With three trading days left to go in the quarter, we wanted to share some quick thoughts on several Tematica Select List positions, especially those like AMN Healthcare (AMN) and Alphabet (GOOGL), both of which received much attention last week that weighed on the shares of both companies. Even though all the major market indices fell last week, it wasn’t all bad news for the Tematica Select List as International Flavors & Fragrances (IFF) continued it move higher as did Facebook (FB) and several others.

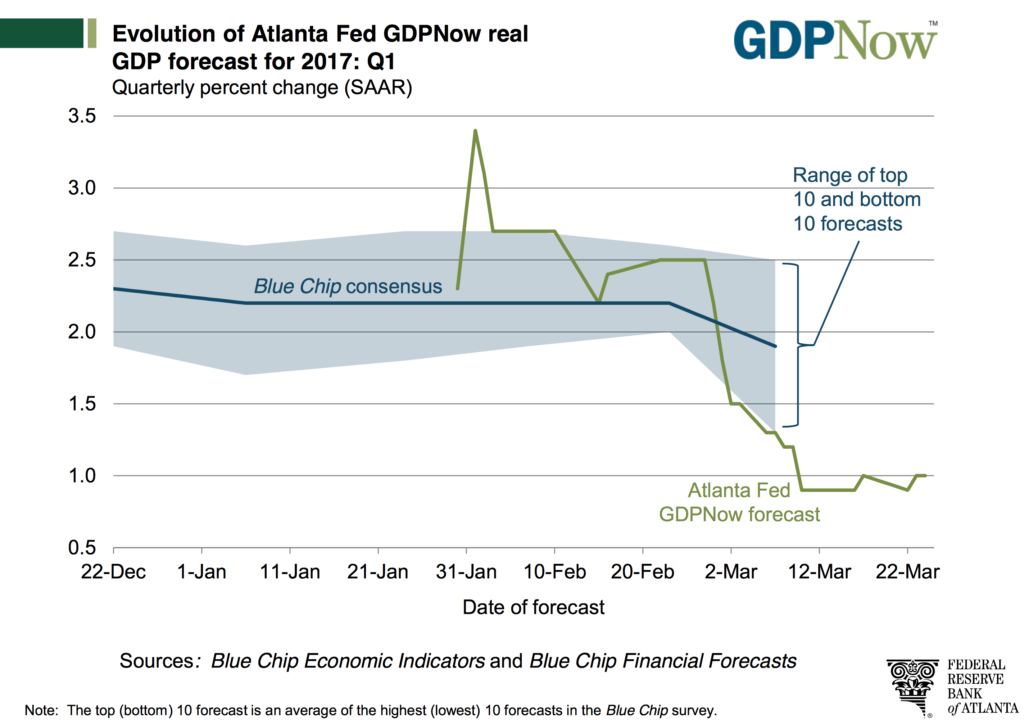

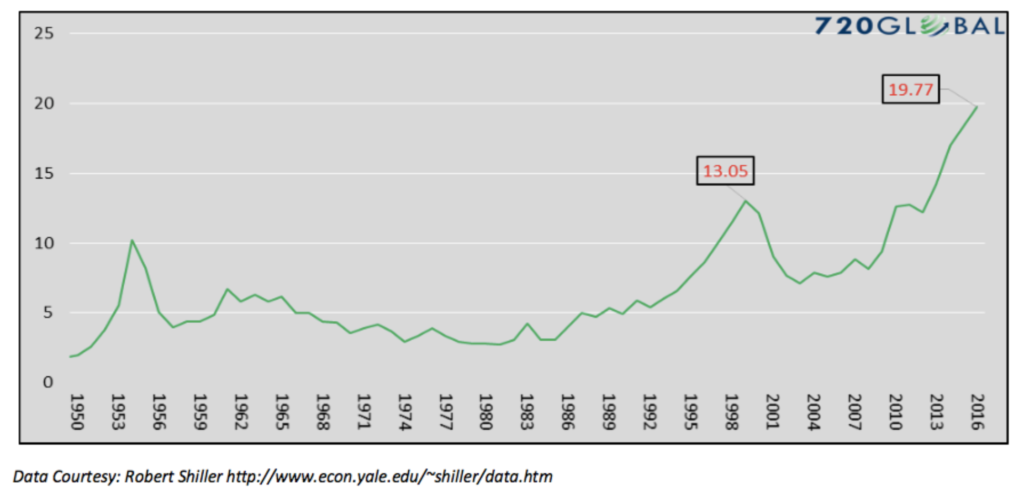

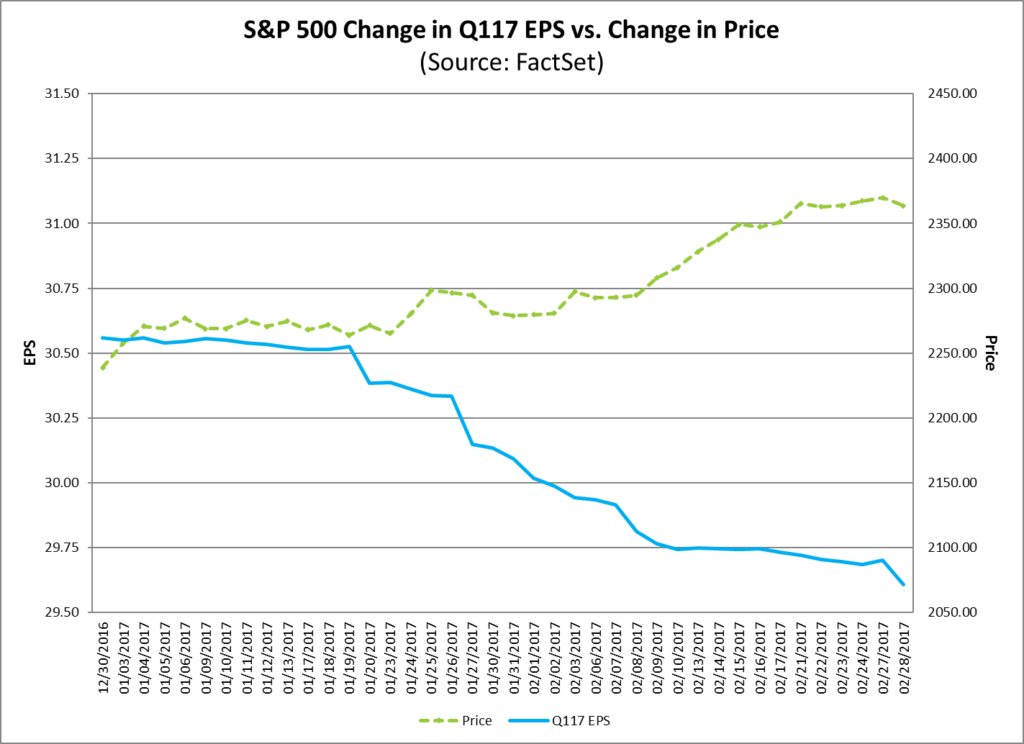

As we shared in this week’s Monday Morning Kickoff and on last week’s Cocktail Investing Podcast, investors are giving the market a re-think as they juxtapose the speed of the economy and prospects for earnings growth near-term. While some shares on the Tematica Select List have come under some pressure, as we noted above, the thematic tailwinds that are powering the businesses behind these companies remain intact. As we get ready for the soon to be upon March quarter earnings season, we’ll be mindful of expectations as we watch for negative earnings pre-announcements. With the deluge of earnings coming at us, we’ll be revisiting stop loss levels in the coming days, and intend to make any and all adjustments before the velocity of earnings reports kicks into higher gear.

