Will the Santa Clause Rally be coming to town this year?

|

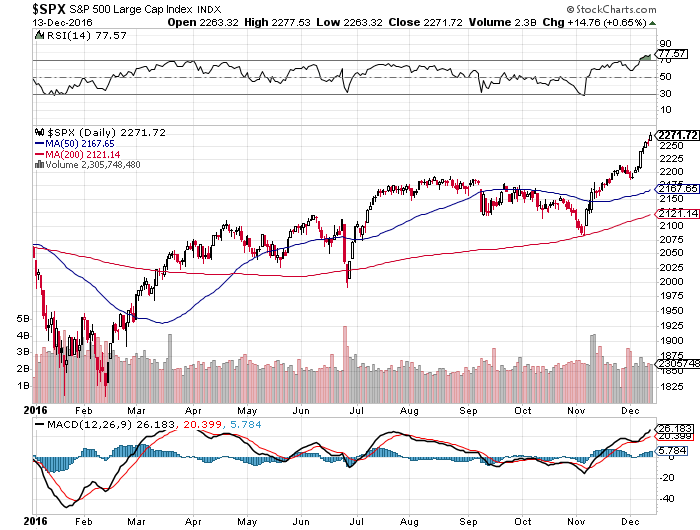

Since our last Tematica Investing update, the Trump Bump rally has continued and the Dow Jones Industrial Average continues its trek toward 20,000. At last night’s close, the Dow stood less than 100 points away from that level and if it hits it, as many speculate it will, it will stand as of the fastest 1,000 point moves for the index. To put some context around that, on Nov. 4 the Dow closed at 17,888,28 and has since climbed more than 1,110 points.

During that same time, all the major indices have put in record high after record high, with many pointing to what is to come under the Trump administration after the January 20, 2017 inauguration. As we wrote in this week’s Monday Morning Kickoff, there are scant signs of selling pressure given the prospect that tax rates will be lower come 2017 than they are today. This means that even though the indices are in overbought territory, we’re likely to soon see the Santa Claus Rally emerge and push stocks even higher.

NOVEMBER RETAIL SALES REPORT — OUR FIRST LOOK AT THE 2016 HOLIDAY SHOPPING SEASON

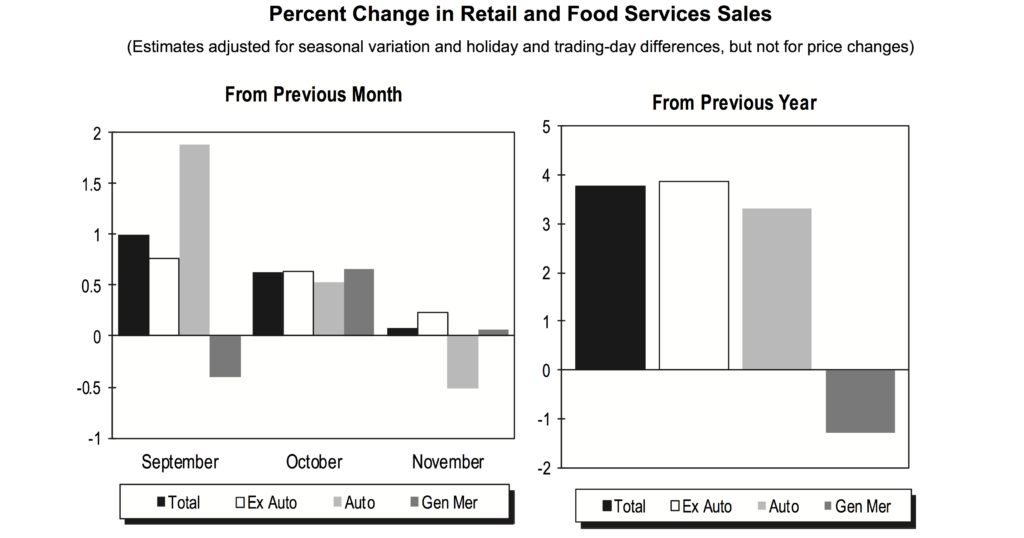

While we are full swing into the holiday shopping season, this morning we received the November Retail Sales Report, which includes the Black Friday to Cyber Monday shopping bonanza. Per the Census Bureau total, November Retail & Food sales rose 0.1 percent month over month. Stripping out food and auto, Retail sales were flat month-over-month and up 3.6 percent year-over-year. Given the data, we’ve seen and shared about Black Friday — Cyber Monday, it comes as little surprise the strongest category of growth was once again Non-store retailers, which were up 11.9 percent year over year. We see that as confirming for our Connected Society positions in Amazon (AMZN) for obvious reason as well as Alphabet (GOOGL) given its search and Google Shopping businesses.

