Weekly Issue: Amid Impeachment Noise, Adding V Shares to Select List

Key points inside this issue

- We are adding shares of Visa (V) to the Tematica Select List with a $200 price target as part of our Digital Lifestyle investing theme.

- We are adding to Living the Life Thematic Leader Farfetch Ltd. (FTCH) at current levels; our price target remains $16

- We remain bullish on shares of Thematic King Amazon (AMZN) heading into the holiday season, and subscribers that are underweight AMZN should be buyers at current levels. Our price target remains $2,250.

Visa: Where we want to be for more than just the holidays

We are using the recent pullback in Visa (V) shares to add them to the Tematica Select List as part of our Digital Lifestyle investing theme given the accelerating shift to digital commerce as well as the movement away from cash and check usage.

While most tend to think of online and mobile shopping when it comes to digital commerce, we also are seeing increases in online grocery, ridesharing and ride services, digital forms of payment for metros and subways, and other changes in spending that require a debit or credit card. And while this may come as a surprise to some, roughly $17 trillion of payments were conducted in cash and by check in 2018.

To me, that means there is ample room for growth ahead and transaction share gains ahead to be had. Unlike American Express (AXP), Visa also stands to be an indirect beneficiary from consumers looking to stretch their spending dollars by shifting their payments to credit from debit or charge cards that must be paid in full. In other words, our Middle Class Squeeze investing theme. Also unlike banks such as Bank of America (BAC), Wells Fargo (WFC) and other credit card issuers, Visa is paid for each transaction and is far less susceptible by rising credit card delinquencies. Moreover, if consumers shift to debit cards, those transactions still have to be processed over a payment network.

Visa’s global scale and reach are made possible by a network of more than 15,900 financial institution clients that issue Visa-branded products. During fiscal 2018, Visa’s total payments and cash volume grew to $11.2 trillion and more than 3.3 billion cards were available worldwide to be used at nearly 54 million business and merchant locations that span over 160 currencies. For that entire fiscal year, Visa processed 124.3 billion transactions, and through the first half of 2019 those transaction volumes are up more than 11% as its install base of cards has continued to grow. As that install base grows and more physical card swipes, chip insertions and online or mobile ordering take place, Visa’s processing volumes grow.

With operating margins of more than 60%, Visa’s incremental margins on each transaction are significant. This has allowed the company to drive robust earnings growth and cash flow, all while continuing to invest in its payment network and layer on security in today’s increasingly cyber-conscious world. That cash flow has also allowed Visa to increase its quarterly dividend to the current $0.25 per share, up from $0.14 per share in late 2015, as well as fund its share repurchase program. Visa has been an active repurchase of its shares, scooping up almost 44 million shares valued at $6.5 billion. That compares to $8.7 billion in cash generated from operations over the same period. Exiting the June 2019 quarter Visa still had $6.2 billion under its current buyback authorization and $8.8 billion in cash and equivalents on its balance sheet.

And let’s not forget about holiday shopping…

While there is an ongoing shift toward non-cash, non-check transactions, there is also the seasonal nature of shopping and consumer spending that tends to rise during the year-end holidays. More transaction volume means more revenue, profits and cash flow for Visa during this time period. To that, we can add the steady year-over-year climb in online and mobile shopping as it has continued to take wallet share during the holiday shopping season. And yes, it is expected to happen once again this year. According to a new online survey from The Harris Poll and ad exchange network OpenX, shoppers are not only expected to spend more year over year but spend more digitally. Per the survey’s findings consumer expect to increase their holiday shopping by 5% more this year with 53% of their holiday shopping to be done digitally.

These transactional shifts in how consumers around the globe are spending have enabled Visa to grow its earnings on a steady basis. Even during the financial crisis, Visa continued to grow its revenues, which in our view is evidence of the power behind those structural shifts. Over the last several years, Visa has been growing its annual EPS at a double-digit clip, with prospects for that rate to continue this year and next. By applying a price-to-earnings-to-growth (PEG) multiple of 2.0 to expected EPS growth of 16% in the coming year, where the consensus EPS forecast is $6.27 for 2020, we derive our $200 price target. That offers roughly X% upside from current levels. My recommendation would be to add to the shares at better prices, but even so, we’ll get started on this as the consumer get ready to begin shopping for not only the approaching year-end holiday season but also Halloween and Thanksgiving as well.

- We are adding shares of Visa (V) to the Tematica Select List with a $200 price target as part of our Digital Lifestyle investing theme.

Adding to Living the Life Thematic Leader Farfetch Ltd. shares

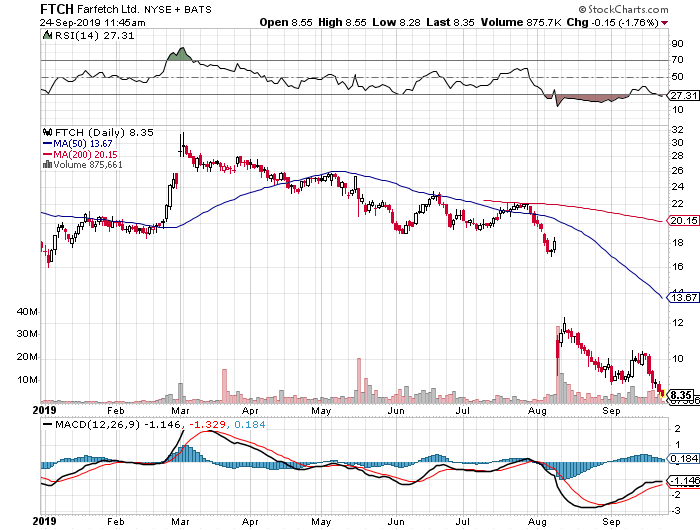

Since we added shares of Farfetch Ltd. (FTCH) to the Thematic Leader board for out Living the Life investment theme, the shares have come under pressure and have entered oversold territory.

This likely has to do with the financing for Farfetch’s New Guard acquisition that will tally $675 million and be equally between cash and stock. We’ll take it as an opportunity to improve our cost basis as we get ready to move into the year-end shopping season, which as noted above will rise nicely year over year and favor digital platforms like Thematic King Amazon (AMZN) and Farfetch.

- We are adding to Living the Life Thematic Leader Farfetch Ltd. (FTCH) at current levels; our price target remains $16

- We remain bullish on shares of Thematic King Amazon (AMZN) heading into the holiday season, and subscribers that are underweight AMZN should be buyers at current levels. Our price target remains $2,250.