Dow hits 20k – Hope Trumps Uncertainty

For anyone whose has spent time listening to Wall Street types, the mantra, “The markets hate uncertainty,” is a familiar one. So with the political upheaval here in the U.S., (an election that defied the pundits and an administration unlike anything we’ve seen before) combined with the upcoming volatile elections across much of Europe, convention wisdom would expect investors and businesses alike to run for safety, but instead, we just saw the Dow Jones Industrial Average hit 20,000 for the first time ever at the Trump Trade is reignited.

The conventional wisdom among economists is that people don’t like uncertainty and the unknowable. Faced with the prospect of upheaval and change with unpredictable outcomes, they become less confident about their prospects and more cautious about making big decisions on spending.

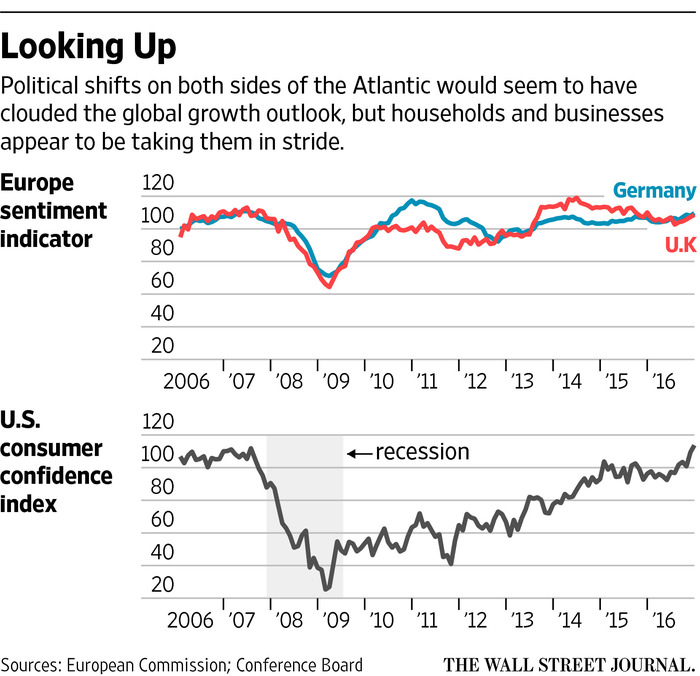

Consumers and businesses in the U.S. and Europe appear undaunted by the prospect of profound political change on both sides of the Atlantic and may even be encouraged by it.

Let’s face it, the problem isn’t uncertainty but the absence of hope. What investors and businesses alike needed was a reason to believe that something was going to kick the economy into gear and get us out of the economic doldrums we’ve been experiencing since the financial crisis.

What we needed was hope that things could change for the better. Today the U.S. appears to be bubbling over with hope. The markets have pretty much fully priced in successful new policies as if they are a fait accompli, but the reality is that President Trump is facing an unprecedented level of antagonism, while history shows that at best, presidents are lucky to see around 60% of their agendas come to fruition. The danger here is that after having priced in all the pro-growth rhetoric, the market may become impatient with the time table.

Just a few days ahead of his election, Trump had a 37% approval rating versus a 55% disapproval rating. For a historical perspective, going back to the same point in the cycle with other newly elected presidents, approval ratings were more optimistic with Ford at 90%, JFK and LBJ at 80%, Obama, George W., Bill Clinton and Reagan all at 70%, and finally Bush Sr. and Nixon at 60%. JFK, Carter, Clinton and George W., with majorities in both the House and Senate, struggled to get through much of what they promised.

To get any significant legislation passed through the Senate, Trump needs 60 votes to avoid a filibuster, which means getting eight Democrats on board. The nomination hearings are giving us quite the preview of just how cantankerous the legislative process is likely to be. On top of that we are already seeing division within Trump’s own party on what corporate tax reform will look like and there is considerable debate over how personal income tax deductions will be affected.

Surveys of sentiment point to a strengthening of confidence in both the U.S. and the U.K. over recent months, while a similar rise in optimism is under way in Europe, which faces a number of elections in 2017 that could lead to big changes in policy.

We love to see enthusiasm, but the reality is that while over 80% of the survey data over the past two months has beaten expectations, over 50% of the actual hard data has come in below expectations. As the indices continue to tick higher, so does downside risk if all that positive sentiment isn’t met by reality before the ever-fickle markets lose patience.

Source: Global Uncertainty Gets Brushed Off in the U.S. and Europe – WSJ