As the Market Bounces Off Oversold Conditions, is this the Start of Another Bull Run?

Market Reversal

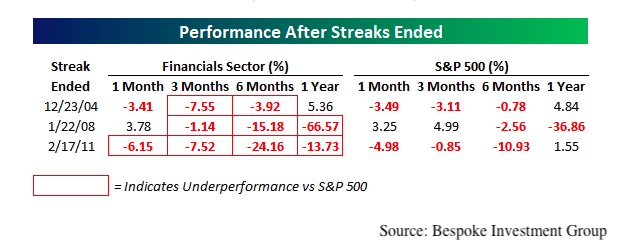

So far in 2019, we are seeing a reversal of the heavily oversold conditions from the end of 2018. Those stocks that were hit the hardest in 2018 are materially outperforming the broader market in 2019. For example, through the close on January 16, 62% of stocks in the Financial sector were above their 50-day moving average, the highest of any sector, versus 44% for the S&P 500 overall. To put that into perspective, Financials have not been the top performer for this metric in 273 trading days, the second-longest such streak since 2001 and only the fourth streak ever of more than 200 trading days. It isn’t just financials as the Energy sector, which was the worst performing sector in 2018, has the third highest percent of stocks above their 50-day in 2019.

While impressive looking, this shift doesn’t necessarily bode well for the Financial sector, nor for the broader market according to data compiled by Bespoke Investment Group.

This recent outperformance by Financials in 2019 is particularly fascinating when I talk to my colleagues at various major financial institutions. Here are a few of the comments I’ve been hearing, paraphrased and without attribution for obvious reasons:

“This deal is way too small for you guys, but I wanted to let you know that our team is working on it.” – (M&A consultant)

“Send it over.We are so late in the cycle that we are looking at damn near anything.” – (Partner at one of the largest global private equity firms)

“What can we do to better serve your company? We are making a major push this year into better serving companies of this size.” – (Partner at one of biggest investment banks to a very surprised member of the Board of Directors of a recently IPO’d company whose market cap would have normally left it well below the bank’s radar. After some investigation, many other board members for companies of a similar size in the sector have been getting the same phone calls from this bank.)

The big financial institutions are having to work their way downstream to find things to work on – that’s a major peak cycle indicator and does not bode well for margins. It also doesn’t bode well for the small and medium-sized institutions that will likely need to become more price competitive to win deals in this new more competitive playing field.

We have also seen some wild moves in a few of our favorites such as Thematic Leader Netflix (NFLX), which reported its earnings after the close on January 17th. Netflix sits at the intersection of our Digital Lifestyle and Disruptive Innovators investing themes and has seen its share price fall over 40% from the July 2018 all-time highs to bottom out on December 24th. Since then, as of market’s close on January 17, shares gained nearly 50% – in around all of 100 trading hours! While about 10% of that can be attributed to the recent price increase that will amount to about $2 or so per month for subscribers, there are greater forces at work for a move of such magnitude. No one can argue that either direction was based on fundamentals, but rather a market that is experiencing major changes.

One of the most important leading indicators as we start the Q4 earnings seasons was the miss by FedEx (FDX) and the negative guidance the company provided for the upcoming quarters. FedEx’s competitor United Parcel Service (UPS) is part of our Digital Lifestyle investing theme – how are all those online and mobile purchases going to get to you? Both FedEx and UPS are critical leading indicator because they touch all aspects of the economy and transportation services, in general, have been posting some weak numbers lately in terms of both jobs and latest price data.

In what could be reflective of both our Middle Class Squeeze investing theme, Vail Resorts (MTN) also gave a negative pre-announcement, stating that its pre-holiday period saw much lower volumes than anticipated despite good weather conditions and more open trains. The sour end of the year in the investment markets and the weakness we’ve seen in markets around the world may have led many decided to forgo some fun in the snow. We’ll be keeping a close eye on consumer spending patterns, particularly by income level in the months to come.

