WEEKLY ISSUE: Earnings Season is Not What Was Expected

Key Points from this Issue:

- Our rating on Applied Materials (AMAT) remains Buy and our price target is $70

- Our rating on LSI Industries (LYTS) remains Buy and our price target is $11

- Our rating on Paccar (PCAR) remains Buy and our price target is $85

- Our price target on Amazon shares remains $1,750, and a win, whole or partial of the pending Pentagon cloud contract would lead to a reassessment of that target.

- Our long-term price target on AXT Inc (AXTI) and Nokia (NOK) shares remain $11 and $8.50, respectively.

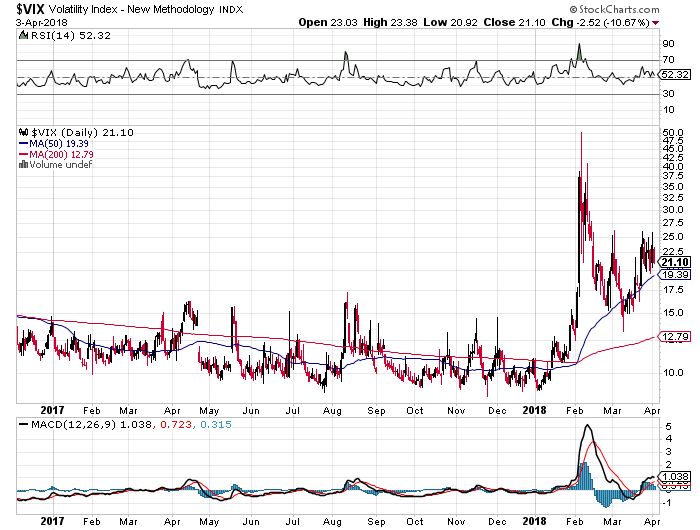

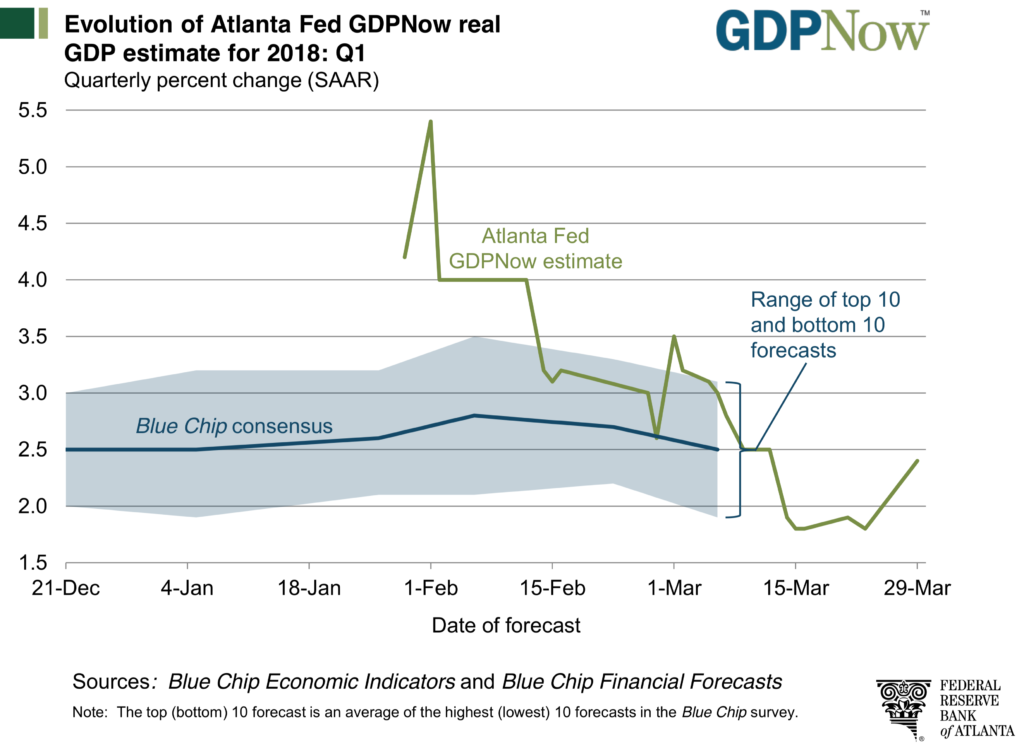

The benchmark 10-year Treasury bond rate went over 3% yesterday for the first time since 2014, sending stock prices down sharply in response. We saw that reverberate through the Tematica Investing Select List as the stock market continues to shoot first and ask questions later. Not surprising given that CNNMoney’s Fear & Greed Index has vacillated between Extreme Fear and Fear over the last month, and commentary thus far this earnings season is aggravating things. Last week it was United Rentals (URI) beating expectations largely due to the impact of tax reform. Yesterday it was Caterpillar (CAT), which after delivering a stellar 1Q 2018 earnings report warned that its margins may have peaked in 1Q 2018 due to rising manufacturing costs. 3M (MMM) also reduced its 2018 outlook and Lockheed Martin’s (LMT) raised outlook included almost all key metrics for the company save the closely watch operating cash flow line.

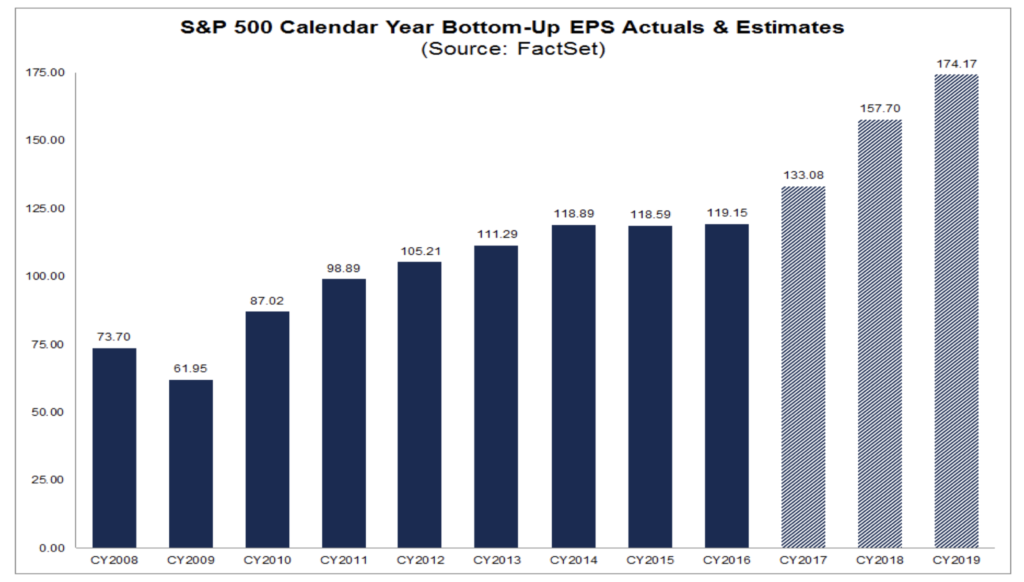