We’ve got a full review of the Tematica Select List, so we’ll keep the preamble to a minimum and get to it . . .

Alphabet (GOOGL)

Asset-lite Business Models

GOOGL shares fell more than 1.0 percent over last week following the decision by a handful of high-profile consumer brands like Verizon (VZ) and our own AT&T (T) to pull advertising from Google’s YouTube over offensive content. While Alphabet doesn’t break out YouTube’s financial performance, this concern over “brand safety” could be a bump in the road for the business as advertisers look to other outlets, from Facebook (FB) to more traditional broadcast and cable TV. Much like fake news, we see this as a temporary set back for Alphabet and suspect before too long Alphabet will put protocols in place for such offensive content.

Also last week it was reported that Alphabet submitted a bid against Amazon and Facebook to stream Thursday Night Football games next season on YouTube. Given the aforementioned YouTube advertising issue, a win here would help smooth over advertisers in our view and Alphabet certainly has the balance sheet to compete.

The accelerating shift toward digital advertising and shopping bodes very well for Alphabet’s core search and advertising business, while the same for streaming bodes well for YouTube. Those drivers have Alphabet tracking to grow earnings more than 17 percent in 2018 vs. 2017 and the shares are trading at 22x consensus 2018 expectations that sit at $38.92 per share, essentially a PEG ratio of 1.25.

