Even though it was a holiday, on Monday, I shared my view on what will be moving and shaking the stock market this week as well as what earnings we have on tap this week from the Tematica Investing Select List. We’re also just over half way through the current quarter and by this time next week, we’ll be getting ready to shut the books of February. That means we’ll have two of the three months in 1Q 2018 behind us. It also means the coming weeks will bring us a smattering of February data that will help us get a better measure on the vector and velocity of the domestic as well as global economy. That data will set the stage as well as expectations for the Fed’s next FOMC meeting to be held on Mar. 20-21.

As I’ve said on recent episodes of our Cocktail Investing Podcast, while the stock market is watching inflation data ahead of the next FOMC meeting in the hopes of gauging the Fed’s upcoming economic and potential policy update. In my view, the event the stock market is really looking forward to is the updated outlooks to be had on Mar. 21. Not only will this include the Fed’s latest thinking on the speed of the economy and inflation outlook, but it will also be the first commentary offered by new Fed Chairman Jerome Powell. Many have cited Powell’s tendency to vote alongside now former Fed chair Janet Yellen, but now Powell is in the Fed hot seat, and many, including us here at Tematica, are anxious to see if he remains as dovish as many suspect.

The bottom line is over the next four weeks or so all eyes will be puzzling out the data to be had. That likely means the stock market will pivot and roll based on the latest data point similar to what we saw between the January Employment Report and the January CPI Report. Said another way, volatility is back and will be with us at least for the next several weeks. As I’ve said before, volatility is not a bad thing – it can offer us an opportunity if we’re prepared, and given our Contender List, I would argue that we are just that.

In next week’s Tematica Investing, I’ll have a short update on each of the current Tematica Investing Select List positions. Ahead of those myriad updates, here is one for MGM Resorts (MGM), which reported quarterly earnings yesterday, as well as some thoughts on Walmart (WMT) as we add it to the Contender List. Speaking of the Contender List, I review the news on Rite Aid (RAD) shares as well. In the next few days, I’ll be providing a deep dive on engine company Cummins Inc. (CMI). Will it make the Select List or just be a Contender? My take later this week.

December quarter results for MGM Resorts (MGM)

Yesterday, Guilty Pleasurecompany MGM Resorts (MGM)reported December quarter results that beat on the top line but missed on the bottom line after adjusting for a non-recurring, non-cash income tax benefit of $2.52 due to the enactment of U.S. Tax Reform at the end of 2017. Excluding that benefit, the company’s bottom line fell well short of the expected $0.08 per share in earnings for the December quarter and the $0.04 achieved in the year-ago quarter. To help take the sting out of that miss, MGM’s Board approved a 9% increase in the quarterly dividend to $0.12 per share from $0.11. In addition to that good news, the company’s earnings press release had a less than subtle reminder that it has $672.5 million remaining under its current stock repurchase authorization. At the current share price, that would equate to more than 19 million MGM shares or 3%-3.5% of the company’s total outstanding shares.

In parsing the earnings release, we can see lower year over year vacancy rates in Las Vegas, which we attribute to recent shooting, as well as higher expenses, which reflect the opening and refurbishment activities during the quarter. While these were expected, the magnitude appears to be more than Wall Street was thinking even though on the earnings conference call MGM management shared the December quarter came in better than was internally expected back in October following the shooting.

That was the all contained in the earnings press release, but what was had on the follow-up earnings conference call, well that was something different. On that call, management shared that based on what it is seeing quarter to date both in Macau and Las Vegas it is expecting a “strong year” due in part to the recent opening of MGM Macau Cotai as well as the separation this year between the Super Bowl and Chinese New Year. Moving past the current quarter, MGM has a solid line up of entertainment and sporting events that should continue to be a draw to the company’s hotels, restaurants and casinos. Some of the headline entertainment in the coming months include Cher, Ricky Martin, Kevin Hart, Paul Simon, Justin Timberlake and Bon Jovi among others. In my view, this paints the picture of moving past the seasonally slow part of the year, but I’ll be looking for confirmation of the monthly gaming data for Nevada and Macau.

Shifting gears, based on the commentary surrounding the Tax Act, I suspect we will see EPS estimates rising, some for 2018 but more for 2019 and beyond given the changes to the company’s estimated effective tax rate. On the earnings call, MGM shared it sees the effective tax rate for 2018 landing in the low to mid 20%s and falling to the mid-to-high teens for 2019 and beyond. That upward move in EPS, combined with the 9% increase in the company’s quarterly dividend, supports our increasing our price target on MGM shares to $39 from $37.

