As we write this, there are just over six trading days left in 2016. It’s been quite a year on all fronts, but in particular, for the stock market as nearly all of the year’s gains have come in the last several weeks. It seems every few days since the 2016 presidential election the major market indices are posting new highs to the board, including again last night as the Dow flirted with the 20,000 mark, which it is still doing this morning — what a tease!

When we look at the market landscape through our thematic lens we see that a number of our investing themes have performed rather well during 2016. From Aging of the Population and our shares in AMN Healthcare (AMN: +21.31%), to our Connected Society theme and our positions in Dycom Industries (DY: +5.46%), AT&T (T: +10.62%) and CalAmp (CAMP: +7.27%) shares, and Universal Display (OLED: +11.32%) that is a Disruptive Technology play, all of these have performed admirably and we see more upside ahead in the coming quarters.

The same holds true for Alphabet (GOOGL: +11.07%), Facebook (FB: +0.24%) and Amazon (AMZN: +3.9%) that round out our Connected Society holdings, but it’s also the case with Food with Integrity company United Natural Foods (UNFI: +15%) and Cash-strapped Consumer play Costco Wholesale (COST: +9.78%).

We also booked a number of wins over the last 12 months:

- Aging of the Population and PetMeds Express (PETS) shares, up 13%;

- Cashless Consumption with USA Technologies (USAT), up more than 28%, and PayPal (PYPL) up just under 14%;

- Connected Society and AT&T (T), up 18%;

- Content is King theme and Regal Entertainment (RGC) shares, up more than 22%;

- Guilty Pleasure and Philip Morris International (PM), up more than 17%;

- Rise & Fall of the Middle Class and Kraft Heinz (KHC), up more than 15%.

With the S&P 500 up just under 11% year-to-date, we would argue that it pays to think different from the herd to uncover pronounced thematic tailwinds and uncover the companies best positioned to ride them.

To be fair, from time to time, we do fall short and in our minds both Sherwin Williams (SHW: -13.14%) and Whirlpool (WHR: -13.32%) serve as reminders to let the data talk to us.

In sum, it’s been a barn burner for the stock market post-2016 election, but as we’ve pointed out once again in this week’s Monday Morning Kickoff., the stock market has a habit of getting ahead of itself. Even CNBC’s Market Strategist Survey of 13 strategists’ outlooks published since the US election found the median 2017 S&P 500 price target is 2,325 — that is 2.5 percent ahead of where the S&P 500 currently resides.

Comments from industrial conglomerate Honeywell (HON) offered a more tempered view, which coincides with recent economic data discussed in greater detail in this week’s Monday Morning Kickoff. If you’re not reading each week’s Monday Morning Kickoff you receive as part of your Tematica Investing subscription, you’re really missing out.

In addition, we starting to hear from companies such as Adobe Systems (ADBE) to Nike (NKE), FedEx (FDX), Honeywell and General Electric cite the impact of the strong dollar on their respective 2017 outlooks. As we ponder that, we’d also note:

- Stretched valuation as the market continues to climb higher of late

- The current reading of 77 or Extreme Greed on CNN’s Fear and Greed Index.

- The Consumer Confidence Index is now at its highest since July 2007.

- The Dow Jones Industrial Average, S&P 500 and the Russell 2000 at or near overbought levels

To us here at Tematica, all of that against the current market environment means we are likely to face a move in the market in early 2017 that will remove some of the current froth. One of Coca-Cola’s old marketing slogans — “A pause to refresh” — is what we’re likely to see, as before too long companies report their December-quarter results. As they do that, some will no doubt raise expectations for 2017 and others, as you’ll see with sneaker retailer Finish Line (FINL) down below, are bound to disappoint.

From our perspective, the thematic tailwinds that power each of our positions on the Tematica Select List not only remain intact but, as we are seeing in the case of the Connected Society, Rise & Fall of the Middle Class, Disruptive Technologies, are only getting stronger. As good as a year as 2016 was for our thematic strategy, we see 2017 being even better. In other words, we’re just getting started…

Updates Updates Updates

Amazon (AMZN) Connected Society

After a few turbulent weeks, our Amazon shares are off to a solid start this week due to several pieces of news, a few of which solidly confirms one aspect of our thesis on the shares.

The first comes from The Wall Street Journal, which we posted to the Thematic Signals section of our website suggests Amazon is “looking at developing mobile technology for scheduling and tracking truck shipments.” We’d caution that the herd tends to miss what Amazon is doing as often as it gets it right.