Stepping back, what we’re seeing is an earnings season that developing far from what was expected. As a reminder, the S&P 500 group of companies were expected to deliver 17%-18% EPS growth year over year in 1Q 2018 and reaffirm the outlook that would equate to at least 18% EPS growth in 2018 vs. 2017. The commentary that we’ve gotten over the last week, raises some questions about those growth expectations as the 10-year Treasury bond rate has inched up, which is likely stoking interest rate hike concerns.

This skittish mentality has hit our Applied Materials (AMAT) shares last week despite a solid earnings report from competitor Lam Research (LRCX) and the vibrant outlook for chip demand over the next several years. We saw it again in our LSI Industries (LYTS) and Paccar (PCAR) shares this week – the former getting gut-punched lower amid a sudden CEO exit, and the later despite a rip-roaring 1Q 2018 earnings report that crushed expectations. With 1Q 2018 truck orders surging to levels last seen more than a decade ago, prospects for Paccar to deliver further margin leverage look rather favorable in my view. With the underlying data pointing to a favorable nonresidential construction market and a continued truck shortage, I remain bullish on LYTS and PCAR shares, especially at current levels.

The current market environment will call for patience, but that’s in keeping with our long-term, thematic perspective. Complicating matters in the short-term is the inability of companies to step in with their share repurchase programs, which would normally help backstop share prices. Until a company reports its results and clears its quiet period window, it’s in a holding pattern with its share repurchase plan. This likely means if the current market mood persists, odds are the market will trade sidewise at best and likely lower in the near-term as investors recalibrate expectations.