As we’ve discussed previously, one potential new market for gaming is Japan and per MGM that topic should come to a boil mid-year when the Japanese government is expected to tackle the gaming bill. Given its presence in Macau, we see MGM as well positioned to capture wallet share if and when Japan opens its borders to the gaming industry. I’ll continue to monitor this development and what it means for this Guilty Pleasure company on the Tematic Investing Select List.

- We are boosting our price target on the shares of MGM Resorts to $39 from $37. Our recommendation is subscribers be more active buyers below $33.50.

Adding Walmart to the Tematica Investing Contender List

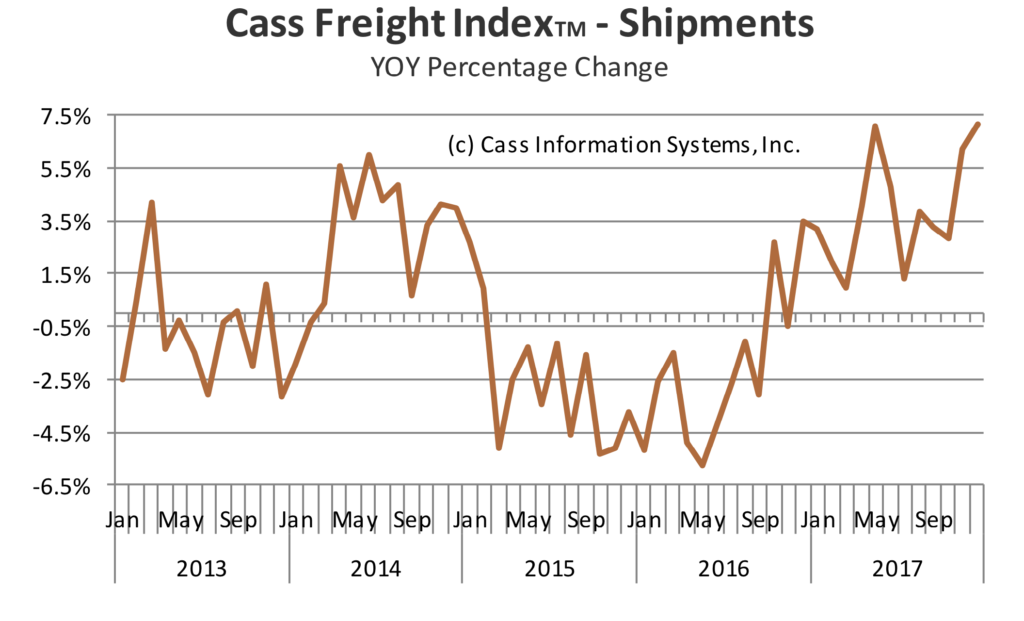

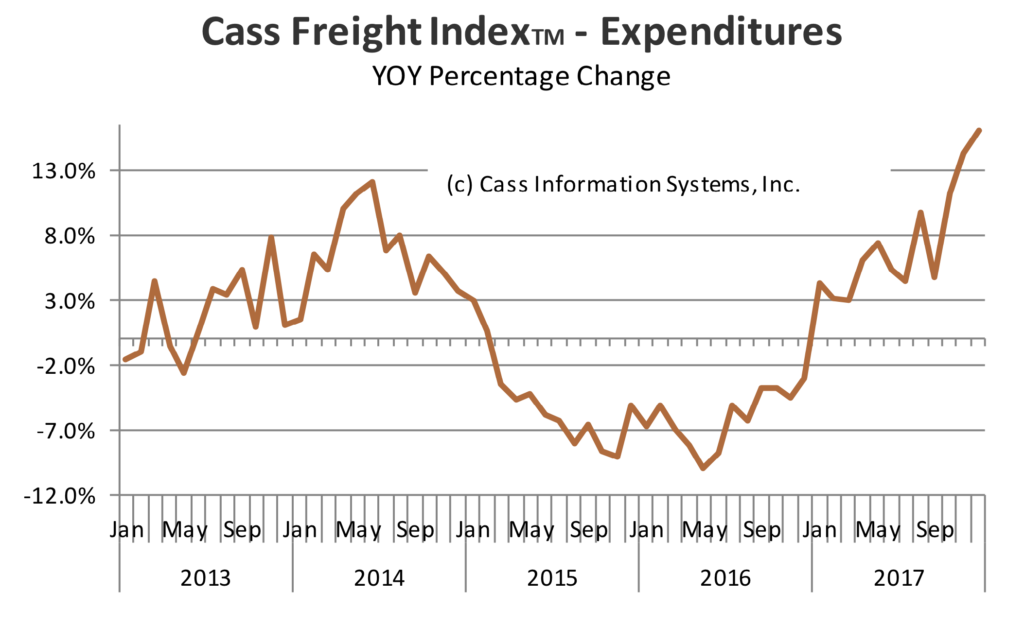

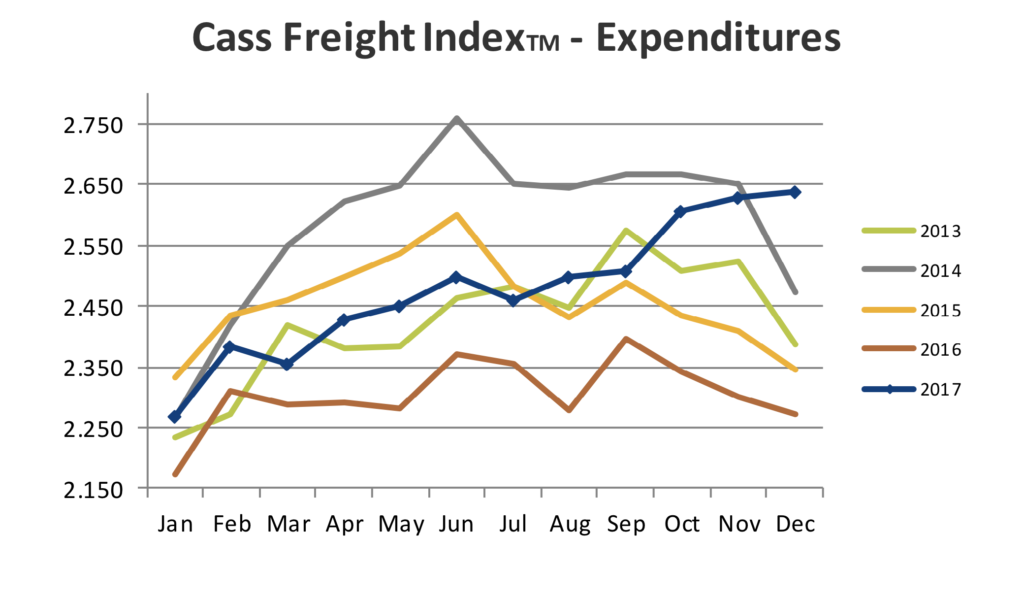

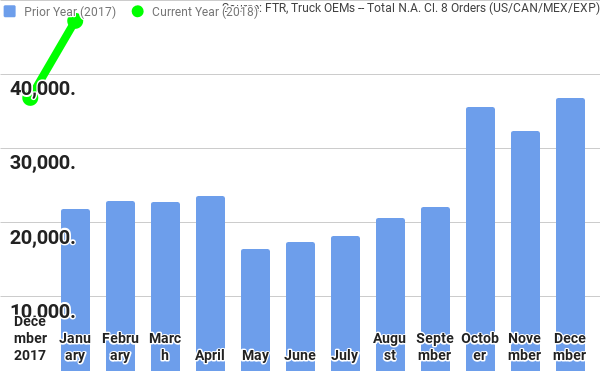

