Subscribers to our premium research received the below note this morning from our Chief Investment Officer Chris Versace, in which he details his thoughts and insights concerning the market volatility over the past few days. Given its importance — and indigestion we are all no-doubt feeling — we wanted to share it with you as well to provide some context and perspective on what’s happening and why.

As we all know, yesterday’s market drop saw the Dow Jones Industrial Average fall 1,175 points, marking its worst closing point decline on record. As we like to say, context is key, and that drop of more than 1,100 points, however, equated to a percentage decline of 4.6% — understandably unsettling, but nowhere near as sharp a punch to the gut one would expect by relying on just the absolute point drop. Yesterday’s market action came on the heels of the move lower we saw last week, which ended with a sharp drop on Friday following the market’s reaction to the January 2018 Employment Report.

All told over the last several days, the major domestic stocks market indices have fallen between 7% to 8.5% — quite a drop and easily the worst group of days for the domestic stock market we’ve seen in some time. It’s also erased the gains that were had thus far in 2018. As we look at domestic equity futures this morning, it looks like there is more downside to be had in the very near-term.

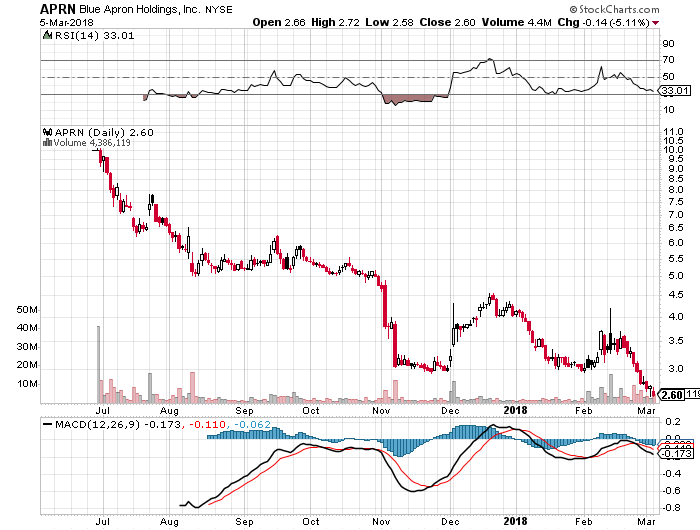

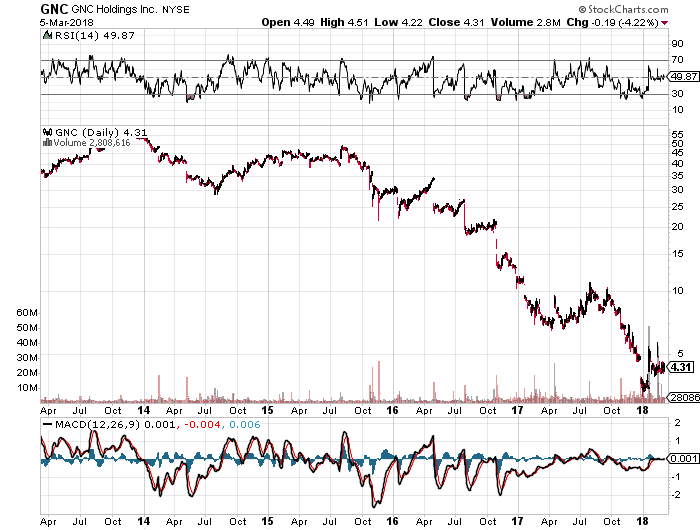

For the last several weeks in these posts, as well as in the Monday Morning Kickoff, the Weekly Wrap and in our Cocktail Investing Podcast, we’ve been sharing our view that the market has been increasingly priced to perfection. As it has climbed higher and higher in January, we’ve only seen it stretching a number of valuation metrics even more so along the way. While we along with most others enjoyed the climb higher and the impact it had on our holdings, it became increasingly challenging to put capital to work in new positions given questions over incremental upside to be had.

What’s fueled the market’s move higher through January as well as the months leading up to it?

Contributing to the market’s melt-up have been a combination of improving economic data and expectations for tax reform benefits to be had on corporate bottom lines, as well as a combination of incremental investment spending and capital returns to investors in the form of dividend hikes and share repurchase plans. In recent weeks, investors have received varying degrees of confirmation of those expectations, and the response has been one of the strongest upward revisions for the S&P 500 earnings expectations. Those “adjustments” have led 2018 EPS expectations for the S&P 500 to stand near $155 and $172 for 2019, up from $132.68 in 2017 and $119 in 2016.

