Brexit Vote: it ain’t over until it’s over, and maybe not even then

Last week we cleared the decks of our call option positions, which served to lock in gains and avoid any losses given what has turned out to be a whipsaw in the market. As we’ve shared over the past few days the hit to the stock market last week was the result of an unexpected shift in the Brexit polls, and in yesterday’s Tematica Investing, we covered how the weekend flip flop in the Brexit polls initially led to a sharp rebound in the market at the start of the week, but even those gains faded as investors recognized that polls are not final votes.

We expect the volatility in the stock market to remain at least until Thursday’s Brexit vote.

Even if the returned vote favors “Stay,” it may not be the end of Brexit like chatter. The fast moving conversation is already starting to move past “What if Britain leaves the European Union?” to “Who might be next?” and “It’s only a matter of time before one country leaves the Union.”

While some of this may be rumor mongering, the headlines are already intimating that Austria could be next on the “get out of dodge” list, while others are saying it will be a “horse race between Austria and Denmark to leave the organization.”

Any such race to the exit is likely several months away, should it ever come to pass. Rather than ride the rumor mill, we’ll look first to digest the outcome of Thursday’s vote. As we’ve shared recently, our view is Britain will remain in the European Union in order to help preserve its influence, lest it be relegated to a far smaller voice with a number of unknown questions surrounding trade, currencies and so on. Investor George Soros is out doom-saying that should Britain leave the EU, it would spur a recession and lead to a Black Friday like market. From our contacts in London, we know hedge funds are hoping for the best and preparing for the worst with Thursday’s vote.

The Brexit issue has us remaining cautious with positions and no option positions ahead of the vote.

Even safer haven securities like iShares Barclays 20+ Yr Treasury Bond ETF (TLT) have been all over the map this past week, hitting $137.53 last Thursday only to fall to $134.03. While that may not seem like big dollar move, it’s a 2.5 percent move in just a few days.

When tensions and uncertainty are high, and potentially shifting at the last minute, it could result in either a pop in the market or a pullback depending on the Brexit vote outcome. Even if we get a pop following a vote to “Stay,” the global economy continues to be on a slowing glide path, and earnings expectations for the second half of 2016 remain overly optimistic in our opinion. This could lead to a “buy the rumor, sell the news” move in the market. We’d rather be on the sidelines watching this unfold than be caught in the middle.

Keep in mind as well, even after the dust settles on the Brexit vote, we’re not exactly out to the woods just yet.

We have less than two handfuls of trading days left in the current quarter and a shortened holiday week soon upon us. The risk as we see it is we start to get a negative earnings pre announcements for June quarter earnings. Yes, there are those companies that like to sneak an earnings cut late on a summer Friday, and it’s only sneakier when they look to do it on a Friday ahead of a long weekend. That’s you July 1st, in case you don’t have your calendar handy.

