Key Points from This Week’s Issue:

- LVMH Moët Hennessy Louis Vuitton S.E. is the obvious way to gain exposure to our Living the Life investment theme; however the lack of liquidity in the shares has us take a pass.

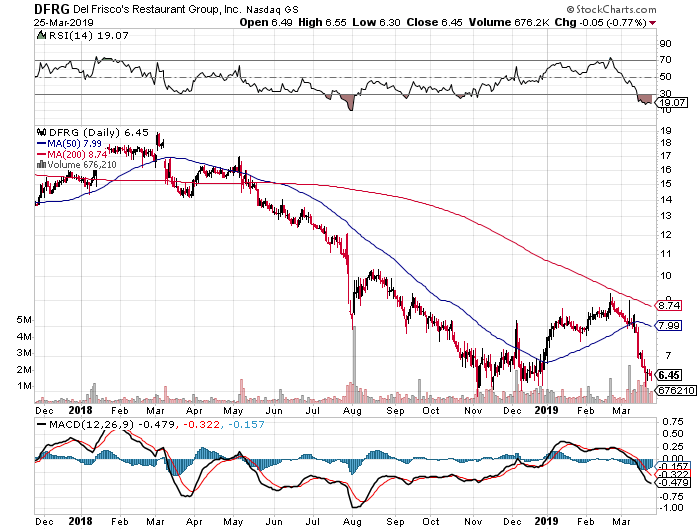

- Instead, we are issuing a Buy on the shares of Del Frisco’s Restaurant Group (DFRG) and adding them to the Tematica Investing Select List with a $14 price target.

Global Demand for Luxury Goods Is Exploding, Giving Rise to Our Living the Life Investment Theme

When we think of the term “living the life” we tend to think of an existence filled with joy, personal satisfaction and the ability to live life to the fullest, which usually implies the finer things in life be it food and drink, travel and hospitality, automobiles, clothing and other personal goods. The word “luxury” originates from the Latin word “Luxus,” which means indulgence of the senses, regardless of cost. Premium to luxury products and services are defined by McKinsey & Co. as ones that have “constantly been able to justify a significantly higher price than the price of products with comparable tangible functions.” The Boston Consulting Group (BCG), meanwhile, defines luxury goods as “items, products and services that deliver higher levels of quality, taste and aspiration than conventional ones.” Between those two definitions are luxury brands like Louis Vuitton, Tiffany, Hermès, Gucci, Ferrari, Prada, Porsche, Rolex and Burberry.

Tematica’s Living the Life investing theme looks to capture the global spending on higher-end affordable luxury as well as luxury branded goods and services that from an economic perspective have a high-income elasticity of demand. As people become wealthier, which we are seeing with the Rise of the Middle Class across many emerging economies, especially China, they will buy more luxury goods.

According to data published by Deloitte, the luxury market reached annual sales of $1 trillion at the end of 2017, of which more than 80% was comprised of luxury cars, luxury hospitality and personal luxury goods. In 2017, the core of the luxury market remained the personal goods category with apparel, beauty and handbags still account for the bulk of the market with shoes, jewelry and handbags ranked as the three fastest-growing product categories for the year.

Data collected by consulting firm Capgemini and published in its World Wealth Report 2018 showed the combined wealth of the world’s millionaires rose for a sixth straight year in 2017, topping $70 trillion for the first time ever due to an improving global economy and strong stock market performance. The number of high net worth individuals (HNWI) — which Capgemini defines as those having investable assets of $1 million or more (excluding primary residence, collectibles, consumables and consumer durables) — reached 18.1 million in 2017, up almost 10% year over year. The four largest geographic markets for millionaires, accounting for 61% of the world’s high net worth individuals, were the US, Japan, Germany and China.

China: the driving force of luxury goods spending

One of the demonstrative forces that is driving and shaping the luxury market is the increasing wealth of Chinese consumers. Our Living the Life investing theme isn’t the only one benefitting from the improving economics or shifting demographics in China. While our Rise of the New Middle Class and our Aging of the Population investing themes are also taking cues from China, our Living the Life investing theme focuses on the explosive growth to be had in China high net worth individuals (HNWIs) and their impact on the demand for luxury goods and services. As you’ll see in the coming paragraphs, luxury goods companies have already recognized that opportunity and positioned their businesses accordingly.