- Our price target on GOOGL remains $975 and the rating is a Buy at current levels.

Amazon (AMZN)

Connected Society

Shares of Amazon rose 1.5%, but year to date are up more than 14 percent. Last week brought a number of announcements that, from out vantage point, confirm the company’s position in our increasingly Connected Society and Amazon’s plans to expand its footprint:

- Amazon acquired all of Souq.com, a Dubai-based online retailer to better position itself in the young and tech-savvy Middle East markets of Kuwait, Saudi Arabia and the United Arab Emirates.

- Amazon is reportedly partnering with the German logistics company DHL to leverage its Cincinnati/Northern Kentucky Airport to build out its upcoming Prime Air cargo hub operation. We see this as the latest step in Amazon looking to shrink time to customer as part of its growing Fulfilled By Amazon offering. The partnership also reportedly includes the introduction of AmazonFresh food deliveries in Germany starting next month, which also serves to extend service offering deeper into the eurozone.

- Amazon is also seeking approval from India’s Trade Ministry to invest about $500 million in a grocery venture.

- For those concerned that Amazon may be putting too much on its plate, it’s being reported that Amazon has postponed a much expected launch into Southeast Asia from 1Q 2017 to sometime later this year.

The common thread among these items is that Amazon continues to expand its footprint, which augurs for continued growth in the coming quarters. Stepping back and looking at the company’s competitive positions that are poised to benefit from their respective tailwinds — the shift to digital consumption (shopping, content streaming, grocery) and Cloud adoption — and are poised for additional share gains, we see favorable revenue and profit growth over the long term.

- For now, we are keeping our $975 price target intact as well as our Buy rating. As we have said before, Amazon is a stock to own, not trade.

AMN Healthcare (AMN)

Aging of the Population

Shares of this workforce management company that serves the health-care industry, and nursing primarily, dropped last week on concerns over the repeal and replacement of the Affordable Care Act. With Republicans pulling the GOP health plan vote last week, and President Trump clearly signaling that he will be moving on with his agenda, we see the pressure that led to the sharp pullback in AMN shares last week abating as the Affordable Care Act remains intact.

We continue to be fans of the pain point that is the healthcare worker shortage, particularly for nurses, that is powering AMN’s business as the domestic population continues to skew older placing greater demands on healthcare.

- With the rebound in the share price over the last few days, we now have roughly 14 percent upside to our $47 price target, which has us keeping our Buy rating for now.

- As the shares approach $43, we would be less inclined to commit fresh capital to the position.

Applied Materials (AMAT)

Disruptive Technologies

Just over a month ago, we added shares of Applied Materials, a leading nano-manufacturing equipment, service, and software provider to the semiconductor, flat panel display (FPD), and solar industries, to the Tematica Select List, with a 12-18-month price target of $47. Recent bullish commentary in Barron’s underscores our bullish view on the company and its shares as it benefits form several multi-year tailwinds that include not only ramping industry capacity for organic light emitting diodes, but also 3D NAND flash and the industry need to add DRAM capacity.

- We have ample upside to our $47 price target and we’d look to scale into our position on share price weakness below $33, as long as the current outlook remains intact, or on signs the ramp in semi-cap and display equipment is ramping stronger than expected.

AT&T (T)

Connected Society

Year to date, AT&T shares have traded sideways, as we wait for more details on the pending merger with Time Warner (TWX). Chatter in and around Washington seems to suggest that President Trump has softened his opposition to the combination of the two companies as it looks to get regulatory approval before the end of the year. This week there is a pending decision to be had in Washington that will create a nationwide publish safety network dubbed FirstNet. That special meeting will be held Wednesday (March 29), and the growing consensus is the ensuing vote is likely to pave the way for AT&T to be awarded with a 25-year deal to build and maintain the much-anticipated nationwide public-safety broadband network. We’ll be looking for the outcome next week, which would be a nice positive for the company’s business and our shares.

- As more clarity on the merger with Time Warner develops, we are likely to revisit our current $44 price target.

- All things being equal we are likely to add to the position below $40.

CalAmp (CAMP)

Connected Society

This wireless solutions company competes in the developing Internet of Things market, better known as telematics, and resonates with our Connected Society investing theme. CAMP shares fell just under 2 percent over the last week. Year to date, the shares are up more than 15 percent. Given growing investor concern over growth, we suspect more short-termed investors were taking profits last week given the CAMP story is one weighted toward the back half of the year given the looming electronic logging device (ELD) mandate.