In this case, given Amazon’s growing number of warehouse locations and the expanding role of Fulfilled By Amazon (FBA), we would not surprised to see Amazon flex its logistics muscles to get its cost under control as well as have greater control over deliveries. Should this turn out to be the case, we see it very much inline with Amazon’s air cargo efforts — a supplement to current logistics services offered by United Parcel Service (UPS) and others. We’ll continue to monitor this to see how real it is, and if so what the potential implications are.

The second piece of news comes from a new data published by Prosper Insights and Analytics that shows Amazon taking a clear lead in holiday shopping this year. After surveying 7,000 US adults, Propers Insights and Analytic found 26% bought “most” of their gifts from Amazon this year, up 10% over year-ago levels. (That 26% would include nearly all of us here at Tematica!)

Trailing well behind Amazon is Wal-mart (WMT) at 14.5% followed by Target (TGT), Kohl’s (KSS), Macy’s (M) and others, including Best Buy (BBY) and JCPenney (JCP), all of which were in the “single-digit range.”

We find the Prosper Insights and Analytics report rather confirming for the part of our Amazon thesis that focuses on the accelerating shift toward digital shopping and a key part of the Connected Society theme. Paired with data from comScore (SCOR) that online desktop spending is up double-digits since Thanksgiving, it looks like the holiday shopping season will be an Amazon one far more people year over year.

Next up, last night FedEx (FDX) reported inline revenue for the quarter that was up just over 19% year over year. The company, however, missed earnings expectations primarily due to lower operating profit at FedEx Freight and the company’s network expansion. That expansion is likely due to FedEx continuing to position itself for the structural shift that favors digital commerce, one of the key tenants behind our Amazon (AMZN) thesis.

As evidenced by FedEx comments during the earnings call last night, it has much work to do on its e-commerce catch-up initiatives, given “that non-e-commerce deliveries to residences and business-to-business traffic represent the vast majority of FedEx Corporation’s estimated $60 billion in FY ‘17 revenues.”

On the bright side for our Amazon shares, FedEx called out the “continued rapid growth of e-commerce” and the “rapid rise in e-commerce.” Add to this the latest data from comScore (SCOR) that showed online desktop spending continues to accelerate as we close in on the Christmas holiday. comScore noted:

“For the holiday season-to-date, $55.2 billion has been spent online, marking a 13% increase versus the corresponding days last year. The most recent week, Dec. 12-18, posted a strong 15% growth in online sales, marking $7.6 billion in desktop spending during the last full week before Christmas.”

With Amazon once again taking the top spot for best online customer experience in the 12th annual Foresee Experience Index and surveys pointing to more shoppers buying on Amazon this year, we continue to see it in the pole position this holiday shopping season and beyond.

We have ample upside to our AMZN price target of $975, which keeps the shares a Buy.

Costco Wholesale (COST) Cash-strapped Consumer

This week Citi upgraded the warehouse retailer’s stock to “buy” from “neutral,” saying it sees a clear path to accelerating comparable sales, thanks to the abatement of deflation in food and gasoline. We’d add the continued expansion in the sheer number of warehouse locations bodes well not only for overall sales growth but also higher margin membership fees.

Over the last week, COST shares have rallied sharply to just under $164, which means there is less than 5 percent upside to our $170 price target. As such, we are not inclined to commit fresh funds to this position, nor should subscribers, and thus rate the shares a Hold for now.

Disney (DIS) Content is King

The early estimates are in for Disney’s weekend debut of Rogue One: A Star Wars Story from Box Office Mojo and others, and they have the latest film in the Star Wars franchise taking in $155 million at the domestic box office and $290.5 million worldwide. That’s the 12th-largest opening of all time and marks only the second December film to debut over $100 million. If you guess the first one was last year’s Star Wars: The Force Awakens, you’d be right.

We see Rogue One’s domestic performance as rather impressive and ahead of the $150 million domestic consensus forecast, despite paling in comparison with last year’s Star Wars film. Make no mistake — despite the headlines saying that Rogue One failed to match Force Awakens, few were expecting it to do so, and even on its recent earnings call Disney warned about tough comparisons compared to Force Awakens. Versace saw the film and thought it was fantastic, especially given the rather surprise appearance at the end.

We do see Rogue One speaking to the power of the Star Wars franchise, which now under the Disney umbrella is set to have a new film each year for the next several years. With the holidays soon upon us, we’ll be monitoring Rogue One’s box office progress to gauge its staying power as we head into the holidays.