Helping propel those upward revisions, analysts and strategists increased their earnings estimates for companies in the S&P 500 for the current quarter, a period that usually sees decreases during the first month of the quarter. Those upward revisions have led the consensus EPS view for the March 2018 quarter to $36.04 (up from $34.36) and compares to $30.84 in the year-ago quarter – all in all, an increase of more than 17% year over year. We’ve only seen year over year first quarter EPS growth expectations rise this much two other times over the last 15 years – in 2004 and 2010. Clearly, expectations are running high.

Let’s add some additional context for the melt up in those earnings expectations — 2018 EPS forecasts derived from the S&P 500 group of companies have risen to $155 from $146 exiting November, while expectations for 2019 rose from $160.50 to the current $172. Much like the stock market move, those expectations have moved pretty far pretty fast leading strategists to boost their price targets for the S&P 500 to 3,000-3,1000 or slightly higher. Some sandbox math shows those targets hinge not on additional multiple expansion, but rather EPS growth. Like we said, expectations are running high.

In many respects it was that positive spiral that led the domestic stock market to melt higher, stretching valuations as we mentioned above, with it becoming increasingly priced to perfection. When we’ve seen the market in states like this, it’s vulnerable to a pullback should something not go as planned. That’s what happened over the last several days as bond yields moved higher.

Inflation & Labor Supply Concerns Only Added Fuel to the Fire

Fueling that steady creep was the growing sense that inflation is poised to move higher, as are borrowing costs, and the January 2018 Jobs Report stoked that flame. That report showed some 200,000 jobs being created during the month with headline wage gains climbing 2.9% year over year. The report also showed an unemployment rate that continued to hover at 4.1%, and this has led some to assert the economy could be a full employment.

Looking at the monthly labor force participation ratio, much like the unemployment rate it has held steady for the last four months at 62.7%. Color us a little skeptical on full employment due in part to the data that showed a decade ago the labor force participation ratio was a 66.2%. Given the aging population, we suspect that few really know what the right labor force participation ratio is, but given the under-saved nature of many retirees, odds are more need to be augmenting their incomes than is reflected in data. That’s a reality that E*Trade made some light of in its Super Bowl ad this year — if you missed it and need to add some levity to your day you can watch it here.

While we contemplate the above, the full employment view has helped fan the flames of inflation fears. The January wage gains, the largest since June 2009, combined with the ongoing claims per the monthly JOLTS that employers can’t find qualified workers has led some to forecast a quicker rise in wages as employers look to recruit the workers they do need.

It’s been some time since we’ve seen the impact of a tight labor force and the ensuing bidding war, but we’d remind readers that for the majority of workers – the 82% that are production employees and nonsupervisory in nature – wages grew relatively tamer, at just 2.4% year over year in January. Still ahead of the Fed’s 2% inflation target, but this tells us the majority of wage gains is concentrated in a smaller group of higher paid workers. Said another way, the view on wage inflation is likely somewhat overstated.

This is coming at a time when economists and analysts are also boosting their price targets for oil as global demand picks up due to the improving nature of the global economy. Over the last four months, we’ve seen those economists and analysts boost their oil forecasts the same number of times, which had the effect of boosting oil price targets by $3 from December to the now current $61 per barrel for Brent Crude. That compares to $54.15 in 2017 and $43.74 in 2016 according to data from the U.S. Energy Information Administration. Odds are you’ve noticed the steady ascent in gas prices when you go to fill up your car or truck over the last few months.

So, we have rising inflation expectations and the growing thought the Fed could raise rates up to four times this year vs. their publicly shared target of three times and the two hikes it put under its belt in 2017. This in itself is a bit of a game changer compared to the last several years when the consensus view is the Fed wouldn’t have the data support to boost rates to the extent they had forecasted.

Added to the mix, the US deficit is expected to grow as a result of tax reform prompting the view the Treasury will need to borrow and borrow heavily. According to the Treasury Borrowing Advisory Committee, the Treasury will need to borrow $955 billion for the current fiscal year that ends in September 2018, up from $519 billion last year. The group goes on to forecast the need for additional borrowings in 2019 near $1.083 trillion and $1.128 trillion in 2020. Yes, that was trillion with a “t” and this is all coming about as the Federal government stares down another potential shut down later this week.