Building off its relationship with Caterpillar (CAT), CalAmp recently introduced AssetOutlook, a telematics application designed to optimize construction operations for off-road equipment and on-road vehicles. CalAmp also recently announced its entrance into the cold-chain and supply-chain visibility markets, an area forecasted to reach $5.4 billion in size by 2021.

- With ample multi-year growth prospects on the horizon, we continue to rate the shares a Buy with a $20 price target.

Dycom Industries (DY)

Connected Society

Year to date, Dycom shares are up more than 15 percent vs. 5.35 percent for the S&P 500. Given the strong move in the shares year to date we suspect some profit-taking has been taking place over the last several days. With the expected win by Dycom customer AT&T (T) this week for a 25-year deal to build and maintain the much-anticipated nationwide public-safety broadband network, we are likely to see some lift in DY. Longer-term as Dycom’s customers deploy both next-generation solutions as well as add incremental capacity to existing networks, we remain bullish on the name.

One risk we have to watch for given the nature of Dycom’s business is disruption due to weather; thus far the company has benefited from mild winter weather, but we now need to account for the recent storm, Stella, that hit the Northeast.

- Our price target is $115, which offers potential upside of more than 25 percent from current levels and has us rating the shares a Buy.

Facebook (FB)

Connected Society

Our Facebook shares continued to move higher last week, ensuring its place as the best-performing position on the Tematica Select List thus far in 2017. While we currently have another 9 percent to our $155 price target, there are reasons to think there could be additional upside potential as the company continues to expand the reach of its platforms (Facebook, Instagram, WhatsApp) and their monetization.

Last week Facebook shared that Instagram’s advertising base topped 1 million businesses, which comes at a time when Google is received advertising blowback given some of its content. While that is likely to be a short-term disruption, we see incremental wins by Facebook across its various platforms. On the news front, Facebook is one of several firms hoping to stream Thursday Night Football games next season — this would be a big win for the company, but it is going up against Amazon and Google. We’ll continue to watch for more details.

The next known catalyst for FB shares will be the F8 Annual Developer Conference on Apr. 18, at which we should learn above new product features as well as the recently launched Facebook 360. This event is likely to be a week or two before the company reports 1Q 2017 earnings.

- For now, our price target remains $155 and our rating a Buy, but should the shares cross $142, we would not add further to the position

International Flavors & Fragrances (IFF)

Rise & Fall of the Middle Class

Having climbed more than 11 percent, IFF shares have been a solid performer year to date. Last week the company gave an upbeat presentation at the CAGE Conference 2017 and the positive reception that drove the shares higher also meant we are encroaching on our $145 price target.

With roughly 10 percent upside to that level, we’re not inclined to add fresh capital to the position at or near current levels. As we do this, we recognize new product categories, such as dairy, that aided Coca-Cola (KO) during the December quarter, as well as alternative sweetener demand by beverage companies ranging from Coca-Cola to PepsiCo (PEP) and Dr. Pepper Snapple (DPS), bode well for the flavors business in the coming quarters. The same is true with candy companies looking to cut back sugar, but preserve taste. Even longer term, the outlook remains bright for this market as the Freedonia Group’s forecast calls for global demand for flavors and fragrances to reach $26.3 billion by 2020, which would be a 21 percent increase from $21.7 billion in 2015.

- As new data becomes available, we’ll continue to evaluate potential upside to our $145 price target.

McCormick & Co. (MKC)

Rise & Fall of the Middle Class

Yesterday as part of reporting better than expected February quarter results and reaffirming it full year guidance, McCormick reshuffled EPS expectations for the balance of the year. The company cut expectations for the current quarter due to continued currency headwinds, a higher than usual tax rate and ramping marketing costs for newer products.

As we expected, MKC shares came under some pressure yesterday, but held off reaching the $95 level at which we’d be more inclined to scale into the position. Also as expected, the double-digit earnings growth in the back half of the year was a central topic on the earnings conference call. Our confidence in the company’s ability to deliver centers on its ability to extract price increase outside of the US later this quarter that will have a full impact in the back half of the year following US price increase in January as well headway on its $100 million in targeted cost savings and additional share buybacks.

- Looking at the bigger picture, consumers continue to eschew restaurants and are shifting their palates to healthier meals, all of which plays into McCormick’s hands.

