Beneath the January Employment Report Headline and Retailer Woes Grabbed our Attention

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

That’s right, the Super Bowl is over and we know there are many out there that wished the company they work for did what Kraft Heinz (KHC) did — give their North American workers today off! Unfortunately, today the Monday after the Super Bowl isn’t a market holiday, so it’s down to business, and let’s get this week kicked off!

Amid a sea of earnings and economic data last week, there was also much debate over immigration policies in general and what it could mean for technology companies like Microsoft (MSFT), Facebook (FB), Apple (AAPL), Amazon (AMZN) and numerous others. Tematica Chief Investment Officer Chris Versace tackled that topic as well as shared our musings on Apple’s still dependent on the iPhone earnings on CGTN’s Global Business.

We tackle that and so much more on our latest Cocktail Investing podcast, which we’re rather pleased to say you can listen to on iTunes, SoundCloud, Stitcher and even TuneIn. And to really hammer home our Connected Society investing theme, those of you with an Amazon Echo device can simply say, “Alexa play the latest Cocktail Investing on TuneIn” and you’ll get to hear not only Versace, but his co-host Tematica’s Chief Global Macro Strategist Lenore Hawkins as well. Either way, you may want to give Lenore’s cocktail recommendation she shares at the end of the episode a try this week as you tune in and listen to the podcast.

One thing we didn’t discuss on the podcast or in Tematica Investing last week was the S-1 filing for Snap Inc, the company behind SnapChat. We expect to share our review of the filing and any notable callouts on the Tematica Research website, like we did with our take on Apple’s earnings and Lenore Hawkin’s dissection of the January Employment report that once again showed the headline excitement isn’t exactly reflected in the underlying data, so be sure to check back in the coming days.

With those housekeeping items out of the way, let’s break down the market and other key happenings from last week

As we closed the books on January and entered February, the stock market was little changed, as evidenced by the lack of movement in the major market indices despite the market’s warm reception to Friday’s better than expected January Employment Report headline. That jobs report showed the domestic economy added 227,000 overall jobs, which was solidly above the consensus view of economists and pundits alike that called for 170,000 jobs in January. Following the surge in January private sector jobs reported by ADP earlier this week — 246,000 vs. the expected 165,000 and 151,000 in December — whispered expectations for the January Employment Report ticked up over the last few days, but the report still bested those revised expectations.

