Housekeeping and adding a heavy truck supplier option play

KEY POINTS FROM THIS ISSUE:

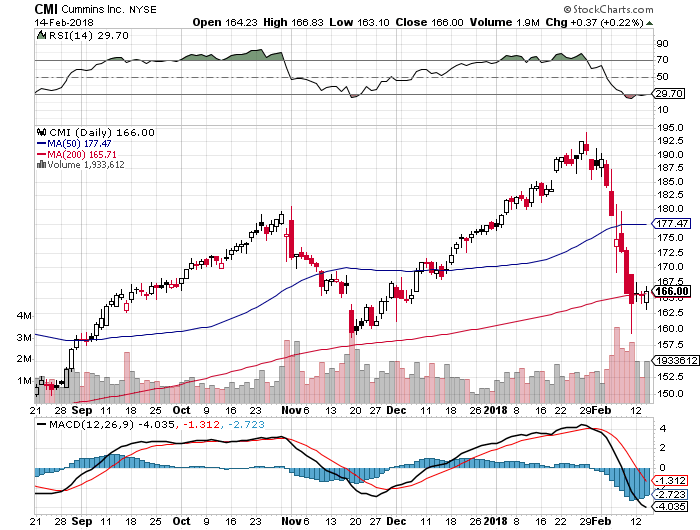

- We are issuing a Buy on the Cummins (CMI) March 2018 170 calls (CMI180316C00170000)that closed last night at 2.15. As we add these calls, we’ll set a protective stop at 1.25, and as the calls move higher I’ll raise that stop loss level.

- We are issuing a sell on the ProShares Short S&P500 (SH), ProShares Short Russell2000 (RWM) and ProShares Short Dow30 (DOG) ETFs.

- Because it will cost more to trade out of the Utilities Select Sector SPDR ETF (XLU) Feb. 16, 2018, 54.00 calls (XLU180216C000540000) than subscribers will see in returned capital, subscribers should let these XLU calls expire on Friday.

Yesterday, I shared my initial take on how the market herd knee-jerk reacted to the January Consumer Price Index report and as the day’s trading wore on moving from losses to gain it seems the herd once again saw the light. Over the coming days, we’ll get several other economic reports, but it was this CPI report that had the stock market on pins and needles. With that report passed, the market breathed a sigh of relief as it looks like the Fed may stick with just three rate hikes this year…. At least right now.

This morning, we’ll get the January Producer Price Index, and odds are much like the January CPI report energy costs – read that as oil, gas and fuel – will have increased dramatically. As I explained this yesterday, we’re already seeing oil prices retreat as inventories build and more U.S. capacity comes on stream, and I suspect the market will see through the January PPI report.

With this behind us, we’re apt to see the market move higher albeit at a more measured pace than we’ve seen in 2017. As such, we’re going to trade out of the inverse ETF positions that we’ve held onto and served us well this month as the market gave back much of its gains.

- We are issuing a sell on the ProShares Short S&P500 (SH), ProShares Short Russell2000 (RWM) and ProShares Short Dow30 (DOG) ETFs.

- As we close these positions out, we’ll record a mix of meaningful short-term and long-term losses that we’ll apply to other positions on the Tematica Investing Select List as well as here at Tematica Options+

Adding a heavy truck supplier play to the fold

Earlier this week, I added shares of heavy truck manufacturer Paccar (PCAR) to the Tematica Investing Select List given rising freight costs due in part a national truck shortage as well as prospects for a firming domestic economy that is driving freight tonnage higher. As much as I would like to follow through with a call option recommendation to positions on the Select List, it’s not always a smart thing to do, largely due to the lack of trading volume for the corresponding options.

In the case of Paccar, the vast majority of the call options trade single digit volumes most days. That level of volume, or more correctly that lack of volume, makes it a very dicey situation to trade and tends to give rise to very wide bid-ask spreads that can make it a challenge to achieve a profitable trade. The same is true with Rush Enterprises (RUSHA), the largest dealer of commercial truck vehicles in the U.S. and one that counts Paccar as a key supplier.

This had me looking into the heavy truck industry supply chain, and one of those key suppliers is Cummins Inc. (CMI), which competes in the diesel and natural gas engines and engine-related component products for the truck markets in the U.S., China and Brazil markets as well as power generation applications. The market indigestion has weighed on CMI shares to $166 as of last night’s market close from just under $193 in late January.

Much like the PCAR share on the Tematica Investing Select List, the opportunity to be had from the mismatch between heavy truck demand and Cummins’ share price is more than favorable in my view. Unlike PCAR shares, the call options associated with CMI shares are far more liquid by comparison. Cummins reported better than expected December quarter results and guided 2018 in-line with consensus expectations even as it offered its view that domestic heavy truck engine shipments would grow 20% year over year.

Much like the PCAR share on the Tematica Investing Select List, the opportunity to be had from the mismatch between heavy truck demand and Cummins’ share price is more than favorable in my view. Unlike PCAR shares, the call options associated with CMI shares are far more liquid by comparison. Cummins reported better than expected December quarter results and guided 2018 in-line with consensus expectations even as it offered its view that domestic heavy truck engine shipments would grow 20% year over year.

In the next few weeks, the Cummins management team will present at the Barclays Industrial Select Conference 2018 and soon after we’ll get the flash heavy truck order report for February. Both events should be a positive for Cummins business, and serve as a catalyst for the currently oversold shares.

- To capitalize on this, I am adding the Cummins (CMI) March 2018 170 calls (CMI180316C00170000)that closed last night at 2.15.

- As we add these calls, we’ll set a protective stop at 1.25, and as the calls move higher I’ll raise that stop loss level.

Housekeeping

Later this week our Utilities Select Sector SPDR ETF (XLU) Feb. 16, 2018, 54.00 calls (XLU180216C000540000) will expire – my advice is given the sharp fall and nearly zero value currently attached to them let them expire. It will cost you more to trade out of these call options than odds are the capital you will get back. Let’s be smart here and do the prudent thing.