The next strongest category, which reflects our Aging of the Population investment theme, was Health & Personal Care Stores, up just over 6 percent year-over -year. Given our position in Starbucks (SBUX) we’d also call out the 3.1 percent year-over-year increase in Food & Beverage Stores for November. Finally, we always say the monthly Retail Sales Reports put context around Costco Wholesale’s (COST) monthly sales figures and once again comparing the two it become rather obvious that Costco continued to take consumer wallet share during the month as Cash-strapped Consumers looked to stretch their spending dollars once again.

WHAT’S IN STORE COMING OUT OF THE FOMC MEETING TODAY

Later today we’ll hear from the Federal Reserve and the widely held expectation is the boost interest rates by 25 basis points. Our concern is that based on recent data they could surprise the market with a 50 basis point hike. As such, we’re going to hold off adding any new position this week, but we anticipate sharing a new recommendation in next week’s Tematica Investing, if not sooner if conditions are right, so be sure to watch your email and the website closely.

UPDATES, UPDATES, UPDATES

Given the market move, the pickings have certainly slimmed down compared to several weeks ago, but we’re already looking at the intersection of thematic tailwinds and stock laggards. You may be surprised to know there are more than a few potentials from our Contenders list and beyond, and now we’re digging in and putting some of those through their paces.

Now with just over two weeks to go until we close the books on the current quarter and 2016, let’s take a look at the current positions on the Tematica Select List. As we get ready to do that, we’d note that we’ve seen a number of positions added in late 3Q 2016 and early this quarter, like AMN Healthcare (AMN), Universal Display (OLED), and CalAmp Corp (CAMP) climb double digits. Quarter to date, we also added new positions in McCormick & Co. (MKC) as well as Facebook (FB) and scaled into International Flavors & Fragrances (IFF), AT&T (T), Amazon (AMZN), Dycom Industries (DY). We’re happy to report each of those positions is nicely profitable with the vast majority offering additional upside from current levels.

The are a couple of sore points on the Select List. One is Under Armour (UAA), but we see the company’s efforts to grow its International, women’s and footwear business starting to pay off and if the number of Under Armour items on our kids’ Christmas lists are an indication, it should be a strong holiday season for the athleisure player. We’d say dividends would also point to a bright future, but UA isn’t a dividend payer.

The other sore point would be the ProShares Short S&P 500 ETF (SH) position, which has come under further pressure as the Trump Bump has pushed the S&P 500 higher over the last several weeks. With that index well in overbought territory, we’ll continue to keep SH shares on the Select List for now, but remember we have these positions in the portfolio as a hedge if the market gets too far into overbought territory, so even though its down right now, it’s doing its job.

Amazon (AMZN) Connected Society

Amazon rebounded nicely since last Wednesday, but the shares remain well below late-October levels. There was a lot of chatter on Amazon’s essentially self-automated grocery store that launched for employees and will be opening to residents of Seattle in 2017 (yes, there are residents in Seattle that don’t already work for Amazon). Despite a colorful discussion, Amazon denied it plans to open 2,000 such locations. As we have seen before with its own logistics initiatives, Amazon tends to zag when people expect it will zig. We view its self-automated store as the latest example.

According to comScore (SCOR), holiday season-to-date online desktop spending is up 12 percent year-over-year, with growth picking up significantly since Thanksgiving. Anecdotally, we’ve never seen so many FedEx and UPS trucks making the rounds as early and as late as they are this year. We’ve also even seen quite a few U.S. Postal Service trucks on Sundays — we know, it’s crazy . . . Chick Fil A is closed, but the mailman is working. Who would have thought?

