Looking past this week’s market relief rally

As expected, the last few days in the market have been a proverbial see-saw, which culminated in the sharp market rally following the mid-term elections. The outcome, which saw the Democrats gain ground in Washington, was largely expected. We’ll see in the coming weeks and months the degree of gridlock to be had in Washington and what it means for the economy, but we have to remember several other concerning items remain ahead of us. To jog memories, these include the next round of budget talks between Italy and EU, which should occur next week; continued rate hikes by the Fed as it looks to stave off inflation and get more tools back for the next eventual recession; and upcoming trade talks between the US-China.

While we like the mid-week, market rebound and what it did for the Thematic Leaders as well as positions on the Select List, the upcoming events outlined above suggest near-term caution is still warranted. Shares of McCormick & Co. (MKC) International Flavors & Fragrances (IFF) as well as Altria (MO), AMN Healthcare (AMN) and Costco Wholesale (COST) have been on a tear of late. Earlier this week, Costco reported its October same-store sales results, which once again confirmed this Middle-class Squeeze company is taking wallet share.

Yesterday, mobile infrastructure company Ericsson (ERIC) held its annual Capital Markets event at which it spoke in a bullish tone over 5G rollouts, so much so that it raised its 2020 targets. I see that along with other similar comments in the last few weeks as very positive for our positions in Digital Infrastructure leader Dycom (DY) and Disruptive Innovator Nokia Corp. (NOK) as well as AXT Inc. (AXTI) shares.

Axon’s – September quarter earnings and an upgrade

Over the last few weeks, share of Safety & Security Thematic Leader Axon Enterprises (AAXN) have come under considerable pressure, but on Tuesday night the company reported September quarter earnings of $0.20 per share, crushing the consensus view of $0.13 per share as both revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) soared. Axon then reiterated its full-year guidance which hinged on the continued adoption of its Axon camera and cloud-storage business. Year over year, the number of cloud seats booked by customers rose to 325,200 exiting September up from 187,400 twelve months earlier. The combination of the 25% pullback in the shares quarter to date and that upbeat outlook led JPMorgan Chase to upgrade the shares to Overweight from Neutral.

Yes, we are down with the shares, but as the market settles out I’ll look to add to the position and improve our cost basis along the way. I continue to expect Axon will eventually acquire rival Digital Ally (DGLY) and its $31 million market cap, removing the current legal overhang on the shares. Our price target remains $90.

Disney earnings on deck tonight

After tonight’s market close, Disney (DIS) will report its quarterly results, and while we are not expecting any surprises for the September quarter, it’s the comments surrounding the company’s streaming strategy and integration of the Fox assets that will be in focus. Expectations for the September quarter are EPS of $1.34 on revenue of $13.73 billion. Our position on Disney has been and continues to be that based on the success of its streaming services, investors will need to revisit how they value DIS shares as it goes direct to the consumer with a cash-flow friendly subscription business model. Our price target for DIS shares remains $125.

Del Frisco’s earnings to follow next week

Monday morning, Del Frisco’s Restaurant Group (DFRG) also postponed its quarterly earnings report from until Tuesday, Nov. 13, citing “additional time required to finalize the accounting and tax treatment of our acquisition of Barteca Restaurant Group, disposition of Sullivan’s Steakhouse, a secondary offering of common stock and debt syndication.”

Coincidence? Perhaps, but it raises questions over the bench strength of these companies as they reshape their business. If you’ve ever been in a negotiation, you know things can slip, but following GNC’s postponement, we are at heightened alert levels with Del Frisco’s. We knew this was going to be a sloppy earnings report and we clearly have confirmation; our only question is why didn’t the management team wait to announce its earnings date until it had dotted its Is and crossed its Ts on all of these items?

To some extent, I am expecting a somewhat messy report in light of the sale of its Sullivan’s business and its common stock offering early in the quarter that raised more than $90 million. In parsing the company’s report, I will be focusing on revenue growth for the ongoing business as well as its profit generation considering that earnings-per-share comparisons could be challenging if not complicated versus the year-ago quarter. Nonetheless, the reported quarterly results will be gauged at least initially against the consensus view, which heading into the weekend sat at a loss per share of $0.25 on revenue of $120 million. For the December quarter, one of the company’s seasonally strongest, Del Frisco’s is expected to guide to EPS near $0.23 on revenue of $144 million.

