We keep hearing that thematic investing is gaining significant popularity in investing circles, especially when it comes to Exchange Traded Funds (ETFs). For more than a decade, we’ve viewed the markets and economy through a thematic lens and have developed more than a dozen of our own investing themes that focus on several evolving landscapes. As such, we have some thoughts on this that build on chapters 4-8 in our book Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better Returns

One of the dangers that we’ve seen others make when attempting to look at the world thematically as we do, is that they often confuse a trend — or a “flash in the pan” — for a sustainable shift that forces companies to respond. Examples include ETFs that invest solely in smartphones, social media or battery technologies. Aside from the question of whether there are enough companies poised to benefit from the thematic tailwind to power an ETF or other bundled security around the trend, the reality is that those are outcomes — smartphones, drones and battery technologies — are beneficiaries of the thematic shift, not the shift itself.

At Tematica Research, we have talked with several firms that are interested in incorporating Environmental, Social and Governance — or ESG — factors as part of their investment strategy. Some even have expressed the interest in developing an ETF based entirely on an ESG strategy alone. We see the merits of such an endeavor from a marketing aspect and can certainly understand the desire among socially conscious investors to ferret out companies that have adopted that strategy. But in our view and ESG strategy hacks a sustainable differentiator given that more and more companies are complying. In other words, if everyone is doing it, it’s not a differentiating theme that generates a competitive advantage that will provide investors with a significant beta from the market.

But there is a larger issue. A company’s compliance with an ESG movement is not likely to alter the long-term demand dynamics of an industry or company, even if certain businesses enjoy a short-term surge in revenues or increased investor interest based on a sense of goodwill.

For example, does the fact that Alphabet (GOOGL) targets using 100 percent renewable energy by 2018 alter the playing field or improve the competitive advantage of its core search and advertising business? Does it do either of those for YouTube?

No and no.

At the risk of offending those sensitive about their fitness acumen, it makes as much sense as investing in an ETF that only invests in companies with CEOs who wear fitness trackers. Make no mistake, our own Tematica Research Chief Macro Strategist Lenore Hawkins, a fitness tracker aficionado herself, would love to see more fitness trackers across the corporate landscape, but an ETF based on such a strategy means investing in companies across different industries with no cohesive tailwind powering their businesses, likely facing very different market forces that overshadow the impact of the one thing they have in common. To us, that misses one of the key tenants of thematic investing.

The result is a trend that is likely to be medium-lived, if not short lived. Said another way, it looks to us to be more like an investing fad, rather than a pronounced thematic driven shift that has legs.

Subscribers to our Tematica Investing newsletter know we are constantly turning over data points, looking for confirmation for our thematic lens, as well as early warning flags that a tailwind might be fading or worse, turning into a headwind. As we collect those data points, we mine the observations that bubble up to our frontal lobes and at times, ask if perhaps we have a new investing theme on our hands. Sometimes the answer is yes, but more often than not, the answer comes up “no”.

Now you’re in for a treat! Some behind the scenes action if you will on how we think about new themes and why one may not make the cut…

The On-Demand Economy: Enough to become a new investing theme?

Recently we received a question from a newsletter subscriber asking if the number of “on-demand” services and business emerging were enough to substantiate the addition of a new investment theme to go along with the other 17 themes we currently track.

By on-demand, we’re talking about those services where you can rent a car, (Lyft or Uber) or find private lodging (AirBnB) with the click of a button for only the time you need it rather than rent an apartment or studio for a week or month. It also refers to the many services that will deliver all the ingredients you need to prepare a gourmet meal in your own kitchen, such as the popular service Blue Apron or HelloFresh.

It was an interesting question because we have been debating this at Tematica Research for quite some time. We’re more than fans of On Demand music and streaming video services like those offered by Amazon (AMZN), Netflix (NFLX), Pandora (P), Spotify and Apple (AAPL). Ultimately, we came to the conclusion that the real driver behind the on-demand economy is businesses stepping into fill the void created by a combination of multiple themes, rather than a new theme in of itself. Here’s what we mean . . .

Take the meal kit delivery services like Blue Apron, what’s driving the popularity of this service? We would argue that it’s not the fact that people like seeing their UPS driver more. Rather it is the result of underlying movement towards more healthy and natural foods that omit chemicals and preservatives — something we have discussed as the driver behind our Foods with Integrity theme — on top of a bigger Asset Light investment theme in which consumers and businesses outsource services, rather than accumulating assets and then performing the service themselves. The on-demand component of Blue Apron is not driving the theme, but is a beneficiary of what we call the thematic tailwind.

The challenge with the shift towards healthier cooking, that sits within our Foods with Integrity thematic, is the amount of work, and in many cases equipment, it takes to cook such foods — the shopping, the measuring, the cutting, special cooking utensils and preparation time, not to mention the cost. Recognizing this pain point, Blue Apron saw opportunity and consumers have flocked to it. As we see it, the meal delivery services are an enabler that addresses a pain point associated with our Foods with Integrity theme, rather than an independent theme unto itself.

There is also a clear element of the Connected Society investment theme behind these services, given how customers order the ingredients to prepare the meals – via an app or online – as well as our Cashless Consumption theme, given the method of payment does not involve cash or check and Asset Light whereby consumers pay for the end product, rather than investing in assets so that they can make it themselves. So that we are clear, the primary theme at play here is Foods with Integrity, but we love to see the added oomph when more than one theme is involved.