We’d also note that Rogue One crushed its next closest competitor, Disney’s Moana, which took in $11 million domestically over the weekend, bringing its domestic box office take to $161.9 million and to more than $280 million worldwide. But $150 million to Rogue versus $11 million for Moana clearly shows that once again, Disney is ruling the box office, and we expect the Disney machine to capitalize on the popularity of these films across its other businesses.

In addition to that, DIS shares were added to the US1 list at Bank of America/Merrill Lynch given what it sees as upbeat prospects for Disney’s parks and resorts, as well as its movie studios. Once again it seems we were ahead of the herd.

Our price target on DIS shares remains $125 and remain a Buy.

Under Armour (UAA) Rise & Fall of the Middle Class

The last 16 hours have seen a whirlwind of comments from Nike (NKE) and Finish Line (FINL), which on their face offer contrasting views on the athletic footwear market. Let’s tackle what they mean for our Under Armour shares.

Last night Nike bested earnings expectations on better than expected revenue, with strong performance in Western Europe, Greater China and the Emerging Markets as well as the Sportswear and Running categories.

There were two wrinkles that emerged during Nike’s earnings call — one was the company’s North America future orders, which came in at -4% vs. the consensus expectations of +1.2%. In recent quarters, Nike has downplayed the importance of its future orders given the growing impact of direct-to-consumer (DTC) and outlet sales, and talked up new products, especially for the basketball and running categories as it incorporates newer technologies, like Air VaporMax and others, across those lines. We’ve seen similar strong results at UA’s online business over the last several quarters.

Our key takeaway from Nike’s earnings call is that athletic footwear remains solid in North America and robust in markets being targeted by Under Armour.

The second wrinkle concerned the impact of the dollar on the company’s outlook, given Nike’s comment that “FX headwinds from further strengthening of the U.S. dollar have put downward pressure on our second half revenue forecast.” Currency is likely to have a more pronounced impact on Nike than Under Armour given that North America accounted for 47% of Nike’s Nike brand business during the November quarter. That compares to North America being roughly 98% of UA’s revenue in its September quarter.

Turning to Finish Line, its shares are getting crushed as the company reported comparable-store sales rose just 0.7% for its latest quarter vs. +8% consensus forecast. Sifting through comments from Finish Line, CEO Sam Sato said, “steep declines in apparel and accessories offset a high-single digit footwear comp gain.” Considering that footwear accounted for 88 to 89% of Finish Line revenue over the last few years, it seems safe to say it’s apparel and accessory business was crushed during the November quarter.

Given some information scrubbed from Finish Line’s Feb. 2016 10-K filing — 73% of Finish Line’s merchandise was purchased from Nike; FL’s top 5 suppliers accounted for 89% of its merchandise, and Finish Line’s business is nearly 100% US based — when comparing Finish Line’s apparel results vs. that for Nike’s North American apparel business, which rose +4% year over year in the November quarter, it sure smells like apparel share loss at Finish Line.

The bottom line for our Under Armour shares is Nike’s North American footwear comments and apparel results, as well as upbeat tone for the holiday shopping season, bode well for UA’s business and our shares. Finish Line’s comments on the other hand likely point to apparel share to other vendors.

Our price target on UA remains $40

Universal Display (OLED) Disruptive Technology

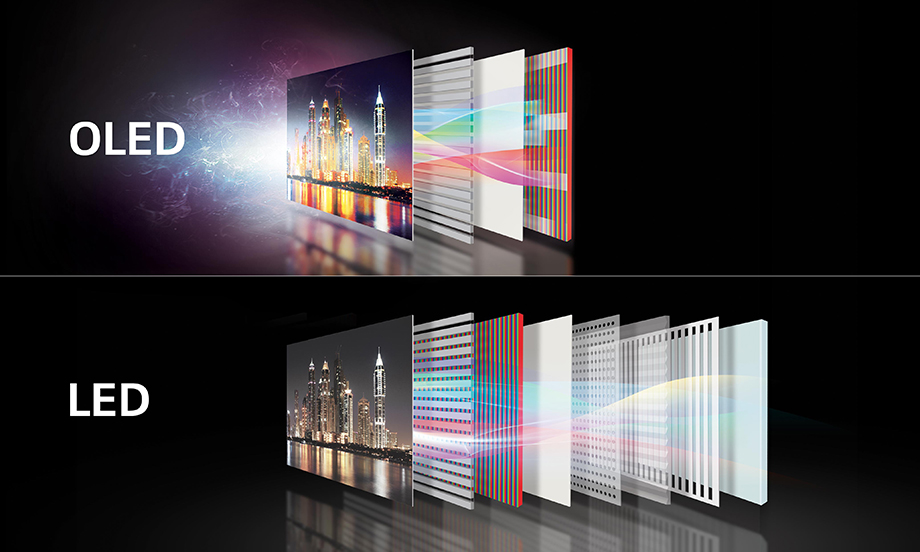

Over the weekend there were several positive mentions for our Universal Display shares. Both articles were bullish, underscoring our thesis on Universal Display shares that the adoption of organic light emitting diode technology will be significant in 2017 and beyond.

