Investors: Just Don’t Overthink It Like the So-Called “Experts”

Last week we closed the books on January and saw volatility rear its head as the earnings bonanza continued while the economic data to be had led yields higher knocking stocks in the proverbial bread basket. In our view, the move lower after one of the strongest starts of the year ever for stocks is poised to take some froth out of stock prices creating opportunities and leaving stocks not quite as priced to perfection as they were several days ago.

We also had President Trump’s first State of the Union Address, in which he unwrapped his $1.5 trillion framework to rebuild the US’s crumbling infrastructure. We also had the January FOMC meeting, the last under outgoing chair Janet Yellen, with a dovish monetary policy statement. All that and we learned the worries over Apple and the iPhone X were once again blown out of proportion. More on all of that we covered in Friday’s Weekly Wrap.

With the 2017-18 NFL season and the Super Bowl in the books, let’s kickoff the first full week of February and take a look at what’s on tap in the coming week…

On the Economic Front

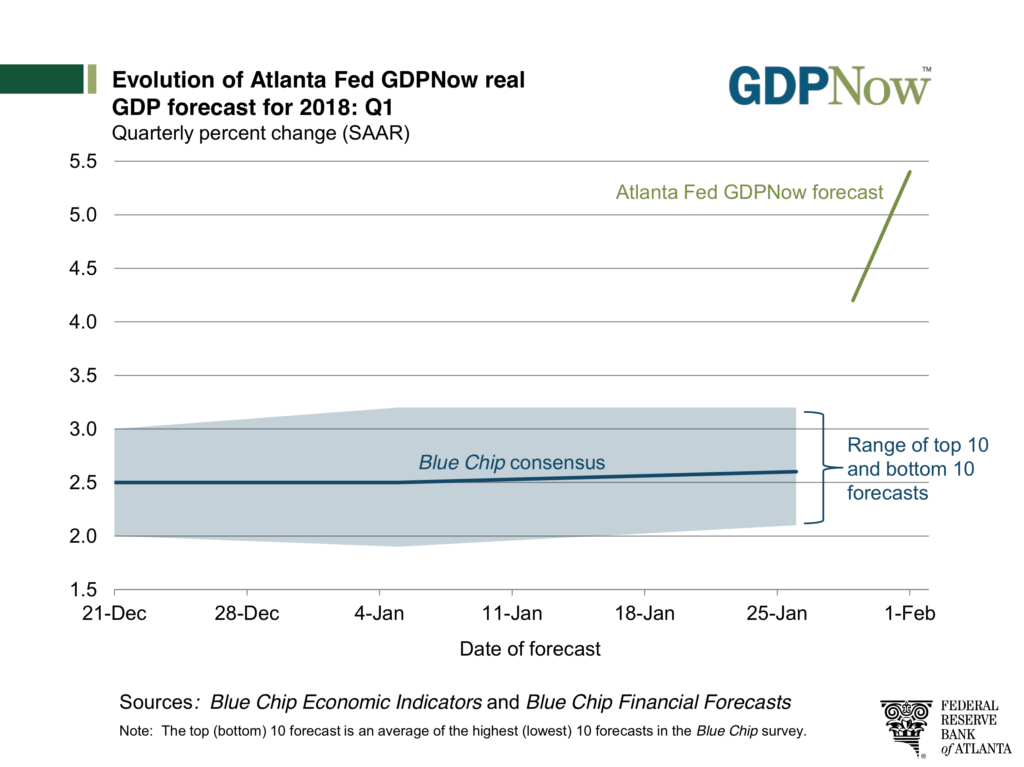

On the heels of last week’s data-filled week, the Atlanta Fed GDP Now’s forecast for GDP in 1Q 2018 catapulted to 5.4% from 4.2% at the start of last week.

That forecast reflects the robust January ISM Manufacturing Index as well as construction data that was published last week. We’d be remiss that it stands significantly higher than the 3.09% GDP forecast published by the NY Fed and 2.6% that is derived from The Wall Street Journal’s Economic Forecasting Survey.

As much as we would like to have some faith in the Atlanta Fed’s forecast, the reality is it has a firm track record of missing to the upside with its forecasts. The most recent example was its last 4Q 2017 forecast that looked for GDP of 3.4% — we all know how far off the mark that was. It prompts us here at Tematica to recall a quote by the famous author Habeeb Akande: “The more you overthink the less you will understand.”

