More Rolling Over from JOLTS and NFIB

Yesterday’s JOLTS reports from the Bureau of Labor Statistics led further credence to our assessment that the economy is in the later stages of this business cycle, with many areas showing signs of rolling over.

Like much of the data we’ve seen lately, Job Openings came in below expectations, with 5,666k openings versus expectations for 5,950k with rather profound drops in Mining and Lodging, (not a shock given what’s been going on with crude oil) and Health Care and Social Assistance, (which is likely reflective of the very high-profile battle over the future of the Affordable Care Act. What is surprising is how much June’s openings fell from the prior month, down 301k. We’ve only seen such a large drop five other times during this business cycle, which makes this a rare event indeed.

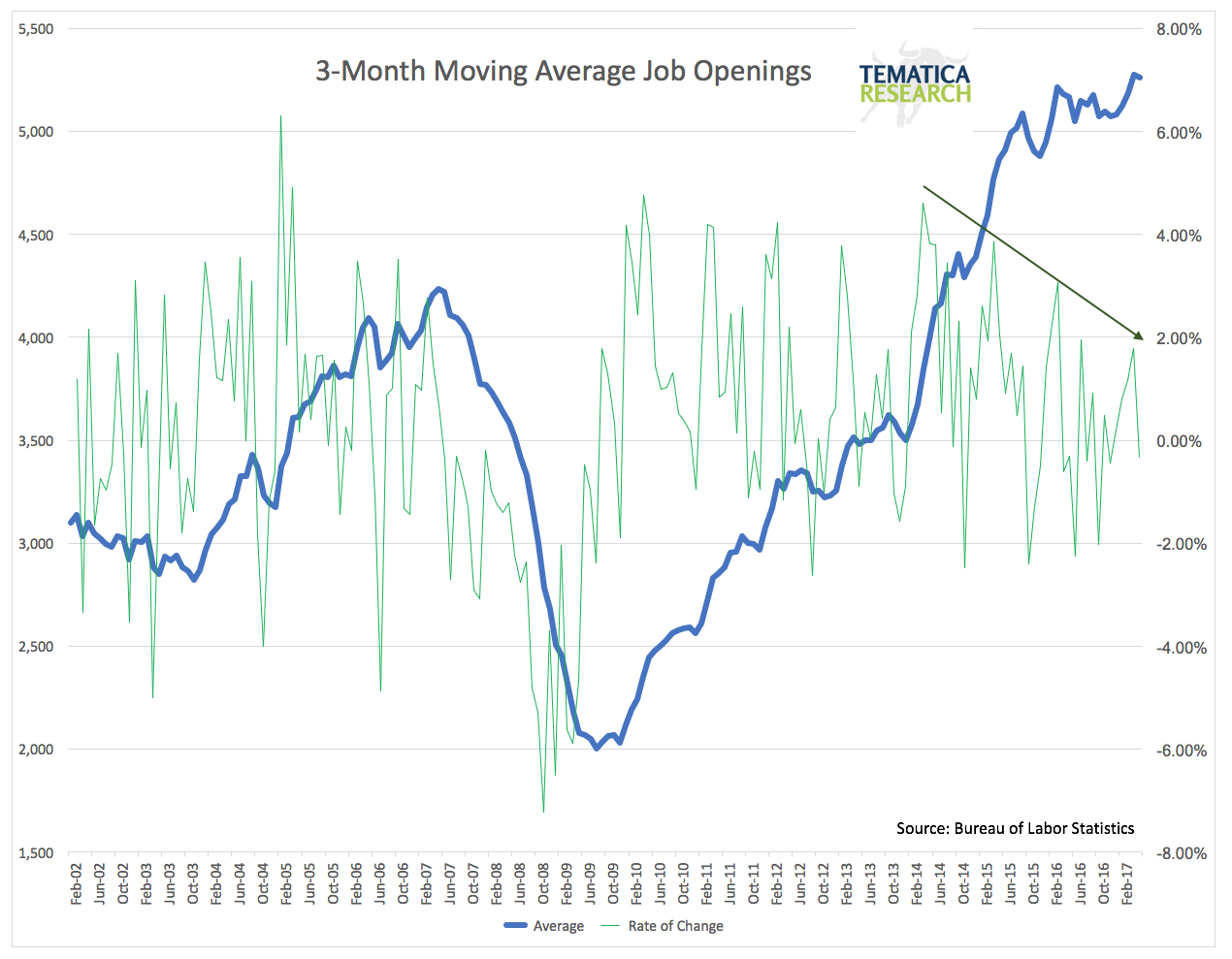

This chart shows that while job openings have been on a long-term upward trend, the rate of growth has been slowing since late 2014 and is moving towards a negative year-over-year trend. This is exactly what we would expect to see in the later stages of the business cycle.