In another key area for Amazon, Amazon Web Services, which is the company’s most profitable division, it was recently revealed that Netflix (NFLX) is partnering with Amazon cloud services group for its infrastructure work. Netflix chief product officer Neil Hunt confirmed that Netflix is “100 percent operating out of AWS.” This is a huge win for Amazon’s higher-margin services business, and likely clears the path for other companies to outsource their data center and cloud operations to Amazon.

- We see no slowdown in the shift to digital commerce, streaming video consumption, and other drivers behind Amazon’s business and believe the current share price offers more-than-favorable upside potential to our $975 price target.

AMN Healthcare Services (AMN) Aging of the Population

Over the last week, AMN shares surged more than 10 percent with the bulk of the move coming after the October JOLTS report. While that report showed a 5.5 percent month-over-month increase in health care and social assistance hiring, that paled in comparison to the 14 percent rise in health care and social assistance job openings in October relative to September. That mismatch underscores the current nursing and health-care shortage fueling AMN’s business.

The softening of President-elect Trump’s position on certain aspects of the Affordable Care Act signals a potentially smoother revamp than was expected under Candidate Trump, which also bodes well for AMN.

We will see how that ACA overhaul by Congress plays out, but we continue to like the longer-term favorable dynamics driving AMN’s business. By 2020, forecasts say the U.S. will need 1.6 million more direct-care workers than in 2010, which equates to a 48 percent increase for nursing, home-health and personal-care aides over the decade due primarily to the aging of 78 million baby boomers.

- Our price target on AMN shares remains $43, which offers 21 percent upside from last night’s close. As such, we would commit fresh capital at current levels to AMN shares.

AT&T (T) Connected Society

AT&T shares rose more than 5 percent for the week, and are now back to late September quarter levels. Last week, the planned acquisition of Time Warner (TWX) took center stage in both Washington, D.C., at a Senate Judiciary Meeting, and at the UBS Global Media & Communications Conference. Despite candidate-Trump’s criticism of the merger during the election cycle, we are encouraged by President-elect Trump’s pro-business perspective as it relates to this pending transaction and his recent comment that AT&T’s intention to acquire Time Warner would be looked at without prejudice. Obviously, a far softer position than his earlier statements that he would block the deal.

Details still need to be sorted out on the regulatory front, including the potential unloading of certain Time Warner TV channels and satellite dishes, which could eliminate a potential review by the FCC. However, we suspect AT&T is open to such options as it looks to transform its business with this transaction, and comments by AT&T CEO Randall Stephenson that consumers will get “better-priced options than they have today” helps thwart concerns about price gouging.

We view the combination of AT&T and Time Warner as bringing content to consumers where and when they want it and a competitive offering to Verizon (VZ) and Comcast (CMCSA). More competition is a bound to be a good thing, despite what Senator Al Franken who stated during the Senate hearing that he is “skeptical of any further consolidation in the media and telecommunications industries that could lead to higher prices, fewer choices, and even worse service for Americans.” Few choices? Has he looked at all the streaming services out there?

In the coming months, we expect the market to focus on AT&T’s new DirecTV Now subscriber metrics to gauge potential churn, as well as measure how successful the service will be relative to expectations.

- Our $44 price target on T shares till stands, but we are likely to revisit it as more details on the pending merger with Time Warner emerge.

CalAmp Corp. (CAMP) Connected Society

CAMP shares continued to make headway this past week, pushing our shares further into the green. The only company-specific news last week was CalAmp setting its next quarterly earnings report date for Dec. 21 when current expectations call for it to deliver EPS of $0.25 on revenue of $83.9 million.

During the week, Goodyear (GY) launched a new pan-European business, comprised of vehicle-to-fleet operations management solutions. The offering is a telematics-based solution that leverages Big Data and predictive analytics and enables fleets to monitor their vehicles and tires in real time to avoid breakdowns and lower total cost of operations (TCO). We see this as confirming for the strategies underway as well as potential opportunities at CalAmp.

Meanwhile, at Trucking.com, Scott Perry, chief technology & procurement officer for Ryder System (R), discussed several factors behind the eventual adoption of semi-autonomous vehicle technologies in fleets, including the driver shortage, which is estimated at 70,000 this year, and may rise to 175,000 by 2024.

