is dramatically slower compared to the 4Q 2016 — and we continue to think that along with a challenging political climate in Washington as well as renewed political tensions with Syria and Russia, investors are questioning earnings and growth prospects more now that at the start of the quarter. Quite a combination and just in time for 1Q 2017 earnings to kick into gear.

We shared our view on all of that in last week’s Cocktail Investing podcast episode 14 – Why the Herd Gets It Wrong. Clearly, a must listen in our view! We also had an extra podcast episode last week in which we Chris Versace, Tematica’s Chief Investment Officer, and Lenore Hawkins, Tematica’s resident Chief Macro Strategist, talked with Hartford Funds on the state of the ETF industry, what’s fueling it’s growth and why risk is as important as potential upside to be had when assessing ETF strategies. That was music to Chris and Lenore’s ears as it was a key point in their book Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better Returns.

Coming up on the podcast this week, Chris and Lenore speak with Sal Gilbertie, President and Chief Investment Officer of Teucrium Trading, a firm that specializes in commodities. On the podcast, you’ll hear Sal share with Chris and Lenore why he thinks agricultural commodities like corn, wheat and soybeans should be a part of everyone’s investing portfolio.

Now let’s get back to the market and economy last week….

As we mentioned above, there was no shortage of economic data last week ranging from the ISM Manufacturing Index to its sister report the ISM Service Index, March Auto Sales and the March Employment Report. Across the board each of these reports disappointed expectations, falling compared to February. We’d note the March Auto Sales missed despite another pronounced step up in incentives; with auto dealer inventories climbing, the auto industry’s outlook is not looking very bright in our opinion.

Among last week’s economic data, the biggest miss was the March Employment Report that not only came up well short of expectations, with just 98,000 jobs vs. the expected 180,000, but once again showed modest wage growth. That same report is also beginning to show the brick & mortar retail pain we’ve been talking about quite a bit as retail jobs fell by 30,000 in March, bringing the two-month tally to roughly 60,000. The sad news is we are only starting to see store closings, but we are also hearing about more bankruptcies, including Bebe Stores (BEBE), and Payless (PSS) as well as potential liquidation at hhgregg (HGG) and others.