As we navigate through the rest of 1Q 2018 earnings season, odds are we will get a few opportunities to improve our cost basis, and odds are LYTS shares and PCAR shares will be among them unless the data suddenly turns sharply lower. As yet there are no signs indicating that is on the horizon.

- Our rating on Applied Materials (AMAT) remains a Buy and our price target is $70

- Our rating on LSI Industries (LYTS) remains a Buy and our price target is $11

- Our rating on Paccar (PCAR) remains a Buy and our price target is $85

Amazon: A looming boost for Amazon Web Services as the Pentagon gets connected

Shares of Amazon (AMZN) have been on a tear this year, up 25% thus far this year even after yesterday’s market. That makes them the best performer on the Tematica Investing Select List over the last year as well. For those wondering if my outlook for the shares of what I affectionally call the poster child company for thematic investing remains vibrant, my response would be a firm yes!

As we learned last week in Jeff Bezos’s annual shareholder letter, Amazon has 100 million Prime members – to put that in perspective that’s 1 member out of every 3.3 people in the U.S. alone – and garnered for the eighth consecutive year the top slot in the American Customer Satisfaction Index. As Bezos discusses the achievements across Amazon’s various business lines, he gives credit to the 560,000 Amazon employees and the “2 million sellers, hundreds of thousands of authors, millions of AWS developers, and hundreds of millions of divinely discontent customers around.”

Across Amazon’s various businesses it has positioned itself not only with the thematic tailwind that is the accelerating shift toward a digital lifestyle but at nearly every turn it has looked to remove friction for its customers be they consumers, enterprise or other institutions. According to data from Statista, e-commerce sales accounted for 9.1% of total U.S. retail sales in 4Q 2017, up sharply from 4.6% in 4Q 2010. The combination of Amazon’s Prime service, which in my view was the beginning of the end for the mall and brick & mortar retail, paired with a still-expanding array of products and services has led Amazon to take consumer wallet share as it disrupts existing business models and industries. As Bezos pointed out, one of Amazons’ not so subtle strategies is to tap into consumer discontent. I see that as a different way to say, Amazon is riding the thematic tailwinds associated with our Connected Society, Disruptive Technology, Cashless Consumption and other investing themes.

What many don’t realize, however, is the secret weapon that is Amazon Web Services (AWS), the company’s cloud business that accounted for 10% of its 2017 revenue but virtually all of its operating profit for the year. I see the cloud as a disruptive force in how companies are conducting their business, and for individuals, a new method to save files of various types, and this means AWS is on the receiving end of a Disruptive Technologies tailwind.

On the one hand, enables Amazon to invest in its other initiatives while more often than not beating EPS expectations over the last several quarters. On the other, this means investors need to pay close attention to AWS and its ability to continue to grow, thwart competition and maintain if not further expand its operating margins.

This brings us to one of the larger known opportunities for AWS – in March, the Department of Defense announced it would select one cloud vendor for a multibillion-dollar cloud services contract to support its 3.4 million users, 4 million devices and some 1,700 data centers. Likely competitors for this include Microsoft (MSFT), IBM (IBM), Alphabet (GOOGL), Oracle (ORCL) and yes, AWS.

This raises the question of market share and here’s the answer. According to data from research firm Gartner, AWS has 44% percent of the public cloud market, followed by Microsoft’s Azure with 7% percent, China’s Alibaba Group with 3% and both Google and Rackspace at just over 2%. Outside those top 5, the remaining 41% of the 2017 $22 billion infrastructure as a service public cloud market was spread across a number of competitors.

For those wondering, AWS has already cracked the government cloud market with the $600 million contract it received from the CIA back in 2013, beating IBM out in the process. What makes all of this interesting is that in February, the U.S. Department of Defense awarded a $950 million cloud contract to REAN Cloud LLC, an Amazon Web Services LLC consulting partner and reseller.