Also last week, the Fed held its last FOMC meeting under Janet Yellen’s leadership. The Fed stuck to the playbook it has operated under over the last few quarters – growth is improving, the Fed will continue to be on the lookout for inflation, and it looks to boost interest rates three times this year. Exiting last week, however, we saw a step in the market’s assessment the Fed could boost rates up to four times this year. As more data comes in over the coming weeks, we’ll look to the Fed’s March meeting, which will be its first under new Fed head Powell and include an updated, multi-year economic forecast. If we see meaningful upward moves in that outlook, we could see the Fed begin to signal that more than three rate hikes could be on the table before year-end.

That means team Tematica will be scrutinizing the data to be had this week and in the coming ones to bet an accurate bead on the pace of the economy. This week we have a relatively lite flow of economic data that includes the ISM Services Index for January as well as the December Trade Balance and JOLTS reports. In my view, the report to watch this week will be the December Consumer Credit report. We’ve seen a ramp up in consumer credit card debt over the last several months, and recent data shows non-supervisory wages were essentially unchanged for the 12-months ending December 2017. With interest rates poised to inch higher in 2018, we continue to see a potential disappointment in the consumer’s ability to spend as he and she struggles with increasing debt service costs. Let’s remember, consumer spending was a key driver in the 2.6% GDP print for 4Q 2017 and the risk is the consumer is not quite the tailwind for the economy that it has been or people expect it to be.

On the Earnings Front

While we get a respite on the economic data front, there is no slowdown on the earnings front this week as the number of companies reporting gaps up to more than 525 from 443 last week. Among that sea of reports, here’s a short list of the ones that I’ll be focusing on:

- Apple (AAPL) suppliers Cirrus Logic (CRUS) and Skyworks Solutions (SWKS) to get confirmation that iPhone shipments are poised to dip 3%-5% year over year in the current quarter, a far cry better than the media was suggesting over the last few weeks.

- Does Cummins (CMI) see an accelerating global economy that is driving a pickup in the heavy truck market that is currently seeing substantial hikes in spot freight prices?

- Are advertising rates at Snap (SNAP) going the way of Facebook (FB) or more like Alphabet (GOOGL), and is SNAP keeping pace with user additions at Instagram?

- How does the latest Star Wars film and a robust slate of Marvel and Pixar movies fit into Disney’s (DIS) proprietary streaming video service? Also, have continued cost reductions at ESPN finally right-sized that business?

- Will T-Mobile USA (TMUS) continue to win postpaid customers from its mobile rivals and is there any acceleration in its 5G network timetable?

- Is one-time high flier Chipotle Mexican Grill (CMG) as done as the growing consensus believes?

- What is the vector and velocity of the recently launched Overwatch e-sports league, and what does it mean to Activision Blizzard’s (ATVI) bottom line?

Thematic Signals

Each week we look for data points pertaining to our 17 investment themes, or as we call them Thematic Signals. These signals can either be confirming or they can serve to raise questions as to whether a theme’s tailwinds are strengthening or ebbing. Be sure to check out the Thematic Signals section of our website to read more about these stories and others we publish throughout the week.

Alibaba hopes to find a silver bullet when it comes to the aging population

Aging of the Population

Over the next 12 years, all of the baby boomers will have moved into the senior generation, resulting in a major structural shift in demographics. From 2010 to 2030, the percent of the population over 65 will increase from 13 percent to 19 percent while the percent of the U.S. population aged 20-64, the primary working years, will decrease from 60 percent to 55 percent.

We in the United States are hardly alone in this demographic shift. Canada, Japan, China and most of Europe have an even higher percentage of their populations in the older age brackets.

Cash-strapped consumer want more digital coupons

Cash-strapped Consumer, Connected Society

In a recent Thematic Signal post, we shared that Apple (AAPL) is making inroads with Apple Pay as smartphones account for a growing percentage of digital commerce. We lamented on the lack of loyalty program support in Apple Pay, but it is becoming increasingly clear that shoppers want digital couponing. Currently there are third party apps that “clip” digital coupons, but wouldn’t it be convenient to have all those coupons alongside your payment cards in Apple’s iOS Wallet… especially if it were tied into Reminders with a “use by” date. Maybe in iOS 12? Such a move by Apple.

Apple playing the long-game with Apple Pay

Cashless Consumption

The current headlines are rumor mongering over iPhone X production cuts for the first half of 2018, but Apple continues to improve the stickiness of iPhone by tapping into the exploding world of mobile payments with Apple Pay. Initially off to a slow start, Apple Pay is now reportedly accepted in 50% of US retail locations… of course, accepted at doesn’t necessarily equate to “used at.” That said, with smartphones and tablets account for 25% of e-commerce transactions in the U.S. it looks like Apple is continuing to play the long game.