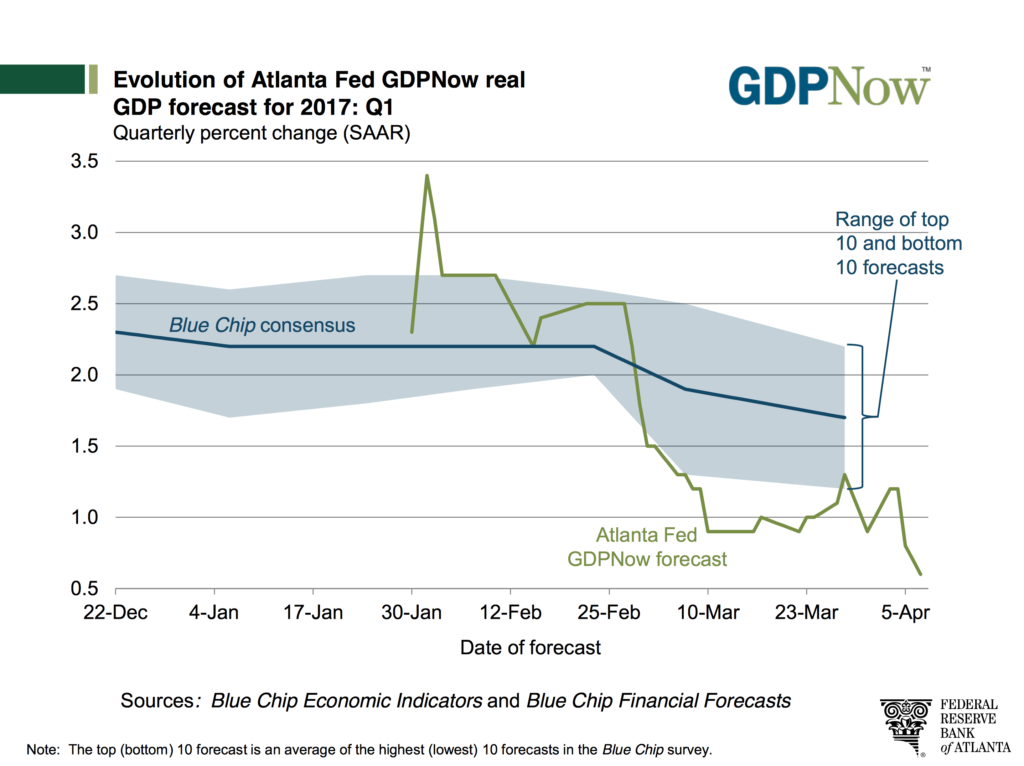

Clearly not the vector or velocity many were hoping would close out the quarter and it led the Atlanta Fed to once again revise its GDPNow forecast for 1Q 2017 lower to 0.6 percent. That’s a sharp drop compared to 2.1 percent in 4Q 2016. It’s somewhat hard to believe that GDP forecast for 1Q 2017 was more than 3 percent just 12 weeks ago, but if we look back at the first year of a new president’s term what we saw was not all that surprising. There tends to be a wave of hope and optimism with a new president, but as history shows the soft data cannot overcome the hard economic data. At some point, the disconnect between the two closes and it tends not to be a pleasant time for investors.

As we have been saying the last several weeks, the warning signs have been there and now we’re starting to get warnings signs that yes, expectations for 2Q 2017 and perhaps 3Q 2017 will need to be revised lower as well. We’re not talking about the expected push out in tax reform and infrastructure spending, which odds are will weigh on GDP expectations near-term. Rather, we’re talking about the deteriorating ability of the consumer to spend and the return of our Cash-strapped Consumer. This past week new data showed:

- For the first time since the financial crisis of 2008, credit card debt hit $1 trillion last year. Creditcards.com senior industry analyst Matt Schulz said while Americans are doing a “good job” meeting debt obligations, “eventually with big debts and rising interest rates,” delinquencies will rise.

- In the last three months of 2016, household debt hit $12.58 trillion according to a report from the New York Federal Reserve Bank.

- Student debt that has increased more than fivefold over the past 14 years, the New York Fed said, totaling $1.3 trillion at the end of last year. Recent graduates who borrowed money to finance their degrees leave school with about $34,000 in debt — a 70 percent increase from a decade ago — and about 5 percent of the borrowers have more than $100,000 in debt.

Because the consumer, directly or indirectly, impacts some two-thirds of the domestic economy, a downshift in consumer spending likely means the economy will have a hard time breaking out of the current soft patch. Currently, The Wall Street Journal Economic Forecast Survey of more than 60 economists is calling for 2.5 percent GDP in both 2Q and 3Q 2017. Much like we did in the prior quarter, we’ll continue to watch the underlying data to determine how realistic those forecasts are, but as we see it today it’s looking like there is more downside than upside.

Given all of that data, as well as Friday’s US missile strike on Syria, it’s not surprising the stock market finished the week lower. From our view, while the coming week is likely to continue to be No Man’s Land, we’re likely to see uncertainty climb as the not only the earnings season approaches but also April 28, the deadline for the government to pass a new funding bill lest we once again face another government shutdown.

Based on what we’re seeing, it’s looking a like April may not come in like a lion and go out like a lamb.

Turning our Gaze to the Week Ahead

It will be a short one given the Easter holiday that sees domestic markets closed for Good Friday. Nevertheless, there will be more economic data to be chewed through and some earnings reports as well before we get to all that weekend candy.

Among the reports we’ll be watching will be the February JOLTS report a well as the March Retail Sales report. Given continued warning signs from retailers, we are not expecting major upside surprises from the March Retail Sales Report, which is already facing tough year over year comparisons given a far later than usual Easter holiday this year.