From 2008 to 2014, the number of Chinese households purchasing luxury products doubled, fueled by growing incomes and greater access to luxury goods. Since 2015, the primary driver of increases in luxury spending has shifted from consumers making their first purchases of luxury goods to incremental spending from existing luxury consumers.

In 2016, it’s estimated that 7.6 million Chinese households purchased luxury goods. That number represents less than 2% of total households in China but is more than the total number of households in Malaysia or in the Netherlands. Each of these 7.6 million households spent twice as much as French or Italian households, leaving Chinese luxury consumers to account for almost a third of the global luxury market.

In 2008, wealthy Chinese represented only a third of Chinese luxury consumers; in 2017 they represented half of the shoppers in this category and account for 88% of Chinese luxury spend. With the number of Chinese millionaires expected to surpass that of any other nation in the coming years, according to Gartner, by 2024 Chinese consumers are expected to make up 40% of all luxury spending.

According to Gartner the top luxury brands in China today include Cartier, BVLGARI, Louis Vuitton, Coach, Gucci, Burberry, Mont Blanc, Valentino, Swarovski and Chow Tai Fook.

According to Hurun’s The Chinese Luxury Traveler 2017 report, enthusiasm for overseas travel shows no signs of abating, with the proportion of time spent on overseas tourism among luxury travelers rising 5% to become 70% of the total. Cosmetics, (45%), local specialties (43%), luggage (39%), clothing and accessories (37%) and jewelry (34%) remain the most sought-after items among luxury travelers. High domestic import duties and concerns about fake products both contribute to the popularity of shopping abroad. These high-end travelers prefer top class hotel accommodations such as The Ritz-Carlton, Banyan Tree, the Four Seasons, Mandarin Oriental, the Fairmont and the Peninsula.

During this past June 2018 earnings season, brands including Kering’s Gucci to Britain’s Burberry and French luxury handbag-maker Hermes all reported resilient demand from Chinese shoppers during the quarter, even as escalating China-U.S. trade tensions took hold. One of the factors that helped buoy demand was the reduction in import duties on certain goods that led brands such as Gucci, Hermès and others to trim prices, thereby closing the price gap between the US and China.

Examining LVMH Moët Hennessy Louis Vuitton S.E. shares

An example of a well-positioned company for the Living the Life investing theme is LVMH Moët Hennessy Louis Vuitton S.E. (LVMHF) and its collection of 70 premium brands that span wine and spirits (10% of sales), Fashion and Leather Goods (39%), Perfumes and Cosmetics (13%), Watches and Jewelry (9%), and Selective Retailing (29%). The Selective Retailing component of LVHHF is comprised of retail aimed at international travel customers through LVMH’s ownership of Hong Kong based DFS, a leading luxury traveler retail and its network of duty free stores 11 major global airports and 20 downtown T Galleria locations, as well as affiliate and resort locations; its ownership in Miami Cruiseline, the leading provider of duty-free retail shops to the cruise ship industry; and select retail with Sephora SA and Le Bon Marché in Paris. Recognizable brands that all fall under the LVMH corporate umbrella include Dom Perignon, Hennessey, Moët & Chandon, Louis Vuitton, Fendi, Christian Dior, Aqua Di Parma, Guerlain, Kenzo Parfumes, BVLGARI, Tag Heuer and Chaumet.

In examining LVMH’s business portfolio, it’s one that tackles numerous aspects of the luxury goods industry, and its geographic position bodes well for continued success. In 2016, 25% of the company’s revenue was derived from Asia excluding Japan, and as the influence of the increasingly wealthy Chinese population that exposure rose to 31% in the June 2018 quarter. That geographic mix shift came primarily at the expense of LVMH’s US business, which slipped to 23% of revenue exiting the June quarter vs. 27% in 2016. That shift was hardly surprising given the emphasis on the company’s Asian store network that hit 1,195 locations halfway through 2018 vs. 991 in 2016, and now accounts for 27% of its overall store footprint. As one might suspect, that makes Asia LVMH’s largest market for its Wine and Spirits, Fashion and Leather Goods, Perfumes and Cosmetics, and Watches and Jewelry business units.

