Fed Wednesday Will Be The Focus, But There’s Much More Going On This Week

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

While the stock market tried to rally Friday off of a very solid February Jobs Report that likely paves the way for the Fed to nudge interest rates higher next week, the S&P 500, Jones Industrial Average and the Russell 2000 Index all ticked lower for the week. Most interesting was the Friday sell-off in both the Financial Select Sector SPDR Fund (XLF) and the PowerShares DB US Dollar Index Bullish (UUP) — one would think that both financials and the dollar would benefit from the likelihood the Fed would raise interest rates next week. Perhaps the sell-off has something to do with what Tematica’s Chief Macro Strategist Lenore Hawkins said on last week on our Cocktail Investing Podcast: the Fed has a track record of boosting interest rates at the wrong time.

The Below the Headlines Findings from the Employment Report

As we pointed out last week, ahead of the Friday Employment Report, the Atlanta Fed cut its GDPNow forecast for the current quarter to 1.2 percent, a sharp, sharp cut from more than 3 percent in January. Even in the solid February Employment Report that showed a favorable mix of higher paying jobs, and a tick up in the labor force participation ratio, average hourly earnings for private-sector workers rose 0.2 percent during February, which was below expectations for 0.3 percent. Wages for nonsupervisory and production employees comprise about 80 percent of the workforce and that group saw their hourly and weekly wages rise by about 2.48 percent on a year over year basis – this group isn’t getting quite the gains that their supervisors are enjoying. Additionally, this metric is not adjusted for inflation and guess what….the most recent inflation rate as measured by the consumer price index was (drum roll) … 2.5 percent. So post-inflation, no real gains. Once we again, it pays to read more than just the headlines when deciphering a report like this.

Wages for nonsupervisory and production employees comprise about 80 percent of the workforce and that group saw their hourly and weekly wages rise by about 2.48 percent on a year over year basis – this group isn’t getting quite the gains that their supervisors are enjoying. Additionally, this metric is not adjusted for inflation and guess what….the most recent inflation rate as measured by the consumer price index was (drum roll) … 2.5 percent. So post-inflation, no real gains.

Once again, it pays to read more than just the headlines when deciphering a report like this.

The sell-off in the Financial Select Sector SPDR Fund (XLF) and the PowerShares DB US Dollar Index Bullish (UUP) could also reflect the euro hitting a more than four-week high against the dollar on Friday after a report that the European Central Bank had discussed the possibility of raising interest rates before the end of its quantitative easing program. The last several PMI reports published by Markit Economics show economic growth in several euro zone countries is gaining traction, and following its March meeting last week the ECB raised its 2018 growth and inflation targets. The strong dollar has been one of the factors aiding the euro zone recovery as it has led to a rebound in export orders over the last several months. As Markit Economics noted in discussing its final February Eurozone Composite PMI, “Improved inflows of total new orders and new export business drove the rate of expansion in manufacturing production to its highest since April 2011.” With the rally in the Euro, Team Tematica in the coming weeks will be watching the currency dynamics to see if there is any noticeable change in import/export demand and if so what it could mean.

Let’s Now Step Back and Look at the Total Market

With all that data bouncing around our heads, when we take a wider view of things we find that so far in March the majority of the major stock market indices have traded off modestly after having climbed consistently higher over the last several months. We chalk this up to the growing realization that the domestic economy is improving, but not quite catching fire as many had expected it would following the presidential elections. Our view has been that it would take time for President Trump’s policies to be unveiled, haggled over and passed, and we are seeing those signs in the media.

With the growing likelihood that tax reform won’t get passed until later this year, we suspect the optimism that has been power the market higher is coming face to face with the economic reality we will be facing at least in the near-term. As we mentioned above, the most recent adjustment to the usually upbeat Atlanta Fed’s GDPNow forecasting tool was before the February Employment Report, and we too will be waiting for the next update that lands on March 15.

