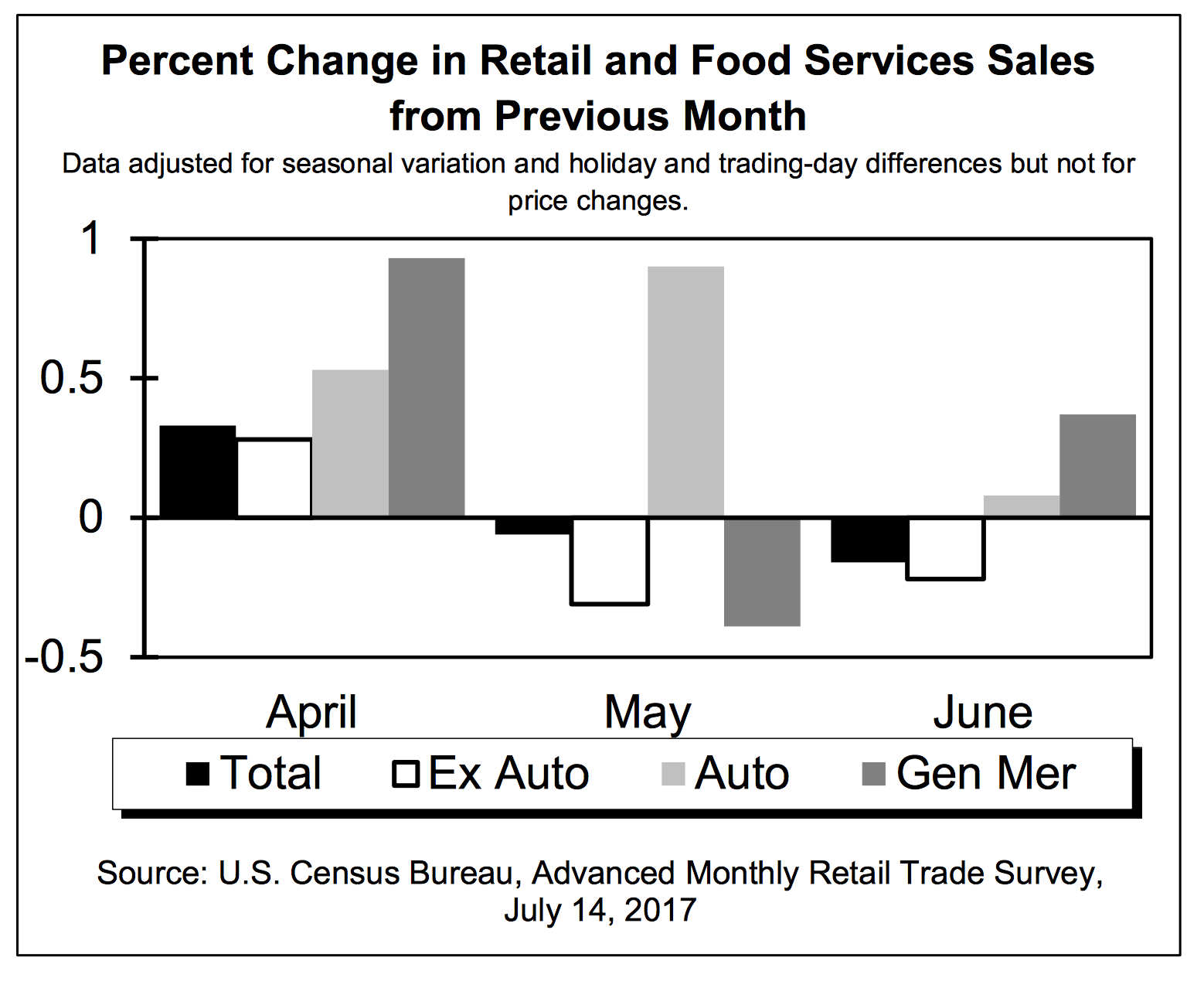

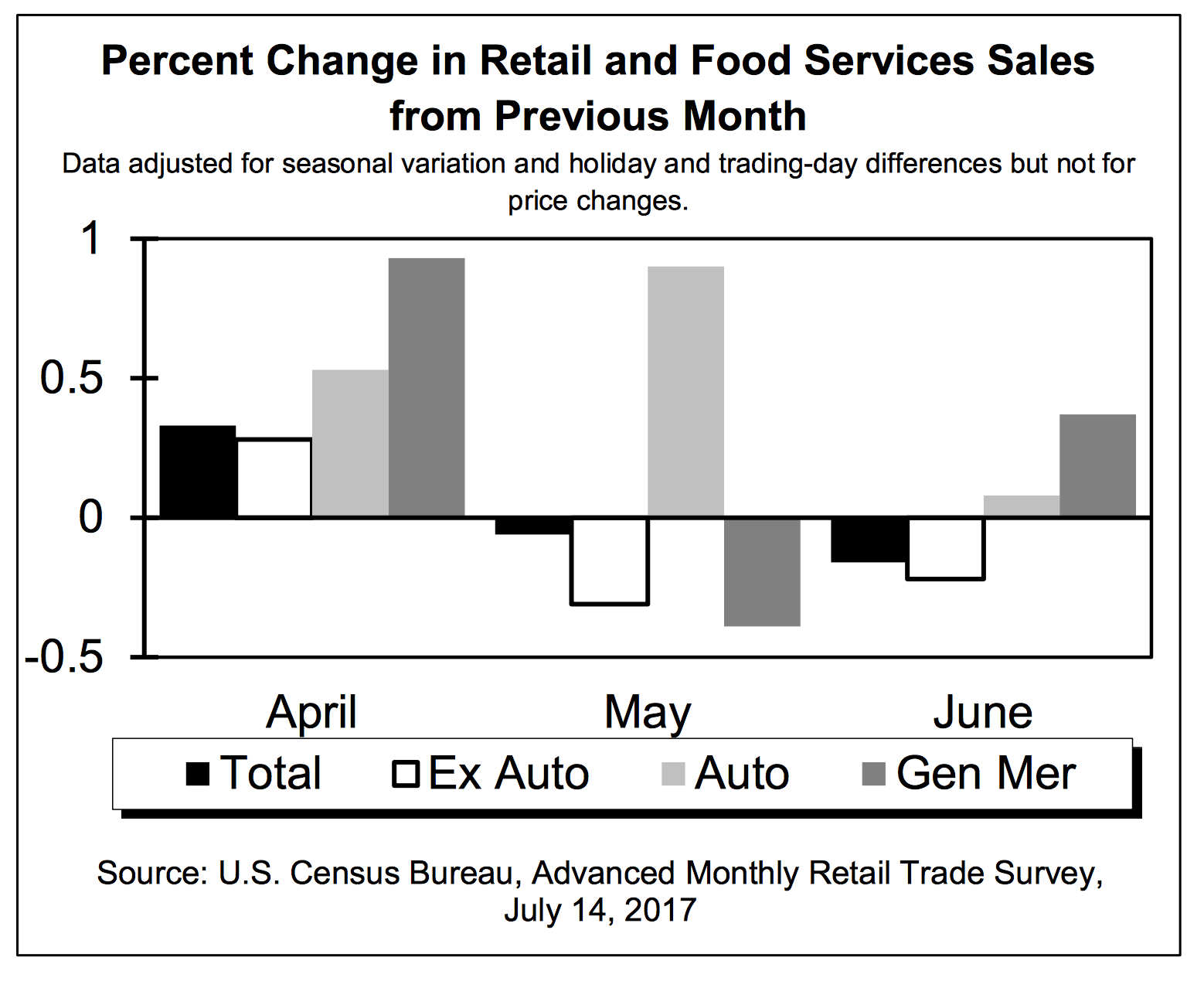

Last week we received the disappointing June Retail Sales report, which pointed to another step down in GDP expectations for the second quarter as well as the ongoing pain for brick & mortar retailers, especially department stores like Macy’s (M), JC Penney (JCP) and the like.