Between the two, the more notable mention was in the Technology Trader column in Barron’s that said, “Other suppliers that could benefit in 2017 include module article chiclet Universal Display (OLED), which helps make possible light-emitting diodes, a technology for sharper, more energy-efficient screens that many expect will come to the iPhone 8 next year.”

True enough, the author trotted out the Apple (AAPL) iPhone speculation, but we have been hearing more and more of that.

That brings us to the second mention, which in our view is far more meaty, but also positive for our Universal Display shares.

Over the weekend, The Korean Herald reported, “All of Apple’s iPhone 8 OLED versions will be curved” and the OLED displays are to be sourced from Samsung. The report also goes on to note that “Samsung Display’s curved OLED capacity for Apple is estimated at around 70 million to 100 million units. This is less than half of Apple’s annual sales of the iPhone series, which stand at around 200 million units a year.”

The comment on limited Samsung capacity supports the growing notion that should Apple make the move to OLED display technology, which chatter suggests is increasingly likely, Apple is likely to do so in the higher end model on the next iPhone. While it doesn’t specifically call out the ramping industry capacity for OLED displays we’ve seen via new equipment orders at Applied Materials (AMAT) and Aixtron AG (AIXG), it does reinforce the shortage pain point. With more devices (TVs, wearables, smartphones, tablets) poised to adopt OLED display technology to improve battery performance and design thickness, we see more resources coming to address this pain point, which bodes well for Universal Display’s chemical and licensing business.

Given prospects for far greater OLED usage in 2017 and 2018, we are rolling up our sleeves to determine potential upside to our $68 price target.

Over the last week, while many have been watching the Dow Jones Industrial Average flirt with 20,000, the Nasdaq Composite Index continued to climb higher. That led our Connected Society investment theme positions in Facebook (FB), Alphabet (GOOGL) and Amazon (AMZN) higher over the last week.

Over the last week, while many have been watching the Dow Jones Industrial Average flirt with 20,000, the Nasdaq Composite Index continued to climb higher. That led our Connected Society investment theme positions in Facebook (FB), Alphabet (GOOGL) and Amazon (AMZN) higher over the last week.

On the continued strength of Rouge One at the box office and the news that Content is King investment theme company The Walt Disney Co. (DIS) is firming up plans for a streaming ESPN service, our Disney shares moved higher over the last several days.

On the continued strength of Rouge One at the box office and the news that Content is King investment theme company The Walt Disney Co. (DIS) is firming up plans for a streaming ESPN service, our Disney shares moved higher over the last several days.

The one drawback when it comes to the VDA market is the players mentioned above have large existing businesses, which means their respective VDA businesses, at least in the next few yeas, will have at best modest influence on their overall financial picture. In keeping with our “buy the bullets not the guns,” coming out of CES 2017 we find ourselves looking at speech technology and voice recognition company Nuance Communications (NUAN).

The one drawback when it comes to the VDA market is the players mentioned above have large existing businesses, which means their respective VDA businesses, at least in the next few yeas, will have at best modest influence on their overall financial picture. In keeping with our “buy the bullets not the guns,” coming out of CES 2017 we find ourselves looking at speech technology and voice recognition company Nuance Communications (NUAN). The growth businesses at Nuance include its automotive, voice biometrics, omni-channel customer care, unified print and scan solutions, Dragon Medical, CDI and diagnostics. Paving the way is the company’s most recent quarterly bookings, which were up 45 percent year on year. Longer-term we expect more applications across the consumer electronics market to develop. As noted above, Whirlpool is working with Amazon and odds are that means before too long we’ll see VDAs built into various appliances across the kitchen and laundry rooms. In our view, that’s just scratching at the surface.

The growth businesses at Nuance include its automotive, voice biometrics, omni-channel customer care, unified print and scan solutions, Dragon Medical, CDI and diagnostics. Paving the way is the company’s most recent quarterly bookings, which were up 45 percent year on year. Longer-term we expect more applications across the consumer electronics market to develop. As noted above, Whirlpool is working with Amazon and odds are that means before too long we’ll see VDAs built into various appliances across the kitchen and laundry rooms. In our view, that’s just scratching at the surface.