Trading Trump Turning to Infrastructure Spending

One of the key tenants of President Trump’s campaign platform was to “Transform America’s crumbling infrastructure into a golden opportunity for accelerated economic growth and more rapid productivity gains.”

Given that the Society of Civil Engineers America’s cumulative GPA for infrastructure is a D+ there is much work needed to be done. It doesn’t, however, come at a small price. The Society of Civil Engineers estimates $3.6 trillion would need to be spent in the next few years to tackle the problem.

As President Trump meets with airline CEOs today, let’s look at the airports aspect of infrastructure. It received a GPA grade of D from the Society of Civil Engineers, as it encompasses several aspects including airports, air traffic control systems, aircraft and travelers. The FAA estimates that the national cost of airport congestion and delays was almost $22 billion in 2012 and is expected to rise to $34 billion in 2020 before going on to $63 billion by 2040 if current funding levels are maintained.

This needs spending meshes rather well with certain aspects of our Tooling & Re-tooling and Economic Acceleration/Deceleration investment themes. Moreover, given Trump’s background in construction, as well as his frequent complaints about US airports during the campaign, domestic infrastructure is likely to receive a helping hand under the Trump administration.

Inching that one step closer to reality yesterday, in anticipation of a major infrastructure initiative promised by President Trump, the National Governors Association forwarded a list of 428 “shovel-ready” projects to the new administration. These projects included an array of transportation, water, energy and emergency response projects. As you’ve seen us discuss in Tematica Investing, one of our investment strategies is to “buy the bullets, not the guns” as it focuses on key suppliers that serve a number of companies — a sort of spider web-like effect. In the case of infrastructure spending, this means looking past some of the actual construction companies, like Granite Construction (GVA), in favor of key material companies, like US Concrete (USCR), which is a provider of ready-mix concrete.

Pretty hard to build bridges, roads, tunnels and other aspects of infrastructure without concrete. US Concrete’s customer base includes contractors for commercial and industrial, residential, street and highway and other public works construction. Just over half of its revenue stream comes from commercial and industrial projects with just under a third from residential and the balance from street, highway and other public works. Key markets for the company include Texas, northern California and New York / New Jersey, but we’d also note the management team has been active in picking off smaller competitors in this fragmented market.

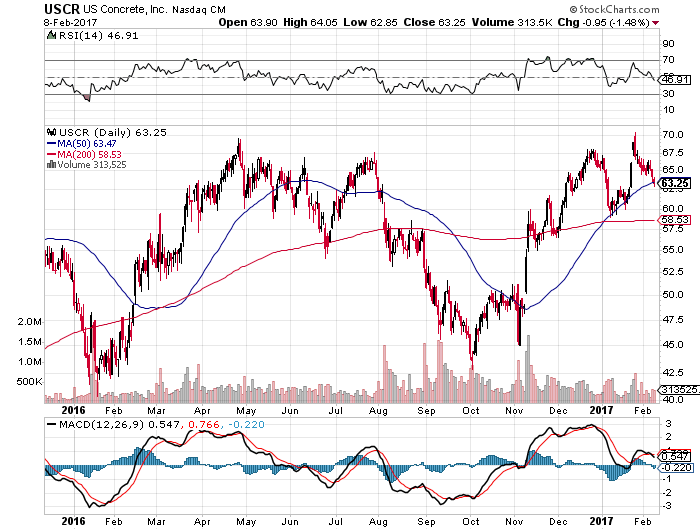

Over the last few weeks, USCR shares have drifted from $70 to $63, but with infrastructure coming back into focus as part of the new administration’s plans to kick the economy into higher gear:

- We’re adding the US Concrete (USCR) May 2017 $70 calls (USCR170519C00070000) that closed last night at $4.00 to the Tematica Pro Select List.

- We’ve selected these particular calls because not only are they among the more liquid ones for USCR shares, but the timing allows us to capture the March, April and May construction season.

- We’d be buyers of these USCR calls up to $4.50, and we’re setting a protective stop-loss at $3.00.

- Should the calls gap up today, we’ll look to revisit this trade over the coming days.

Subscribers looking for a more detailed background on US Concrete should listen to this week’s Cocktail Investing Podcast that features an interview with US Concrete CEO Bill Sandbrook. That podcast will post later this week. Be sure to do it up.

Fed Heads Talk More About the March FOMC Meeting

Last week we shared several economic data points, including the January Manufacturing PMI data from ISM and Markit Economics, that pointed to firming economic activity as well as rising prices. As we added the PowerShares DB US Dollar Bullish ETF (UUP) June 2017 $27 calls (UUP170616C00027000) to the Tematica Pro Select List, we shared our view that Fed officials are likely to begin taking up the probability of a rate hike at upcoming March FOMC meeting. It turns out we’re already starting to see that happen. Earlier this week, Philadelphia Federal Reserve Bank President Patrick Harker said an interest-rate hike should be on the table at the U.S. central bank’s next meeting in March. It’s important to note that Harker is not just any talking Fed head, he’s an actual voter when it comes to monetary policy this year.

It’s likely we see more of the same talk in the coming weeks. It’s also not lost on us that Fed Chairwoman is likely to be a lame duck under the Trump administration. While we will remain data dependent, the monetary policy winds seem to be blowing far more toward a tighter monetary policy than this time last year. We also still have those Eurozone elections coming up, and as the outcome, given what we saw here with the 2016 presidential election as well as the Super Bowl reminds us, it’s not over until it’s over.

- As such, we continue to rate the UUP June $27 calls a Buy at current levels.

- As we said when we added them last week, we’d be buyers of the calls up to 0.32, and we are setting a stop loss at 0.10.