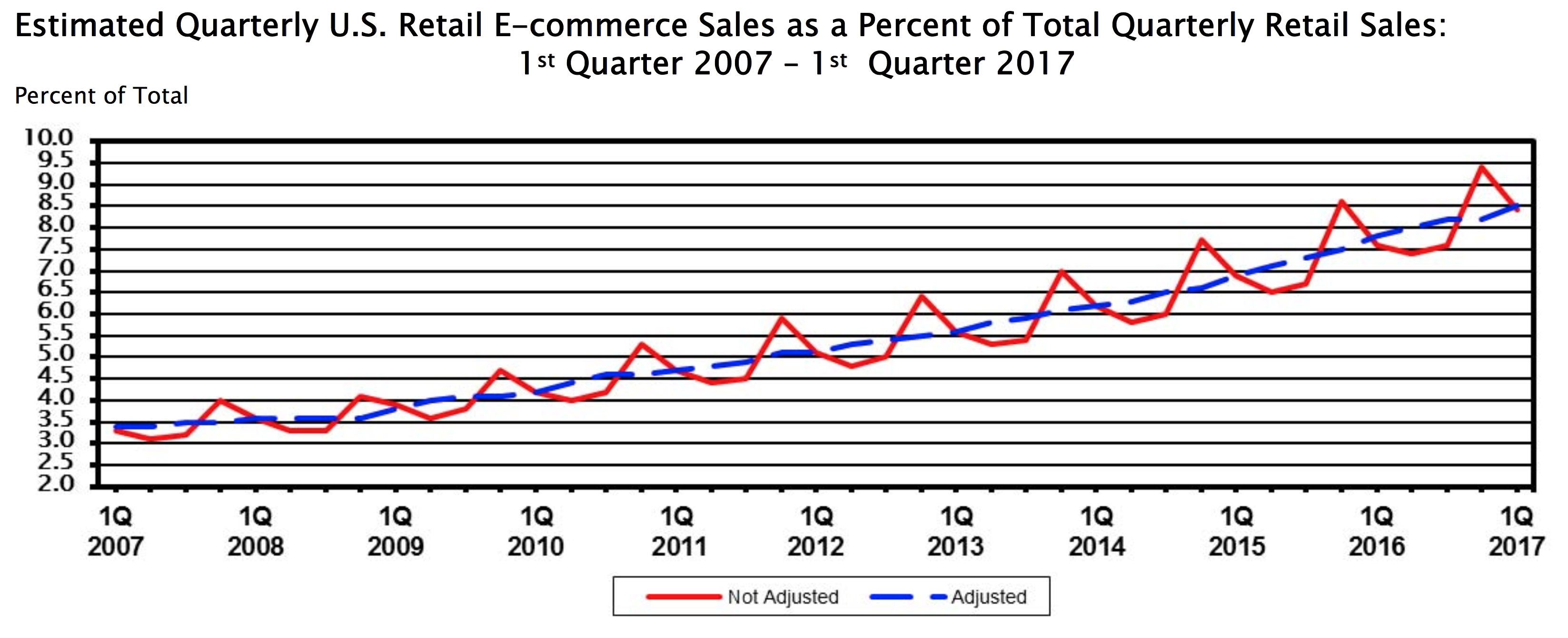

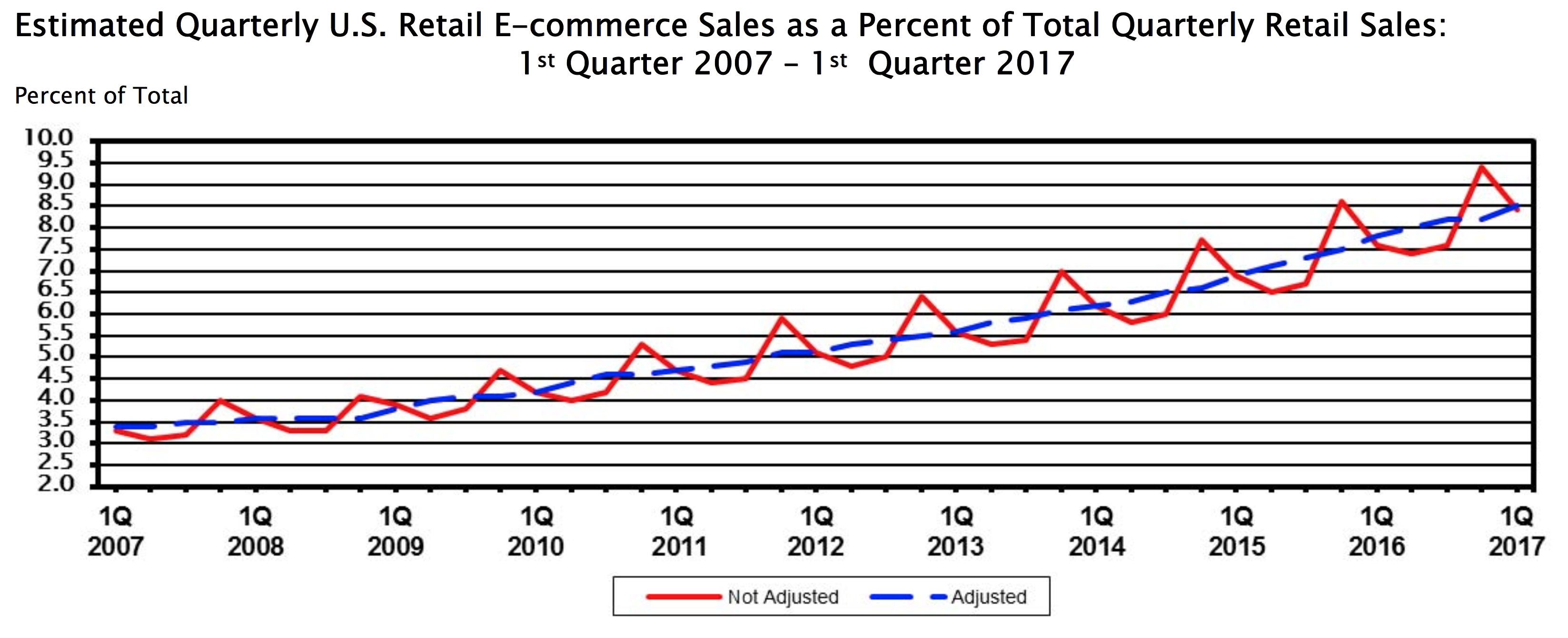

Digging into the June retail sales report, we noticed month-over-month declines almost across the board, but one of the larger declines was in… you guessed it.. department stores, which fell 3.9 percent year over year. By comparison, Nonstore retailers (code for e-tailers), like Amazon (AMZN), rose 9.7 percent year over year.

We’d also note the June retail sales report caps the second-quarter data and, in tallying the three months, nonstore retailer sales rose more than 10 percent year over year. On the other hand department stores fell more than 3 percent, while the sporting goods, hobby, book and music store category dropped nearly 6 percent year over year. Keep in mind that Nike (NKE) only recently partnered with Amazon to leverage its second to none logistics as Nike looks to reduce its reliance on third party retailers such as Foot Locker (FL) and grow its higher margin Direct to Consumer business. Yet another reason to expect declining mall traffic in the coming months especially if more branded apparel companies look to partner with Amazon… and yes, we expect that to happen.

This week, Amazon sent more than a flare across the bow of newly public meal kit company Blue Apron (APRN) and took one step deeper into expanding its food focused efforts. As they’ve become public, recent trademark filings reveal Amazon is looking to attack the growing meal kit business and has trademarked “We do the prep. You be the chef,” “We prep. You cook” and “No-line meal kits.”

Looking into the filings, the described service offering tied to these trademarks is “Prepared food kits composed of meat, poultry, fish, seafood, fruit and/or and vegetables and also including sauces or seasonings, ready for cooking and assembly as a meal; Frozen, prepared, and packaged meals consisting of meat, poultry, fish, seafood, fruit and/or vegetables; fruit salads and vegetable salads; soups and preparations for making soups.”

As we said above, it sure looks like Amazon is looking to leverage its growing presence in food, and our Food with Integrity investing theme, to capitalize on the growing meal kit business that led Blue Apron to go public. Looking back over the last few years, we see this as a natural extension of its food efforts that began in 2013 with the launch of Amazon Fresh for groceries followed by Amazon Restaurants for restaurant delivery in 2014. Of course, the pending acquisition of Whole Foods (WFM) is the key ingredient (see what we did there) to rounding out its position in the meal kit business and tap the $800 billion grocery opportunity.

