Adding defensive measures as earnings season brings back volatility

DOWNLOAD THIS WEEK’S ISSUE

The full content of Tematica Investing is below; however downloading the full issue provides detailed performance tables and charts.Click here to download.

Our Thoughts on Connected Society Company

Apple’s “Record” Earnings

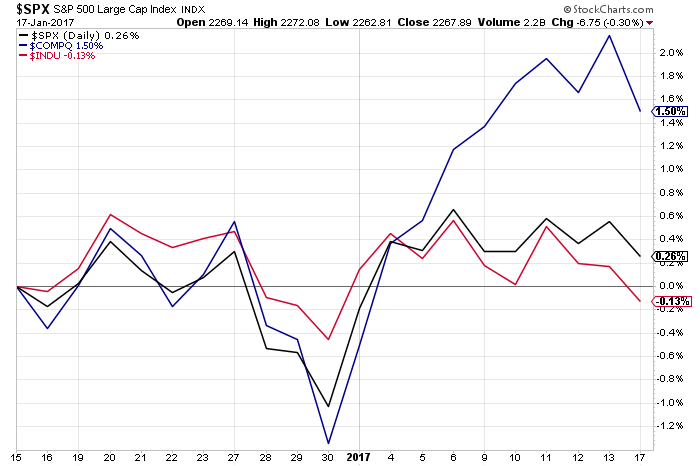

We wish we could say it’s been a quiet week since our last issue of Tematica Investing, a smooth sailing one in fact, but thanks to the growing political drama coming out of the new White House and a pick up in the velocity of earnings reports this week, the only word we can use to describe it is “frenetic.”

Last night I was a guest on CGTN America to discuss Apple’s (AAPL) quarterly results. The long and short of it is that while Apple CEO Tim Cook called it a record quarter, the reality is the iPhone still accounts for 70 percent of Apple’s overall business. While Cook boasted of strong Apple Watch growth, iPhone shipments were up 5 percent year over year, hardly the robust growth levels we’ve seen in the past.

Meanwhile, the Mac business — the next largest business line next to the iPhone — saw volumes rise 1 percent year over year, while iPad units fell 19 percent compared to the year-ago quarter. If Apple didn’t flex its cash position, which now sits at $246 billion, to buy back stock during the quarter, reported earnings would have been flat year over year.

To us here at Tematica this means until Apple can bring to market a new product, or reenergize an existing one that can jumpstart growth, the company will be tied to the iPhone upgrade cycle. Expectations for the next iteration, the presumed iPhone 8, call for a new body, new display — hence our position in Disruptive Technology company Universal Display (OLED) — and a greater use of capacitive touch that should eliminate the current home button. But we’ll have to see if this new model on the 10thanniversary of the transformative device’s launch will capture the hearts of customers, as the last couple of models have only had a meh response.

Despite Apple’s current reliance on the iPhone, there are hopeful signs in other areas, such as the new AirPods that echo past design glory, an Apple TV business that has 150 million active subscriptions and a growing services business. We’ll continue to keep tabs on this poster child company for our Connected Society company, but with no evident catalyst over the coming months, we’re inclined to sit patiently on the sidelines and pick off the AAPL shares at better prices.

In the meantime, our position in Universal Display (OLED), up 24 percent since initiating the position in October, gives us exposure to any Apple upside as the rumors persist it will integrate the OLED technology into the iPhone 8. As we often like to say — even though it’s somewhat politically incorrect in today’s hyper-sensitive world — “it’s better to buy the bullets, not the gun.”

- Until there is more confirmation of the integation of OLED’s into the next iPhone, or another thematic tailwind reveals itself, we are maintaining a Hold rating on Universal Display (OLED) as the current price of $66 per share is close to our $68 per share target.

Confirming Thematic Data Points From Earnings Reports and Other Sources

While we are not buyers of Apple shares just quite yet, there was a number of confirming thematic data points shared during the company’s earnings conference call last night:

- Rise & Fall of the Middle Class — “The middle class is growing in places like China, India, Brazil, but certainly, the strong dollar doesn’t help us.”

- Cashless Consumption — “Transaction volume was up over 500% year over year as we expanded to four new countries, including Japan, Russia, New Zealand, and Spain, bringing us into a total of 13 markets. Apple Pay on the Web is delivering our partners great results. Nearly 2 million small businesses are accepting invoice payments with Apply Pay through Intuit QuickBooks Online, FreshBooks, and other billing partners. And beginning this quarter, Comcast customers can pay their monthly bill in a single touch with Apple Pay.”

- Content is King — “In terms of original content, we have put our toe in the water with doing some original content for Apple Music, and that will be rolling out through the year. We are learning from that, and we’ll go from there. The way that we participate in the changes that are going on in the media industry that I fully expect to accelerate from the cable bundle beginning to break down is, one, we started the new Apple TV a year ago, and we’re pleased with how that platform has come along. We have more things planned for it but it’s come a long way in a year, and it gives us a clear platform to build off of… with our toe in the water, we’re learning a lot about the original content business and thinking about ways that we could play at that.”

- Connected Society — “every major automaker is committed to supporting CarPlay with over 200 different models announced, including five of the top 10 selling models in the United States. “

Aside from Apple, there has been no shortage of thematic data points buried in earnings reports over the last few days. Even though we cut Under Armour (UAA) from the Tematica Select List yesterday, we’d note its Direct to Consumer business, which reflects its online and mobile shopping efforts, rose 26 percent year over year in the December quarter. H&M Stores has announced it will slow its physical store openings and instead focus more of its efforts online. Both confirming data points for our Connected Society investment theme.

