It’s Going to Take More Than a Week for the Market to Sort Itself Out

There are times when I sit down to compose the Weekly Wrap that frankly, it is a bit of a struggle. The markets and the economy don’t always provide inspiration. This was not one of those weeks. Holy cow! The hyper volatility that we’ve been warning was on the horizon has stormed in sending, shocks through the previously complacent markets.

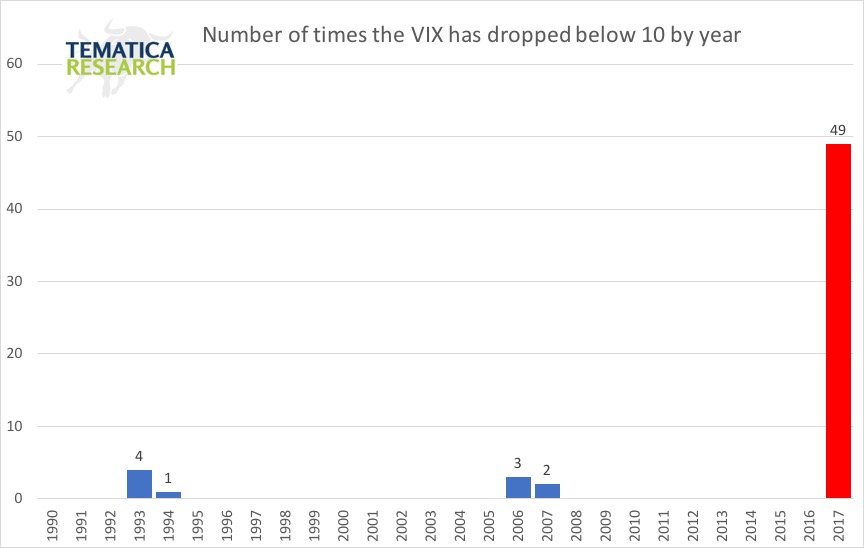

Our regular readers will recognize this chart, as it is one we presented regularly throughout 2017 to illustrate just how low volatility had been relative to historical norms and warning that suppressed volatility ultimately leads to hyper-volatility.

In 2017 the number of times the VIX closed below 10 quintupled the number of times it did so in all previous years combined! How is that for suppressed volatility? By Monday, February 5th, the VIX had gained 238% from the start of the year. Here comes the hyper phase – think 2-year old, post trick-or-treating Halloween night.

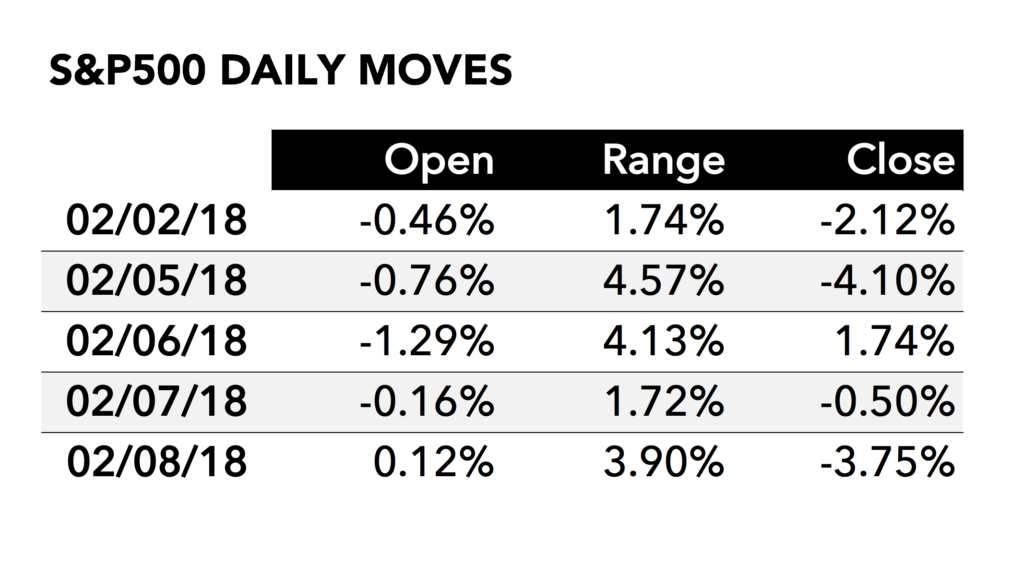

Up until the recent market turmoil, the S&P 500 had gone 311 sessions without a 3% decline and 405 days without a 5% decline. All that changed starting last week. Part of me wants to take a bit of a victory lap on this one, and the other part is thinking “Holy cow!”

Monday the major indices lost around 4% in just one day alone. The S&P 500 dropped well below its 50-day moving average and its 14-day RSI (Relative Strength Indicator) fell below 30, which put the index into oversold territory for the first time since late 2016. Despite that move into oversold territory, the week didn’t see the index improve.

