Even Buffett acknowledges the coming disruption of driverless cars and the auto insurance industry

Technology tends to bring disruption, and more often than not disruption upends existing business models often times with a ripple effect in tow. Many people tend to think of direct impact, while we here at Tematica think of that as well as the second and third derivatives to be had. Maybe its the fact that the majority of team Tematica were math majors in college, but nevertheless it allows us to recognize the second and third waves of disruption as well as those companies poised to benefit and those that will not.

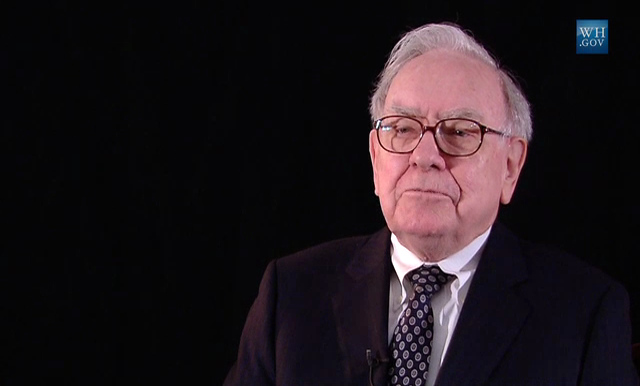

In the case of autonomous vehicles, which is part of our Disruptive Technologies investing theme, there are a number of ripple effects to be had that will alter industry dynamics. We discussed a number of them on during episode #35 of our Cocktail Investing Podcast when we spoke with Brad Stertz, Director of Government Affairs at Audi, but it seems that now Warren Buffett is realizing the potential disruption to be had on the auto insurance industry from autonomous cars. Keep in mind, Buffett has historically shied away from technology, but even he is seeing the coming writing on the walls.

[podcast src=”https://html5-player.libsyn.com/embed/episode/id/5787585/height/90/width/470/theme/custom/autonext/no/thumbnail/yes/autoplay/no/preload/no/no_addthis/no/direction/forward/render-playlist/no/custom-color/88AA3C/” height=”90″ width=”470″]

By now, the question for driverless cars is when, not if. For Warren Buffett, CEO of Berkshire Hathaway (BRK.A, BRK.B), which owns Geico, that prompts the question: what does this mean for car insurance?

In an interview with Yahoo Finance, Buffett mused that this technological revolution would likely mean less auto insurance required.

“Driverless cars will reduce — perhaps dramatically — the need for auto insurance if they’re safer,” said the legendary investor and CEO. “If driverless cars are successful and people don’t hack into ’em, that will reduce auto insurance premiums — and perhaps drastically reduce them.”

But even if premiums are lowered, that’s not necessarily bad for business. Car insurance will likely remain — the government mandates a degree of it in many states — and added safety doesn’t just mean cheap premiums, it means cheap payouts.“

You want safer cars. Safer cars mean lower insurance. Safer driving means lower insurance costs,” said Buffett.

Source: Warren Buffett on driverless cars and auto insurance