The source of weakness in job openings looks to be in two main areas: Health Care and Mining.

While brick and mortar retail has been getting seriously slapped around thanks to the forces behind our Cash Strapped Consumer and Connected Society investing themes, retail job openings haven’t seen the same kind of downturn as health care and energy.

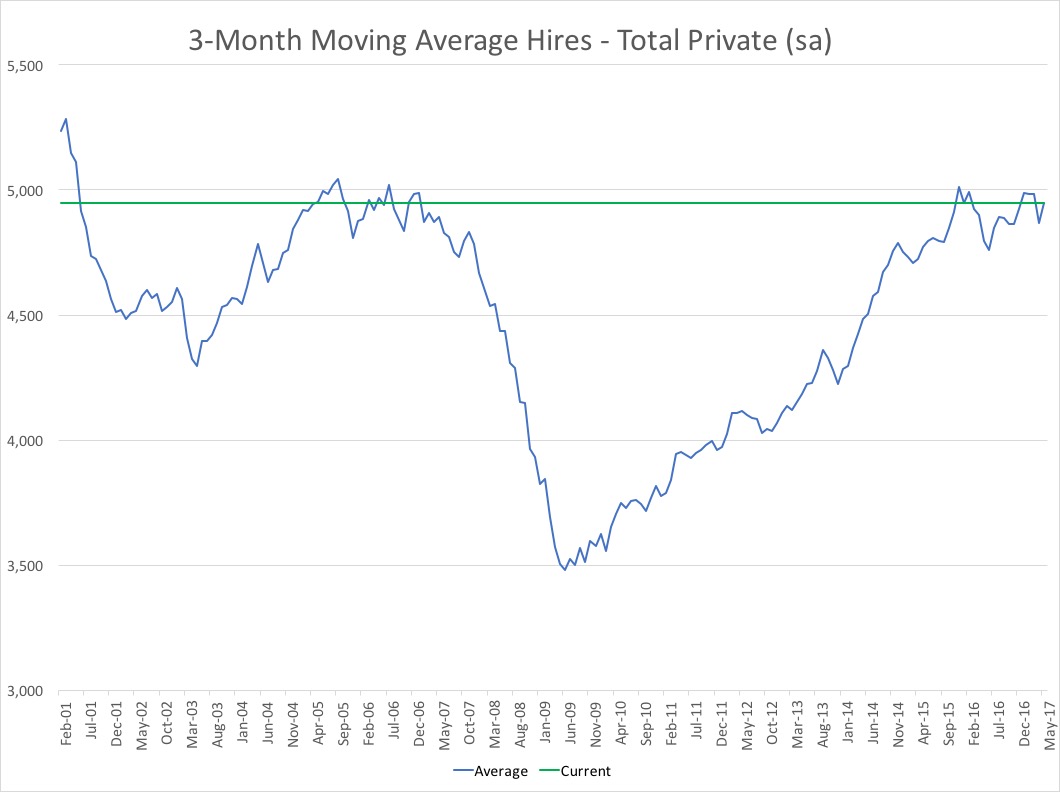

We have also see the pace of hirings moderating since late 2015, which is also as would be expected at this stage of the cycle.

