Signs of Slowing Economy Continue to Mount

The market is now back in a bullish mood that is driven primarily by the “not gonna happen” news flow hopes. Rate hike? Not gonna happen. Government shutdown repeat? Not gonna happen. China trade war escalation? Not gonna happen. The question is, just how long can the “not gonna happen” hopes keep pumping hot air into a market when we are staring down a likely earnings recession amidst a global economic slowdown?

- Housing remains a miserable mess – just look on Zillow at the breadth of the price reductions.

- The employment picture isn’t quite what the headlines would lead one to believe.

- Consumer confidence looks to have peaked and is falling.

- Consumer credit trends and retail sales are flashing warning signals.

- Corporate earnings and loan demand are also flashing warning signs as are shipping rates.

- Geopolitical risks are profuse and profound ranging from no-deal Brexit fallout to Italy’s ongoing battles in the EU to US-China trade relations to rising military tensions between the US and Russia to relations between Italy and France at lows not seen since WWII.

- The level of bullish sentiment is no longer a contrarian positive with the AAII poll of individual investors putting the bull camp at 40% versus 32% last week and the highest level in the past three months. Bears are down to an 8-month low of 23% versus 50% back in December. Even the CNN Money Fear & Greed index is back in greed mode after hitting fear one month ago.

Housing Headwind

More than 12 years after the US housing market started an epic crash in 2007, an unprecedented number of homes are still underwater (meaning the outstanding mortgage on the home is at least 25% above the home’s current market value), according to a real-estate market report from ATTOM Data Solutions. This is clearly a consumer headwind that is part of our Middle-Class Squeeze investment theme. The states with the highest share of mortgages include Louisiana (21%), Mississippi (17%), Arkansas (16%) and Iowa (15%). Of the over 7,500 zip codes having a minimum of 2,500 properties examined in the report, 27 had more than half of all properties underwater including zip codes in cities such as Chicago, Cleveland, Trenton, Memphis, Saint Louis, Virginia Beach and Detroit. If you’re a real estate investor, you should be taking note and as is often said with stocks, you should be building your shopping list.

Job Picture Not So Rosy

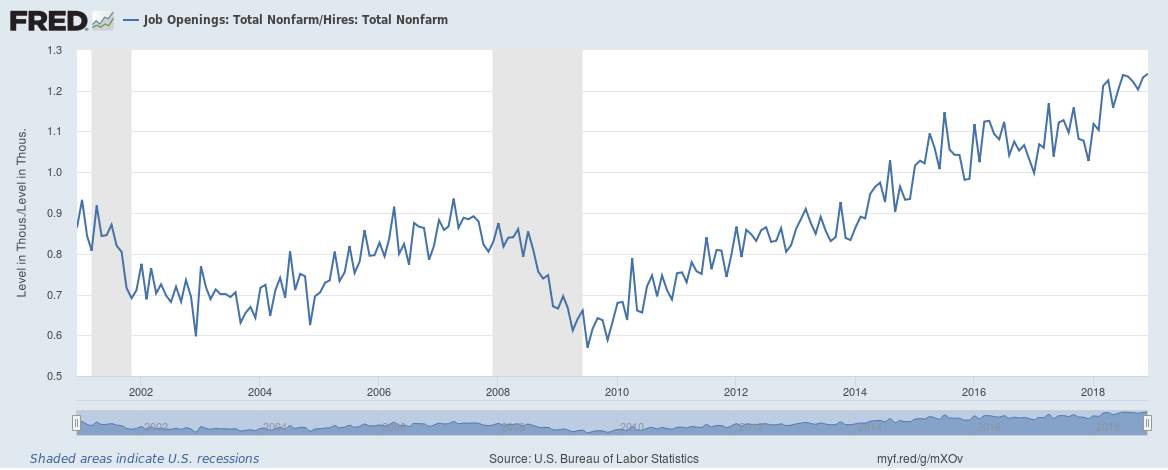

This week we received the Job Openings and Labor Turnover Summary for December from the Bureau of Labor Statistics (BLS) which revealed a record high 7.335 million job openings. The unemployment rate has risen from the November low of 3.7% to 3.9% in December and 4.0% in January – possibly indicating that we are now on an uptrend. There are now 1.17 job openings for every job seeker, with December slightly below November’s all-time record high of 1.19 job openings.

