Tax Reform, Debt Ceiling, Government Shut Down & Amazon’s Latest Move

Tax Reform, the Debt Ceiling, a Government Shut Down and

Amazon’s Latest Move

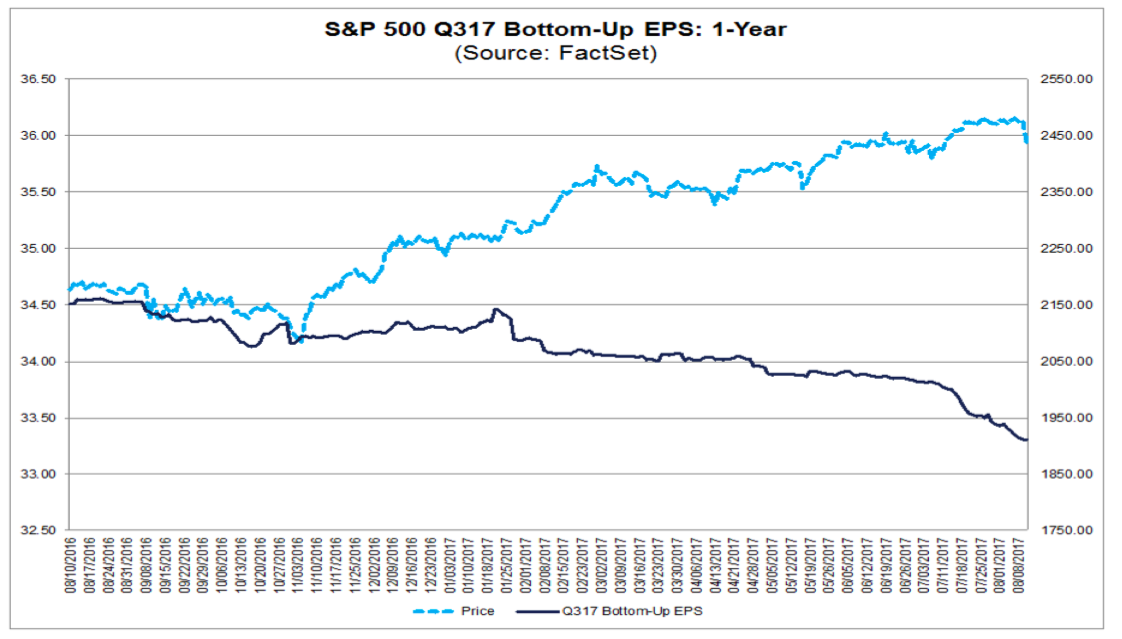

As we look back at the events and data that unfolded last week, what we come away with is the continued unfolding of evidence that we are facing a slower than previously thought economy, with political uncertainty running at an all-time high, all as we head into September, one of the most tumultuous months for stocks. As we’ve long suspected, earnings expectations for the second half of the year are coming down, and in our view, once investors and businesses are back to work after the Labor Day holiday, upcoming investor conferences will set the tone of the market for the coming months.

Meanwhile, thematic investing poster child Amazon (AMZN) lifted the covers off of what it will do once the acquisition of Whole Foods Market (WFM) closes this week. While we are certainly excited about what Amazon has in store for Whole Foods’ shoppers, we doubt Kroger (KR) and other grocery chains share that same excitement. We suspect this pairing will soon lead to investors shifting their view from “death of the mall” to “death of the grocery store.” More fun in retail land, and yes, that was sarcasm.

Recapping the Big News from Last Week

Last week was yet again dominated by drama coming out of Washington, D.C. Barbs involving a government shutdown were tossed around all week like smack talk before a playoff game, while the southern states braced for the impact of Hurricane Harvey. On the other hand, Friday’s speeches from Federal Reserve Chairman Janet Yellen and European Central Bank head Mario Draghi at the central bank’s annual conference in Jackson Hole, Wyoming thankfully offered little in the way of market drama — we’ve got enough going on elsewhere! For those thinking that Yellen would provide some confirmation that the Fed would start its balance sheet unwinding in a few weeks, it was no dice on that front. Hardly a surprise when we look back at this event over the years, which is far more of an economic symposium than a monetary policy platform.

