Weekly Issue: Retail Sales Report Keeps Us Bullish on UPS

Key points inside this issue

- The earnings reports of the last few days are helping the stock market find its footing, but it will still be day to day as more earnings and data is had.

- We will continue to hold our United Parcel Service (UPS) January 2019 120.00(UPS190118C00120000) calls that closed last night at 3.64 vs. our 3.60 entry point. Our stop loss of 2.50 remains in place.

- We are issuing a Buy on and adding the Chipotle Mexican Grill (CMG) January 2018 450 calls (CMG190118C00450000)that closed last night at 22.20 to the Tematica Options+ Select List. As we do this we are setting a stop loss at 14.00.

- Programming note: Much commentary in this week’s issue centers on the September Retail Sales Report, but on this week’s soon to be released Cocktail Investing podcast, we do a deep dive on that report from a thematic perspective. Be sure to look for it.

Quite a market reversal over the last few days compared to the downward moves experienced across the board by the major stock market indices last week. In hindsight, it was a very prudent move to close our ProShares Short S&P500 (SH) November 2018 28.00 (SH181116C00028000) calls last week for combined return of about 315% – not bad for a few weeks of work, and it certainly is rather nice when a trade works out as well as that one.

I continue to think the stock market in the near-term will trade day to day based on the news of the day, be it earnings, economic data, trade or even other saber-rattling from the Chief Commander in Tweet that is President Trump. So far this week, we’ve seen a number of positive earnings reports, some a tad ugly, but on the whole the last few days have been positive for the market, giving it a tonic to rebound from last week’s pain.

September Retail Sales Report keeps us bullish on UPS calls

Earlier this week, we received the September Retail Sales Report, which handily confirmed the accelerating shift toward digital commerce. As you might imagine, this buoyed our United Parcel Service (UPS) January 2019 120.00(UPS190118C00120000) calls, which closed last night at essentially breakeven with our 3.60 entry point some two weeks ago.

Per that report, Total Retail & Food Services rose 5.7% year over year while Retail climbed 4.4% compared to September 2017. Other than gas station sales, which were up more than 11% year over year in September, the other big gainer was Nonstore retailers, which saw an 11.4% increase in September retail sales vs. year ago levels. That strong level clearly confirms our investment thesis that digital shopping is taking consumer wallet share, which bodes well for our Thematic Leader position that is Amazon as well as UPS. Again, I know I sound like a broken record, but all that purchased stuff needs to get to where it is going, and UPS is well positioned to capture that volume as we move into the holiday shopping filled season. Let’s continue to hold the UPS calls, and as they inch higher, I’ll look to ratchet up our stop loss that is sitting at 2.50.

- We will continue to hold our United Parcel Service (UPS) January 2019 120.00(UPS190118C00120000) calls that closed last night at 3.64 vs. our 3.60 entry point. Our stop loss of 2.50 remains in place.

Adding a call position on Chipotle shares

That same September Retail Sales report also showed consumers are spending at restaurants or as the Census Bureau calls them “Food Services & Drinking Places.” Year over year, retail sales at such establishments rose 7.1% in the month of September and 8.8% for the entire September quarter. While some may say consumers are embracing the notion of “you only live once” we prefer to think of them as being part of our Living the Life investing theme, but we realize at least some consumers are likely eating at fast-casual restaurants while others eat at the likes of Del Frisco’s Restaurant Group (DFRG), the Thematic Leader for our Living the Life investing theme.

Earlier this week we heard fast-casual Mexican restaurant company Del Taco (TACO) espouse about the benefits of food deflation, echoing the comments made a few weeks ago from Darden (DRI). More positives to be had for our DFRG shares, but the option flow for them is rather thin and that has kept me and you away from them.

Here’s the thing, those comments are also positive for our Chipotle Mexican Grill (CMG) shares, or as others might call them – the Thematic Leader for our Clean Living investing theme. We also know that Chipotle is embracing digital ordering and delivery, an aspect of our Digital Lifestyle theme and we’ve seen the benefits at companies like Habit Restaurant. We also know from experience that as we enter the holiday shopping season, there is far more grab and go dining to be had.

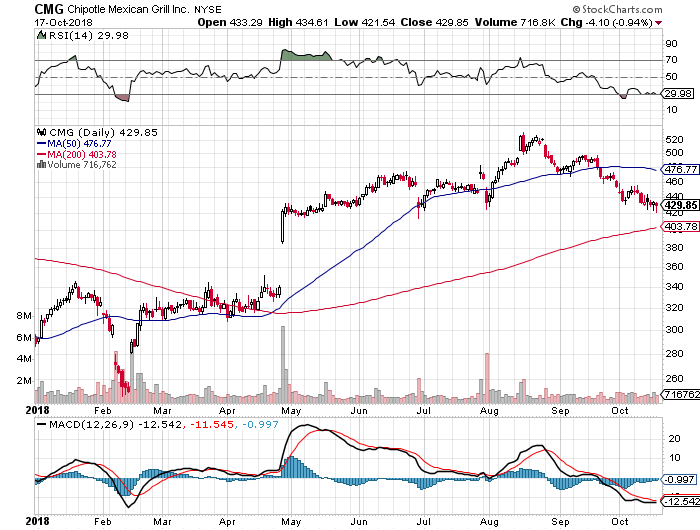

When I put it all together, the signs are positive for the company’s business and its shares, which have fallen nearly 13% in the last month and are well in oversold territory.

All of this has me adding the Chipotle Mexican Grill (CMG) January 2018 450 calls (CMG190118C00450000)that closed last night at 22.20. To be fair, CMG shares are currently a battleground stock but given our long-term time horizon, I’m inclined to be patient as the new management team continues to execute its Big Fix plan but for these options, it means setting a stop loss at 14.00. Wide enough to give us time to scale in, but not so wide that we’ll lose our shirts on this position.

- We are issuing a Buy on and adding the Chipotle Mexican Grill (CMG) January 2018 450 calls (CMG190118C00450000)that closed last night at 22.20 to the Tematica Options+ Select List. As we do this we are setting a stop loss at 14.00.