Let’s look at Uber, the on-demand private taxi service.

We’re big users of the service, particularly when traveling, and we love the ease of use. To us, while the service offered by Uber is very much On-Demand, from the customer perspective, it fits into our Asset Light theme, as it removes the need to own a car. If you think about, what’s? the amount of time you spend using your car compared to the amount of time it spends parked at home, at work or in a parking lot? The monthly cost to own and maintain that vehicle vs. the actual number of hours it is used offers a convincing argument to embrace an Asset Light alternative like Uber.

We also like the payment experience — or the lack of an experience. We’re talking about having the ride fee automatically charged. No cash, no credit card swiping or inserting, no awkward “how much do I tip?” moments. It’s our Cashless Consumption theme in all of its glory, walking hand-in-hand with Asset Light — and the only thing better than a strong thematic tailwind behind a company is two!

The biggest users of the Uber and Lyft services, and the ones driving the firms’ valuations to stratospheric levels, are the Millennials who are opting to just “Uber “ around town — it’s become a verb — or use a car-sharing service like a ZipCar (ZIP) or the like.

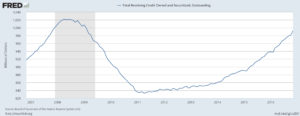

Sure, Millennials have the reputation of being a more thrifty, frugal group compared to previous generations. But we have to wonder is it them being thrifty or just coming to grips with reality?

With crushing costs of college and student loans, as well as stagnant wage growth, many young workers are forced to cobble together part-time and contractor jobs rather than enjoying a full-time salaried position, so what choice do they have? Why buy a car and pay for it to sit there 95% of the time when you can just pay for it when you need it?

We call that the Cash-strapped Consumer theme meets Asset Light, and many businesses have also stepped in to service this rising demand for what has become known as the “sharing economy.”

Finally, what is the underlying function of all these on-demand services?

As we mentioned earlier, it’s the ability to connect and customize the services that consumers want through a smartphone app or desktop website, or from our thematic perspective, the Connected Society.

One of the key words in the previous sentence was “service.” According to data published by the Bureau of Economic Analysis in December 2015 and the World Bank, the service sector accounted for 78 percent of U.S. private-sector GDP in 2014 and service sector jobs made up more than 76 percent of U.S. private-sector employment in 2014 up from 72.7% in 2004. Since then, we’ve seen several thematic tailwinds ranging from Connected Society and Cash-strapped Consumer to Asset Light and Disruptive Technologies to Foods with Integrity that either on their own, or in combination, have fostered the growth of the US service sector. Given the strength of those tailwinds, we see the services sector driving a greater portion of the US economy. What this means is folks that have relied heavily on the US manufacturing economy to power their investing playbook might want to broaden that approach.

Now let’s tackle the thematic headwinds here

Headwinds involve those companies that are not able to capitalize on the thematic tailwind. A great example is how Dollar Shave Club beat Gillette, owned by Proctor & Gamble (PG), and Schick, owned by Edgewell Personal Care (EPC), by addressing the pain point of the ever-increasing cost of razor blades with online shopping. Boom — Cash-strapped Consumer meets Connected Society.

While Gillette has flirted with its own online shave club, the price of its razor are still significantly higher, and as far as we’ve been able to tell, Schick has no such offering. As Dollar Shave Club grew and expanded its product set past razors to other personal care products, Unilever (UL) stepped in and snapped it up for $1 billion.

Going back to the beginning and the impact of the food delivery services like Blue Apron — are we likely to see food companies build their own online shopping network? Most likely not, but they are likely to partner with online grocery ordering from Kroger (KR) and other such food retailers. That still doesn’t address the shift toward healthy, prepared meals and it’s requiring a major rethink among Tyson Foods (TF), Campbell Soup (CPB), The Hershey Company (HSY), General Mills (GIS) and many others. Fortunately, we’ve seen some of these companies take actions, such as Hershey buying Krave Pure Foods and Danone SA (DANOY) acquiring WhiteWave Foods, to better position themselves within the thematic slipstream.

The key takeaway from all of this is that a thematic tailwind can be thought of as a market shift that shapes and impacts consumer behavior, forcing companies to make fundamental changes to their business model to succeed. If they don’t, or for some reason can’t, odds are their business will suffer as they fly straight into an oncoming headwind.

Recall how long Kodak was the gold standard for family photographs, yet today it is nowhere to be seen, killed by forces that emerged completely from outside its industry. As digital cameras became ubiquitous with the advent of the smartphone and the cost of data transmission and storage continually fell, the capture and sharing of images was revolutionized. Kodak didn’t keep up, thinking that film would forever be the preferred medium, and paid the ultimate price.

As thematic investors, we want to own those companies with a thematic tailwind at their back — or maybe even two or three! — and avoid those that either seem oblivious to the headwind or won’t be able to reposition themselves, like a hiker who finds he or she has already gone way too far down the wrong path and is so utterly lost, needs to be helicoptered to safety.

Of course, when it comes to these “On-Demand Economy” darlings — Uber, Dollar Shave Club, Airbnb —few if any of them are publicly traded, which frustrates us so, since most of them are tapping into more than one thematic tailwind at once. If and when they do turn to the public markets for some added capital and we get a look into the economics of these business models, then we’ll also get to see the key performance metrics and financials behind these businesses.

In the meantime, stay tuned as we will be discussing more readily investable thematics next.