That emphasis on China is paying off for LVMH as its sales and profits in the first half of 2018 rose more than 10% year over year before adjusting for currency, led by its Fashion and Leather Goods business that climbed nearly 25% year over year. All of the other segments generated positive reported sales growth save for Wines & Spirits, which was flat on a reported basis as strong volume demand in Asia, particularly China, was offset by exchange rate fluctuations.

From a profit generation perspective, the two businesses we as investors should focus on when it comes to LVHM are its Fashion and Leather Goods (58% of profits) and Wines & Spirits (15%). Not only are these the two largest profit generators that contribute the bulk of LVMH’s earnings, they are also the higher margin businesses at roughly 32% of sales vs. the corporate average near 22%. As these two business lines go, so goes LVMH’s profit stream and its stock price. Margin improvement across all of its businesses, combined with its more than 10% top line increase, led company profits to climb more than 25% in the first half of 2018.

As one might expect, both the luxury goods industry and LVMH’s business are seasonal in nature owing to the heavy gift-giving season and holidays that span from the December quarter into the March quarter, owing to the growing influence of Chinese New Year which typically falls around either late January or February. As one might suspect it means a disproportional amount of revenue and profits for LVMH come during the second half of the year. In 2017, 68% of the company’s revenue and 69% of its profits were delivered in the second half of the year.

As we once again head into that holiday and shopping filled season, LVMH’s portfolio and geographic positioning have it well positioned to capture the growth in luxury goods spending. The continued focus on cost containment and the benefit of select price increases, with a more favorable mix of product bode well for LVMH’s profit growth to outpace that for its top line. It’s hard to argue with a well-positioned company that is delivering positive operating leverage.

Year to date, LVMHF shares have had a strong run, up some 24%, and are up nearly 150% since the beginning of 2016, but there is more upside to be had as the growing impact of the increasingly wealthy Chinese consumer is felt and as the company continues to grow its bottom line and dividend payments. By 2020, consensus expectations call for LVMH to deliver EPS of €14.90, up from €10.20 in 2017, with its dividend per share hitting €6.93 compared to €5.00 in 2017.

As alluring as LVMH’s business may be to investors, following the strong move in the share price, the shares are currently trading at the upper end of their historical P/E multiple and dividend yield ranges. From a risk to reward profile, while upside to the $420 level in LVMHF shares is likely, the downside risk to $320 doesn’t offer enough net upside to warrant getting involved at current levels. A more favorable entry point for the shares would be below $345.

The other item we must consider with LVMHF shares is the lack of liquidity. Fortunately, LVMH also has a US-listed ADR in LVMUY shares, which while not the most liquid stock it’s far, far better compared to LVMHF shares. In adjusting the above analysis for LVMUY shares, the net upside to downside tradeoff based on historical multiples would be 5%. Also in keeping with the comments above, a preferred entry point for LVMUY shares would be below $69, which offers more than 20% upside to the implied $84 price target.

Del Frisco shares offer a tasty Living the Life offering

Now let’s turn to Del Frisco’s Restaurant Group (DFRG), and if you’ve had the pleasure of eating there, you’ll recognize it’s a high-end experience with a bill to match. Quite a different business model compared to the recently exited Habit Restaurant (HABT) shares that netted more than an 80% return for the Tematica Investing Select List. Also unlike Habit shares that are now trading north of 270x expected 2019 EPS, Del Frisco shares are currently trading at just over 21x expected 2019 EPS of $0.44 and less than 1.0 on a 2019 enterprise value to sales basis).