Also, yesterday, increasingly omnichannel retailer Walmart (WMT) reported December quarter earnings that missed expectations, with the company clearly signaling that it will continue to invest in its ongoing transformation. Those investments along with higher freight costs, which I see as a resounding positive for the recently added PACCAR (PCAR) shares to the Tematica Investing Select List, hit Walmart’s margins in the December quarter and are expected to do so in the coming months as well.

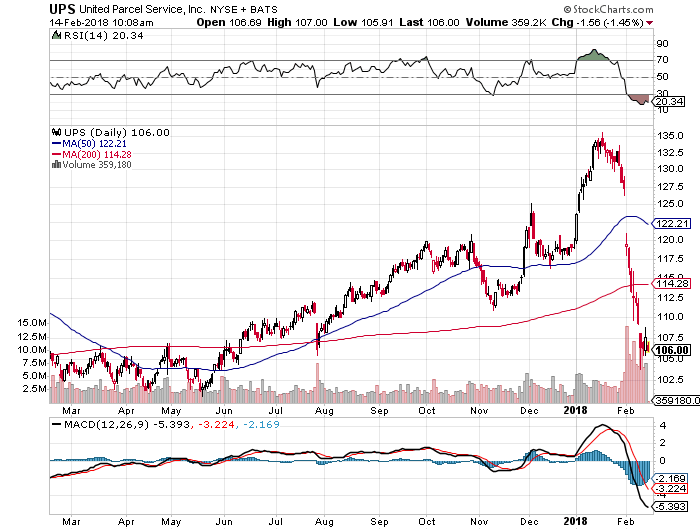

Adding insult to injury, Wall Street didn’t like that Walmart’s digital sales rose just 23% year over year in the December quarter. The criticism is it was a sharp slowdown from the 50% growth rates in the prior quarter, but let’s remember the December 2017 quarter saw the anniversary of Walmart’s JET.com acquisition. We also know that other companies, like United Parcel Service (UPS)were overwhelmed by the shift to digital commerce from brick & mortar sales this past holiday shopping season. I suspect the same was true from Walmart.