- Our price target on the shares is $110, which offers just under 12 percent upside from current levels.

- Again, we’d be more inclined to scale into the shares closer to $95.

Nuance Communications (NUAN)

Disruptive Technology

Nuance shares were rose more than 1 percent over the last week and year to date are up more than 13 percent. As the shares moved higher, we continued to get more proof points for voice digital assistants from Marriott (MAR), which is testing Apple’s (AAPL) Siri and Amazon’s Alexa technology to decide which it will use to control devices in its hotel rooms. Also too, Starbucks (SBUX) now allows for mobile orders via Ford (F) vehicles equipped with its SYNC3 voice-activated technology as well as Amazon’s Echo devices.

While we tend to focus on home and car voice applications, we’d remind you that healthcare is a burgeoning market for voice digital assistants and plays into Nuance’s strengths, as does mobile. We view the growing adoption and deployment of VDAs in other applications (smartphone, auto, home, etc.) lending credence to Tractica’s forecast for unique active consumer VDA users to grow from 390 million in 2015 to a whopping 1.8 billion worldwide by the end of 2021. During the same period, unique active enterprise VDA users are expected to rise from 155 million to 843 million.

As that market heats up, it isn’t lost on us that Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Samsung and Huawei are likely to acquire voice-technology companies to improve their capabilities in this area. We can also add IBM (IBM) to that list as it moves toward “human-like accuracy” for speech recognition.

- Against that backdrop, our rating on NUAN shares is Buy and our price target continues to be $21

PureFunds ISE Cyber Security ETF (HACK)

Safety & Security

In our view, cyber security should be a part of everyone’s portfolio, especially when we consider that losses from cyber theft, espionage, disruption, and destruction are now spoken of in the trillions of dollars. The global market for cybersecurity, which was only $3.5 billion in 2004, will this year reach $170 billion with the federal government alone will spend $18 billion on cybersecurity. Add these data points to the recent re-introduction of the Developing and Growing the Internet of Things (DIGIT) Act, which shows Congress has estimated that more than 50 billion devices will be connected by 2020, and we are easily reminded that cyber security remains a growth industry.

Our view remains that cybersecurity is a growing issue for individuals, companies and other institutions as connective technologies move past smartphone and other maturing platforms into new areas such as the IoT. The issue is cyber security companies are very much like game console companies — who has the latest offering that is attracting customers? By investing in HACK shares, we get a diversified offering that allows us to catch the rising tide of cyber and related attacks.

- Our price target on HACK shares is $35

Starbucks Corp. (SBUX)

Rise & Fall of the Middle Class

Starbucks recently held its annual shareholder meeting at which new CEO Kevin Johnson reiterated the strategy to create new occasions for customer visits, including its new Starbucks Mercado lunch items. We see this building on the company’s food offering, which to date has largely focused on breakfast items. The company is also looking to capitalize on our Food with Integrity investing theme by bringing a line of iced teas to market this summer that have no artificial flavors or sweeteners, as well as gluten-free and vegan food options. With the gluten-free food market expected to grow at an annual rate of roughly 12 percent through 2021, according to global research group Technavio, as investors we applaud Starbucks move to tap into this tailwind. We’d also add this move with iced teas also confirms our position in International Flavors & Fragrances (IFF) as we’re pretty sure Starbucks and others don’t want to sacrifice taste while making these healthy changes.

Amid all of that, Starbucks continues to expand its global footprint as it continues to play the long game, particular in China where it aims to double its store count to 5,000 by 2021. In sum, these initiatives have the company targeting “annual high-single digit unit growth, mid-single digit same store sales growth and EPS growth of 15 to 20 percent.”

The trick in this continued expansion will be ensuring product quality and the consumer experience as the company grows past its 25,000 plus location footprint. We certainly believe the company has watched McDonald’s (MCD) struggle with these issues across its near 37,0000 restaurant locations across the globe and has learned from those mistakes.

While we continue to monitor the company’s top line growth prospects, we’ll also be watching key cost inputs like coffee, which is up 9.7 percent year over year, as well as those for milk (up roughly 7 percent year over year), wheat and other key ingredients. When faced with sustained cost increases Starbucks has tended to implement modest hikes, and while we’ve not heard of any such increases thus far in 2017, we’ll be keeping our ears open. While painful for consumers, these price increases tend to benefit margins when coffee, milk and other input costs fall.

- Our price target on SBUX shares remains $74, which offers 29 percent upside from current levels even before we factor in the quarterly dividend and keeps the shares in the Buy zone.