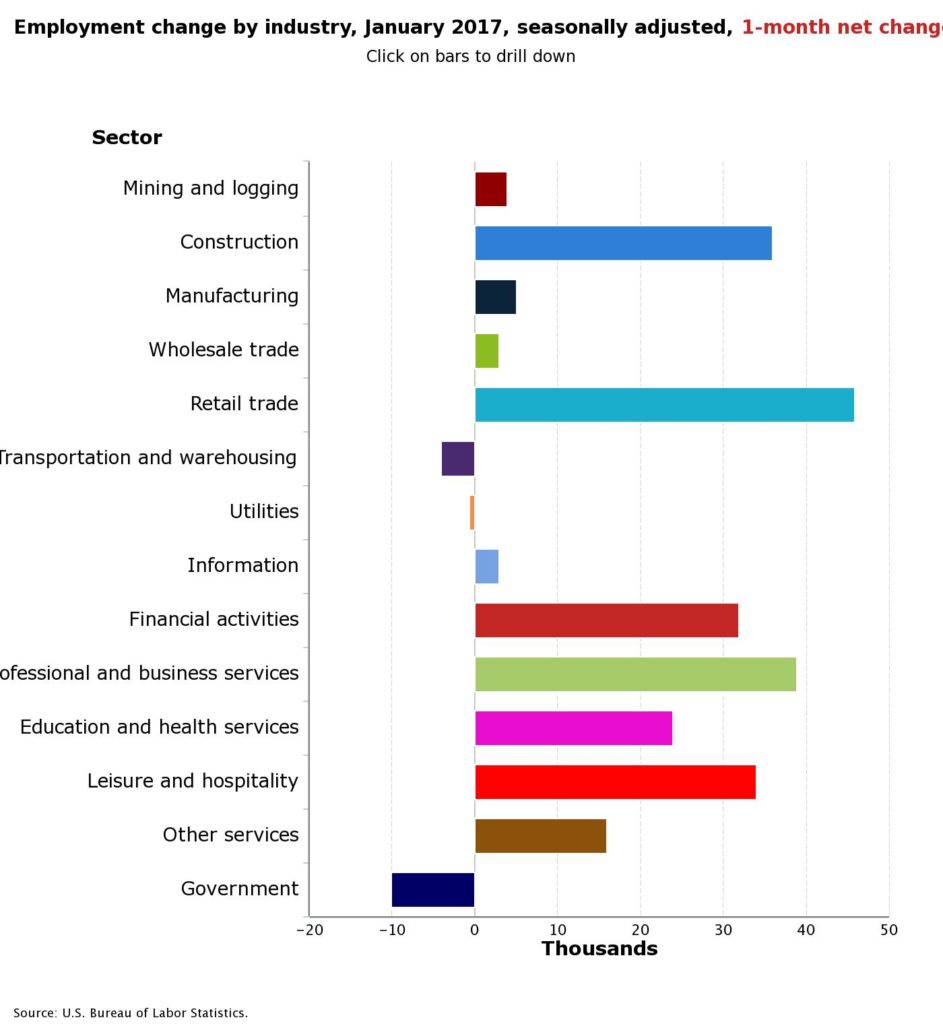

Looking below the headline figure and breaking down the underlying data, we find solid job creation in construction (+36,000) and financial firms (+32,000). What we found somewhat surprisingly came in retail number, +46,000, which was the strongest job creation category in the report. We say surprisingly given that in a typical environment retailers tend to wind down seasonal hiring during January, but as we saw this past Holiday shopping season it was anything but typical with online eCommerce players taking significant wallet share. So to see a number of that strength from retail raised more than a few eyebrows.

Backing out the growth in the retail sector, January job creation would still have been ahead of expectations, just not quite the blowout relative to expectations. At the same time, we continue to hear brick & mortar retailer woes as they get ready to report quarterly earnings that include the holiday shopping season and the subsequent “return” and post-holiday sale season shoppers have become accustomed to. From our perspective, those retailers continued to be plagued by the shift to digital shopping that is one of the pillars of our Connected Society investing theme, but also rising revolving debt levels that will likely see consumers, especially Cash-strapped Consumer, keep a tight reign on the purse strings.

This also calls into question what’s next for the auto industry following several years of rising vehicle sales? January auto sales reports showed year over year declines at:

- General Motors (GM), down 3.8%;

- Ford Motor (F), down 0.6 percent;

- Fiat Chrysler (FCAU), down 11 percent;

- Toyota Motor Corp. (TM), down 11 percent.

While one month in and of itself does not make a trend, the data calls into question the consumer spending appetite. As crazy as it may sound, if underwear and t-shirt company Hanesbrands (HBI) missed expectations and Under Armour (UAA) had to once again reset guidance, it would seem consumers are once again reassessing their spending, looking to make the most of their disposable spending dollars and potentially going commando. Either that, or there are quite a few folks forsaking underwear altogether and “going commando.”

In our view, the retail space woes were confirmed by the blowout January same-store sales reports by Costco Wholesale (COST) last week, good news for subscribers to our Tematica Investing newsletter service. Looking through our Cash-strapped Consumer investment theme lens, we see body blow after body blow to the stomach’s of brick & mortar retailers, and it makes sense that Costco comes in and delivers a 9 percent year over year increase for January with same-store comp sales up 7 percent year over year as consumers look to stretch their disposable income dollars as far as they can.