While the Pentagon is not slated to make any formal announcement as to the winner of the contract until September, there is pushback on the decision to go with one vendor. Understandable as even companies like Apple (AAPL) loath to be tied to just one supplier. In this case, there is the obvious risk that just one cloud vendor for the entire Pentagon would more than likely make that vendor the world’s largest target for hackers and other digital malcontents. But there are other business reasons for the Pentagon to consider multiple vendors including competitive pricing and innovation as well as limiting complacency.

As an investor, would I like to see Amazon win the Pentagon contract? Absolutely. But given the increasing frequency of cyber-attacks and a bloating government budget, the smarter business decision looks to be having at least a few cloud vendors. As the American author, Nancy Pearcey summed up rather nicely, “Competition is a good thing, it forces us to do our best.” And let’s remember, any slice of the Pentagon contract is a win for all of these potential cloud suppliers.

- Our price target on Amazon shares remains $1,750, and a win, whole or partial of the pending Pentagon cloud contract would lead to a reassessment of that target.

AXTI and NOK: Checking the 5G news

On Friday, Ericsson (ERIC) one of the leading mobile infrastructure companies reported better-than-expected results, which contained positive comments on the North American market that reflect investments in network expansions and in 5G readiness. This bodes very well not only for our Nokia (NOK) shares but also our AXT Inc. (AXTI) ones as well. It also happens that both companies are reporting later this week – AXT after Wednesday’s market close and Nokia before the market open on Thursday.

Here’s the thing – Ericsson wasn’t the only company to paint a favorable picture for these two companies when it comes to 5G. AT&T (T) recently shared that it will expand its “5G Evolution” wireless technology to more than 140 U.S. markets, which lays the groundwork for its planned mobile 5G service launch later this year. For those that are unfamiliar with AT&T’s 5G Evolution technology, it can deliver theoretical peak speeds for capable devices of up to 400 megabits per second. By the end of 2018, AT&T targets having 5G Evolution in more than 500 markets “including major cities like Baltimore, Cleveland, Denver, Detroit, Las Vegas, New York City, Philadelphia, Seattle and Washington D.C.” Alongside that announcement, AT&T also shared it is making its LTE-LAA technology available in parts of 3 new markets, bringing the total number of markets served to 7. AT&T’s LTE-LAA technologies can deliver theoretical peak speeds for capable devices of up to 1 gigabit per second.

Again, those rollouts are paving the way for AT&T 5G service. The company has been running test trials of 5G service in preparation for deployment in 12 US markets later this year. The carrier shared its speed test results and a few other notes on Tuesday. AT&T has been testing 5G with small businesses over the last year in three separate cities: Waco, Texas; Kalamazoo, Michigan; and South Bend, Indiana. Here are some of its findings:

- Waco’s 5G speeds were 1.2Gbps from 500 feet over a 400MHz channel, with 9-12 millisecond latency. That was with “hundreds of simultaneous connected users,” according to AT&T.

- Kalamazoo had 1Gbps speeds at 900 feet in “line of sight” conditions, and no negative impact from rain or snow. AT&T noted the signals could penetrate “significant foliage, glass, and even walls” better than expected, but it’s unclear what that specifically means.

- South Bend didn’t report specific speeds but claimed “gigabit wireless speeds” in the line of sight and “some non-line of sight” conditions. To put that in perspective, my home’s Wi-Fi speed is around 100Mbps and my phone on AT&T LTE averages around 25Mbps.

Putting aside the technical mumbo-jumbo, an analogy from RF semiconductor company Skyworks Solutions (SWKS) and AXT customer drives home the data speed differential – downloading a full-length HD movie in 3G took one day, in 4G, the same file took minutes. On a 5G network, this content will be downloaded in mere seconds. Talk about the next disruptive iteration in mobile technology. Given its move to acquire Time Warner (TWX), I’d argue that AT&T has a vested interest in scaling its 5G network.

In January, AT&T shared that it plans to launch its mobile 5G network in a dozen markets in late 2018, along with a phone that will actually be able to use it. When AT&T reports its 1Q 2018 results after Wednesday’s close and then holds its annual shareholder meeting on Friday (Apr. 27), we’ll be looking for confirmation of those plans and possibly either an upsizing or pulling forward of them as well. We would view any of those scenarios as positive for our AXT and Nokia shares.

- Our long-term price target on AXT Inc (AXTI) and Nokia (NOK) shares remain $11 and $8.50, respectively.