United Natural Foods (UNFI)

Foods with Integrity

United Natural Foods is a specialty food distributor, which is benefiting from our Food with Integrity tailwind as consumers increasingly look for non-GMO, natural and organic food products, as well as those tied to other lifestyle choices such as gluten-free and paleo. UNFI shares flip-flopped once again last week falling just under 3 percent, but still remain well above their recent post-earnings lows.

According to a study that was recently published in the Journal of the American Medical Association, diet indeed plays a major role in increasing a person’s risk of dying from heart disease, stroke or diabetes — collectively referred to as “cardio-metabolic killers.” In a nutshell, it suggests that in order to lower the risk of dying from a cardio-metabolic disease, Americans likely have to do more than just eat more healthy foods — they have to eat less unhealthy foods as well. We see this as helping explain the shifting consumer preference toward natural and organic products that should continue to drive organic revenues and faster-growing EBITDA at United Natural as it focuses on cost controls.

- Our price target on UNFI shares is $60.

United Parcel Service (UPS)

Connected Society

Year to date, UPS shares are down more than 7 percent, but are up modestly since we added them to the Tematica Select List in late February. Despite that performance, we continue to favor the shares as the “missing link” in the accelerating shift toward digital commerce. We see this in aggregate each month in the Retail Sales report, but we are also seeing the toll this shift is taking on brick & mortar retailers through a growing combination of store closures and bankruptcies. As those retailers grapple with that shifting landscape, a growing number of them are focusing on direct to consumer via online and mobile platforms, which means more packages needing to be shipped to more people that buying more products online. The bottom line is those packages still need to get to the buyers or the intended recipients, which bodes well for UPS shares. From time to time, there UPS shares get knocked around on chatter than Amazon (AMZN) is building its own logistics business, but that is related to its Fulfilled By Amazon offering and the need to compress shipping as Amazon offers more products under its Prime umbrella. We rather doubt that Amazon is interested in fully replicating UPS’s entire hub and spoke delivery system far and wide across the country.

Given the magnitude of this shopping transformation, we will continue to be patient with UPS shares, especially when there is a holiday shopping lull.

- Our price target remains $122, which keeps the shares with a Buy rating.

- As we are being patient, we’ll be more than happy to collect the current $0.83 per share quarterly dividend, which offers a dividend yield of 3.2 percent at the current share price, and helps support the share price.

Universal Display (OLED)

Disruptive Technologies

Shares of this materials and IP licensing company that serves the organic light emitting diode (OLED) display industry climbed nearly 4 percent over the last week, bringing our return to 60 percent since last October. Currently, OLED industry capacity is limited, but adoption by Apple (AAPL) and other smartphone manufacturers, TV vendors and the automotive industry is leading to a pronounced pick-up in this area, which bodes well for Universal’s materials and intellectual property business over the coming quarters. The biggest risk with Universal Display, in our view, is timing associated with new industry capacity coming on stream. Given, however, that our time horizon spans the next few years we are inclined to be patient investors with OLED shares.

- Our price target is $100, which offers sufficient upside from current levels to warrant a Buy rating.

Walt Disney (DIS)

Content is King

Disney shares rose just shy of 1 percent last week, bringing the year-to-date return to more than 8 percent and leaving roughly 10 percent upside to our $125 price target. There were two key pieces of news last week, the first of which was the record box office performance of Beauty and the Beast last weekend. We see this offering a number of positives for Disney’s other businesses, just the way Star Wars, Marvel and Pixar films have in the past and should in the coming months.

Also last week was the news over the extension of Chairman & CEO Bog Iger’s contract to July 2019, which should quell concerns over management succession planning at least for the near term. While the bears are likely to pick at ESPN, the reality is we are now in spring break season, which bodes well for Disney’s park business.

As a reminder, Disney recently announced it was boosting ticket prices, which we may cringe at as consumers, but love as shareholders. Combined with leveraging its Frozen and Star Wars content at the parks over the coming years, we see Disney providing new reasons to revisit these destinations.

As we move past March and April, the next catalyst we see for the shares will be several box office films being released by Disney — Guardians of the Galaxy 2 (May 5), Pirates of the Caribbean: Dead Men Tell No Tales (May 26), Cars 3 (June 16) and Spider-Man: Homecoming (July 7). Those rapid fire releases, likely bode well for this Content is King company across several of its businesses in the second half of 2017.

- Our price target on DIS shares remains $125.