We are also seeing a record high length of time to hire someone, which is derived by taking the number of job openings and dividing it by the number of hires. Prior to the financial crisis, this metric was always less than one month, but in August 2014 it broke above a month for the first time in recorded history and has been rising ever since then to a new high in December of 1.24 months. We see this as confirming that employers are having an increasingly difficult time finding the right talent for the position.

This would make one think that the consumer is doing great, but as always, digging below the surface reveals a different picture. At the start of February, the January Payroll report got a lot of attention as job growth utterly blew away estimates, coming in at 304,000 new jobs versus expectations for just 170,000. However, the other employment survey from the Bureau of Labor Statistics (BLS), the Household Survey, rather than providing confirming view of the labor market revealed a very different picture, click here to read about how the two differ in the data they track.

The Household Survey found that employment dropped 251,000 in January, the first such decline in five months, some of which can be attributed to the government shutdown. But employment for the prime working-age population declined 46,000 in January after an 11,000 drop in December and 48,000 in November – more of that Middle-Class Squeeze investment theme at work.

The last time we saw employment in this demographic decline for three consecutive months was in October 2009. The number of full-time jobs declined 76,000 while the number of people working part-time for economic reasons rose 10.5% to 5.145 million which is a 16-month high. The number who are working part-time because of “slack work business conditions” rose a whopping 19.4% to 3.45 million which is a 23-month high. For both metrics this was the biggest one-month change since September of 2001 – a month no one can forget – and before that February 1982, both times the economy was in a recession. The Household Survey also revealed that the largest category of hiring was for those with a high-school education or less, which may explain why average hourly earnings rose the smallest amount since October 2017 at just 0.1%.

Consumer Credit Warning Signs

The latest Senior Loan Office Survey found that demand for auto loans, credit card loans, GSE-eligible mortgage loans, qualified jumbo mortgage loans, non-qualified mortgage jumbo loans, non-qualified mortgage non-jumbo mortgage loans, government mortgage loans, and consumer loans ex-credit card and ex-auto all are in contraction mode. In a nutshell – folks are not interested in borrowing any more than they already have. That is not what we typically see during economic expansion. We are also seeing a record high 7 million Americans are 90-days or more behind on their auto loan payments – yet more Middle-Class Squeeze.

Consumer Confidence Falling

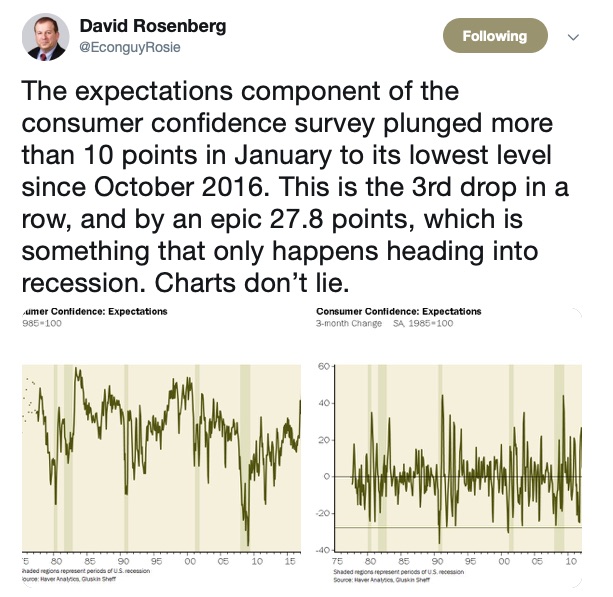

With the job market not quite as rosy as the headlines would suggest coupled with the trends in consumer credit, it wasn’t a big surprise to see the Conference Board’s Consumer Confidence index fall to an 18-month low in January, dropping to 120.2 from 126.6 in December versus expectations for 124.0. The January reading also marked the third consecutive decline after hitting an 18-year high of 137.8 in October. Gluskin Sheff’s David Rosenberg summed up the results quite succinctly in his tweet.