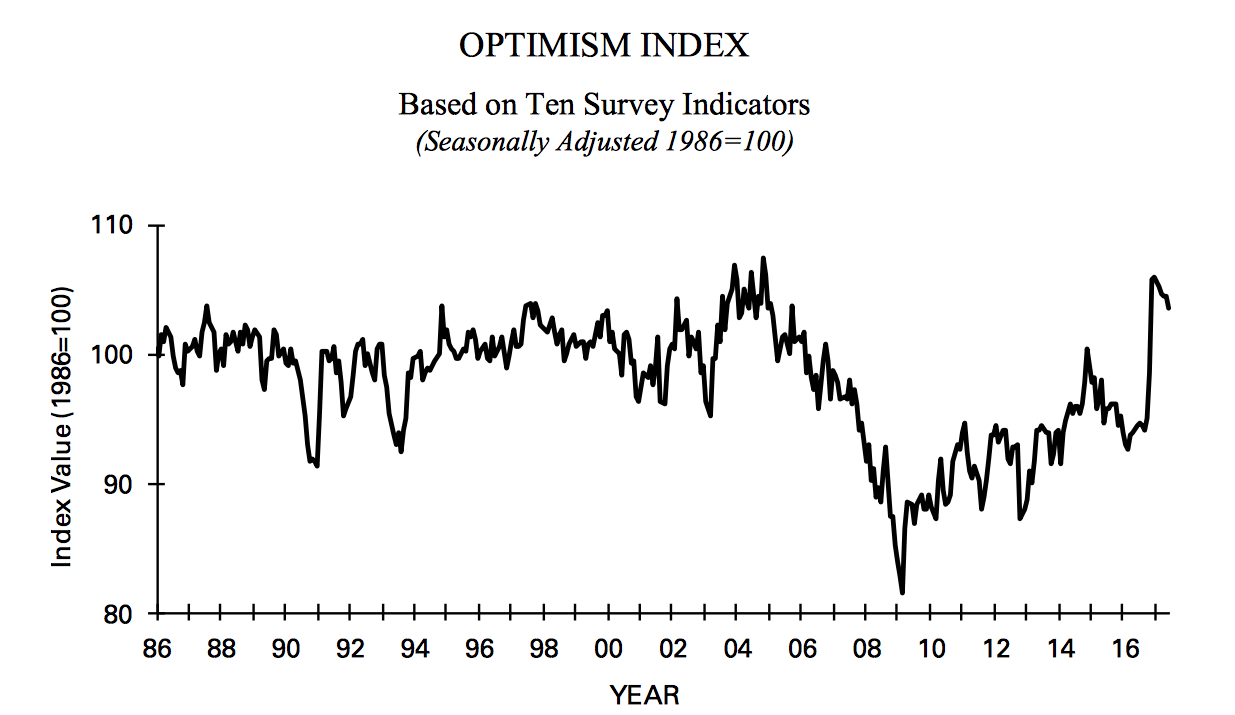

The NFIB Small Business Optimism Index also disappointed, coming in at 103.6 in June versus expectations for 104.4 and below May’s 104.5. This metric has now been negative for five consecutive months and is now at a seven-month low. Four of the index’s components improved, while five declined and one remained flat. Looking through the various components, rollover is the phrase of the day.

