Weekly Issue: Investor anxiety continues

Key points inside this issue

- As the investors grapple with anxiety over trade as well as the speed of economic and earnings growth, we’ll continue to hold ProShares Short S&P 500 (SH) shares.

- Our price target on the shares of Guilty Pleasure Thematic Leader Del Frisco’s Restaurant Group (DFRG) remains $14.

- Our price target on Middle-Class Squeeze Thematic Leader Costco Wholesale (COST) shares remains $250.

- Our price target on Amazon (AMZN) shares remains $2,250

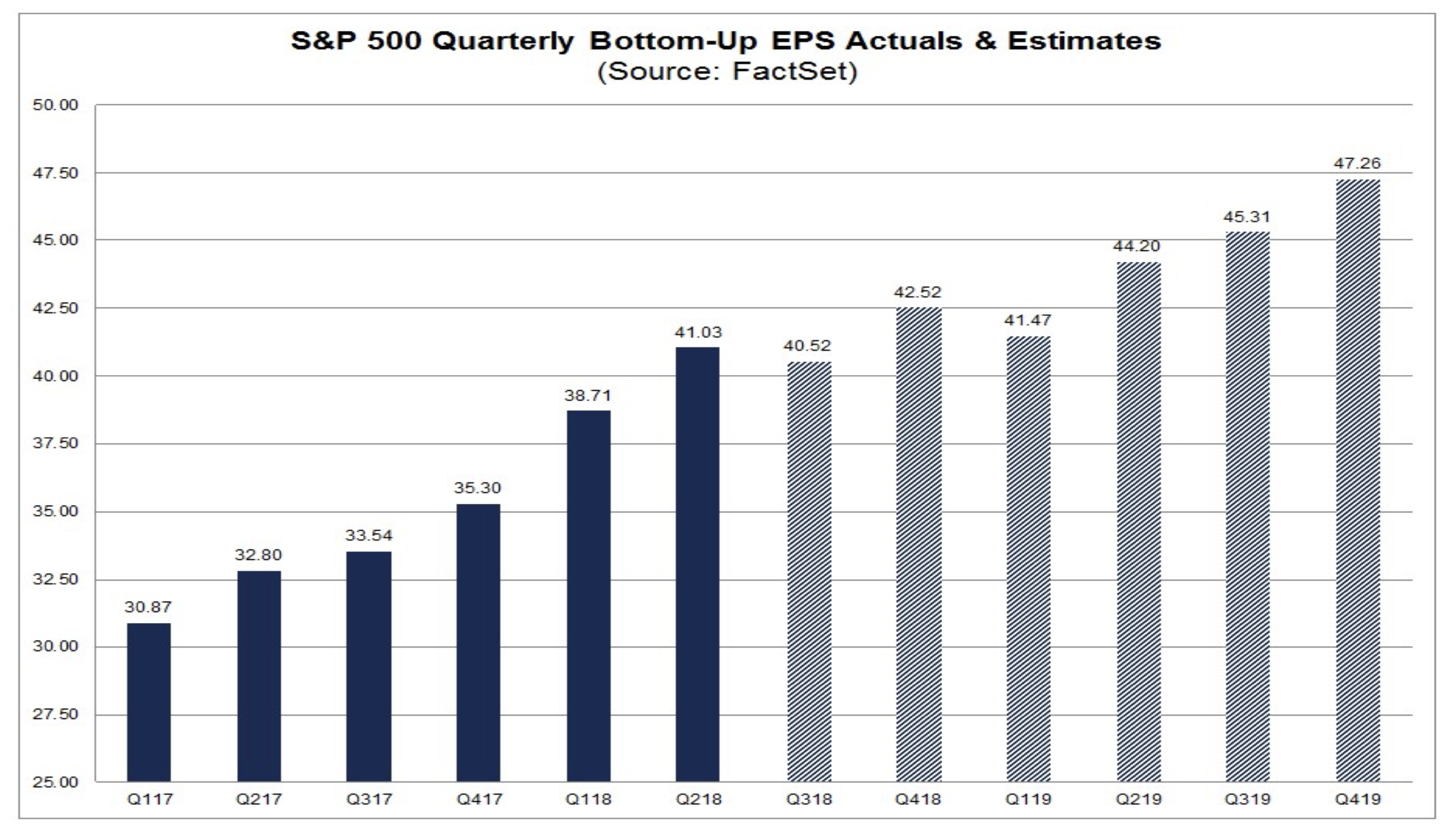

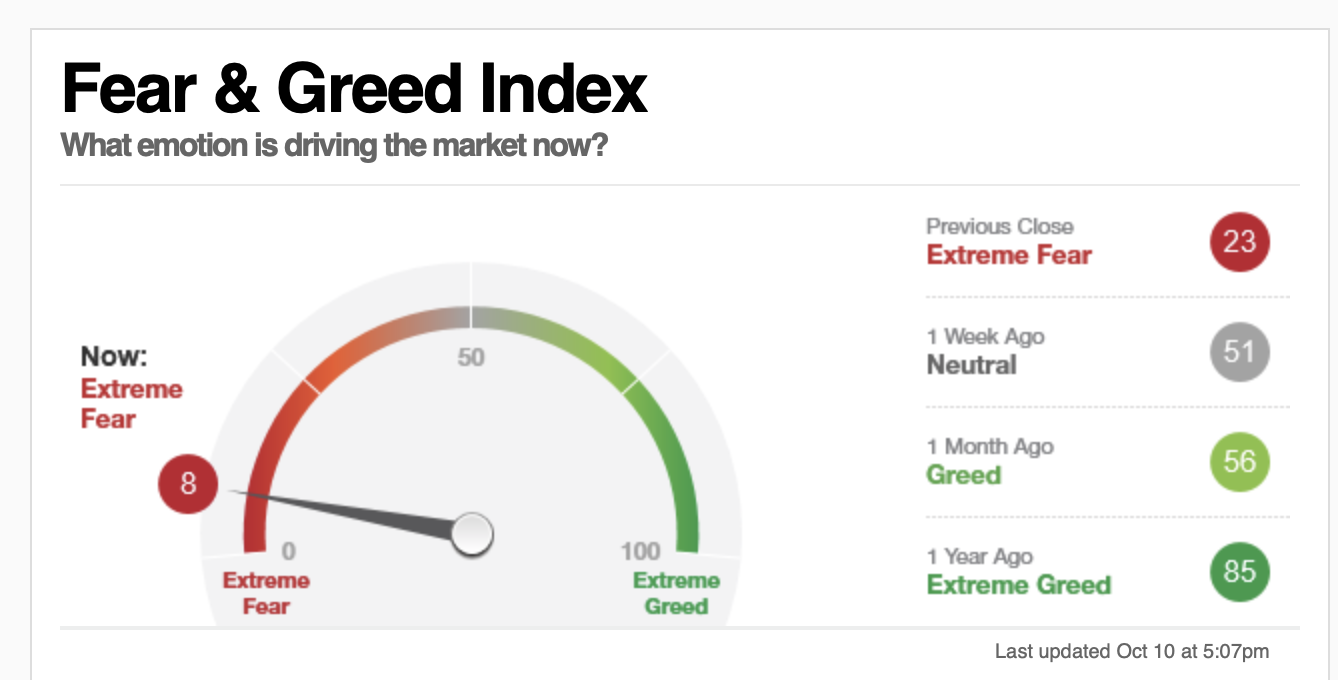

The stock market experienced another painful set of days in last week as it digested the latest set of economic data, and what it all means for the speed of the domestic and global economy. Investors also grappled with determining where the U.S. is with regard to the China trade war as well as the prospects for a deal by the end of March that would prevent the next round of tariffs on China from escalating.

There remain a number of unresolved issues between the U.S. and China, some of which have been long-standing in nature, which suggests a fix in the next 100+ days is somewhat questionable. This combination induced a fresh round of anxiety in the market, leading it to ultimately finish the week lower as the major indices sagged further quarter to date. In turn, that pushed all the major market indices into the red as of Friday’s close, most notably the small-cap heavy Russell 2000, which finished Friday down 5.7% year to date. For those keeping score, that equates to the Russell 2000 falling just under 15% quarter to date.

