Key points inside this issue:

- Oh how the stock market has diverged over the last week

- Ahead of Apple’s (AAPL) upcoming annual product refresh, we are boosting our price target to $225 from $210 for the shares.

- Our price target on Amazon (AMZN) shares remains $2,250.00

- Our price target on Costco Wholesale (COST) remains $230.00

- Our price target on Nokia (NOK) shares remains $8.50

- Our price target on AXT Inc. (AXTI) shares remains $11.50

- Our price target on Dycom (DY) shares remains $125.00

- Here come earnings from Habit Restaurant (HABT)

Oh how the stock market has diverged over the last week

Last week the divergence we saw in the major domestic stock market indices continued as both the Dow Jones Industrial Average and the S&P 500 powered higher while the Nasdaq Composite Index and the small-cap heavy Russell 2000 retreated. The technology-heavy Nasdaq moved lower following drops in Facebook (FB) and Twitter (TWTR) late last week, while the Russell’s move lower likely reflecting potential progress on trade following a positive meeting between the US and EU.

In recent weeks, we’ve shared our view that 2Q 2018 earnings season would likely lead to the resetting of earnings expectations, and it appears that is indeed happening. The stock market, however, didn’t expect that resetting to happen with Facebook, Twitter, Netflix (NFLX) and other high fliers. We also shared how that resetting could lead to some downward pressure in the overall market, so we’re not surprised by how it is digesting these realizations.

Also weighing on the market is the realization the 2Q 2018 GDP figure of 4.1%, which was propped up by government spending and some pull forward in demand ahead of tariff phase-ins, is not likely to repeat itself in the current quarter. As we noted above, there was some progress on trade between the US and EU last week — more of an agreement to work on an agreement — and there are still tariffs with Canada, Mexico, and China to face. And as much as we would like to see last week’s progress as hopeful, we’ve heard from a number of companies about how under the current environment higher input costs will weigh on margins and profits in the back half of the year. The response has companies boosting prices to pass along those increased costs, which could either sap demand or stoke inflation concerns.

We saw that rather clearly in the IHS Markit Flash US PMI for July last week. The headline flash PMI index clocked in at 55.9, a three-month low with the manufacturing component at a two month higher while services slipped month over month. One of the key takeaways was summed up by Chris Williamson, Chief Business Economist at IHS Markit who said, “…the July flash PMI is in line with the average for the second quarter and indicative of the economy growing at an annualized rate of approximately 3%.” The same flash report also showed a steep increase in prices with survey respondents citing the impact of tariffs, but also supply chain delays, which in our experience tends to be a harbinger of further price increases.

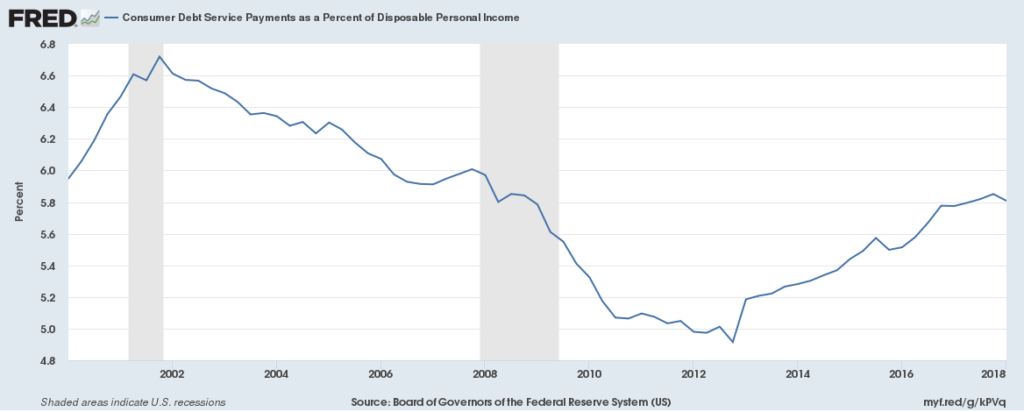

Because we’re still in the thick of earnings, we’ll continue to assess the situation as more company commentary becomes available and what it means for profits in the coming quarters. Odds are, however, the Fed, is seeing the above and will remain on a path to boost interest rates in the coming months. We’ll get more on that later today when the Fed exits its latest FOMC policy meeting. Barring a meaningful pick up in wage growth it could lead to more restrained consumer spending. We see that as positives for incremental consumer wallet share gains at Amazon (AMZN) and Costco Wholesale (COST) as we head into the seasonally strong shopping season.