We see these as additional signposts for the burgeoning Connected Car, Truck and Equipment market for which CalAmp is well positioned. As that market opportunity develops further, we continue to focus on the fundamentals, and near term that means watching public and private fleet management companies deploy telematics solutions to drive productivity and contain costs.

- With ample upside to our $20 price target, we continue to rate CAMP shares a Buy.

Costco Wholesale (COST) Cash-strapped Consumer

Shares of the warehouse retailer climbed more than 5 percent over the last several days following upbeat comments made on the company’s earnings call last week. Although Costco will continue to feel the impact of food deflation in the near-term, the company targets growing its warehouse count further over the coming year, which bodes well for sales as well as membership fees. As management overhauls the company’s e-commerce business, it could be a sleeping catalyst for the shares over the coming year.

- With just over 5 percent to our $170 price target, we are holding steady with COST shares and not adding to the position at current levels.

Dycom Industries (DY) Connected Society

The latest edition of the Ericsson’s Mobility Report forecasts there will be 550 million 5G subscriptions in 2022, with the fastest uptake in North America, which is forecasted to account for roughly 135 million 5G subscriptions. While we’ve seen these hockey stick-like forecasts before with both 3G and 4G adoption, the reality is networks will need to be in place over the coming quarters at companies like AT&T and Verizon, which bodes rather well for both wireless and wireline infrastructure spending.

We see this as further confirmation of the industry investing to be done to deliver faster network speeds and incremental capacity as service providers bring more services to market, and Dycom is a prime beneficiary of that spending. At the same time, we see incremental spending to address capacity bottlenecks on existing networks, which is also good for Dycom.

- The current share price offers subscribers who are underweight DY an excellent opportunity to acquire the stock at better prices than we’ve seen the last few weeks.

- Our price target remains $110.

Walt Disney (DIS) Content is King

Disney shares climbed another 3 percent this past week, raising its return to more than 12 percent over the last three months, putting both positions on our Select Investment list back into the green — our patience has paid off.

Concerns certainly still linger over the health of Disney’s ESPN business, which has prompted some chatter questioning whether it might be wise for the company to unload the business, but Disney’s strength at the box office has continued with Marvel’s Dr. Strange and its latest animated family-friendly film Moana. Of course, that’s all ahead of this Friday’s release of Rogue One: A Star Wars Story. Color us excited, but in our view, Friday cannot come soon enough.

We expect Rogue One and related merchandise to perform well this holiday season and in follow up quarters. Looking into 2017, it’s apparent it will be a transition year for Disney due in part to costs associated with ESPN’s new NBA contract that spans to the 2025/2026 season, the launch of new attractions at Disney World and Disneyland and a tough film comparisons year over year due to Star Wars: The Force Awakens.

Earlier this week was the dividend record date (Dec. 12) for the recently hiked semi-annual dividend to $0.78 per share, a 9.9 percent increase from the prior dividend of $0.71. The new dividend is payable on Jan. 11.

We are inclined to be patient with Disney as we see it as THE Content Is King company, with its international efforts propelled by rising disposable incomes and a brand-conscious rising middle class. We continue to see Disney making the right investments (streaming media and turning studio content into park rides and attractions) to drive revenue and profits.

- Our price target remains $125.

Alphabet (GOOGL) Asset-lite Business Models

GOOGL shares soared 5 percent over the last week, but that only brings them back to levels last seen at the end of September. There was no blockbuster news this week, but there were several minor developments worth noting — the company helped form the Global Virtual Reality Association, and its self-driving car team made additional hires and launched a new China-based developer site, marking a partial return to the Chinese Web. These are all positive developments that are likely to bear fruit over the medium to longer term. Near-term the core business driver will remain the search and advertising business.

We remain bullish on GOOGL as we see no slowdown in the tailwinds that are propelling the company’s businesses— specifically, the increasing shift toward digital from analog lifestyles that is driving incremental advertising dollars to online and mobile; streaming video consumption; and online shopping. Those drivers have the company tracking to grow earnings more than 20 percent and the shares are trading at 20x consensus 2017 EPS expectations of $40.97, essentially a PEG ratio of 1.0. Alphabet’s board authorized a new $7 billion share repurchase program following completion of the prior one.