On Tuesday, after opening sharply lower, stocks reversed direction on heavier volume than Monday and managed to bounce off a couple of support levels. The S&P 500 bounced off its 100-day moving average and came within a hair’s breadth of a full 10% correction before turning higher, closing up over 1.7%. A number of large cap stocks experienced significant upside reversals, which gave many hope that the worst was over. Both Apple (AAPL) and DowDuPont (DWDP) bounced off their 200-day moving averages and Home Depot (HD), Goldman Sachs (GS) and Caterpillar (CAT) dipped briefly below, then moved back above their 50-day moving averages. By the end of the day, many of the talking heads on financial TV were chastising that this was but a blip and investors should all just calm down. They were wrong.

Wednesday the S&P opened slightly in the red, rebounded to a high of 1.2% but then closed down -0.5%, not great, but not nearly the drama of Monday and Tuesday which had experienced intraday swings of over 4%, so perhaps investors ought to calm down?

Remember that hyper volatility? Not likely folks. A few days isn’t going to make up for what we saw in 2017.

Thursday morning it appeared that the ship really was righting itself with the S&P 500 opening up 0.12% above Wednesday’s close, but then all hell broke loose, and the index closed down -3.75%, just shy of the day’s lows of down -3.77% and officially in a correction, down 10.2% from the January 26th high. Transports and Industrials, the Nasdaq 100 and the NYSE Composite were all in correction territory as well.

Friday the market opened up 0.81%, but then began trading down later in the morning as the Dow Jones Industrial average was on track for its worst week since October 2008.

During this time yields have been rising with the 10-year Treasury briefly touching a 4-year high of 2.85%, the dollar strengthened to a three-week high and gold, traditionally a safe haven hasn’t been acting all that safe.

Wait, hold on! We’ve seen the market move into correction territory as the yield on the 10-year Treasury gains 16+ basis points? We’ve only seen something like this happen in 1987 and 1994 going all the way back to the 1930s – not exactly typical.

So what brought us here?

As we discussed on this week’s Cocktail Investing Podcast, the asymptotic moves in equity indices over the past months have been fueled by:

- Stronger than expected global growth

- Weaker than expected inflation data

- Loose monetary policy from the world’s major central banks

This is changing.

As global growth has been stronger than expected, growth expectations have been adjusted upwards and we are now seeing that the Citigroup Economic Surprise Index (CESI) for major advanced economies has risen to near record-high levels, which means that expectations are moving towards outpacing reality. The Economic Cycle Research Institute is warning that global growth expectations are, “Running short on Fuel.”

Looking at U.S. growth, without the drawdown in the savings rate and the jump in consumer credit combined with the post-hurricane repairs, there was not much growth in the economy in the fourth quarter. In terms of valuations, at the January 26th peak, the forward S&P 500 had reached its highest level in 16 years, which means that much of the good news had already been priced into the market. In January global retail investors put a record $100 billion into equity funds and margin debt was skyrocketing to record levels according to Haver Analytics. Recall Bob Farrell’s Rule #5 that, “Retail investors buy the least at the lows and most at the highs.”

It isn’t just in the public markets that we see such heady expectations. According to CBInsights, there are over 100 start-ups in the U.S. valued over $1 billion, leaving a lot of room for disappointment.

The week’s Federal Reserve policy meeting statement sounded much more upbeat about the economy and inflation, signaling a more different stance under the new Fed Chair Jerome Powell. The Fed is sounding more hawkish than it has been in years, having shifted to a tightening stance at a rather peculiar time given that roughly 20% of the outstanding level of debt in the household, corporate and government sectors, (around $10.5 trillion) is coming due within the next year. When it is rolled over, much of it will be at higher rates, which means higher debt-service costs.

When equities form a top, it isn’t a simple discrete event, but rather a process. For example, back in 2007, the market rose around 3% from the start of the year to late February only to then lose 6% by early March for a 3% loss from the start. Then it rose 13% by mid-July only to then fall 9.4% by mid-August, then again back up 11% by mid-October and back down 10% by late November and then back up 7.7% the first part of December. In the end, the S&P 500 closed the year up 3.5%. In 2008 the S&P 500 just kept falling, never once closing above 2007’s close, losing 38.5% for the year. In 2009 the index lost another 25% before reaching bottom in March. We are not saying the market is going to repeat 2007 – markets never do exactly replicate the past. We are pointing out that markets don’t tend to correct in a week and then go back to the previous status quo.

The bottom line is expectations, along with valuation, had reached some seriously frothy heights as investor confidence skyrockets and complacency abounded. We don’t expect that the reversion to volatility will be resolved in just one week, so investors should be getting ready with their shopping list of what they’d like to add to their portfolio and at what price it becomes attractive so they are ready to act when those price points arrive.