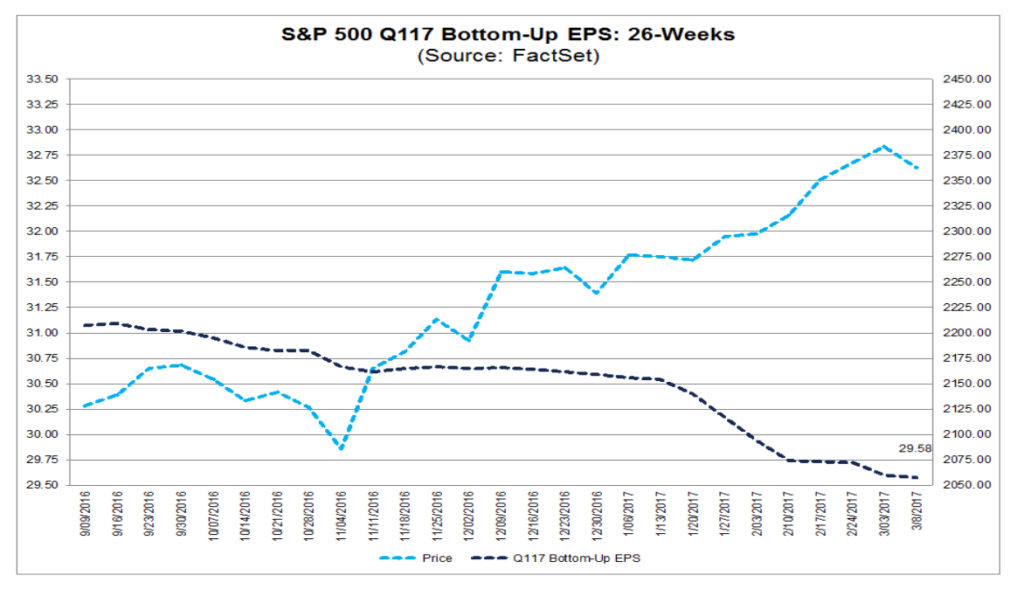

We probably won’t see much impact from Trump’s policies until late this year, with a more pronounced impact in 2018. In recent weeks we’ve started to see that realization creep into earnings forecasts for the S&P 500, particularly in those for the current quarter. Odds are the Atlanta Fed’s GDP reading will get some lift from the February Employment Report, but even that isn’t likely to catapult it back to levels seen several weeks ago. We see this realization creeping steadily in the mindsets of professional investors.

When it comes to retail investors, January had roughly $35 billion in ETF inflows, and February also saw roughly $52 billion in inflows. According to Dave Nadiq, CEO of ETF.com, the last two months have been “the biggest two-month run in ETFs since ETFs were invented.” Stepping back a bit further, ETFs have racked up 18-straight weeks of positive inflows. If you’re thinking that right around the time of the 2016 presidential election, you would be correct. Historically, the retail investor tends to return to the market near the top only to get burned and with the market trading at more than 18.1 forward earnings that are once again starting to be trimmed, it’s possible history could be repeating itself once again. Keep in mind, that even though the CNN Money Fear & Greed Index has traded off from Extreme Greed levels as the stock market has softened in March, it still remains well within Greed territory.

While all that capital coming into the market could lead it to melt up more, from our perspective, at best we’re likely to see the market trade sideways in the coming weeks and we could see further weakness should earnings expectations for the current quarter and all of 2017 get dialed back. We’ve already started to see that happen, and we suspect that as economists and analysts update their models, more is likely to be had. The real fun should being in about a month’s time when we start to get 1Q 2017 earnings results… yep, it’s almost that time again.

Given our view, we’d welcome the opportunity to scale into recently added positions on the Tematica Select List, especially those that are benefitting from multi-year tailwinds found in our Connected Society, Disruptive Technology and other investing themes.

Turning to the Week Ahead

Next week brings a busy domestic economic calendar that includes both inflation metrics for February as well as the February Retail Sales Report. All of these will hit ahead of the Fed’s likely announcement Wednesday afternoon that it will indeed nudge interest rates higher. Soon after, we’ll get the latest housing starts picture and then another look at the industrial economy courtesy of the February Industrial Production report as well as the March reading on the Empire Manufacturing and Philly Fed indices. We’ll also get the latest industrial product and retail sales in China this week, as well as the latest stances on monetary policy from the Bank of Japan and the Bank of England. In Washington, the White House is due to release the Trump administration’s budget plan for fiscal 2018, and if it’s received like several of Trump’s initiatives, we’re sure there will be ample commentary to digest.

As the velocity of earnings reports subsides, there are several conferences occurring next week including:

- The JPMorgan 2017 Aviation, Transportation & Industrials Conference, which means watching for reactions in the US Global Jets ETF (JETS) and The Industrial Select Sector SPDR Fund (XLI) ETFs.

- Semicon China — we’re already seeing a pick up in semiconductor capital equipment demand as new technologies bolster orders at Applied Materials (AMAT) and others. ETF investors should keep their eyes on Technology SPDR ETF (XLK) and Vanguard Information Technology ETF (VGT) this week.

- Barclays Global Healthcare Conference should put some attention on the iShares Dow Jones US Healthcare ETF (IYH) and Guggenheim S&P 500 Equal Weight Healthcare ETF (RYH) shares.

- Barclays Emerging Payments Forum, which meshes well with our Cashless Consumption investing theme, means watching investor reaction in PureFunds ISE Mobile Payments ETF (IPAY) shares.