Getting back to that upside surprise in January retail hiring, looking at it against the trials and tribulations we are hearing from brick-and-mortar retailers — so bad that even Macy’s (M) is at least listening to at takeout offer from the Canadian-based owner of Saks Fifth Avenue, Hudson’s Bay — we suspect we are likely to see a reversal in retail job creation in the coming reports. Should Macy’s become part of the Hudson Bay fold, we would think another round of mall square footage rationalization is to be had, and that will cost jobs.

Looking past that gloomy retail environment, we remain encouraged when it comes to job creation in the U.S., given the wave of companies that are examining opportunities to bring manufacturing and other jobs to the U.S.

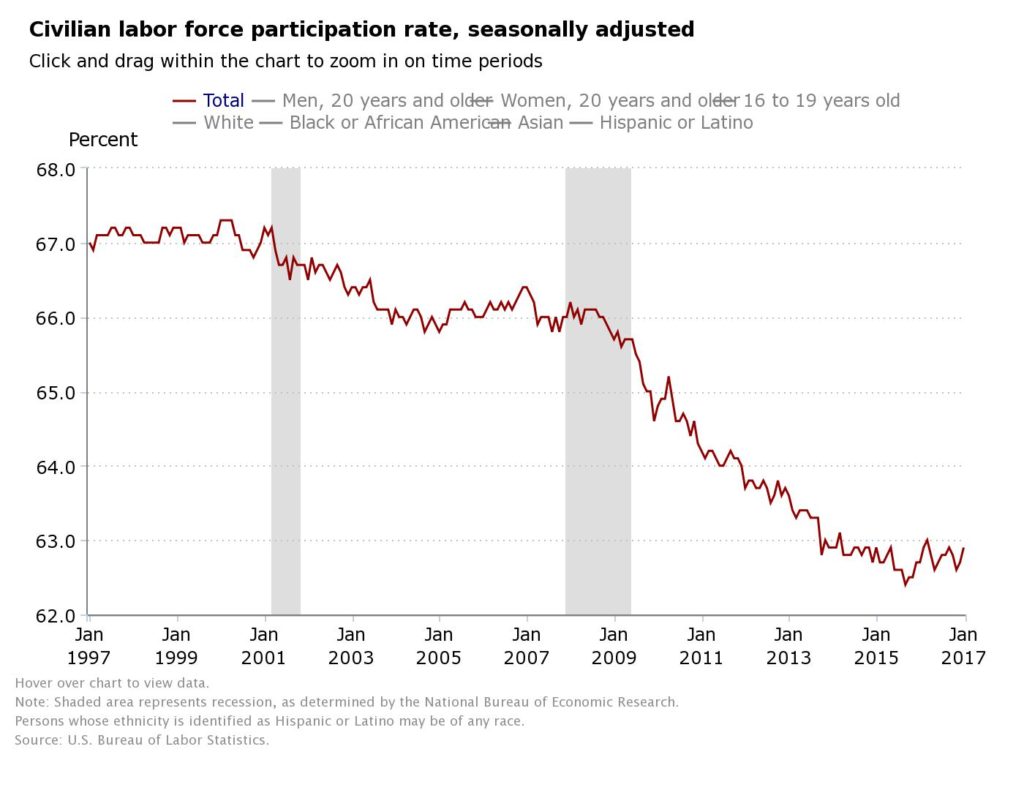

On the bright side, the labor force participation ticked up month over month to 62.9, but still remains near historical lows and is up modestly from 62.7 in January 2016. Month over month, the “not in labor force” category shrank, which in our view is a positive, but again, given the likelihood of job losses in the retail sector in the months ahead we could see a reversal in the coming months.

Looking at wages, average hourly earnings rose 2.5 percent year over year in January, which, in our view, is bound to catch the eye of the Federal Reserve as it contemplates inflation against its shared view that it could boost interest rates up to three times in 2017. We chalk this move up in wages to the step up in minimum wages across the country; we’ll be checking that against costs across several industries as they report current quarter earnings. As we said back in December when the Fed shared potential 2017 action, we’ll continue to watch the data to determine if the Fed is likely to do this vs. simply remaining the economic cheerleaders they tend to be.