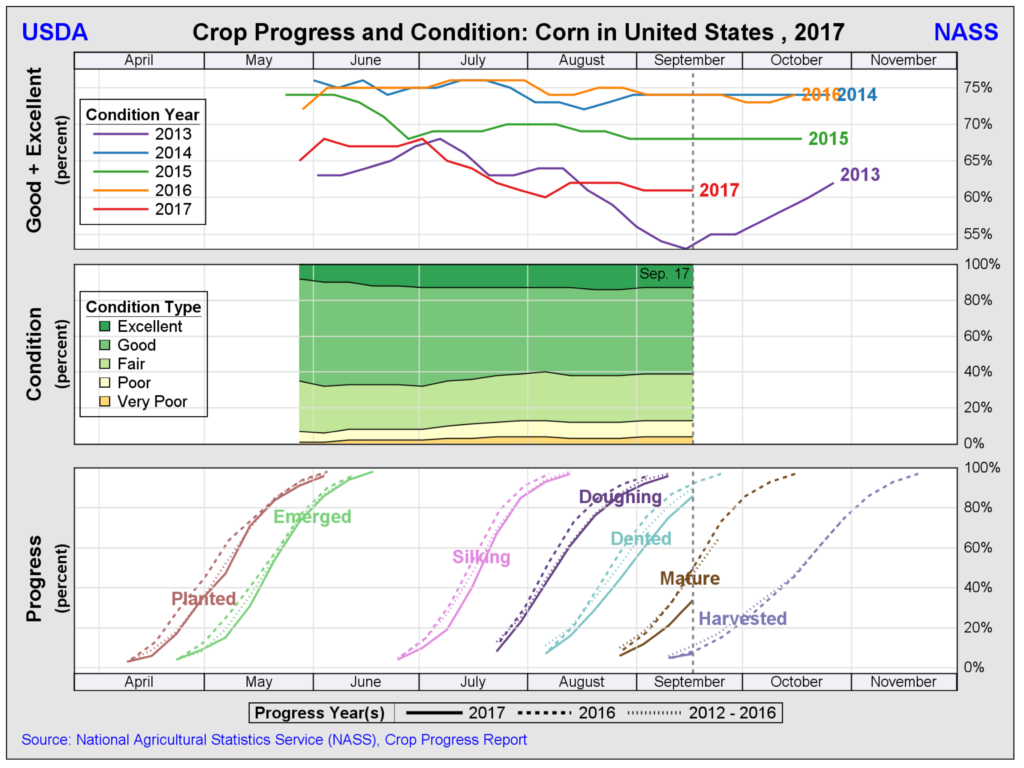

So far this earnings season we’ve heard how restaurant companies including Bloomin’ Brands Inc. (BLMN), Ruth’s Hospitality Group (RUTH), Del Taco Restaurants Inc. (TACO), Chipotle Mexican Grill Inc. (CMG) and more recently Wingstop Inc. (WING) are seeing their margins benefitting from food deflation. Along with a pickup in average check size owing to prior price increases, these companies have delivered margin improvement and expanding EPS. I expect the same from Del Frisco’s. When coupled with an expected uptick in holiday spending and consumer sentiment running at high levels, we remain bullish on DFRG shares heading into Monday’s earnings report. Our price target on DFRG shares remains $14.

What to Watch Next Week

On the economic front, we’ll get more inflation data in the form of the October CPI report next week, which follows tomorrow’s October PPI one. In both we hear at Tematica will be scrutinizing the year over year comparisons and given the growing number of companies issuing price increases we expect to see those reflected in these October as well as November inflation reports. If the figures come in hotter than expected, expect that to reignite Fed rate hike concerns. Also, next week, we have the October reports for Retail Sales and Industrial Production as well as the first look at November with the Empire Manufacturing and Philly Fed indices.

With the October Retail Sales report, we’ll be once again parsing it to compare against the October same-store sales reported yesterday by Costco Wholesale (COST), which were up 8.6% year over year (+6.6% core). Odds are we will once again have formal confirmation that Costco is taking consumer wallet share.