One dark cloud for the market that we have been looking out for did rear its head last week — concern over raising the debt ceiling in the coming weeks. Our position has been that while Congress will eventually act — it really has no choice — the conversation could turn into a political drama as we have several key elections coming up in the coming weeks. Given Trump’s approval ratings, we suspect several candidates will look to distance themselves from the president, and we can’t rule out those inflammatory headlines.

Despite assurances from Treasury Secretary Mnuchin and Senator Mitch McConnell that the debt ceiling will be raised, political saber rattling could be a disruptive force for an increasingly wary stock market in the coming weeks. That includes President Trump’s recent comment that “If we have to close down our government, we’re building that wall.”

On a positive note, last week all three major market indices finished the week higher. That move certainly wasn’t a result of any positive robust economic data, and it came in spite of all the political wrangling we just recapped. Rather one of the drivers behind the market’s upward move was the news that President Trump would begin campaigning around the country this week for tax reform. In an interview with the Financial Times, Gary Cohn, one of Trump’s key economic advisors, laid out the administration’s priorities on tax reform, which includes getting the corporate tax rate “as low as possible” and allowing a one-time repatriation of overseas cash. Interestingly in that interview, Cohn did not reiterate the administration’s promises of a 15% tax rate.

We expect more details to emerge as this week unfolds, which should not only frame Trump’s tax proposal, but also point to the likelihood of the plan getting through Congress. We continue to see corporate tax reform having a far easier time getting passed than individual tax reform.

The Stock Market Thus Far in August

Before we tackle what will be the likely focus for the stock market during this last week of August, let’s first recap what’s happened thus far in August. As of Friday’s close, the S&P 500 broke its 2-week losing streak as the Nasdaq and Russell 2000 did the same for their 4-week streaks. Even so, all the major U.S. equity indices remain in the red for the month of August, with the small cap Russell 2000 index falling the furthest, down 3.6% since August 1st and down 5.0% from its recent highs. Unsurprisingly, given the data that has unfolded over recent months, we’ve seen earnings expectations for the S&P 500 move lower for the current quarter.

While many tend to focus on the S&P 500, given that it’s a key benchmark for many institutional investors, we’d point out that while the Russell 2000 index is up 19% since before the election, forward EPS estimates for the index are now back to where they stood pre-election.

Breadth continues to be a problem, with the S&P 500 cap-weighted index outperforming the equally-weighted S&P, down 1.3% to down 2.1%, respectively during the month. In addition, the S&P 500 failed to close above its 50-day moving average for the third consecutive Friday, making for a rather wobbly domestic equity world.

According to data from Bespoke Research, less than half the Industry Groups in the S&P 500 have rising 50-day moving averages, which is a sharp change from the beginning of the month when 88% were rising and only 29% of Industry Groups today sit above their 50-day moving average.

At Tematica Research, we are all about confirming data points, so the 6.4% outperformance of the Utilities sector over Consumer Discretionary so far in August further supports our concern with current market dynamics. That can be measured by the month-to-date performance of Utilities Selector Sector SPDR ETF (XLU), versus Consumer Direct Select Sector SPDR ETF (XLY). Utilities are one of the strongest sectors year-to-date as well, up 13.5%, and was outperformed only by the Technology Select Sector SPDR ETF (XLK) that was up 19.3% and Healthcare, which was up 14.5%. In contrast, the iShares Transportation Average ETF (IYT), which is generally a good leading economic indicator, has just hit a 9-month low.

What’s the Economic Data Telling Us?

During last week, we saw tepid economic July data points in the form of New Home Sales and Existing Home Sales and Durable Orders, but there was some optimism to be had in the August US Flash Composite PMI this week. Last week we also saw a rather profound decline in the Philadelphia Fed’s 1-month Coincident Economic Activity Index (say that five times fast). That index has declined in 4 of the past 5 months and is now at a level last seen in December 2009, having fallen from 68 in May to 56 in June to 36 in July. Only twice in its history has this index fallen below 36 without a recession following. Those instances came in late 1992 and late 2002, which instead saw near recession level double dips in the economy.

