Tematica’s Take on the February Jobs Report, and What It Means for the Fed and Stocks

This morning the Bureau of Labor Statistics published the February Employment Report. One of the last few indicators economists, market watchers and the Fed will get ahead of next week’s Federal Open Market Committee meeting came in better than expected on several fronts. Over the last few week’s we’ve seen a rising expectation for a March rate hike, but more recently we’ve gotten conflicting signals in a variety of data points. While the February reports for the both the Producer and Consumer Price Indices and Retail Sales will be published early next week, barring any major snafus in those reports the February Employment Report clears the way for the Fed to nudge interest rates higher next week.

The details of the February Employment Report how it stacked up against expectations

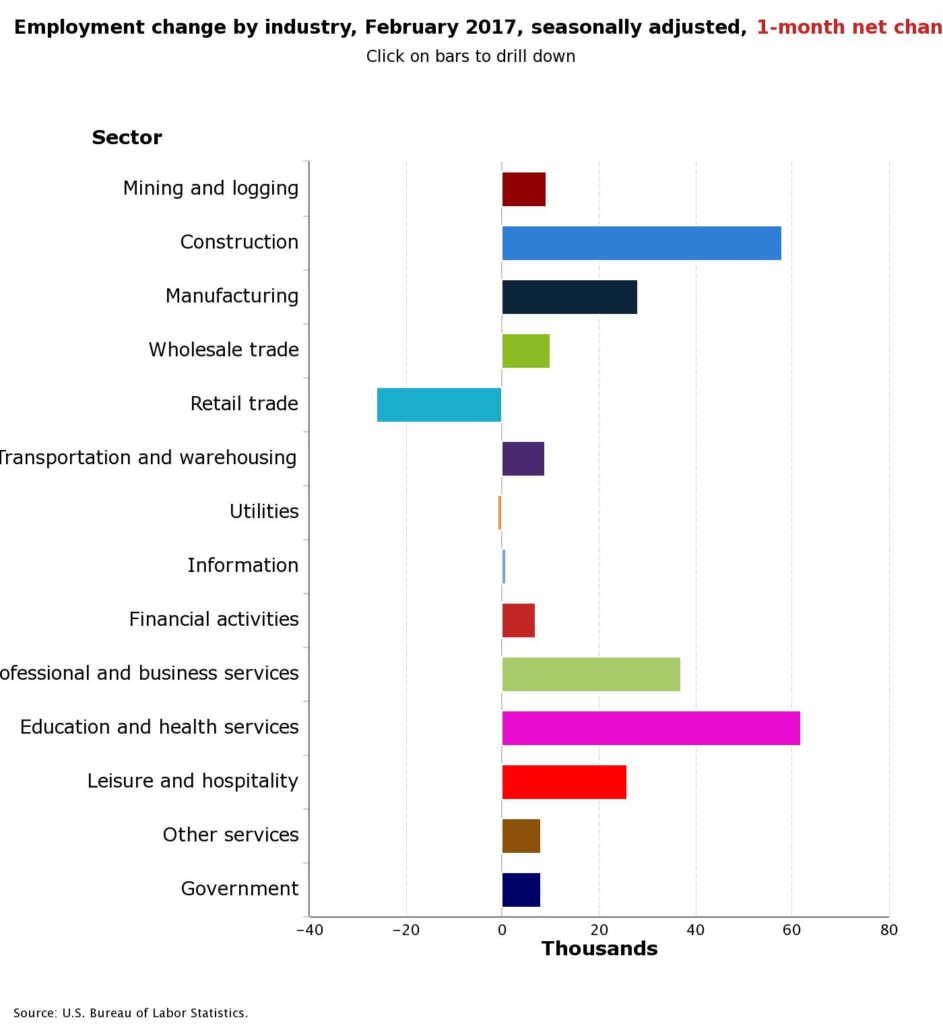

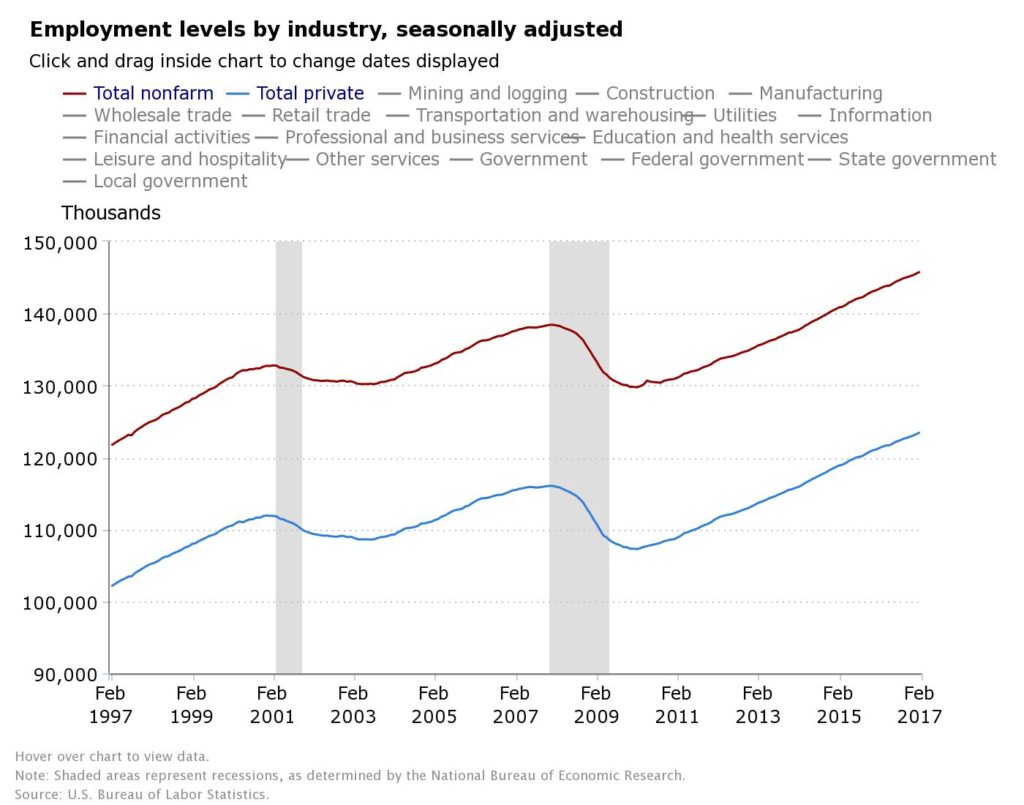

Nonfarm payrolls came in at 235K besting expectations for 190K-200K depending on the source, and the Unemployment rate held steady at 4.7 percent. A nice beat, but job growth slipped month over month compared to the 238K revised number of jobs created in January. Overall payrolls are up around 1.6 percent over the past year as we’ve seen the 12-month trend slowing over the past few years, which is to be expected in the later stages of this cycle. Job gains were reported in in construction, private educational services, manufacturing, health care, and mining, which was offset by job losses in retail.

