On-Going Delays in Trump Agenda Forcing Downward GDP & Earnings Expectations

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

We’re now past the Memorial Day holiday weekend, and that means for some, it’s time for short workweeks as people get a jump on the summer. For investors that cut the week short and left on Thursday last week, they missed out on Friday’s market action. The Nasdaq Composite Index had its worst day in some time losing 113 points or roughly 1.8 percent, while the Dow Jones Industrial Average rose just shy of 90 points. Even after that one-day move in the market, the Nasdaq remained up more than 15 percent year to date, vs. 7.6 percent for the Dow and 8.6 percent for the S&P 500.

In the following paragraphs, we delve into the events that spurred the Nasdaq’s fall and identify the next several events that could very well alter the market’s course.

The U.S. / Europe Tennis Match of Political Turmoil

Like any good circus, there were several attractions going on simultaneously under the market’s big top last week, including former FBI Director James Comey’s testimony before the Senate Intelligence Committee and the UK elections. With Comey’s testimony released on Wednesday ahead of Thursday’s actual appearance, the market appeared to shrug off this latest Trump concern.

Sticking with Washington, on Friday the House voted to repeal Dodd-Frank, with the next hurdle to pass being the Senate vote, which appears to have a united Democratic opposition — in other words, it’s pretty much dead in the water. While the repeal would be helpful to smaller banks by alleviating the regulatory burden, investors should see how things play out in Washington before scooping up shares of SPDR S&P Regional Banking ETF (KRE) or iShares U.S. Regional Banks ETF (IAT).

From a higher level, we’ll continue to watch DC on-goings to see if we start to get any movement on Trump’s overall reform agenda or if it continues to look like the soonest movement is likely to come will be late this year. Our concern is the later these reforms come, the more likely GDP and earnings expectations get revised lower near-term.

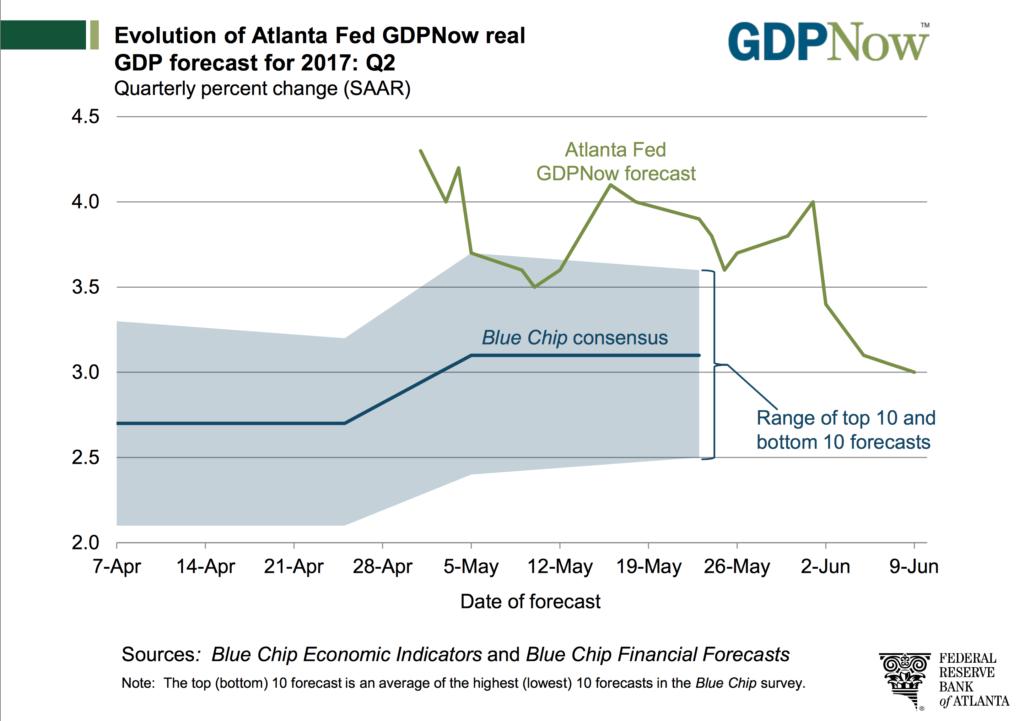

As we’ve mentioned in the last several Monday Morning Kickoffs, we’ve already seen both the Atlanta Fed and New York Fed trim their respective 2Q 2017 GDP forecasts and start pairing back 3Q 2017 expectations. As of last Friday (June 9), the Atlanta Fed’s forecast for 2Q 2017 GDP stood at 3.0 percent, down from 4.0 percent on June 1 and 4.3 percent on May 1. By comparison, the New York Fed’s GDP Nowcast stood at 2.3 percent for 2Q 2017 and 1.8 percent for 3Q 2017 this week. Things are clearly not headed in the right direction, but this should come as no surprise as we’ve forecasting these downward revisions for some time now.

Across the pond, the outcome of Thursday’s United Kingdom elections resulted in the Conservative party losing its majority, with Labor gaining significant ground. The net effect was a hung parliament, casting a number of questions, including renewed ones over Brexit timing and a slumping British Pound as Theresa May scrambles to form a minority government. At the same time, German Chancellor Angela Merkel announced she wants to see the Brexit negotiations “done quickly”, further turning the screws. On Friday, S&P Global warned the UK could see another rating downgrade due to greater uncertainty following the election’s outcome.