Shifting gears somewhat, a new study from the Food Marketing Institute and Nielsen projects online grocery sales in the U.S. could grow tremendously in the next decade. By 2025, the report suggests that American consumers could be spending upwards of $100 billion on online grocery purchases, comprising some 20 percent of the total market share. Currently, 23% of US consumers purchase groceries through digital channels.

Confirming the accelerating shift toward digital shopping that is a hallmark of our Connected Society investing theme, during the December quarter United Parcel Service (UPS) saw its domestic average daily volumes rose 5% year over year with International domestic growth up more than 20% in Asia and 10% across the Eurozone. Noting the strong growth in Asia, we’d say it likely reflects the Rise aspects of our Rise & Fall of the Middle-Class thematic.

We expect to hear much more on the accelerating shift toward digital shopping when Amazon (AMZN) reports its quarterly earnings tomorrow (Feb. 2).

Getting back to Cashless Consumption, Juniper Research now expects $1.35 trillion to be spent worldwide through mobile wallets by the end of 2017. The nearly 30 percent increase over 2016 spending will be due to users in the Far East and China through Alipay and WeChat while Westerners continue to embrace mobile wallets from Apple Pay, MasterCard (MA) and PayPal.

Turning to our Fattening of the Population theme:

- McDonald’s (MCD) is deploying Big Mac vending machines… yes, we know what you’re thinking and there is no way we could make something like that up.

- Civil servants in the UK have been warned that bringing cake into work for birthdays and celebrations could be a “public health hazard”. The Faculty of Dental Surgery at the Royal College of Surgeons (RCS) warned that in large offices, sweets and cakes have become a daily occurrence and the growing trend is contributing to poor oral health and the obesity epidemic. (There is a “bad teeth” joke somewhere in there, but for once we’ll take a pass on that one) On a serious note, sadly it seems that yes, despite what we may like to think, too much a good thing may not be good for us.

Hey Alexa, Order My Starbucks

Our most recent addition to the Tematica Select List was Disruptive Technologycompany Nuance Communications (NUAN) given the explosive growth that is expected in voice digital assistants over the coming years. We know that Starbucks (SBUX) has been an early adopter of technology that allows customers to pay and order ahead online with the Starbucks app. Starbucks Mobile Order & Pay currently accounts for more than 7 percent of transactions in US company-operated stores. Building on that, Starbucks has launched My Starbucks Barista, a voice-activated “barista” baked into the company’s existing iOS mobile app that uses artificial intelligence. Currently in beta testing, My Starbucks Barista will be available to 1,000 select US customers initially, with a planned rollout through summer 2017 and an Android version to follow.

As we pointed out when we added NUAN shares to the Tematica Select List, Amazon’s Echo technology is leading the way, and the same holds with Starbucks. Select customers can now use Amazon’s Alexa to order “on command” and the ability to recall and repeat past favorite drinks is also included. Customers simply need to say “Alexa, order my Starbucks” from wherever they have an Alexa device.

As with My Starbucks Barista, we expect Starbucks will deploy this across more Echo devices in the coming months. What it means is more people adopting the use of voice technology, and we find that very bullish for our NUAN shares.

- We continue to rate NUAN shares a Buy with a $21 price target, as well as Guilty Pleasure company Starbucks (SBUX) with a price target of $74.

Beholden to the All-Mighty Buck

Finally, one recurring standout this earnings season is the impact of currency given the dollar’s strength during 4Q 2016. We’ve heard it from Buy-rated McCormick & Co. (MKC), United Parcel Service (UPS) and others, but it was Apple that really hammered the point home. In the earnings call last night, Apple said, “we expect foreign exchange to be a major negative as we move from the December to the March quarter.” Not exactly a surprise, given that 60 percent of its revenue is from outside the US.

Housekeeping at the House of Mouse

While The Walt Disney Company (DIS) will not report its December quarter results until February 7, we’re boosting our protective stop loss on the shares to $101.50 from $87. Currently, we’re up 10 percent% on a blended basis with the shares and while we are enjoying that nice return, after languishing in the red for a while on the positions we are aware of how volatile earnings season can be. This move in the stop loss should prevent any losses in the Disney position on the Tematica Select List.

Why $101.50? Because our blended buy-in price is $101.50.

Even as we reset this stop loss level, we remain bullish on Disney shares given the slate of Marvel, Pixar and Star Wars films that will hit theaters in coming quarters. We are also encouraged by Disney’s other moves to spread the content wealth across its licensing and parks businesses as well as its exploration of streaming alternatives for ESPN.

- As we boost our protective stop-loss on DIS to $101.50, our price target for the shares remains $125

Setting a Stop Loss on Facebook (FB) Shares

We’ve come to appreciate the volatile nature of corporate earnings season and we’re starting to see that once again these last few days. While we continue to see Facebook (FB) benefitting from its monetization efforts across its various social media platforms as advertisers embrace digital over radio, print and broadcast, we’ve noticed a something that could be a near-term issue. Over the last several weeks, we’ve noticed a shift toward people curbing their Facebook usage due to a growing sense of political outrage complete with over the top comments. This has prompted some to start referring to Facebook as “Hatebook”.

Our concern is all of this could lead to a softer short-term outlook than most might be expecting for the current quarter.

- As such, we’re going to install a protective stop loss at $112 for our FB shares. Better to be prudent ahead of time, than sorry later is our thinking.

DOWNLOAD THIS WEEK’S ISSUE

The full content of Tematica Investing is above; however downloading the full issue provides detailed performance tables and charts. Click here to download.