- Our price target on Amazon (AMZN) shares remains $2,250.00

- Our price target on Costco Wholesale (COST) remains $230.00

Apple delivers and boosting our price target in response

We are boosting our price target on Apple (AAPL) shares to $225 from $210. This boost follows last night’s solid June quarter results and guidance, which topped expectations as investors and consumer prepare for the latest iteration of iPhone and other Apple products to hit shelves in the coming months. Here are some of the highlights from Apple’s June quarter:

- Reported EPS of $2.34 vs. the consensus forecast of $2.18 on revenue of $53.265 billion vs. the expected $52.43 billion.

- Year over year revenue grew 17% with led by double-digit increases at iPhone, Services and Other while Mac and iPad revenue declined vs. year-ago levels.

Moreover, the company forecasted September quarter revenue to grow double digits sequentially with prospects for an improving gross margin profile. That combination is leading Wall Street to take its EPS expectations higher, and I suspect we will see a number of price target increases this morning.

As exciting as this is — as well as proof positive the Apple model is not broken as some doomsayers would suggest — in several weeks Apple will take the wraps off its revitalized Fall 2018 new product lineup that is expected to have a number of new models across iPhones and iPads. Some products, like iPads, are expected to get new features such as FaceID, while the iPhone X lineup should expand to larger screen sizes as well as lower cost models utilizing an LCD screen instead of an organic light emitting diode (OLED) one. I see the Apple enthusiasm once again cresting higher as that date approaches.

Now let’s break down the quarter’s results:

iPhone revenue grew 20% year over year to $29.9 billion despite tepid smartphone industry dynamics. During the quarter Apple sold 41.3 million iPhones, which paired with the 19% year over year improvement in average selling price (ASP) to $724 vs. $606 in the year-ago quarter drove the revenue improvement. That surge in ASP reflects ongoing demand from the company’s premium iPhone products – iPhone X, iPhone 8 and iPhone 8+.

The Services business grew 30% year over year to $9.5 billion, roughly 18% of overall Apple revenue vs. 16% in the year-ago quarter. The total number of paid subscriptions rose 30 million sequentially to hit 300 million, up from 185 million exiting the June 2017 quarter. I see this as a positive given the subscription nature of iCloud, Apple Music, Apple Care, Texture and other offerings that drive not only cash flow but revenue predictability. During the earnings call, Apple tipped that it has over 50 million Apple Music listeners “when you add our paid subscribers and the folks in the trial…”

As the Services business continues to grow across the expanding Apple device install base, accounting for a greater portion of revenue and profits, odds are investors will begin to re-think how they value Apple shares, especially as the company’s dependence on iPhone sales is lessened at least somewhat. That will be especially true as Apple tips its original content plans, from both a programming perspective as well as pricing and subscription plan one.

Other products grew 37% vs. the year-ago quarter driven by wearables (Apple Watch, Air Pods, Beats) to account for 7% of overall revenue for the quarter.

For the September quarter, Apple guided revenue to $60-$62 billion with gross margin between 38.0-38.5% (vs. 38.3% in the June quarter). That double-digit sequential revenue improvement looks strong heading into the Fall unveiling of new devices, including multiple iPhone models, which as I mentioned earlier is expected to include a larger screen sized iPhone X model as well as a new iPhone X model and a lower priced one with an LCD screen. That implies a rebound in unit volume growth tied with favorable ASPs to drive iPhone revenue growth in the coming quarters. Of course, I continue to see the next major upgrade cycle tied to 5G, which increasingly looks to go live in North America during 2019 and outside the US thereafter.

Investor confidence in new products and Apple’s new product pipeline should be bolstered by the growth in R&D spending that has now outpaced revenue growth in 24 of the last 25 quarters. Historically speaking, when this has happened in the past, it was a forbearer of Apple unveiling a number of new products, including a new product category or two. While it would be easy to read into the possibilities of potential products as 5G goes mainstream, we’ll continue to focus on the near-term upgrades to be had in a few month’s time and what it means for Apple’s businesses.