Retail Sales Take Biggest Hit Since 2009

US Retail sales saw the biggest one-month drop in December since September 2009 with even ecommerce sales suffering as retail sales fell -1.3% month-over-month and up just 2.1% year-over-year. Retail sales ex-gasoline stations fell -0.9% in December and even the typically strong non-store retailers, which includes mail-order and ecommerce as are part of our Digital Lifestyle investment theme, saw sales decline -3.9%. However online players such as Amazon (AMZN) – a Tematica Research all-star – and eBay (EBAY) still enjoyed strong sales gains through the holiday season.

That’s the sequential comparison. On a year over year basis, retail sales in December 2018 rose 2.1% year over year with stronger gains registered at Clothing & Clothing Accessories Stores (+4.7%), Food Services & Drinking Places (+4.0%), Nonstore retailers (+3.7%) and Auto & other motor vehicles (+3.4%). That’s not to say there weren’t some sore spots in the report – there were, but they are also the ones that have been taking lumps for most of 2018. Sporting goods, hobby, musical instrument, & bookstores fell 13% year over year in December, bringing the December quarter drop to 11% overall. Department Stores also took it on the chin in December as their retail sales fell 2.8% year over year.

While that’s a more favorable view, the reality is December Retail Sales came in weaker than expected. Between the government shutdown, falling equity prices, global trade wars and ballooning debt levels, folks opted to keep their wallets in their pockets this past holiday season. In keeping with our Middle-Class squeeze investing theme, consumers looked to stretch the dollars they had to spend, which helps explains Costco Wholesale’s (COST) eye-popping, by comparison, December 2018 same-store sales of 7.5% in December (7.1% excluding gasoline prices and foreign exchange). Those consumer wallet share gains, which likely continued into January with Costco’s same-store sales of 6.6% (7.3% excluding gasoline prices and foreign exchange), and its expanding warehouse footprint are why Costco is Tematica’s Middle-class Squeeze leader.

Corporate Earnings and Confidence Weakening

The earnings outlook for companies in the S&P 500 continues to deteriorate with expectations down to 1% year-over-year growth for 2019 versus 5% just a few months ago. The last Federal Reserve Beige Book found that 25% of the US is in contraction with the remaining 75% expanding at only a modest to moderate pace. The corporate outlook isn’t all that rosy either as venture capital investors are advising their start-ups to hold onto more cash. For example, Index Ventures is reportedly telling their entrepreneurs they need 18 to 24 months’ of coverage versus 9 to 12 months’ worth a year ago according to an article in the Financial Times.

It isn’t just the big guys that are struggling. Economic confidence for small companies declined during most of 2018 and in January reached its lowest level since President Trump was elected according to a monthly survey for the Wall Street Journal by Vistage Worldwide. The report noted that for the first time since the presidential election, small firms were more pessimistic about their own financial prospects than they were a year earlier, including plans for hiring and investment. In January 2018, 83% of the firms surveyed expected to grow revenues over the coming year versus 66% by January 2019. This decline was affirmed by the ISM non-manufacturing PMI report which found that the share with growth dropped from 94.4% last September to 50% today – the lowest since January 2016. The share contracting rose to 44.4%, the highest level since January 2016.

Corporate Loan Demand Echoing Consumer Weakness

Just as we saw demand for consumer credit declining, so has demand for corporate credit been on the wane. Demand for commercial and industrial loans from large and middle-market firms has been flat or in contraction in 10 of the past 13 quarters. For smaller firms, demand has been flat or in contraction in 9 of the past 13 quarters. Demand for commercial real estate loans for construction and land development has been in contraction since the first quarter of 2017.

