Adding this Missing Link Connected Society Stock to the Tematica Select List

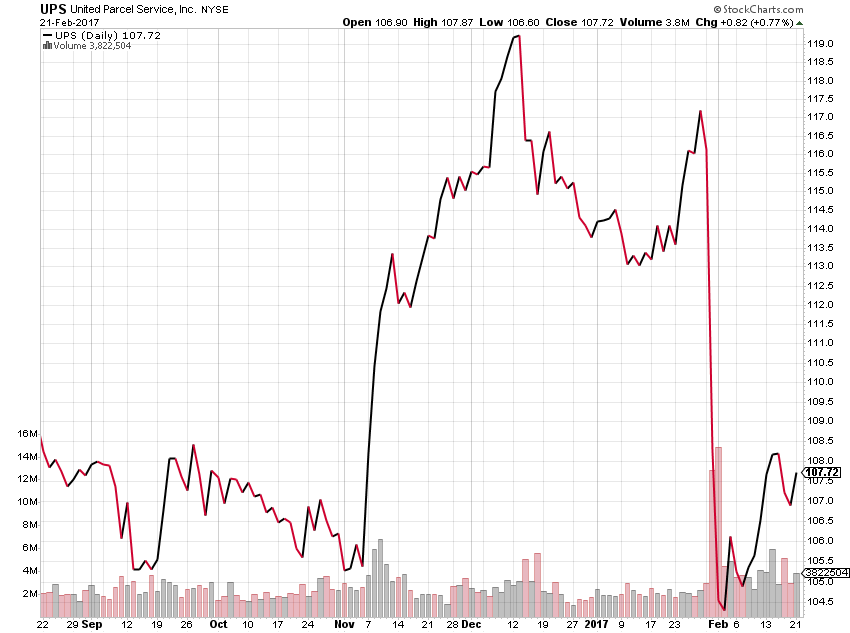

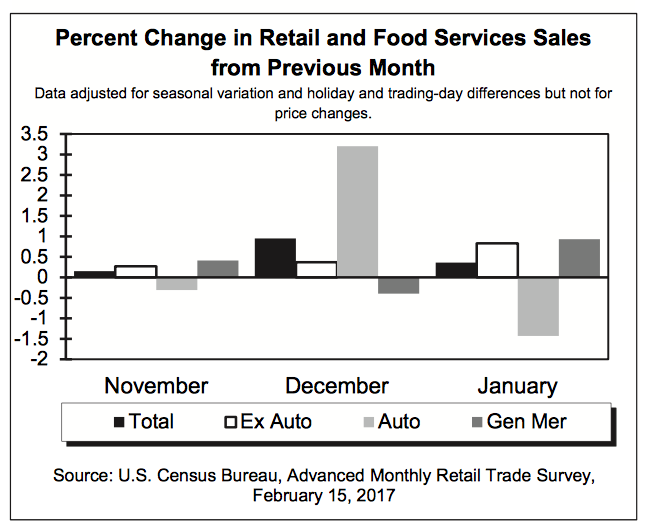

This morning we are adding shares of delivery and logistics company United Parcel Service (UPS) to the Tematica Select List with a price target of $122. We’ve often referenced UPS and its business as the missing link in the digital shopping aspect of our Connected Society investing theme. Year to date, UPS shares have fallen 6 percent, which we attribute in part to the seasonal slowdown in consumer spending. As we pointed out in our analysis of the January Retail Sales report last week, the shift toward digital commerce continues to accelerate and we see that a positive tailwind for UPS’s business and comments from UPS’s annual investor day held yesterday confirm our view.

As of last night’s market close UPS shares stood near $108, which when compared to our $122 price target offers 14 percent upside before we factor in the 3.1 percent dividend yield. Including the quarterly dividend of $0.83 per share into our thinking, we see 17 percent upside from current levels to our price target. As such we are adding UPS shares to the Tematica Select List with a Buy rating. Should the shares drift toward the $100 level, we are inclined to get more bullish on the shares given the business fundamentals as historical dividend yield valuation metrics.

A Look Ahead to 2018-19 for UPS

Yesterday, at its annual investor day United Parcel Service shared its 2018-2019 financial targets, expanded delivery and pick-up schedule, and continued buybacks. In reviewing those details, we continue to see the accelerating shift toward digital commerce at the expense of brick & mortar retail powering the company’s business. While most tend to focus on Amazon (AMZN) when we think of digital shopping, the reality is we see a far more widespread push toward it from the likes of Wal-Mart (WMT) as well as traditional retailers and consumer product companies. Wal-Mart, in particular, is shared on its earnings call yesterday that it would expand its online efforts to include grocery and called out both mobile and online as part of is efforts to “provide customers with a better offer.”

What all of this tells us is we have reached the tipping point for digital commerce, and like a tanker that is turning, once it hits the tipping point it tends to pick up speed. We see that in the coming quarters as retailers that lagged behind are now forced to invest to stay relevant with consumers.

In response to that accelerating shift, UPS is planning to expand its delivery and pickup schedule to six days for ground shipments, including Saturdays. In tandem, UPS will continue to invest in its logistics network, which signals it is preparing for the continued transformation in how consumers shop. That transformation is leading UPS to forecast revenue growth in the range of 4-6 percent over the 2018-2019 period, which means no slowdown in revenue growth from 2017 is expected. UPS also shared it intends to repurchase between $1-$1.8 billion in share repurchase during 2018-2019, which should allow it o grow EPS faster than revenue. UPS expects EPS during 2018-2019 to grow 5-10 percent, which is at the upper end of current expectations. As such, we expect to see Wall Street boosting price targets today and tomorrow up from the current consensus of $115 to something more inline with our $122 price target.

Embracing Technology of the Future

A drone demonstrates delivery capabilities from the top of a UPS truck during testing in Lithia, Florida, U.S. February 20, 2017. REUTERS/Scott Audette

UPS also shared it continues to test drone deliveries, including launching the drone from the top of a UPS van that is outfitted with a recharging station for the battery-powered drone. Granted this in testing, but in our view, the hub and spoke method of deploying drones from UPS trucks makes sense given that drones, especially those carrying packages, are like to operate for limited time frames due in part to battery power demands. In UPS’s tests, the battery-powered drone recharges while it’s docked. It has a 30-minute flight time and can carry a package weighing up to 10 pounds.

Again, we find this interesting, but odds are we will not see any pronounced impact on UPS’s delivery business for at least several quarters. Longer-term, initiatives such as these could spur further productivity and margin improvements.

The Bottomline on United Parcel Service (UPS)

- We are adding shares of United Parcel Service (UPS) to the Tematica Select List with a price target of $122.

- Should the shares drift toward the $100 level, we are inclined to get more bullish on the shares given the business fundamentals as historical dividend yield valuation metrics.