This week also has the usual inflation indicators for March, the Consumer Price Index as well as the Producer Price Index, as well as the NFIB Small Business Optimism Index and Consumer Sentiment indices. Given the signs of higher input costs we’ve been seeing these last few months, we’ll continue to keep tabs on the figures. That said, we also recognize the year over year percentage increases are due in part to sharp drops in commodity prices last year and in the coming weeks, we are likely to see the pace of rising input costs ameliorate. This is something Lenore and Chris talk about on last week’s podcast, and Lenore also published a piece on this last week.

The week is also a little light on Fed speakers with just Minneapolis Federal Reserve BankNeed Kaskkari speaking on Tuesday. Given the data we’ve been getting over the last several weeks and then Friday’s March Employment Report, we would have liked to have heard the view from more than just one Fed head next week to decipher when the Fed may next boost interest rates. While one month does not make a trend, given the vector and velocity of 1Q 2017 another month of weaker than expected economic data could push the talk around the Fed’s next interest rate hike into the second half of 2017.

Given yet another negative revision in the Atlanta Fed’s GDPNow forecast for 1Q 2017 to just 0.6 percent following today’s Employment Report, we continue to think it will be a volatile earnings season over the coming weeks. For context, GDP in 4Q 2016 was recently revised up to 2.1 percent and the expectation for President Trump’s fiscal stimulus initiatives continue to get pushed out rather than pulled in. We expect companies to reflect all of this in their comments and expectations over the coming weeks.

Call this week the final calm before the earning storm, because there are only a handful of companies reporting earnings during the shortened week, including Asset-lite Business Model company Infosys (INFY) and Economic Acceleration/Deceleration contender Fastenal (FAST) as well as Taiwan Semiconductor (TSM). Of the three we’ll be tuning into Taiwan Semiconductor to get a better handle of the ramp of both new NAND flash and organic light emitting diode demand as well as expectations for PCs and smartphones that will likely impact Apple (AAPL) as well as Qualcomm (QCOM). For those invested in Applied Materials (AMAT) and LAM Research (LRXC) and other semiconductor capital equipment companies, Taiwan Semi’s comments on its 2017 capital spending plans will be a must watch.

Next week, the week after Easter, however, we see a pronounced pickup in the number of companies reporting earnings both in general and from a thematic perspective. Roughly 280 companies share quarterly results and offer their latest take on what’s ahead after we finish gorging on chocolate Easter eggs… or at least some of that do that, up from roughly 60 this week. Yep, it’s going to get a bit frenetic next week and even more so the week after.

As all those reports get digested, we see the potential for first-quarter 2017 earnings season to be a volatile one that is likely to lead to negative revisions to earnings expectations for at least the current quarter. We continue to think this return of volatility will take some of the froth out of the market and allow us to buy shares in quality companies at better prices. For those that have been sitting on the sidelines, the next few weeks could offer the opportunity to revisit quality companies at better prices. Of course, we’ll be looking to do that with the Tematica Select List for our subscribers as we continue to let our thematic investing perspective be our North Star.

One House Keeping Note

In observance of the upcoming Easter holiday, US stock markets will be closed on Friday, April 14. With spring break in full swing this week, we too here at Tematica will be taking a respite as we get ready to gear into 1Q 2017 earnings the following week. Enjoy the week and we’ll see you back here on April 24. In the meantime, be sure to check TematicaResearch.com for our thoughts and musings as well as recent episodes of the Cocktail Investing podcast.

Thematic Earnings Calendar

The following are just some of the earnings announcements we’ll have our eye on for thematic confirmation data points:

Asset-lite Business Models

- Infosys (INFY)

Connected Society

- Taiwan Semiconductor (TSM)

Economic Acceleration/Deceleration

- Fastenal (FAST)

Rise & Fall of the Middle Class

- Delta Airlines (DAL)

- Pier 1 Imports (PIR)