- Our price target on GOOGL shares remains $975.

Facebook (FB) Connected Society

After sliding over the last few weeks, FB rose 2.5 percent over the last five days. Helping move FB higher was the overall uptick in the Nasdaq, but also that the news that company is developing tools to deal with the increasing concern of “fake news.” The company also announced new tools for estimating reach and audience size, which should help ease recent concerns over audience metrics data.

From our perspective, FB remains very well positioned to capture the shift in advertising dollars to digital platforms, not just from radio and print, but broadcast as well. In other words, the key to the shares will be progress on its advertising/monetization strategies (especially video) and international revenue per user growth, and other opportunities that help grow its user base. Those are the factors behind its revenue and EPS expectations, which call for continued growth over the coming years.

Consensus expectations have FB earning $4.10 per share this year, up from $2.28 in 2015. But the valuation story and bullish demeanor across the investment community for FB is really a 2017-to-2018 one. As FB continues to grow and improve its global monetization efforts, EPS expectations rise to $5.20 for 2017 and $6.55 for 2018. The recently announced $6 billion share repurchase program that begins in 1Q 2017 has the potential to shrink the share count by around 2 percent near current share price levels, which should help in meeting those earnings expectations as well as giving the stock some support.

- Our price target on FB remains $150.

International Flavors & Fragrances (IFF) Rise & Fall of the Middle Class

IFF shares were essentially unchanged over the last week. As with our recently added position in McCormick & Co. (see below), we see IFF as well-positioned as a result of rising disposable income, particularly in the emerging markets, but also from the shift in consumer preferences to natural/organic flavors. At the same time, soda companies, such as Coca-Cola (KO) and PepsiCo (PEP), are looking to reformulate their products to exclude sugar or to utilize organic flavors and fragrances, which bodes well for IFF’s solutions.

In its latest report, “Global Markets for Flavors and Fragrances,” Research and Markets forecasts the global market to grow from $26 billion in 2015 to $37 billion by 2021 — an overall increase of more than 40 percent!

- We would say there is nothing iffy to us about our position in IFF or our $145 price target.

McCormick & Co. (MKC) Rise & Fall of the Middle Class

Ahead of the Thanksgiving holiday, we started a position in McCormick given the company’s history of annual dividend increases, the shift in consumer preferences that has people favoring eating at home over restaurants, and the rising disposable income outside the developed markets that is spurring a step-up in diets (protein consumption, flavor).

McCormick tends to be a somewhat sleepy name when it comes to news flow, and this week was no exception. That said, MKC shares were recently rated a new “Buy” at Bank of America Merrill Lynch with a $100 price target. Our long-term price target remains $110. As a reminder, the company boosted its quarterly dividend to $0.47 per share from the prior $0.43 — a 9.3 percent boost. These annual dividend increases tend to result in a step function in the share price. This 31st consecutive dividend increase will be paid on Jan. 17, 2017 to shareholders of record this coming Dec. 30.

We see the company as well-positioned to capitalize on “seasons’ eatings” over the coming weeks. Ask anyone that plans on baking if what they’ve paid for vanilla extract this year, and you’ll see what we’re getting at.

Starbucks Corp. (SBUX) Guilty Pleasure

At Starbucks there’s been much a brewin’ as we like to say, as we saw its shares climb more than 3% last week bringing our return on the position to more than 8 percent.

The recent management change sees longtime CEO Howard Schultz stepping down and handing over the reins of the company to Kevin Johnson, the existing COO. While Schultz will remain the Chairman of the Board, he will shift his efforts to the company’s premium segment, Starbucks Reserve Roasteries, and Starbucks Reserve Retail stores, as the company looks to expand these businesses globally. We suspect the day to day details of this management shift have largely been in play behind the scenes for some time. Unlike the last time Schultz left the company that resulted in some misdirection, this time Schultz remains its Chairman, which should allow him to keep a steady read on the overall business.