Let’s remember too that in addition to thinking it will boost interest rates, the Fed is also unwinding its balance sheet, which is adding to the supply of treasuries in the market.

Here’s the thing – when it comes to treasuries more supply tends to mean lower prices, which drives yields up and higher yields offer an alternative to US stocks. With the Fed keeping interest rates extremely low over the last decade, it’s been a comparatively low bar for equities to walk over, but as the Fed boosts rates or at least is expected to do so alternatives are emerging. That is something many have contemplated but is now happening.

There is also the simple fact there is better growth to be had outside the US, and that has prompted investors to shift gears, pulling capital from the domestic market and putting it to work in Europe and Japan as the global neighborhood is looking better. According to EPFR Global, as of Jan. 23, $20 billion was withdrawn from US equities since the start of 2018 with $42 billion going into continental European equities and $55 billion in Japanese stocks.

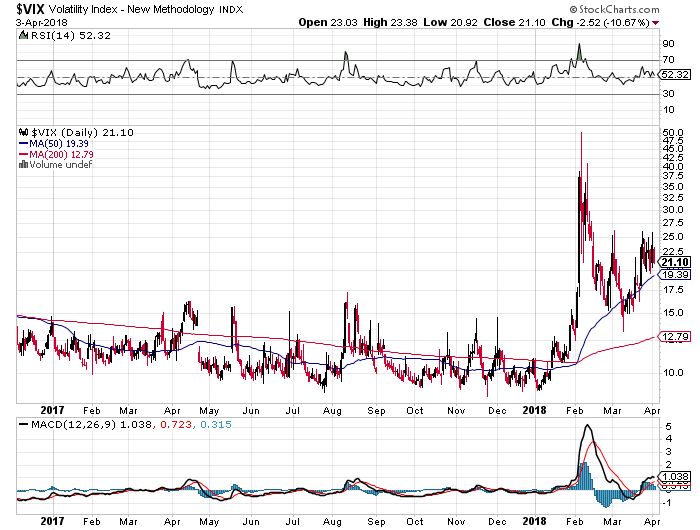

All of this has led to volatility returning, which in and of itself is something new for investors coming to the market for the first time since November 2016.

As we have shared, given the rise in the market over the last several months it has likely has led to “hold your nose and buy anyway” among institutional investors lest they be left behind by the market. Mid-January, the latest Bank of America Merrill Lynch Fund Manager Survey showed fund managers had trimmed their cash allocations to the lowest level in five years and are at a two-year high in allocation to stocks. With little institutional investor cash on the sidelines, who is left to swoop in to buy the pullback over the last week and cushion the blow? Let’s also remember the influx of funds into ETFs over the last several months as those vehicles by definition don’t have a cash component.

This has likely compounded the problem – it’s challenging to say the least to have an orderly market when there are few capable buyers.

Putting it all Together — Where Do We Go From Here?

We are seeing what we and many others have been calling for – a removal of the froth in the stock market that will pull stocks down from nosebleed levels, offering upside to be had for well-positioned companies in return. The substantial move lower in the S&P 500 over the last six trading days has been fast, but so too was the January advance and the rise in the S&P 500 since Oct. 31, 2017.

As we look at the economic data, we do not see a recession imminent, but rather a firming economy that should offer solid footing to a more sanely priced stock market as investors come to grips with the current and near-term market dynamics. The January ISM Manufacturing Index while a tad lower than December’s reading, bested forecasts to come in a 59.1 for the month vs. the expected 58.6. We saw the same with the January ISM Non-Manufacturing Index, which jumped to 59.9 in January, well ahead of the expected 56.7 and up vs. the 56.0 reading in December.

As more data arrives over the coming weeks, we’ll look to the Fed’s March meeting, which will be the first under new Fed Chair Powell and include an updated, multi-year economic forecast. If we see meaningful upward moves in that outlook, the Fed may begin to signal that more than three rate hikes could very well be on the table before year-end. The somewhat good news is the stock market is likely already pricing some likelihood of that fourth hike in.

Indigestion can be unpleasant if not painful as it occurs and that is what we’re seeing with the market now. It tends to pass and with the market at some point equilibrium will be reached as buyers match up with sellers. As we wait for that we’ll be looking at data points to be had to ferret out those companies that are best positioned for what’s ahead and are trading at favorable risk to reward profiles.