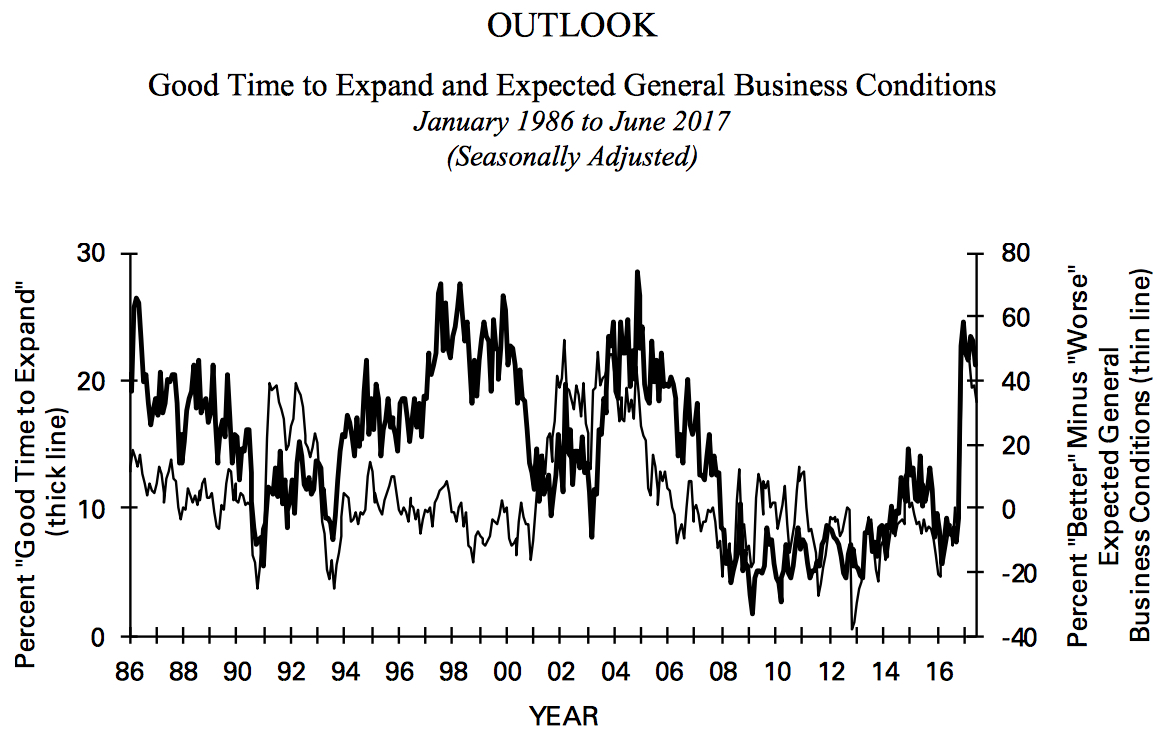

The component for “Now is a good time to expand” dropped all the way to a seven-month low, erasing the post-election enthusiasm.

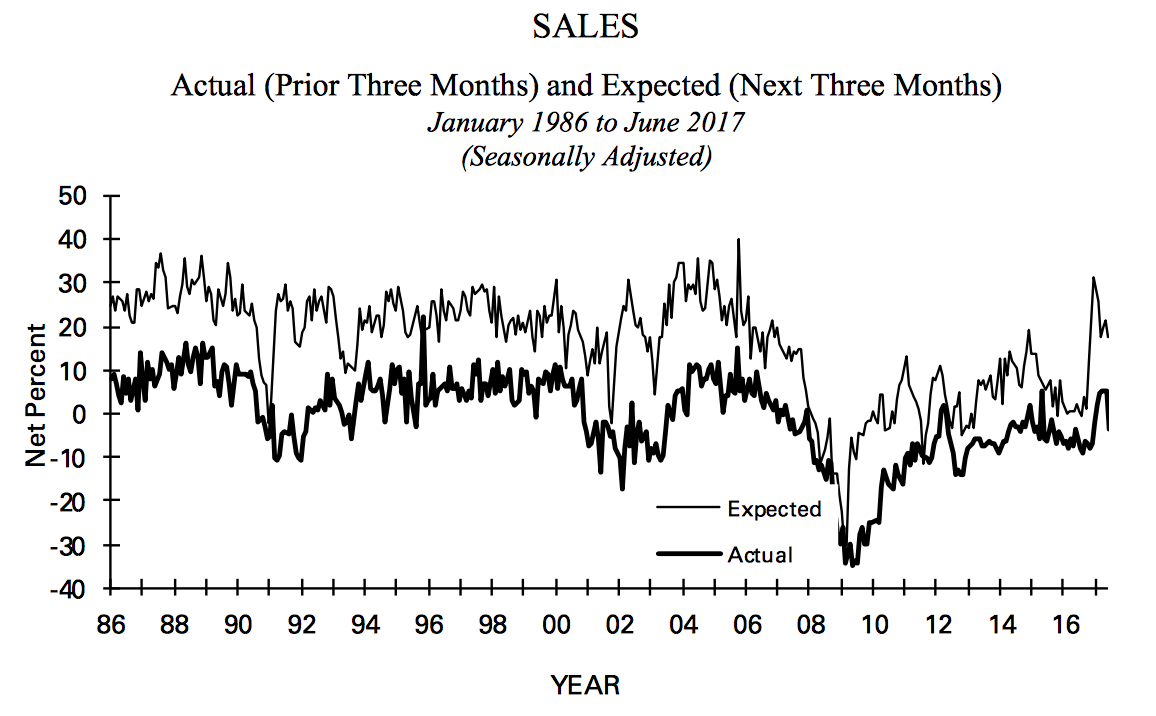

The metrics for expecting the “economy to improve” really bombed, after reaching 50 after the election, then falling in five of the past six months to sit at a seven-month low of 33 in June. This measure is matched in its rather dour outlook by sales expectations, which have dropped to 17 from 31 at the beginning of 2017, with actual sales turning down faster than expectations.

Bottom Line: More and more indicators are flashing warning signs that the economy is slowing. The economy and the market, however, are two very different things and as history has shown many times over, an over-priced market can get even more over-priced. This economic data shows that there are increasing downside risks with shrinking upside potential for the broader markets as a whole, but it isn’t a reliable timing tool. Our investing thematics seek to identify those areas that can experience growing demand thanks to long-term trends that extend beyond cyclical forces.