So what other puzzle pieces did we get last week?

- Domestic manufacturing activity reported by ISM’s January Manufacturing Index climbed month over month, with order activity remaining at strong levels. This marked the fifth consecutive month of sequential increases, with the January reading of 56.0 being the highest in the last 12 months; for perspective, the 12-month average was 52.1. This report also showed another leg higher in the price index, again something the Fed is likely to factor into its thinking.

- The January Markit U.S. Manufacturing PMI report showed new orders growth climbing to a 28-month high, with overall output picking up steam, both month over month and year over year. Survey respondents noted that greater production volumes had been underpinned by improved client demand and efforts to boost inventory levels at the start of 2017. Echoing the move higher in prices found in the ISM report, Markit’s findings showed cost pressures intensified in January, driven by higher prices for a range of raw materials (particularly oil and metals).

The bottom line is the domestic manufacturing economy is on firmer footing as we enter 2017, and this is not likely to go unnoticed by the Fed. Looking past the manufacturing economy, ISM’s Non-Manufacturing Report on Business showed continued month over month gains in the services sector. Month over month findings from ISM point to continued growth in overall business activity, new orders, employment and yes, prices. On the downside, the export metrics contracted at a faster rate month over month — no surprise given the commentary we are hearing from a growing number of companies, especially those with meaningful international exposure, in the current earnings season. Of all the commentary we’ve heard on the topic, the one that jumps out most came from Apple CEO Tim Cook, who said the impact of foreign currency is expected to be a ‘major negative’ as the company moves from the December to the March quarter.

In our view, if the coming economic data ahead of the Fed’s March FOMC meeting continues to point to an improving economy, all things being equal, we are likely to see talk of that first potential rate hike in 2017 bubble to the surface. In other words, we, and we suspect the rest of the market, will be keeping a close eye on the January and February data that is yet to come.

That Brings us to the Week’s Economic Calendar

This week is rather light on the data front, but that slack will be taken up by a number of Fed officials making the rounds. As we shared earlier, the next Fed FOMC meeting isn’t until March, but it will be interesting to hear various members’ takes on this week’s upbeat data. We suspect a more hawkish tone is likely.

The economic data we will get includes the monthly JOLTS report, which should be wood to throw on the current immigration brouhaha fire, as well as a look at China’s service economy. Also, this week is the IOT Evolution Expo 2017, and a number of Connected Society and Disruptive Technology companies ranging from Amazon (AMZN) to Microsoft (MSFT), IBM (IBM) and Cisco Systems (CSCO) are slated to be there. We’ll be keeping tabs on the expo as well as press releases from companies that may not be attending.

Also on our radar will be the forthcoming Trump policies on tax reform and health care, which this morning the president shared should be coming shortly. Alongside those, we’ll continue to watch immigration developments and how they may or may not impact technology companies as well as potential trade conflicts with Mexico.

While all that is going on, we have more than 400 companies issuing their quarterly results and outlooks this week. Granted that’s down from the roughly 550 that issued such information last week, but even so, we still have 84 S&P 500 companies (including 2 Dow 30 components) scheduled to report results for the fourth quarter. That means as we close out the week, we’ll have more than two-thirds of quarterly results for the S&P 500 group of companies. Already we’ve seen Wall Street reduce 1Q 2017 earnings estimates by 1.5 percent and we suspect there are more revisions to be had.

During the month of January, analysts lowered earnings estimates for companies in the S&P 500 for the first quarter. The Q1 bottom-up EPS estimate (which is an aggregation of the EPS estimates for all the companies in the index) dropped by 1.5 percent (to $30.10 from $30.57) during this period. As we close the week, 2017 earnings growth prospects should start to take shape, and we’ll be matching that against the expected growth rate of 12 percent.