Last week we added downside protection to our holdings in the form of ProShares Short S&P 500 (SH) shares, and we’ll continue to hold them until signs of more stable footing for the overall market emerge. As we do this, I’ll continue to evaluate not only the thematic signals that are in and around us day-in, day-out, but also examine the potential opportunities on a risk to reward basis the market pain is creating.

Shares of Del Frisco’s get some activist attention

Late last week, our shares of Guilty Pleasure Thematic Leader Del Frisco’s Restaurant Group (DFRG) bucked the overall move lower in the domestic stock market following the revelation that activist hedge fund Engaged Capital has acquired a nearly 10% in the company with a plan to push the company to sell itself according to The Wall Street Journal. Given the sharp drop in DFRG shares thus far in 2018, down 52%, it’s not surprising to see this happen, and when we added the shares to our holdings, we shared the view that at some point it could be a takeout candidate as the restaurant industry continues to consolidate. In particular, Del Frisco’s presence in the higher end dining category and its efforts over the last few months to become a more focused company help explain the interest by Engaged.

In response, Del Frisco’s issued the following statement:

“Del Frisco’s is committed to maximizing long-term value for all shareholders. While we do not agree with certain characterizations of events or of our business and operations contained in the letter that we received from Engaged Capital, the Company values constructive input toward the goal of enhancing shareholder value. “

Compared to other Board responses this one is rather tame and suggests Del Frisco’s will indeed have a dialog with Engaged. Given the year to date performance in DFRG shares, odds are there are several on the Board that are frustrated either with the rate of change in the business or how that change is being viewed in the marketplace.