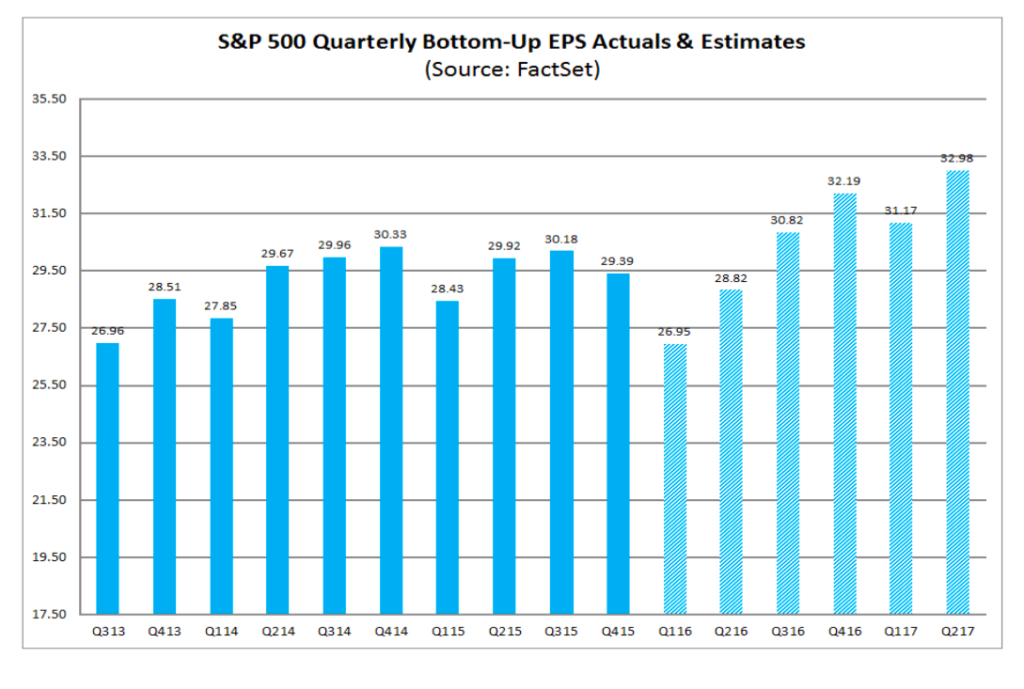

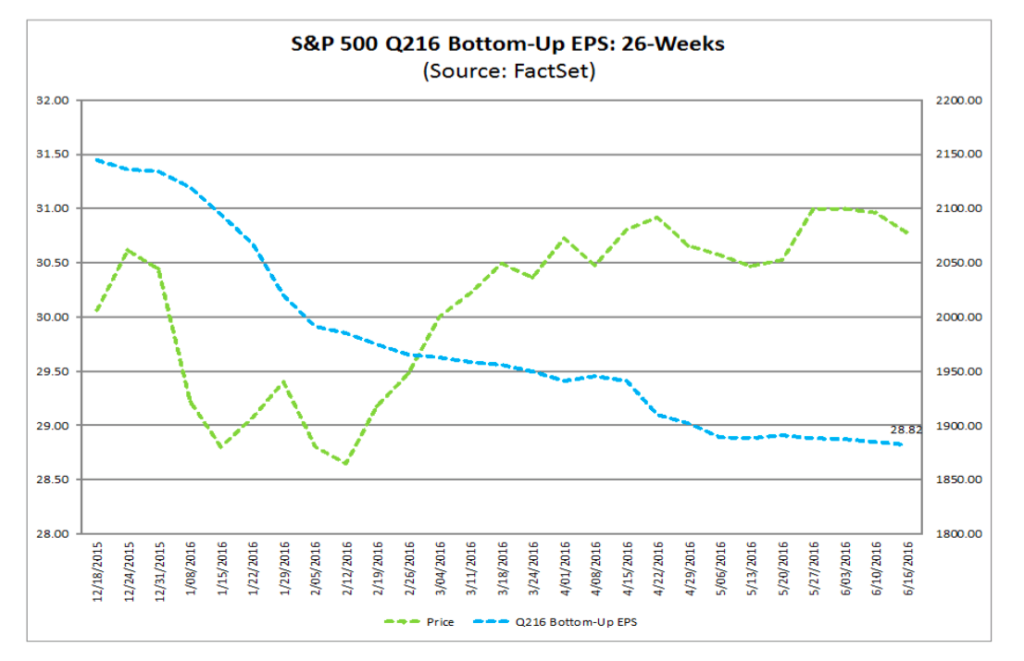

Even before those negative pre-announcements roll in, earnings for the S&P 500 are expected to decline 5.1 percent for the June quarter, down from an estimate for a decline of 2.8 percent on March 31.

Even before those negative pre-announcements roll in, earnings for the S&P 500 are expected to decline 5.1 percent for the June quarter, down from an estimate for a decline of 2.8 percent on March 31.

In our view, given the economic data over the last few months, that was hardly surprising. If earnings do come in negative, and we think there is a high probability this will be the case, it will be the first time the index has recorded five consecutive quarters of declining year-over-year earnings since the third quarter of 2008 through the third quarter of 2009 — you know, during the fallout of the Great Recession. It comes as little surprise to us the index keeps struggling to reach new highs given its stretched valuation on little to no earnings growth in 2016.

Of course, guidance this earning season will be crucial as it will set the tone for the back half of 2016. Yes, yes, we’ve been critical over current expectations as we don’t see how the S&P 500 can deliver near 13 percent earnings growth in the back half of the year compared to the first half given the current global economic glide path. For a number of reasons, the June quarter earnings season will be one to watch and digest carefully.

Of course, guidance this earning season will be crucial as it will set the tone for the back half of 2016. Yes, yes, we’ve been critical over current expectations as we don’t see how the S&P 500 can deliver near 13 percent earnings growth in the back half of the year compared to the first half given the current global economic glide path. For a number of reasons, the June quarter earnings season will be one to watch and digest carefully.

All of this has us thinking it is far better to be patient and look for a clearer opportunity to put capital to work and add to the Tematica Pro Select List.

IMPORTANT PUBLISHERS NOTE:

As a reminder, we will be taking a needed break next to recharge ahead of the upcoming earning season. So there will be no issue of Tematica Pro on Thursday June 30, 2016.

Rest assured should circumstance dictate the need to take action, we will be sure to issue a detailed special alert via email. Otherwise, your next issue of Tematica Pro will be published on July 7th.