All in all, it was a mixed bag when it comes to GDP expectations for the current quarter. Much like we’ve seen in the last two quarters, as the supporting economic data rolls in we are seeing the Atlanta Fed adjust its GDP expectations for the current quarter lower. On August 3rd, it forecasted 4.0% GDP for 3Q 2017. That has since slipped to the current 3.4% as of today. We’ve also seen the NY Fed reverse course with its 3Q 2017 GDP forecast, which it raised to 2.1% on August 18, only to revise it back to 1.9% at the end of last week, due primarily to weak durable orders. We’ll look to this week’s final August PMI reading from IHS Markit for clues to how business activity faired in August, and what order level suggest lies ahead in September.

Thematic Happenings

Support for our Cash-Strapped Consumer investing theme was easy to find this week. All we had to do was look to mortgage applications for new purchases, which have been declining in 4 of the past 5 weeks, and today are down roughly 50% on an annualized rate. July home sales came in well below expectations, falling 9.4% month-over-month to a 571,000 annual rate versus expectations for 610,000 and are down 8.9% from levels one year ago. This was the steepest decline in home sales on a year-over-year basis since June 2014. We also saw inventory levels rise from 5.2 months to 5.8 months with the number of unsold units rising 16.5%. With the first three weeks in August seeing a 3% decline in mortgage approvals versus July, this trend doesn’t look to be changing course. On the plus side for housing, we will point out that the average price for new homes is up over 7% year-over-year. Overall all three major housing related indicators (FHFA House Price Index, New Home Sales, and Existing Home Sales) were weaker than expected.

Our Cash-Strapped Consumer theme was also evident in Amazon’s (AMZN) announcement that after its acquisition of Whole Foods (WFM) closes on Monday, its first order of business will be to reduce prices. Those reductions will be “…on a selection of best-selling grocery staples across its stores, with more to come.” Price reductions will cover everything from avocados, (music to the ears of guacamole lovers) to organic salmon, organic chicken and even almond butter. Grocers have been struggling this year as downward pricing pressures have been ubiquitous. Amazon’s entrance into this arena in a big way means those pressures are likely only going to intensify.

While some are focused on what the acquisition will do for the Amazon Fresh service, as well as the much-discussed Amazon meal kit business, we see Amazon looking to tap the combined data between the two businesses to goose sales by cross-promoting products, especially for the combined companies’ private-label brands. Think of it this way: If you just watched a Mexican food show on Amazon video, Amazon might point you to deals on avocados and perhaps offer subscriptions for regular deliveries of tortillas and canned beans. Or it might automate a grocery shopping list based on a chosen recipe on your Kindle e-reader.

In our thematic investing language, it’s Connected Society meets Food with Integrity investment themes. Should Amazon deploy sensors in stores like it did in its grocery store test bed in Seattle, it would drive demand for several aspects of our Disruptive Technologies theme.

That’s a game-changer that few will be able to replicate in the near to medium term, and it builds on the accelerating shift toward digital commerce that is powering wallet share gains at the existing Amazon retail business. These realizations and announced price cuts sent competitors’ shares lower. Wal-Mart (WMT) and Costco (COST) certainly fell, however, grocers were by far the hardest hit. Kroger (KR) shares lost nearly 5% in full last week, while shares of Sprouts Farmers Market (SFM) dropped more than 10%.

The Week Ahead

This week we close the 2017 chapter on August and open the one on September. That means we’ll be two-thirds of the way through the current quarter, and moving into one of the more tumultuous months for the stock market. As we’ve shared previously, there are several reasons to think that historical pattern will continue this year, including the completion of US-South Korea military exercises near North Korea, the debt ceiling debate and debut of President Trump’s tax reform plan as well as the potential balance sheet unwinding by the Fed.

From an economic perspective, while last week was a relatively quiet one, this week is going to be a monster with 29 major reports, 12 of which we’ll get on Friday. Yep, it’s the usual “end of one month, start of the next” flow of data. This means the latest figures for Personal Income & Spending and ISM Manufacturing will be coming in, as well as the usual plethora of employment data from the Bureau of Labor Statistics, ADP and other third-party firms.