From a thematic perspective, it’s a big week for our Content is King investing theme with Disney (DIS), 21st Century Fox (FOXA), Time Warner (TWX) and several others. We’ll also be hearing from a number of Fattening the Population companies — Coca-Cola (KO), Mondelez International (MDLZ) and Yum Brands (YUM) — and across the group, we’ll be listening for comments on product reformulations to cut sugar as well as the impact of higher labor costs. For a more detailed thematic take on corporate earnings to be had this week, we’ve once again shared a more detailed listing if you continue reading.

Enjoy the week, and be sure to check back at Tematica Investing for more on Snap’s S-1 filing as well as other thematic and global macro thoughts.

Earnings on Tap This Week

The following are just some of the earnings announcements we’ll have our eye on for thematic confirmation data points:

Affordable Luxury

- Coty (COTY)

- Blue Nile (NILE)

- Michael Kors (KORS)

Aging of the Population

- Brookdale Senior Living (BKD)

- Calamos Asset (CLMS)

- CVS Health (CVS)

- Humana (HUM)

- LPL Financial (LPLA)

- Phibro Animal Health (PAHC)

- Premier Inc. (PINC)

- US Physical Therapy (USPH)

- VCA (WOOF)

- Vascular Solutions (VASC)

Asset Lite Business Models

- Corporate Executive Board (CEB)

- Expedia (EXPE)

- Insperity (NSP)

- Medidata Solutions (MDSO)

- Nielsen (NLSN)

- Thomson Reuters (TRI)

- Travelzoo (TZOO)

- ScanSource (SCSC)

- Ultimate Software (ULTI)

Cashless Consumption

- Fiserv (FISV)

Cash-strapped Consumer

- Spirit Airlines (SAVE)

Connected Society

- Akami Tech. (AKAM)

- CenturyLink (CTL)

- Mobile Iron (MOBL)

- Nvidia (NVDA)

- GrubHub (BRUB)

- Twilio (TWLO)

- Twitter (TWTR)

- Yelp (YELP)

- Zillow (ZG)

Content is King

- 21st Century Fox (FOXA)

- Activision Blizzard (ATVI)

- Disney (DIS)

- Glu Mobile (FLUU)

- Lions Gate Entertainment (LFG.A)

- McClatchy (MNI(

- News Corp. (NWSA)

- Regal Entertainment (RGC)

- Take-Two (TTWO)

- Time Warner (TWX)

Disruptive Technologies

- American Superconductor (AMSC)

- iRobot (IRBT)

- Nuance Technologies (NUAN)

Economic Acceleration/Deceleration

- Regal-Beloit (RBC)

- Vulcan Materials (VMC)

Fattening of the Population

- Buffalo Wing Factory (BWLD)

- Coca-Cola (KO)

- Dunkin’ Brands (DNKN)

- Kellogg (K)

- Mondelez International (MDLZ)

- Panera Bread (PNRA)

- Sysco (SYY)

- TreeHouse Foods (THS)

- Yum Brands (YUM)

- Yum China (YUMC)

Foods with Integrity

- Farmer Brothers (FARM)

- Whole Foods (WFM)

Fountain of Youth

- Cynosure (CYNO)

- Omega Health (OHI)

- Performance Food Group (PFGC)

Guilty Pleasure

- Reynolds American (RAI)

Rise & Fall of the Middle Class

- AGCO Corp. (AGCO)

- Alaska Air (ALK)

- Archer-Daniels (ADM)

- Cavco Industries (CVCO)

- Church & Dwight (CHD)

- Dentsply Sirona (XRAY)

- General Motors (GM)

- Kemper (KMPR)

- Pilgrim’s Pride (PPC)

- Select Comfort (SCSS)

- Tyson Foods (TSN)

Safety & Security

- Brinks (BCO)

- Carbonite (CARB)

- Cyberark Software (CYBR)

- Imperva (IMPV)

Scarce Resources

- Mosaic (MOS)

Tooling & Re-tooling

- Fabrinet (FN)