Putting another car on the tracks

As a Tematica subscriber, you know we tend to watch a number of indicators and metrics when examining and re-examining our investment themes. This also means looking at “official” economic statistics as well as alternative ones, like truck tonnage, for example, to get a better bead on the true pace of the economy, domestic or otherwise. One of our preferred “alternatives” is weekly rail traffic. Throughout 2015 and 2016 we talked about this a number of times simply because if rail traffic or even truck tonnage is contracting it means that demand for finished products, parts, assemblies, commodities and the like aren’t there.

In short, rail traffic is a great gauge for the economy.

Since entering 2017, we’ve seen a solid pickup in a number of economic metrics, including ISM manufacturing and services data and the same from Markit Economics, and we’re seeing that increase reflected as well in weekly rail traffic. Total car loadings for the week ending Feb. 11 were up 3.9 percent year over year and year to date, U.S. railroads reported cumulative volume up 4.5 percent.

Not only does this tell us the economy is chugging along and poised for a better performance in the current quarter than we saw in the back half of 2016, it also informs us that railcar capacity is starting to tighten. Granted that capacity is well below 2014 levels, but when it comes to economically sensitive stocks that fall into our Economic Acceleration/Deceleration investment theme history has shown the time to add those names to a portfolio is when the fundamentals are bottoming out and the stock looks cheap.

Why?

Because when the fundamentals are bottoming, it means the company’s earnings are also bottoming out and that makes the shares look expensive on a P/E basis. History has also shown the time to get long in railcar manufacturers is when industry railcar backlog levels bottom out.

As we wait for the railcar industry statistics to be published, there have been signs that demand could be perking up due to grain exports, the rebound in construction activity that could get some legs from President Trump’s infrastructure spending stimulus, and the growing number of US rigs coming back online as well as return of shale producers as following the OPEC production cut.

When looking at potential railcar manufacturers there are really just four players to consider: Greenbrier (GBX), American Rail Car (ARII), Freight Car America (RAIL) and Trinity Industries (TRN). Of the four, Trinity is the largest player, but it also has several other businesses outside of railcars, including Trinity Construction that serves the construction industry and related infrastructure projects, including highway safety. Other businesses include its Energy Equipment Group and Railcar Leasing business. This business mix exposes Trinity to not only a potential rebound in railcar demand, but the pickup in construction and energy markets, which in our view makes it a more well-rounded play than the other three railcar manufacturers.

In looking at earning expectations for Trinity, the consensus view for next year sits at $1.26 per share down from $2.18 this year. Quite a drop, but those expectations have not been updated in nearly 90 days, and in our view, there is a growing probability that those expectations for both this year and next year will be revised higher.

With Trinity slated report its December quarter earnings after today’s close with a follow on earnings conference call tomorrow, we’re taking heed of Greenbrier reiterating its 2017 guidance several weeks ago we’ll make the following change to the Tematica Pro Select Investment List:

- Adding the Trinity Industries (TRN) April 2017 $30 calls (TRN170421C00030000) that closed last night at 1.10.

- With earnings due tonight, we’ll hold off instilling a protective stop loss as we’re inclined to use any post-earnings weakness to add to the position next week.

- We chose the April strike date so as to capture several months of additional rail traffic data and the pending news on Trump’s infrastructure spending.

- We’d be buyers of the TRN April calls up to $1.35.

Checking the Foundation for Our US Concrete Calls

Last week we added the US Concrete (USCR) May 2017 $70 calls (USCR170519C00070000) to our holdings. Since that time, the calls have risen some 20 percent from our 3.10 buy-in piece last week, closing last night at 3.75.

We continue to see the underlying business — ready mix concrete — benefitting from the rebound in construction activity and pending infrastructure spend under the Trump administration. As we have said previously, we would be buyers of the calls up to 4.50, and for those have already entered their position, the next move is to sit tight and wait for both the January construction spending data that will be published on March 1 and more details on the Trump infrastructure plan.

As a reminder, our May strike date affords us the March, April and May construction season, while our 3.00 stop loss should limit any meaningful downside from current levels. As the calls move higher, we’ll look to move that stop loss higher to lock in gains.

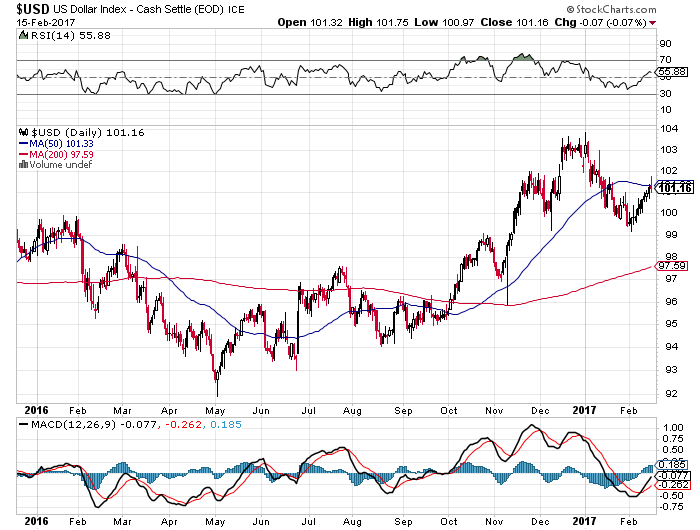

Yellen and the Dollar Keeping UUP Calls in Buy Zone

As we detailed in yesterday’s Tematica Investing, Fed Chairwoman Janet Yellen was back on Capitol Hill the last few days talking about the economy and likelihood of the next interest rate increase. Of course, investors and elected officials alike had to break out their secret decoder rings to parse through the clear as mud script that Yellen stuck to. No surprise to us as she is not going to telegraph a rate hike with several weeks of data to go and pending details on Trump’s economic stimulus initiatives to get the US economy to 4 percent GDP vs. the sub-2 percent we saw in the December quarter.

In response to Yellen’s comments, the dollar inched higher in anticipation of a rate hike by the Fed either at its March or May FOMC meeting. While we continue to watch the data, unless we get meaningful clarity on Trump’s economic proposals well ahead of the March meeting, odds are the Fed is more inclined to be patient and wait until its May meeting.

Either way, we’re covered with our PowerShares DB US Dollar Bullish ETF (UUP) June 2017 $27 calls (UUP170616C00027000) given the June expiration. While those calls closed up 13 percent from our buy-in just two weeks ago, the current price has kept them in the buy zone.

As a reminder, we would buy these UUP calls up to $0.32.