Over the last few months, personal spending has been looking a bit peaked while the ISM Manufacturing Index has been hovering between 55-57 – still in expansion territory, but hardly robust. We’ll be looking into the August order pattern for the ISM index to get a bead on what September is looking like. Rounding out the week, we’ll receive August auto & truck data for the month; it’s been a weakening environment filled with incentives and bloated inventories, which confirms the tepid consumer spending environment of late.

From a thematic perspective, there are several corporate earnings reports that are on our radar:

- With regard to the build-out of existing wireless and wireline networks, as well as 5G deployments that are key to our Connected Society and Disruptive Technologies themes, we’ll be dialing into results from Dycom Industries (DY). In particular, we’ll be looking for clues as to when 5G networks are poised to move out of beta testing and in to initial rollout, which will be a key stepping point for our Connected Society investing theme.

- We will also be scrutinizing reports from Best Buy (BBY), G-III Apparel (GIII) and Barnes & Noble Education (BNED) to get a bead on Back to School spending, as well as first hints at holiday 2017 shopping expectations.

- With regard to our Guilty Pleasure investment theme, Brown Forman (BF.A) should tell us whether wine and spirits continues to take share from beer demand, something that has been impacting shares of Budweiser (BUD) and Molson Coors (TAP) as well as Boston Beer (SAM).

Investor conference will soon be back on the radar screen in full-force come September. We suspect what is or isn’t said at those confereences will be a key determinant for how the stock market finishes the current quarter. Ahead of that return in force, next week brings the Jefferies 2017 Semiconductor, Hardware & Communications Infrastructure Summit and Conference, the Credit Suisse 2017 European Telecoms Conference, and Drexel Hamilton Telecom, Media, and Technology (TMT) Conference 2017. These three could offer some interesting data points to our Connected Society, Content is King and Disruptive Technologies themes. Investors looking to gauge reactions to these conferences should watch moves in the Vanguard Telecommunications Services ETF (VOX), First Trust Nasdaq Semiconductor ETF (FXTL), iShares STOXX Europe 600 Telecommunications UCITS ETF (EXV2).

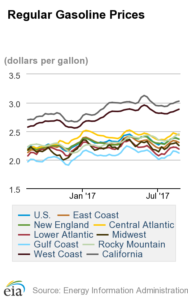

Finally, with regard to our Scarce Resources and Cash-Strapped Consumer investing themes, we’ll be scrutinizing the oil markets reaction to Hurricane Harry this week. Oil prices will be impacted by damage to oil rigs and other operations. Depending on that severity, as well as the potential downtime, we could see gas prices trend even higher compared to 2016 levels at this time of year. As of August 21st, average gas prices across the US were $0.17 per gallon higher year over year. Should gas prices pop higher in the near-term, odds are we could see at least a short-term crimp in consumer spending as well as higher than expected costs for businesses, like FedEx (FDX) and JB Hunt (JBH) to that count gas as a meaningful factor in their cost structure.

Finally, with regard to our Scarce Resources and Cash-Strapped Consumer investing themes, we’ll be scrutinizing the oil markets reaction to Hurricane Harry this week. Oil prices will be impacted by damage to oil rigs and other operations. Depending on that severity, as well as the potential downtime, we could see gas prices trend even higher compared to 2016 levels at this time of year. As of August 21st, average gas prices across the US were $0.17 per gallon higher year over year. Should gas prices pop higher in the near-term, odds are we could see at least a short-term crimp in consumer spending as well as higher than expected costs for businesses, like FedEx (FDX) and JB Hunt (JBH) to that count gas as a meaningful factor in their cost structure.

Despite what is likely to prove to be a seasonally low week in terms of trading volume, we’ll be watching the data, both economic as well as industry and company specific, to chart our next moves with the Tematica Select List. During the week, be sure to catch our latest thoughts and musing at TematicaResearch.com, where we’ll be sharing a number of Thematic Signals as well as the next episode of our podcast, Cocktail Investing.

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.