In terms of who might be interested in Del Frisco’s, we’ve seen a number of going private transactions in recent years led by private equity investors that re-tool a company’s strategy and execution or combine it with other entities. We’ve also seen several restaurant M&A transactions as well. Let’s remember too how on Del Frisco’s September quarter earnings conference call, the management team went out of its way to explain how the business performed during the last recession. That better than industry performance may add to the desirability of Del Frisco’s inside a platform, multi-branded restaurant company.

As much as we may agree with the logic behind Del Frisco’s being taken out, we’d remind subscribers that buying a company on takeout speculation can be dicey. In the case of Del Frisco’s, we continue to see a solid fundamental story. We are seeing deflation in food prices that bode well for Del Frisco’s margins and bottom line EPS. Over the last quarter we’ve seen prices in the protein complex – beef, pork, and chicken – move lower across the board. According to the United Nation’s Food and Agriculture Organisation’s (FAO) food price index, world food prices declined during the month of November to their lowest level in more than two years. We’re also seeing favorable restaurant spending per recent monthly Retail Sales reports, which should only improve amid year-end holiday dinners eaten by corporate diners and individuals.

We’ll continue to hold DFRG for the fundamentals, but we won’t fight any smart, strategic transaction that may emerge.

- Our price target on the shares of Del Frisco’s Restaurant Group (DFRG) remains $14.

What to watch in the week ahead

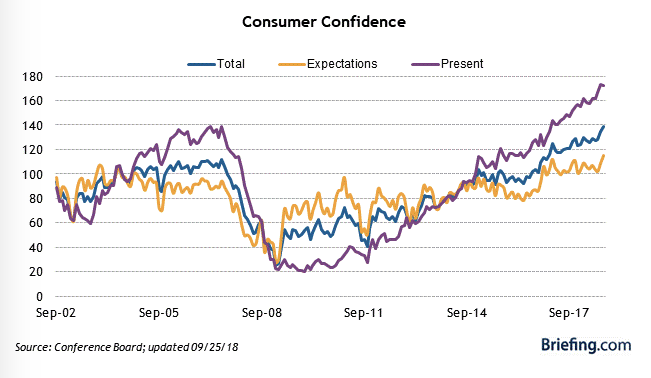

As we move into the second week of the last month of the quarter, I’ll continue to examine the oncoming data to determine the vector and velocity of the domestic as well as global economy. Following Friday’s November Employment Report that saw weaker than expected job creation for the month, but year over year wage gains of 3.1% the Atlanta Fed continued to reduce its GDP forecast for the current quarter. That forecast now sits at 2.4%, down from 3.0% at the end of October.

With the sharp drove in oil prices has consumers feeling a little holiday cheer at the gas pump, odds are next week’s November inflation reports will be tame. The fact that world food prices per the Food and Agriculture Organization’s (FAO) food price index hit the lowest level since May 2016 also bodes well for a benign set of inflation data this week. Later in the week, we’ll get the November Retail Sales report, which should be very confirming for our holiday facing positions – Amazon (AMZN), United Parcel Service (UPS), McCormick & Co. (MKC) and Costco Wholesale (COST) – that given the kickoff of “seasons eatings” with Thanksgiving and the start of the holiday shopping season that clearly shifted to digital shopping.

That report will once again provide context for this shift as well as more than likely confirm yet again that Costco Wholesale (COST) continues to take consumer wallet share. Speaking of Costco, the company will report its quarterly results this Thursday. Quarter to date, the company’s monthly same store sales reports are firm evidence it is winning consumer wallet share, and we expect it did so again in November, especially with its growing fresh foods business that keeps luring club members back. Aside from its top and bottom line results, I’ll be focused once again on its pace of new warehouse openings, a harbinger of the crucial membership fee income to be had in coming quarters.

- Our price target on Middle-Class Squeeze Thematic Leader Costco Wholesale (COST) shares remains $250.

We’ll end the economic data stream this week with the November Industrial Production report. Given the sharp fall in heavy truck orders in November, I’ll be digging into this report with a particular eye for what it says about the domestic manufacturing economy.

As discussed above, this week Costco will report its results and joining it in that activity will be several other retailers such as Ascena Retail (ASNA), DWS (DWS), American Eagle (AEO) and Vera Bradley (VRA). Inside their comments and guidance, which will include the holiday shopping season, I’ll be assessing the degree to which they are embracing our Digital Lifestyle investing theme. We’ll also see Adobe Systems (ADBE) report its quarterly result and I’ll be digesting what it has to say about cloud adoption, pricing and prospects for 2019. As we know, that is a core driver of Amazon Web Services, one of the key profit and cash flow drivers at Amazon (AMZN).

- Our price target on Amazon (AMZN) shares remains $2,250