We had more Eurozone election “fun” this weekend as France voted on Sunday in its parliamentary election to determine the degree to which any limits are placed on newly elected President Macron’s agenda. Also over the weekend, Italy held its first round of municipal elections, which for investors will help to determine the extent of the country’s populist sentiment as they look to size up the next potential source of political risk in the Eurozone. The results of both elections were not tallied when this edition of the Monday Morning Kickoff was put to press, but the results could make for an interesting start to this week.

Hindsight being 20/20, the outcome of the British elections and concerns over what could happen in France and Italy helps explain Friday’s risk-off market that favored U.S. focused companies, while investors took profits in stocks that have been out performers over the last several months. Case in point, the shares of Facebook (FB), Amazon (AMZN), Alphabet (GOOGL), Apple (AAPL) and Microsoft (MSFT) – the five stocks have been largely responsible for the surge in the Nasdaq Composite Index year to date – each fell between 2.3 to 3.9 percent on Friday. Interestingly enough, while the FAANG stocks — that is Facebook, Amazon, Apple, Netflix (NFLX), and Google — accounted for over two-fifths of the Standard & Poor’s 500 index’s gain in market value this year per findings from The Wall Street Journal.

The weekend’s outcome could determine the next moves the market takes, as well as the dollar. Already on the back of the UK election results, the dollar is enjoying its best week in over a month and the weekend’s results could spur the dollar even higher. We’ll continue to watch this to determine what it may mean for export related revenue for US companies; a stronger dollar generally tends to act as a headwind to US exports that benefits import order and export revenues for other countries. The weekend’s outcome could also lead to nervous investors flocking further back to the US stock market as they look for relative safety that looks like the best house on the block despite the once again slowing economy. In our view, this additional melt-up in the market would stretch it’s already high valuation past the 18.5x expected 2017 earnings the S&P 500 it closed at today. Remember as GDP revisions are baked into Wall Street models odds are we’ll see more negative EPS revisions in the coming weeks and months.

It seems our concern finds us in good company given comments from BlackRock (BLK) CEO Larry Fink — “I’d say the second quarter is going to be disappointing in terms of earnings and growth. It’d tell me markets are probably fully priced at this moment.” — and Vanguard CEO William McNabb, who thinks “the U.S. market is fully valued right now.” Time to be cautious, which means checking your stop loss levels as well as building your shopping list so you are prepared should Friday’s market pullback continue.

Turning Our Gaze to the Week Ahead

As we noted above, we’ll be watching the election results from over the weekend, which will clearly shape how we begin the week. Here at U.S. shores, there are several key economic indicators that will be reported ahead of the Fed’s FOMC meeting that spans June 13-14, including PPI, CPI and Retail Sales data for May. As we have repeated over the last several months, we’ll be looking to the monthly retail sales report for continued confirmation for the shift to digital commerce that powers one aspect of our Connected Society investing theme. Based on recent commentary from Macy’s (M), Michael Kors (KORS) and Sears (SHLD) as well as the mixed May auto sales data we are not expecting any major upside surprises in the May Retail Sales figures.

While the expectation is the Fed will boost interest rates at its meeting this week, we suspect the UK’s election fallout, as well as the latest round of domestic economic data that points to a still soft but growing economy, is likely to be reflected in the Fed’s commentary around the move. Our view is with the current recovery long in the tooth, the Fed is looking to put more arrows in its monetary policy quiver for the next recession.

To be clear, while we did use the dreaded “R” word, we do not see a recession on the horizon. But we must acknowledge that at some point one is going to happen. As much as we might question the risk of boosting rates that might crimp what little speed we do have in the domestic economy, we also would like to see a Fed that has sufficient tools to contend with when that eventual recession does happen.

On the heels of the Fed meeting and its results, we’ll get additional May data for Industrial Production as well as Housing Starts. While the industrial production report will likely show ample slack in the manufacturing economy and likely means business investment will remain subdued, especially given near-term uncertainty over the timing President Trump’s reforms, recent Census data revealed for the first time in more than a decade there were more new home buyers than renters. As such, we’ll be examining upcoming housing related data to mine for potential opportunities.

Also this week we’ll get the first rash of June economic data from the regional Fed banks, which should help paint between the lines, giving us a clearer picture of the economy in 2Q 2017 in the process. As we noted above, we are already seeing some trimming back for 2Q GDP expectations, and we’ll be putting the June data under the scope to determine if more is needed as well as what it may mean for EPS expectations for both the current quarter and the back half of the year. This will be an ongoing process over the next several weeks seeing as the last of the key June data won’t be published until well into July.

When it comes to earnings reports, it’s a rather sparse week. Much like last week, and most likely the next few, that earnings void will be partially filled by more than a few investment conferences being held next week.

Here’s a short list of those conferences and the corresponding ETFs investors should be monitoring:

- William Blair’s 37th Annual Growth Conference

- Credit Suisse’s Semiconductor Supply Chain Conference:iShares PHLX Semiconductor ETF (SOXX) and VanEck Vectors Semiconductor ETF (SMH)

- Piper Jaffray’s 37th Annual Consumer Conference: First Trust Consumer Staples AlphaDEX Fund (FXG) and Consumer Staples Select Sector SPDR Fund (XLP).

- Deutsche Bank’s Global Consumer Conference: iShares Global Consumer Staples ETF (KXI)

- Stifel Industrials Conference 2017:Industrial Select Sector SPDR Fund (XLI) and Vanguard Industrials ETF (VIS)

- JPMorgan European Capital Goods CEO Conference: iShares Global Industrials ETF (EXI)

- Marcum Microcap Conference: iShares Micro-Cap ETF (IWC)

Enjoy the week, and be sure to check TematicaResearch.com during the week for other macro and market commentary.