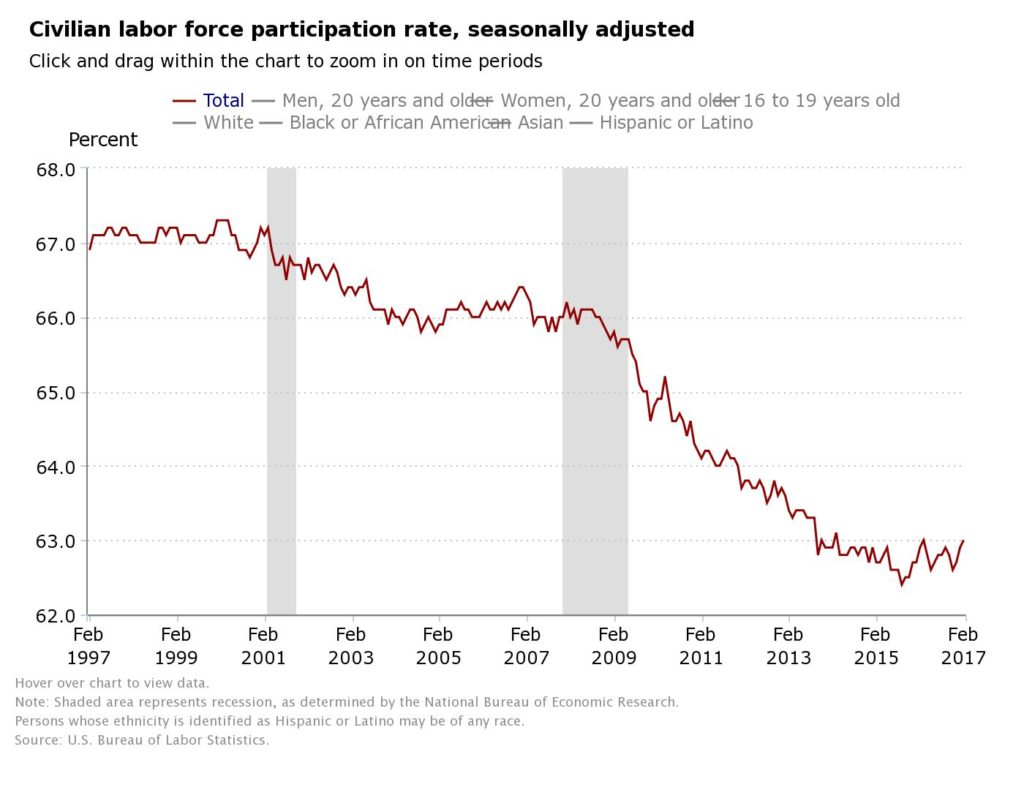

In looking at several other metrics in the report, the Labor Force Participation Ratio edged up a tick month over month to hit 63.0 percent in February and we saw another sequential decline in the Not in Labor Force category. The percent of Americans actually working has reached 60 percent for the first time since 2009. In our view, those metrics are moving in the right direction.

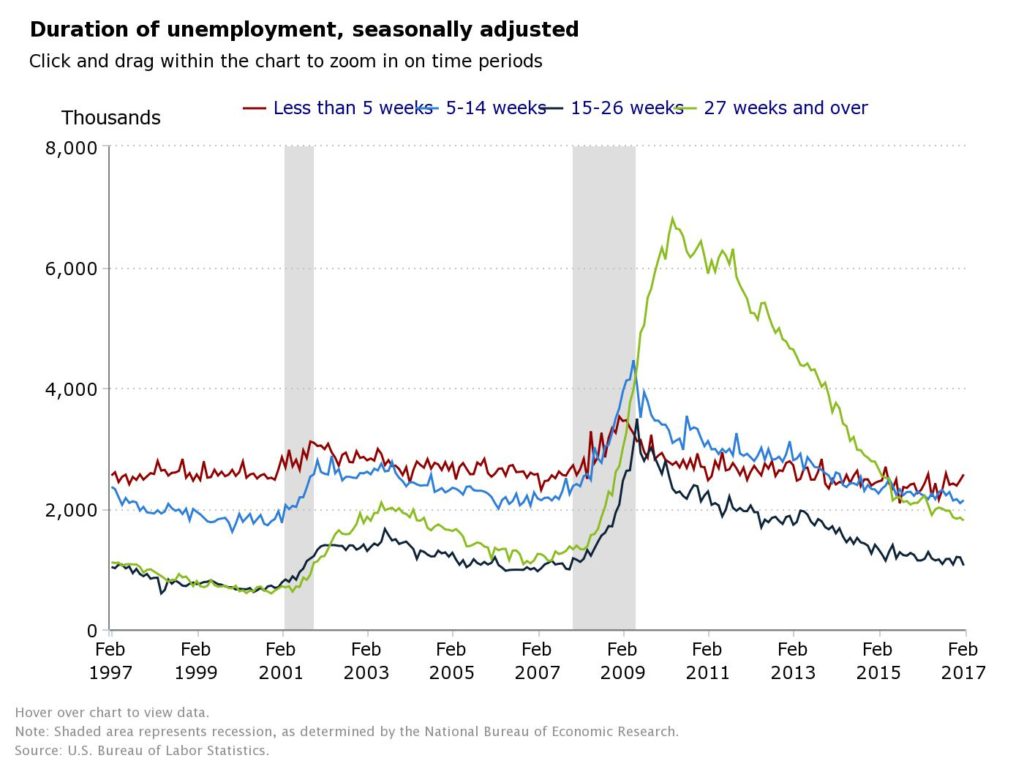

We also like seeing the median duration of unemployment has been continually declining since its peak in 2010. Today that number has dropped to around 10 weeks.

Since the recovery, job growth has been concentrated primarily in lower-paying jobs in sectors such as retail, hospitality, education and food service. Recently we have seen higher-paying sectors such as manufacturing and construction posting material gains. While every sector outside of retail and utilities experienced gains, manufacturing grew 28,000, the largest increase in that sector since August 2013. Construction also surged by 58,000 jobs which was the biggest gain since March 2007 and has now added 177,000 to payroll in the past six months, a likely positive sign for housing.