No Love in the Eurozone

On Valentine’s Day we learned that economic growth in the eurozone was a meager 0.2% quarter over quarter in the fourth quarter of 2018 – so basically flat. Year-over-year growth stood at just 1.2% for the final quarter of 2018. This came after news that the eurozone economic powerhouse Germany had no growth itself in the fourth quarter after a contraction of -0.2% in the third quarter – narrowly missing a recession. Italy experienced its second consecutive quarter of economic contraction, putting it in a technical recession. All this put further downward pressure on the euro versus the US dollar.

Another major headwind in the Eurozone that has consequences far beyond the region is the lack of any Brexit deal. To put the situation in perspective, nations in the Eurozone have been trading with the United Kingdom for 30 years, resulting in highly integrated economies and corporations. Imagine being a grocery store manager in Edinburgh, Scotland and not knowing how your near-daily imports of fruits and vegetables from France are going to be affected or being a Swede working in London, who owns a home there and having no idea how your residency or work situation may be altered.

Without a long-term free trade agreement between the UK and the EU, new trade barriers will have to be introduced at borders and the prospect of different rules on standards and safety could make it harder and more expensive for companies to import and export. The cost of a no-deal Brexit will also affect consumers. The UK imports 30% of its food from within the EU. While companies can build up inventories in advance, there is a limit to what can be done given the shelf-life of some products and raw materials and limits to storage capacity. On top of that, all the additional storage and inventory represents additional business costs, diverting resources from investment in the company and its employees.

There is also no love lost these days between France and Italy, with relations between the two nations at levels not seen since the end of WWII. Italy’s relationship with the Eurozone, in general, has been challenging as its per capita GDP has grown all of 1% in the nearly two decades since it joined the unified currency while France has enjoyed 17% growth, Spain 23% and Germany 29%. For reference, the United States has seen per capita GDP grow 25% during this time.

Relations between the two traditionally close allies that are France and Italy have been degrading since mid-2018 when Italy’s Deputy Prime Minister Luigi Di Maio and Matteo Salvini of the League part starting firing pot-shots at Macron and France over immigration policies. Macron has occasionally fired back, for example, to criticize Salvini when he refused to allow a boatful of migrants rescued in the Mediterranean to step on Italian soil, forcing them to remain on the boat while it was docked. The group has since been moved out of Italy and Salvini has been sued by the court of Catania (where the ship was docked) for the kidnapping of minors. Good times.

Earlier this month France recalled its ambassador to Italy, something it last did in 1945 after Italy’s Deputy Prime Minister Luigi Di Maio – who is also the head of the anti-establishment 5-Star Movement (Cinque Stelle) – met with members of France’s Gilet Jaune (Yellow Jacket) movement. These are the folks who have been protesting in France and amongst other acts of violence, have set fires in cities all across the nation including Paris. To say they have been vexing France’s President Macron would be a massive understatement.

This tension could not be coming at a worse time when the no-deal Brexit crisis looming.

Global Shipping Confirms Weaker Growth

The Baltic Dry Index (BDI), which tracks the cost of moving bulk commodities and is considered a leading indicator of global trade, is down more than 50% since the start of the year. Shipping brokers in Singapore and London have reported capsized vessels, the largest ships that move bulk commodities like iron ore, coal and aluminum, had been chartered in the spot market for as low as $8,200 a day last week. Break-even costs for carriers can be as high as $15,000 a day, and daily rates in the capesize market hovered above $20,000 last year. That’s a serious drop-off in demand, and the BDI tends to be a leading indicators investors and traders watch closely much the way we also watch rail traffic and truck tonnage data.

The Bottom Line

Signs of slowing continue to mount both domestically and internationally, alongside rising geopolitical risks and excessive bullishness in domestic equity markets. This is a good time for investors to put together a shopping list of those stocks that will enjoy long-term tailwinds despite global economic slowing and add them to your portfolio when they reach an attractive price point as we are likely to see a pullback in the markets soon.