Exiting the quarter, Apple’s balance sheet had a net cash position of $129 billion even after retiring some 112 million shares during the quarter. On a dollar basis that was $20.7 billion spent on share repurchases during the quarter, including the last part $10 billion of its prior authorization. That leaves roughly $90 billion under its current $100 billion authorization and we continue to see the company supporting the shares with that mechanism.

Finally, last night Apple’s board of directors has declared a cash dividend of $0.73 per share of the Company’s common stock. The dividend is payable on August 16, 2018, to shareholders of record as of the close of business on August 13, 2018.

In sum, it was a stronger than expected quarter that showed Apple’s various strategies bearing fruit with more to come as it updates existing products and introduces new ones as well as new services. If there was one disappointment in the earnings release and conference call it was the lack of discussion around 5G and original content efforts, but my thinking on that is good things come to those who wait.

- Ahead of Apple’s (AAPL) upcoming annual product refresh, we are boosting our price target to $225 from $210 for the shares.

Nokia scores the biggest 5G contract win thus far

Earlier this week, T-Mobile (TMUS) named Nokia (NOK) as a supplier for $3.5 billion in 5G network gear, making this the largest 5G deal thus far. This is clear confirmation of the coming network upgrade cycle that bodes well for not only Nokia’s infrastructure business but will expand the addressable market for its licensing business as well.

Nokia’s deal with T-Mobile US is multi-year in nature, which means the $3.5 million will be spread out over eight-plus quarters. To put some perspective around the size of that one contract, over the last two quarters, Nokia’s infrastructure business has been averaging a little over $5 billion per quarter. In our view, this speaks to the diverse nature of the customer base across not only the US but the EU, Africa, and Asia.

The thing is, 5G networks will be coming to each of those geographies over the coming years, and for those further out deployments, mobile carriers will be adding incremental 4G LTE capacity. In other words, we are at the beginning of the 5G buildout, and it may seem like it has taken longer than expected to emerge, the data points from smartphone components to network builds suggest 2019 will be the beginning of a multiyear upcycle in mobile infrastructure demand.

And a quick reminder, we see the coming 5G buildout and the necessary smartphones and other devices driving demand for AXT Inc.’s (AXTI) compound semiconductor substrates. Those shares have been bouncing around like ping-pong balls of late, but we’ll continue to focus on the long-term drivers such as 5G and the eventual smartphone upgrade cycle.

And I would be remiss if I didn’t touch on Dycom Industries (DY) as well. To me, this T-Mobile US news says it is serious about building out its 5G network, and I strongly suspect both AT&T (T) as well as Verizon (VZ) will be sharing their own buildout plans in the coming days and weeks. These carriers are all about one-upping each other be it on data plan pricing or how good their networks are. As AT&T and Verizon fight back, it’s a solid reminder of the activity to be had for Dycom’s specialty contracting business.

- Our price target on Nokia (NOK) shares remains $8.50

- Our price target on AXT Inc. (AXTI) shares remains $11.50

- Our price target on Dycom (DY) shares remains $125.00

Here come earnings from Habit

Quickly turning to Habit Restaurants (HABT), the company will report its quarterly earnings after today’s market close. Consensus expectations are looking for EPS of $0.03 on revenue of roughly $100 million for the June quarter. Ahead of that report, Wall Street is coming around to the Habit story. On Monday, investment firm Wedbush bumped up their price target to $15 from $12 and upped their rating to Outperform from Buy. Yes, I am wondering where they’ve been for the last 30% plus rally in HABT shares…

The gist of the upgrade reflects the positive impact to be had from recent price increases as well as premium pricing associated with delivery. Those are certainly positive drivers for revenue and margins, however, I continue to see the bigger thesis centering on the company’s geographic expansion. That expansion means more burgers and shakes being sold in more locations, drive-thru, and delivery. In other words, it’s the platform that allows for these other margin improving activities. This means I’ll be watching the company’s capital spending plans for the coming quarters.

As tends to be the case, I’ll be reassessing our $11.50 price target with tonight’s earnings report given the shares have sailed right through it over the last few days.

- Heading into tonight’s earnings report, our price target on Habit Restaurant (HABT) shares remains $11.50.