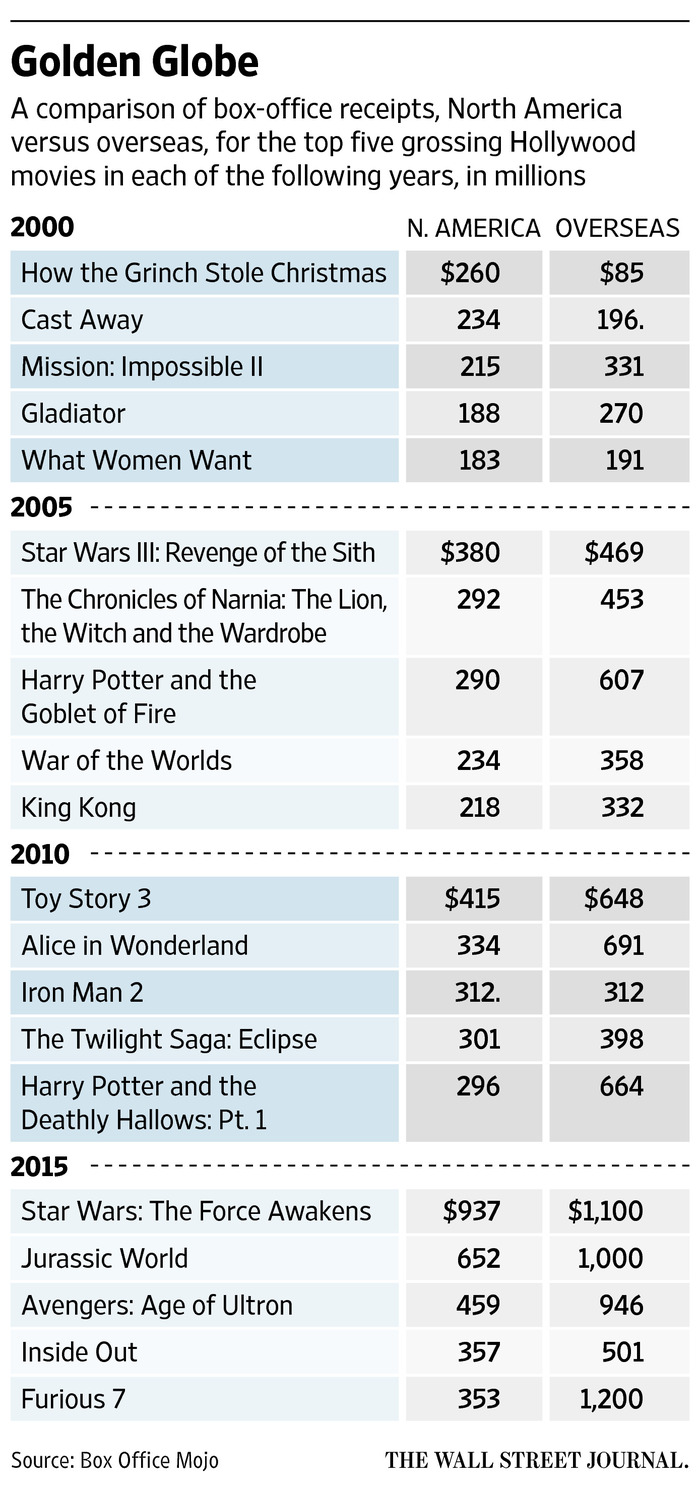

Compared to the more than 1,200 earnings reports we had this week, the 345 or so next week will be a proverbial walk in the park. there will be several key reports to watch including Home Depot (HD), Macy’s (M), JC Penney (JCP), Williams Sonoma (WSM), and WalMart (WMT). We’ll be matching their forecasts for the current quarter up against the 2018 holiday shopping forecasts from the National Retail Federation, Adobe (ADBE) and others that call for overall holiday shopping to rise 4.0%-5.5% with online shopping climbing more than 15% year over year. I continue to see that as very positive for our shares in Amazon (AMZN), Costco and United Parcel Service (UPS) as well as McCormick & Co. (MKC).

Perhaps the biggest wild card next week will be the Italian budget and as we near the end of this week, things are already getting heated on that front. Today, the Italian government said it is sticking with its plan to rapidly increase public spending despite the budget dispute with the European Union, and it has no intention of revising its plan by next week. As background, Italy is the third largest economy in the EU, and if a joint resolution is not reached we expect this to reignite talk of “Italeave,” which will stoke once again questions over the durability of the EU. Given its size compared to Greece, the Italian situation is one we will be watching closely in the coming days.