- The Bank of America Merrill Lynch 2017 Consumer and Retail Technology Conference should be an interesting one given what’s going on in the retail space and consumer wallets. If you missed our conversation on the podcast about WalletHub’s credit card survey and the retail landscape, you’ll want to listen to it here because it’s not good news. ETFs to watch include Consumer Discretionary SPDR ETF (XLY) and SPDR S&P Retail ETF (XRT).

In terms of earnings that we will be getting, the handful that we’ll be focused on will include Tiffany’s (TIF) and Inter Parfums (IPAR), both Affordable Luxury contenders, to see if the emerging wealthy are still spending. We’ve heard the Connected Home is growing, just not as fast as some had forecasted and results at Alarm.com (ALRM) should tell us the speed at which consumers are blending Safety & Security and Connected Society in their homes.

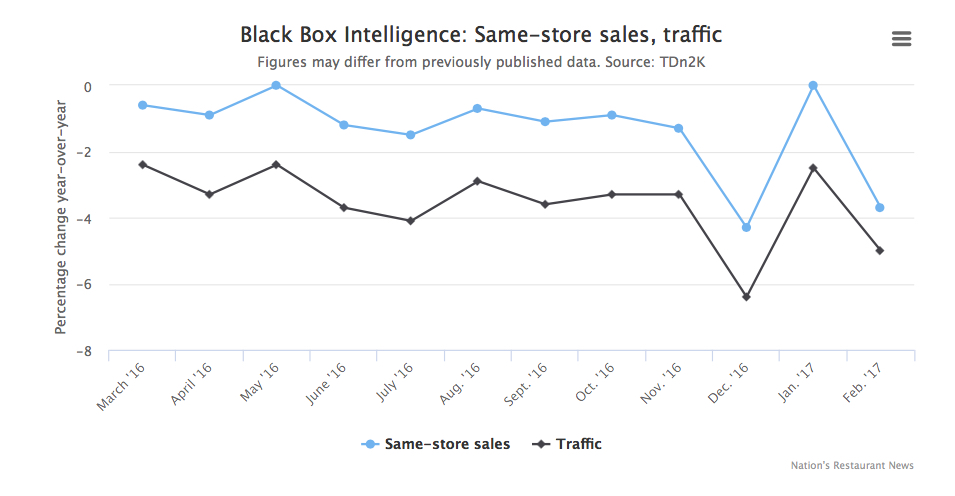

As part of our Fattening of the Population theme, we have several restaurants reporting earnings this week, and we’ll keep our ears open given recent reports that some are instilling a “labor surcharge” to contend with higher minimum wage costs. If true, this could be a boon for those companies like United Natural Foods (UNFI) and Kroger (KR) that are catering to more consumers eating at home and eating food that fits with our Foods with Integrity investing theme. As you can see in the chart below, restaurant traffic has been awful and we rather doubt an added surcharge is going to help attract diners.

A Second Round of Cocktail Investing Served This Week

Also coming up this week, we have a twofer with Tematica’s Cocktail Investing Podcast. In the first episode, the Tematica mixologists talk with Steve Fredette, the President of Toast, a technology company that is serving the restaurant industry. Not only do we get the 411 on toast, but we also get to hear an insider’s view on what Steve and the Toast team are seeing in the restaurant industry today.

Later in the week, Chris and Lenore will be joined by Jack Mohr, who until recently co-managed Jim Cramer’s Action Alerts Plus portfolio at The Street. We expect a fun filled conversation on the markets and stocks, and perhaps we can coerce Jack into revealing some of his favorite current stock picks.

Earnings on Tap This Week

The following are just some of the earnings announcements we’ll have our eye on for thematic confirmation data points:

Affordable Luxury

- Inter Parfums (IPAR)

- Tiffany & Co. (TIF)

- William Sonoma (WSM)

Aging of the Population

- US Physical Therapy (USPH)

Cash-strapped Consumer

- DSW (DSW)

- Dollar General (DG)

Connected Society

- Adobe Systems (ADBE)

- Oracle Inc. (ORCL)

Economic Acceleration/Deceleration

- HD Supply Holdings (HDS)

Fattening of the Population

- Del Taco (TACO)

- Fogo de Chao (FOGO)

- Hostess Brands (TWNK)

- Papa Murphy’s (FRSH)

Guilty Pleasure

- Craft Brew Alliance (BREW)

Rise & Fall of the Middle Class

- Tilly’s Inc. (TLYS)

- Guess? (GES)

Safety & Security

- Alarm.com (ALRM)

Scarce Resources

- Primo Water Corp. (PRMW)

Tooling & Re-tooling

- Rosetta Stone (RST)