Weekly Issue: Apple and Disney Showing Transformational Signals

Key points inside this issue

- What the March NFIB Small Business Optimism Index had to say

- Making sense of the IMF’s latest economic forecast cut

- Ahead of Disney’s (DIS) Investor Day today, we continue to have a Buy on Disney (DIS) shares, and our $125 price target is under review

- Based on its recent string of monthly same-store-sales reports and year over year progress in warehouse openings, with more to come, I am bumping our price target on Middle-Class Squeeze Leader Costco Wholesale (COST) to $260 from $250.

- Our price target on Thematic King Amazon (AMZN) shares remains $2,250.

- Our price target on Alphabet/Google (GOOGL) shares remains $1,300.

What the March NFIB Small Business Optimism Index had to say

This past Tuesday, we received the March Small Business Optimism Index reading from the National Federation of Independent Business (NFIB). The index edged higher, month over month, to 101.8. For the March quarter, the Optimism Index reading averaged 101.56, with March’s reading the highest, which was well below the March 2018 quarter’s 106.4 reading and the 105.5 level for the December 2018 quarter. Clearly, the year-ago level benefited from tax-reform euphoria and while the index has fallen in recent months, the uptrend during

Digging into the report, one of the bigger soft spots was inventories, as levels were viewed as too large and plans to invest pointed to more firms reducing rather than adding to their inventories. That’s another sign to us of potentially softer guidance relative to expectations in the upcoming earnings season.

Adding to that we also found the Outlook for General Business Conditions component, which looks at the coming six months, has softened considerably, hitting 11 in March, continuing the downtrend in the data since peaking at 35 last July. To us, this reflects that the ongoing trade war, domestic economic data and growing worries over the consumer have taken their toll.

What’s most worrisome to us, however, is the accelerating decline in small business earnings over the last two months. Survey respondents chalk this up to falling sales volume and rising costs that include labor, materials, finance, taxes and regulatory costs.

With lower tax rates and the cut in federal regulation by the Trump administration, the other three factors are the likely culprits behind the month-over-month declines in earnings the last few months. On top of that, the sales expectation for the coming three months has also softened compared to the second half of 2018.

With small business being one of the key job creation engines, these softening sales and earnings expectations could pressure hiring plans and corporate spending, adding to the headwind(s) for the domestic economy.

What’s also interesting ahead of bank earnings that kick off later this week, is the survey revelation that loan availability became harder to obtain during February and March. There was also a drop in expectations for credit in March.

Rather than relying on just one set of numbers, we here at Tematica prefer to leverage several pieces of data to get a fuller, more robust picture. In this case, however, it does mean that we’ll be on guard with bank earnings, especially from those that are outside of the bulge bracket banks — JPMorgan Chase (JPM), Citigroup (C), Bank of America (BAC) and the like. Those names tend to be far more diversified in their revenue streams and can weather the potential storm far better than smaller, regional banks, such as First Community Bankshares (FCBC), that make their profits primarily on deposit and loan volumes.

Making sense of the IMF’s latest economic forecast cut

Also, on Tuesday, the IMF lowered its 2019 World Growth Outlook to 3.3% from 3.5% in January to reflect cuts in both US and European forecasts and a modest upward revision in China. The downward revisions come as the IMF appears to be factoring the recent global economic data that we’ve been getting in recent weeks and in its view “this weakness” is expected to continue in the first half of 2019. Following on that, yesterday morning the European Central Bank (ECB), held interest rates steady and warned that recent data pointed to a “slower growth momentum” in the eurozone.

In many respects these comments were not surprising given the domestic economic and global IHS Markit data we’ve been reviewing here over the last few months. If anything, we see the IMF’s downgrade as overdue. But similar to how the Fed is a cheerleader for the domestic economy, the IMF is forecasting a global economic rebound in 2020, but then proceeds to list a series of downside risks and uncertainties, including “a rebound in Argentina and Turkey and some improvement in a set of other stressed emerging market and developing economies” and a “realization of these downside risks could dramatically worsen the outlook.”

Rather than get wrapped up in the economic forecasts of the IMF, the Fed or other entity, we’ll continue to parse the data and triangulate the data points to get as real-time a view on the domestic and global economy as possible. This includes not only the government issued economic indicators, but also those from trade associations and other third parties. Yesterday we talked on the March Small Business Optimism Index from the NFIB and what it had to say. Other indicators we’ll be watching include monthly truck tonnage data, which fell year over year in February per the American Trucking Association, and weekly rail carloads fell 8.9% year over year in March per data from the Association of American Railroads.

Late yesterday, we received the Fed’s minutes from its March FOMC monetary policy meeting. Recall that exiting the March meeting, the Fed’s post-meeting statement said it would be patient when it comes to future monetary policy actions as it downgraded its GDP forecast in 2019 and 2020. Moreover, it’s updated Economic Projections forecasted only one rate hike between March 2019 and the end of 2020. The meeting minutes confirmed this patient view was widespread across the committee. No surprise there in my view. With inflation data, as well as the vector and velocity of other recent domestic data, tipping lower, I expect the Fed is likely to remain optimistic but dovish in its forthcoming commentary and speeches, especially as the US-China trade negotiations drag on.

