Auto Loans and Household Income – Time for a Reality Check!

In general, I tend to be a very positive person. I’m decidedly in the glass-is-half-full camp and even though no one would accuse of me being a morning person, I love watching the sunrise, large cup of joe in hand of course, with a smile on my face as I contemplate what mischief I may get myself into as the day unfolds.

I say this because the ubiquitous “Consumer is doing great” refrain is putting me in the uncomfortable position of feeling like a perpetual Debbie Downer, a role that is not in my nature, but I feel obligated because the mainstream financial media is telling a tale that needs a reality check.

If households are doing oh so fabulously, then why this?

In the first nine months of 2016, around 32 percent of U.S. vehicle trade-ins carried outstanding loans larger than the worth of the cars, a record high, according to the specialized auto website Edmunds, as cited by Moody’s.

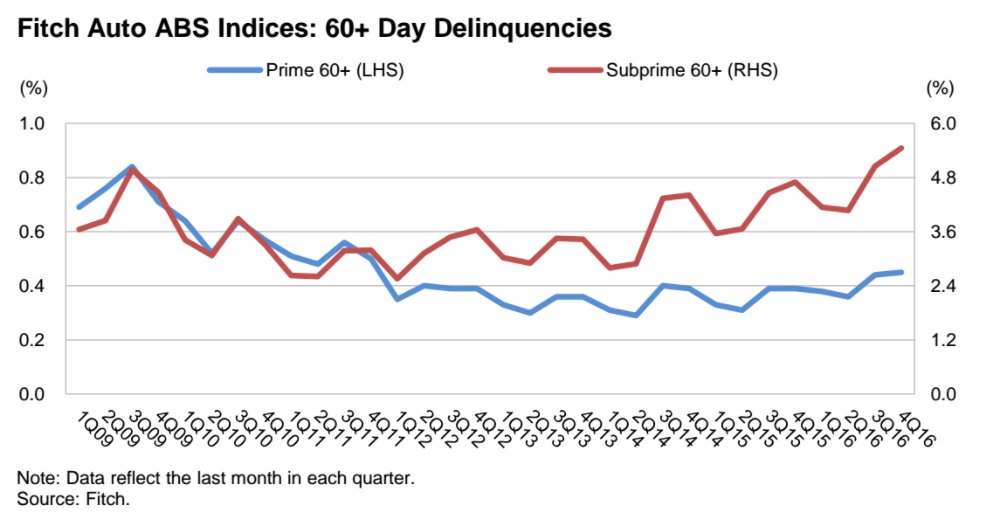

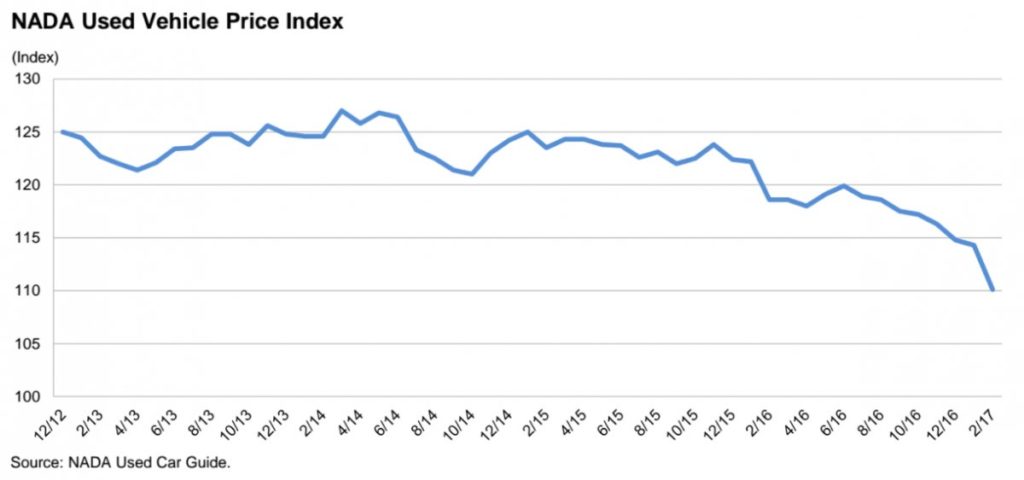

The non-recovery recovery is lifting off and yet one-third of trade-ins during the first three-quarters of last year were underwater? The delinquency rate for subprime auto loans is at the highest level in at least seven years while used vehicle prices are dropping sharply, as the market is flooded with off-lease vehicles. The NADA’s Used Vehicle Price Index was down 8 percent year over year through February 2017, the eighth consecutive monthly decline and the sharpest monthly decline since November 2008. Asset-backed securities based on auto loans are starting to show signs of stress and a growing proportion of the auto loan asset-based security market is now made up of “deep subprime” deals.

Yeah, that doesn’t bring back any housing crisis nightmares.