While best known for its Del Frisco’s Double Eagle Steak House, the company’s portfolio also includes Sullivan’s Steakhouse, Del Frisco’s Grille, Barcelona Wine Bar, and bartaco that emphasizes steaks, chops, fresh seafood, tapas, street food, and wines and cocktails. In full the company operates 84 restaurants in 24 states and as one might expect for a company known for its steakhouse, it has a location in DC for those power dining folks. By comparison, Del Frisco’s is a far smaller restaurant footprint than its competition that includes Bloomin Brands’ (BLMN) Fleming’s Prime Steakhouse and Wine Bar, Darden’s (DRI) The Capital Grille, Smith & Wollensky, The Palm, Ruth’s Chris Steak House (RUTH) and Morton’s The Steakhouse. All pricey experiences that fit the mold of Tematica’s Living the Life investing theme.

When examining these kinds of companies, we have to keep a close watch on their cost structure and one of those key areas is food cost. In the case of these establishments that serve steaks, chops and other higher-end fare, Del Frisco’s it means beef, pork and chicken prices. The most recent data from the Livestock Monitor shows cattle and hog slaughter levels are higher year over year in aggregate, which has led to higher production levels and lower prices. We’ve seen the benefit of falling commodity prices in the past and what it means for margins, and as alluded to above Starbucks (SBUX) was a great example of margin expansion during periods of falling coffee prices. When Ruth’s Hospitality reported its quarterly results in offered some confirming comments:

“Food and beverage costs as a percentage of restaurant sales decreased 180 basis points year over year to 28.1%. This decrease was primarily driven by a 10% decrease in total beef costs as well as by 1.4% increase in average checks. Last summer, beef prices were driven to record high levels due to increased retail demand for prime beef. This year, we have not experienced increased retail demand, and as a result, we now expect full-year beef deflation of 1% to 4%. We currently expect this deflation to be the highest in the third quarter before returning to more normal levels in the fourth quarter.”

This wind up of this beef deflation led Ruth’s Hospitality to reduce its costs of goods sold to 28% to 30% of restaurant sales from its prior guidance of 29%-31%. We see that as a positive for the peer group, and especially for Del Frisco’s high margin Double Eagle business, which is also its largest revenue generator (roughly 48% of company revenue).

In examining Del Frisco’s shares, there is visible upside to $14 price target (roughly 32x 2019 EPS, but roughly 1.0 on a 2019 enterprise value to sales basis) vs. the 52-week bottom near $8. From risk-to-reward perspective, that equates to 45% upside as we head into the seasonally strong part of the year with falling beef prices vs. downside of 20%. Odds are that downside level is somewhat higher than $8 given the seasonal strength and falling beef prices, but nonetheless, the current risk-reward in the shares offers net upside of roughly 25%. That has us adding DGRG shares to the Tematica Investing Select List with a Buy rating. Should DFRG shares move lower, we’d look to scale into the position below $9 aggressively provided our thesis on the shares remains intact.

As we do this, it’s worth noting the company is pursuing strategic alternatives for its Sullivan’s Steakhouse business and has shared it has received “several bids from interested parties to purchase the concept and continue to engage in discussions.” A sale of this business which was its lowest margin business during the first half of 2018 would leave a stronger business mix and add cash to the company’s coffers. In my opinion, it also makes for a cleaner takeout story of the remaining Del Frisco’s business by a larger entity such as Bloomin Brands, Darden or privately held Landry’s that own Morton’s Steakhouse.

In terms of catalysts to watch, Darden will report its quarterly earnings on Sept. 20 and we’ll be looking for confirmation in beef deflation as well as improving restaurant traffic sales and margins, particularly at its Capital Grille business.

- We are issuing a Buy on the shares of Del Frisco’s Restaurant Group (DFRG) and adding them to the Tematica Investing Select List with a $14 price target.

Companies riding the Living the Life Tailwind

- American Express (AXP)

- Burberry Group (BURBY)

- Constellation Brands (STZ)

- Coty (COTY)

- Diageo plc (DEO)

- Estēe Lauder Companies (EL)

- Ferrari NV(RACE)

- Inter Parfums (IPAR)

- Hermès (HESAY)

- Ruth’s Hospitality (RUTH)

- Prada S.p.A (PRDSY)

- Tapestry (TPR)

- Tiffany & Co. (TIF)

- Volkswagen (VLKAY)