If we were to pick one fly in the jobs report ointment it would be the sharp increase in the number of people with multiple jobs, which climbed to 5.3 percent of total employed, up from 5.0 percent a year ago. To us, this signals that more people are under the gun when it comes to helping make ends meet due to higher health care costs, soaring student debt levels or the need to boost savings levels, especially for retirement. From a thematic perspective, we see the pick up in multiple jobholders as a confirming data point for our Cash-strapped Consumer investing theme. More about that in a few paragraphs.

So what do all these employment “tea leaves” tell us about what the Fed might be thinking?

As Team Tematica discussed on this week’s Cocktail Investing Podcast, retail job losses were anticipated given the growing number of store closing announcements over the last several weeks from the likes of Macy’s (M), Kohl’s (KSS), JC Penney (JCP), hhgregg (HGG), Crocs (CROX) and others. All of these companies are contending with the downside of our increasingly Connected Society that has consumers increasingly shifting toward digital shopping. Given the relatively mild winter weather, the pick up in construction work likely bodes well for the housing market, which is one we keep tabs on as part of our Rise & Fall of the Middle Class investing theme. From an exchange traded fund perspective, the mix of jobs created in February likely means a higher share price for SPDR S&P Homebuilders ETF (XHB) and PowerShares Dynamic Building & Construction Portfolio ETF (PKB) are to be had while SPDR S&P Retail ETF (XRT) get left behind.

As Tematica’s Chief Investment Officer, Chris Versace, reminds his graduate students at the NJCU School of Business, the Fed has a dual mandate that focuses on the speed of the economy AND inflation. The one item that is bound to catch the Fed’s attention is wage growth, which rose even though hours worked remain unchanged in February vs. January. Per the report, “In February, average hourly earnings for all employees on private nonfarm payrolls increased by 6 cents to $26.09, following a 5-cent increase in January.”

While that wage growth likely reflects some impact from rising minimum wages, the mix shift in job creation toward higher paying jobs in mining, construction and manufacturing and away from lower-paying retail jobs was the primary driver. If we had to guess the one line item that could get some attention at the Fed, it would be the combined January-February wage growth, which equates to a 2.8 percent increase year over year – near the fastest pace of growth during the current expansion, and better than the expected 2.7 percent, but still well below the rate of growth prior to the financial crisis.

However, on a monthly basis, average hourly earnings for private-sector workers rose 0.2 percent during February, which was below expectations for 0.3 percent. If we dig a bit deeper, that 2.8 percent year-over-year growth is an overall number. Wages for nonsupervisory and production employees comprise about 80 percent of the workforce and that group saw their hourly and weekly wages rise by about 2.48 percent on a year over year basis – this group isn’t getting quite the gains that their supervisors are enjoying. Additionally, this metric is not adjusted for inflation and guess what….the most recent inflation rate as measured by the consumer price index was (drum roll) … 2.5 percent. So post-inflation, no real gains. Once we again, it pays to read more than just the headlines when deciphering a report like this.

That being said, in our view, this month Employment Report helps pave the way for the Fed to nudge interest rates higher next week. We expect financials, including shares of banks such as Wells Fargo (WFC), Bank of America (BAC) and Citigroup (C) to name a few to trade higher today and lead the market higher. It goes without saying that means Financial Select Sector SPDR Fund (XLF) shares are likely to trade higher.

As the likelihood of higher interest rates are upon us, we have to consider what the incrementally higher borrowing costs could mean to consumers that have taken on considerably more debt in 2016? Team Tematica touched on this and what it likely means in this week’s podcast. While we’ve seen decent wage growth thus far in 2017, a new study from WalletHub shows that “US consumers racked up $89.2 billion in credit card debt during 2016, pushing outstanding balances to $978.9 billion, which is roughly $3 billion below the all-time record set in 2007.” This would certainly help explain the year over year increase in multiple jobholders we talked about several paragraphs above.

For an economy whose growth is tied rather heavily to consumer spending, higher interest rates could crimp the health of that economic engine when consumers start to look at their credit card interest rates. Add in higher gas prices and odds are Cash-strapped Consumers will be with us once the euphoria of today’s February Employment Report dies down. We’ll be watching credit card transaction levels at Visa (V) and MasterCard (MA) to gauge consumer debt levels and whether average transaction sizes are shrinking.

— Tematica’s Chief Macro Strategist, Lenore Elle Hawkins contributed to this article.