Soon after that news, Starbucks hosted its biennial Investor Conference at which it presented its five-year strategic plan to grow revenue by 10 percent, EPS by 15-20 percent, and drive mid-single-digit comp growth each year. As part of that plan, it expects by 2021 to add 12,000 stores globally — to a total of 37,000 — while focusing on its Roasteries and Starbucks Reserve stores to elevate the Starbucks brand and customer experience. The company also shared that it will continue to innovate on mobile and expand the menu at its Starbucks store locations.

There is little question that Starbucks will continue to grow as it extends its global reach, particularly in China and other emerging economies. We do find it interesting that the once Affordable Luxury experience offered by Starbucks needs to be reinvested in the form of its Roasteries and Starbucks Reserve stores. That new experience bears further investigation and we’re up for the task. We do see the menu expansion as a positive development as it should help drive the food-beverage attach rate higher.

Finally, as the cold weather and holiday shopping intersect, we can expect long lines at many a Starbucks as consumers look to not only get warm but also plunk down their money for gift cards.

- With 25 percent upside to our $74 price target, we continue to rate SBUX shares a buy.

Under Armour (UAA) Rise & Fall of the Middle Class

Before we get under way, a quick reminder that last week the ticker symbol for Under Armour’s Class A shares was changed to “UAA” from “UA” This was a little confusing in an unnecessary way, if you ask us, especially since not all quoting services updated the ticker information in a timely fashion last week. But that appears to be all sorted out now.

Despite that disruption, Under Armour shares rose more than 4 percent over the last week, following the positive reception for its recently announced deal with Major League Baseball. In recent quarters, the company has continued to expand its retail presence with Macy’s (M), Foot Locker (FL) and other brick-and-mortar retailers. Versace’s recent holiday mall walks (a holiday season staple) showed Under Armour’s footwear and apparel are clearly on display.

Also receiving some positive buzz last week was the company’s Under Armour Sportswear (UAS) line, which has launched several pop-up shop locations as a showcase. UAS designer Tim Coppens was also featured on the fashion blog Fashionista last week, which should help position UAS differently compared to Under Armour’s expanding athletic apparel and footwear line.

We’ll continue to monitor holiday shopping channel checks for sports apparel and footwear as well as gauge Under Armour’s efforts to bring new footwear and women’s products to market during this all-important season. Longer term, Under Armour is poised to grow its revenue and operating income as its initiatives (footwear, International, women’s and UAS) take hold.

- Our price target for UAA is $40, which offers attractive upside potential.

United Natural Foods (UNFI) Food with Integrity

Last week, UNFI reported underwhelming quarterly results, largely due to the impact of food deflation, but the company maintained its outlook for the coming quarters. We’ll continue to monitor food deflation trends, but given the expected record corn crop, odds are that deflationary pressure will persist. The silver lining is it is driving consumers back to grocery stores and eating at home. This, of course, will pressure restaurant companies and an early look at 2017 from Fitch Ratings sees the pain continuing for restaurants as grocery spending remains on top.

With the ongoing shift toward natural, organics and “good for you foods” we continue to see United as a prime beneficiary. A recent report from Research and Markets forecasted the global market for organic food would grow at “a CAGR of over 14 percent during 2016-2021, on account of high demand for organic food.”

- We will continue to be patient with the shares as the company regains investor confidence after stubbing its toe during 2015, but we’ve trimmed our price target to $60 from $65.

Universal Display (OLED) Disruptive Technologies

Universal Display shares catapulted 6.5 percent over the last week following a Wall Street Journal article that said, “Analysts widely expect the next iPhone to adopt a technology called organic light-emitting diode, at least for high-end versions. OLED displays, which are thinner, more flexible and give better contrast, will eventually replace the current liquid-crystal displays, or LCDs.”

Outside of Apple (AAPL) speculation, we continue to hear more reports of increasing industry capacity to meet rising demand from smartphone, TV and other markets that are set to adopt OLED technology. All of this points to improving demand for OLED technology, which bodes well for both the chemical and licensing business at Universal Display. We’ll continue to monitor OLED equipment order activity at Applied Materials (AMAT), Aixtron and Veeco Instruments (VECO) as well as new product announcements and OLED applications from consumer electronics companies at events such as CES 2017.

- Our price target is currently $68, however, based on the number of new products announced at the upcoming CES event in January, it could be revised higher.

|