As we said above, it sure looks like Amazon is looking to leverage its growing presence in food, and our Food with Integrity investing theme, to capitalize on the growing meal kit business that led Blue Apron to go public. Looking back over the last few years, we see this as a natural extension of its food efforts that began in 2013 with the launch of Amazon Fresh for groceries followed by Amazon Restaurants for restaurant delivery in 2014. Of course, the pending acquisition of Whole Foods (WFM) is the key ingredient (see what we did there) to rounding out its position in the meal kit business and tap the $800 billion grocery opportunity.

This announcement, paired with others that include Amazon’s move into the apparel industry, bolsters its already strong position for the quarters to come. Now for a word of caution – of late it seems that Amazon can do no wrong and in our view, this sets up pretty high expectations for the company’s 2Q 2017 earnings and the outlook for the second half of 2017, which includes Back to School, and holiday shopping.

One of the few places the herd gets tripped up with Amazon is on the cost side of the equation, particularly when it comes to investing for future growth. Given the number of initiatives Amazon has in place, we think there is a meaningful probability that Amazon boosts its investment spending near-term for these newer initiatives as it has done in the past when it reports its quarterly results on July 27. If we’re right, it could lead to a pullback in the shares especially since Amazon tends to be rather tight lipped when it comes to details on its earnings conference calls. We would look to scale into AMZN shares between $820-$870, roughly a 15-20 percent drop from current levels, which tends to be the range that high profile stocks like Amazon get hit if they come up short on earnings or guidance.

- We continue to see Amazon as a long-term wallet share gainer as it continues to expand its umbrella of service offerings and geographic footprint, while benefitting from the adoption of its high margin cloud business.

- Our price target remains $1,150.