Investor Sentiment Slips

According to the American Association of Individual Investors, bearish investor sentiment peaked at 50.3% on December 26, right after the market bottomed. Bullish sentiment over the past month rose from 20.9% to 38.5% but then stalled this week, falling back to 33.5% as the markets reached resistance levels. Bullish sentiment is now back below the historic average but still well above the December lows. Bearish sentiment, on the other hand, is on the rise, up to 36.3% from last week’s 29.4%. This is just further indication that much of what we’ve seen so far in 2019 is a recovery from the earlier oversold conditions.

As we look at the unusual pace at which the major indices lost ground in the latter part of 2018 and the sharp reversal in recent weeks, I can’t help but think of one of the many aspects of our Aging of the Population investment theme. A large portion of the most powerful demographic of asset owners is either in or shortly moving into retirement. Many already had their retirement materially postponed by the losses incurred during the financial crisis. They are now 10+ years older, which means they have less time to recover from any losses and have not forgotten the damage done in the last market correction. I suspect that we are likely to see more unusual market movements in the years to come than we have since the Boomer generation entered into the asset gathering phase of life back in the 60s and 70s. Today this group has a shorter investment horizon and cannot afford the kinds of losses they could 20+ years ago.

The Shutdown and the Fed

Aside from a rebound against the oversold conditions, another dynamic that has the market in a more optimistic mood, at least for the near term, is the narrative that the government shutdown is good news for interest rates as it will likely keep the Federal Reserve on hold. Given that estimates are this shutdown will cost the economy roughly 0.5% of GDP per month, it would be reasonable for the Fed to stay its hand.

Inflation certainly isn’t putting pressure on the Fed. US Producer Prices fell -0.2% last month versus expectations for a -0.1% decline. The bigger surprise came from core ex-food and ex-energy index which fell -0.1% versus expectations for an increase of +0.2%. Keep in mind that core PPI declines less than 15% of the time, so this is meaningful and gives Powell and the rest of the FOMC ample cover to hold off on any hikes at the next meeting.

US import prices fell -1% month-over-month in December after a -1.9% decline in November, putting the year-over-year trend at -0.6%. That’s the first negative year-over-year print since August 2014. Yet another sign that inflation is rolling over.

Economy Flashing Warning Signs

Despite all the hoopla earlier this month over the December’s job’s report, this month’s Job Openings and Labor Turnover Survey (JOLTS) report showed that for the first time since the end of 2017 and just the 6thtime in this business cycle, hirings, job openings and voluntary quits fell while layoffs increased in November.

By digging further into the details of the Household survey as well we see that people holding onto more than one job rose +117k in December, accounting for over 80% of the total employment gain. On top of that, the number of unincorporated self-employed rose +126k. These two are things we normally see when times are tough, not when the economy is firing on all cylinders. Not to be a Negative Nancy or Debbie Downer here, but the prime-working-age (25-54) employment shrunk -11k in December on top of 48k the month before. This was before things started to get really scary for many workers with the government shutdown. Imagine how many more are now looking for a second job to make ends meet while they wait for those inside the beltway to work this mess out.