And here we go…. March quarter earnings season

The March quarter earnings season “fun” will start off with a trickle of earnings this week, 28 in all including several high-profile bank earnings later this week. The pace will pick up next week when roughly 170 companies will be issuing their results. The following week, which begins on April 22nd, it jumps considerably with more than 700 companies issuing their quarterly results and guidance. It is going to be fast; it is going to be furious.

As you know, over the last few weeks I’ve been increasingly vocal about the potential for a rocky stock market during this earnings season as expectations are likely to get reset for a variety of reasons including the slowing speed of the global economy, dollar headwinds, rising costs, and trade uncertainties to name a few. And let’s remember the March 2018 earnings season saw companies wrap their heads around the impact of tax reform on their collective bottom lines. That bottom-line life preserver, from a guidance perspective, has come and gone. Be sure to hold some downside protection over the next few weeks, like the ProShares Short S&P 500 ETF (SH) shares.

Tematica Investing

First Apple and today Disney

A few weeks ago, Apple (AAPL) held its special event that focused on its Services businesses, specifically the forthcoming streaming video, gaming and news services, all of which look to drive recurring subscription revenue. Today, The Walt Disney Company (DIS) will hold its annual investor meeting at which it will debut Disney+, its own streaming service. The new service from Disney will not only utilize the entire Disney and Fox entertainment library but also build on the company’s direct to consumer efforts with original programming across its Marvel, Star Wars, Pixar and other tentpole franchises.

While DIS shares have not graduated to the Thematic Leaders, they have been on the Select List since mid-2016 as part of our former Content is King investment theme, which has since been folded into the Digital Lifestyle theme. When we first learned of the Disney+ service, my view was that if success is measured by consumer adoption, it had the possibility of transforming how investors should value the company. As more details have emerged on the service, it seems that more across Wall Street have adopted that same view. Earlier this week DIS shares received an upgrade from Cowen & Company to Buy, while BMO Capital Markets raised its rating to Outperform. These moves follow a boost from Goldman Sachs and Rosenblatt Securities last week.

As we move from leaks and rumors on Disney+ to firm details with today’s event — and event that should also touch on other developments as well such as the

- Ahead of Disney’s (DIS) Investor Day today, we continue to have a Buy on Disney (DIS) shares, and our $125 price target is under review

Costco Wholesale does it again in March

Last night

The other item that I track rather closely when Costco issues these monthly reports is the number of open warehouses. Exiting March, it had 770 open warehouses, which compares to 749 exiting March 2018. That year over year increase bodes extremely well for Costco as more warehouses delivers increased high-margin membership fee revenue, which generates roughly 70% of the company’s operating income.

- Based on its recent string of monthly same-store-sales reports and year over year progress in warehouse openings, with more to come, I am bumping our price target on Middle-Class Squeeze Leader Costco Wholesale (COST) to $260 from $250.

eMarketer sees continued Digital Advertising growth ahead

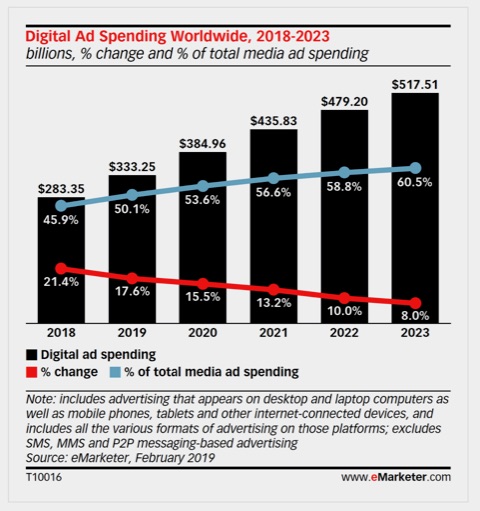

Ad spending will continue to rise across the globe, with digital driving most of the growth. According to data published by eMarketer, this year worldwide digital ad spending will rise by 17.6% to $333.25 billion, which means that, for the first time, digital will account for roughly half of the global ad market. In my view, this reflects the changing nature of where, how and when we consume content be it video, music, news or some other format that is a key part of our Digital Lifestyleinvesting theme. Advertisers want to go where the eyeballs are, and while this is a tailwind for a number of companies, the change in ad spend location is a growing headwind for “legacy” media companies. No wonder CBS (CBS), Comcast’s (CMCSA) NBC and others are looking to join the streaming video fray.

eMarketer’s forecast depicts one of the core thesis items behind our holding shares of Alphabet Inc. (GOOGL) — namely, that digital advertising will continue to take

Digging into eMarketer’s forecast, it sees Google remaining the top digital ad seller dog in 2019 with 31% market share. Behind it will be Facebook (FB) and its various properties and then Alibaba (BABA). In fourth place is Amazon, which eMarketer sees as generating $14 billion in ad revenue this year. To most companies, $14 billion would be the business, but at

We are seeing some shifting of ad spend among Google, Facebook and Amazon, with Amazon being the up and comer. That said, the digital ad spend tide is still rising, and with concerns over privacy for Facebook and others the odds are better than good that both Google and Amazon will continue to ride that tide over the next few years. Longer term, as the shift to digital advertising continues, we will see slower growth rates much like any maturing industry, but we’re far from that point today.

- Our price target on Thematic King Amazon (AMZN) shares remains $2,250.

- Our price target on Alphabet/Google (GOOGL) shares remains $1,300.