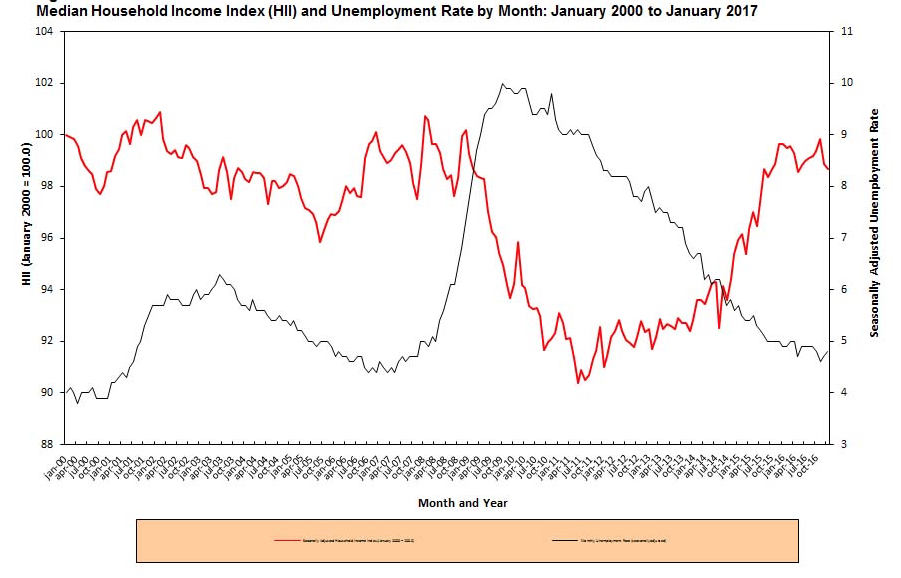

Oh and then there is this sticky little bit that paints a seriously less-than-rosy picture of household finances, the Sentier Research Median Household Income Index. The red line is the index and the black line is the unemployment rate. The index was set to 100 back in January 2000 and today is at a whopping 98.7. Yep, that’s a brutal seventeen years later and the median household is worse off, yet the talking heads keep telling us that things are going oh so great.

We’ve also talked here at Tematica about the lack of wage gains. Recall that just a few weeks ago we learned that,

From February 2016 to February 2017, real average hourly earnings decreased 0.3 percent, seasonally adjusted. The decrease in real average hourly earnings combined with no change in the average workweek resulted in a 0.4-percent decrease in real average weekly earnings over this period.

So over the past year real average weekly earnings have fallen and yet, consumer credit keeps growing. In the fourth quarter of 2016, consumer credit rose 6.5 percent on a year-over-year basis and averaged 6.2 percent year-over-year growth during 2016. Think about that for a second – falling wages but borrowing more. Does that sound like things are improving and does that really sound like a sustainable trend? Declining incomes coupled with rising credit doesn’t bode well for future buying trends.

Today we’ll get the latest on Consumer Confidence and the S&P/Case-Shiller home price index update. I’m sure the mainstream financial media will be clapping their hands over just how glorious it all is.

I’m going to go find myself a spot of sunshine and plot my next move with bonds.

Source: Plateau in US auto sales heightens risk for lenders: Moody’s