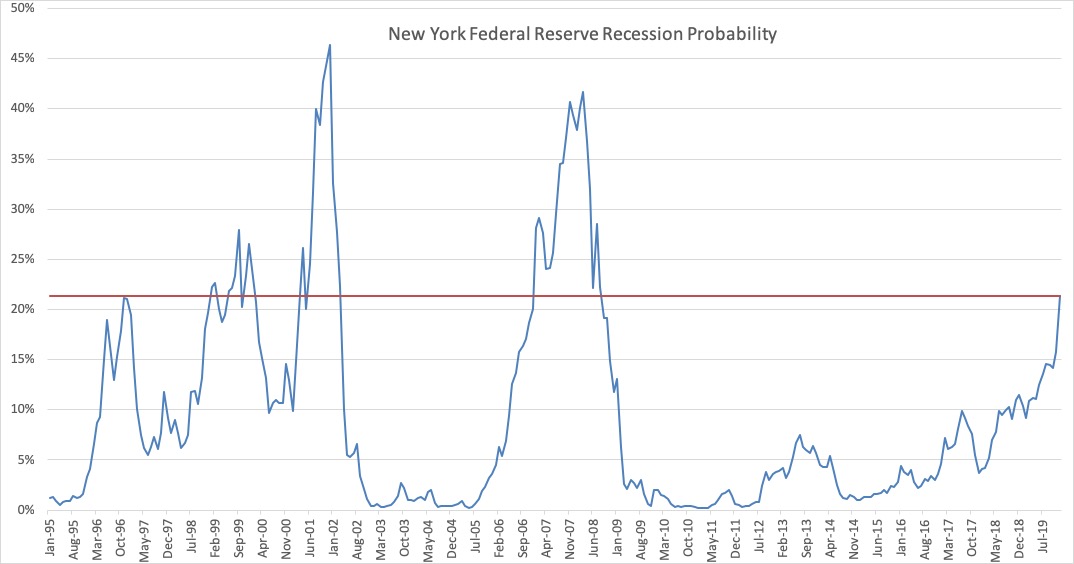

We also got a materially weak New York Empire Manufacturing survey report this week that saw New Orders decline for the second consecutive month and a sharp drop in the 6-month expectation index. The New York Federal Reserve’s recession risk model is now placing odds of a recession by the end of 2019 at over 21%, having more than doubled since this time last year and having reached the highest level in 10 years. Powell and his team at the Fed have plenty of reasons to hold off on hikes. I wouldn’t be surprised if their next move is actually to cut.

Risks, what risks, we don’t see no stinking risks

US economy isn’t as strong as the headlines would make you think. The political dialogue going back and forth while on the one hand entertaining in a reality TV I-cannot-believe-he/she-just-said-that kind of way isn’t so funny when we look at the severity of problems that need to be addressed – excessive debt loads, a bankrupt social security program, a mess of a healthcare sector – just to name a few. The market today isn’t pricing much of this in, and based on the year to date move in the major market indices, particularly not the potential economic damage the government shutdown if the situation worsens.

If we look outside the US, the market’s indifference is impressive. UK Prime Minister Theresa May’s Brexit plan suffered a blistering defeat in Parliament, the largest such defeat on record for over 100 years, leaving the entire Brexit question more uncertain than ever and it is scheduled to occur just over two months away. In the two days post the Brexit vote back in 2016 the Dow lost 870 points and the CBOE Volatility Index (VIX) rose 49%. This time around the equity markets were utterly disinterested and the VIX actually fell 3.5% – go figure. A messy Brexit has the potential to have a material impact on global trade and yet we basically just got a yawn from the stock market.

Over in Europe flat is the new up with Germany’s GDP expected to come in every so slightly positive and this is a nation that accounts for around one-third of all output in the euro area – with China a major customer. Overall, Eurozone imports and exports fell -2% in November.

The other major exporter, Japan, just saw its machinery orders fall -18.3% in December after falling -17% in November. Japan already had a negative GDP quarter in Q3 and the latest data we’ve seen on income and spending aren’t giving us much to be positive about for the nation.

The Trade War continues with some lip service on either side occasionally giving the markets brief moments to cheer on some potential (rather than actual) signs of progress. The overall global slowing coupled with the trade wars is having an effect. China’s exports for December were far worse than expected, -4.4% from year-ago levels vs expectations for +2%. Last week Reuters reported that China has lowered its GDP target for 2019 to a range of 6% to 6.5%, which is well below the 6.6% reported output gain widely expected last year which itself is the weakest figure since 1990. Retail sales growth has fallen to a 15-year low as auto sales contracted 4.1% in 2018, the first annual decline in 28 years. With a massive level of leverage in its economy, banking assets of $39.1 trillion as of Sept. 30, and nearly half of the $80.7 trillion 2017 world GDP, (according to the World Bank) waning economic growth could be a very big problem and not just for China. We’ll be watching this as it develops given our Rise of the New Middle-class and Living the Life investing themes.

The bottom line is we’ve been seeing the markets bounce off seriously oversold conditions after a breathtakingly rapid descent. The fundamentals both domestically and internationally are not giving us reason to think that this bounce is the start of another major bull run. With all the uncertainty out there, despite the market’s recent “feel good” attitude, we expect to see rising volatility in the months to come as these problems are not going to be easily sorted out.