Also catching investors off guard, Walmart is now shifting to annual guidance and shared it see the current year coming in at $4.75-$5.00, well below the consensus of $5.08 per share that Wall Street was modeling. That miss, which was somewhat softened by the 45thhike to Walmart’s annual dividend to $2.08 per share from the prior $2.04 per share, led WMT shares to have one of their worst days since January 1988 as they fell more than 10%.

Several times before, I’ve shared my view that Walmart alongside current Tematica Investing Select List residents Amazon (AMZN)and Costco (COST)is likely to be one of the three major retailers to be had amid the current brick & mortar shake-up. While Walmart’s margins are being hit today, I see the company following a similar path taken by Amazon in 2015-2016 as it invested for the Connected Society tailwind it, and we, saw coming. Over the coming weeks, I’ll be digging more into Walmart’s business as well as determining the potential upside to be had in the shares over the coming 12-24 months as it realizes the benefits of investments made in the near-to-medium term. As such we are placing WMT shares on the Tematica Investing Contender List.

- We are adding Walmart (WMT) shares to the Tematica Investing Contender List.

- Our price target on Amazon (AMZN) shares remains $1,750.

Contender List Rite-Aid catches a bid from Albertsons

Yesterday, The Wall StreetJournal is reporting that privately held grocery chain Albertson’s “plans to buy the rest of Rite Aid Corp. (RAD) that isn’t being sold to Walgreens Boots Alliance (WBA).” When I added RAD shares to the Contender List in January, I labeled the company a turnaround story, and while that likely remains the case – how much progress could even a stellar management team make in five weeks? – the reality is we are seeing both grocery as well as pharmacy companies scramble in the wake of Amazon.

While details on the proposed transaction are scant, per the Journal, the cited transaction would lead to Albertsons, which already owns Safeway and 19 other supermarket chains, holding “roughly 71% of the combined company, while Rite Aid investors would own the rest.” Now, this is where things get interesting, following completion of the merger, Albertsons Companies shares are expected to trade on the New York Stock Exchange.

The combined company will operate approximately 4,900 locations across under 20 well-known banners including Albertsons, Safeway, Vons, Jewel-Osco, Shaw’s, Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star Market, Haggen and Carrs, as well as meal kit company Plated. In addition, the new Albertsons will have, 4,350 pharmacy counters, and 320 clinics across 38 states and Washington, D.C., with its full complement of locations serving 40+ million customers per week.

On a pro forma basis, during its first year, the combined company is expected to generate revenue of approximately $83 billion and adjusted EBITDA of approximately $3.7 billion, which bakes in run-rate cost synergies to be had. As one might expect, the transaction has been approved unanimously by the boards of directors of both companies, and the merger is expected to close early in the second half of the calendar year 2018.

From my perspective, this combination is a response to the impact Amazon is having on the grocery industry as well as over the counter health products with companies such as Albertson’s looking to tap into the tailwind of our Aging of the Population theme. Much like with Costco Wholesale (COST)and McCormick & Co. (MKC), we see Albertson’s line of grocery stores as well positioned for the increasingly debt-laden Cash-strapped Consumers that are shifting to eating at home and embrace our Food with Integrity theme when and where possible. We saw proof of this shift in the January Retail Sales Report that showed food-and-beverage retail sales at grocery stores climbing 4.5% year over year vs. falling same-store sales and traffic in January reported by the National Restaurant Association.

As we approach the closing of the merger between these two companies and more details become available, I’ll look to be the new company through its paces to see if it deserves an update to Select List… or not.

- Our price target on Costco Wholesale (COST) remains $200.

- Our price target on McCormick & Co (MKC) remains $110.

A reminder on Universal Display’s earnings report

After tomorrow’s market close, Disruptive Technologies investment theme company Universal Display (OLED) will report its December quarterly results. I expect an upbeat earnings report to be had relative to the December quarter consensus forecast for EPS of $0.85 on revenue of $100 million, up 55% and 34%, respectively, year over year. Based on what I’ve heard from Applied Materials (AMAT)as well as developments over organic light emitting diode TVs and other devices at CES 2018, I also expect Universal will offer a positive outlook for the current as well as coming quarters.

- Our price target on OLED shares remains $225.