Weekly Issue: Putting on Our Apron After a Barn-Burner of a March

Key points inside this issue

- Despite a slowing global economy, the March quarter was a barn burner for stocks, but risks remain heading into the March quarter earnings season.

- Our price target on Apple (AAPL) remains $225.

- Our price target on shares of Living the Life Thematic Leader Del Frisco’s Restaurant Group (DFRG) remains $14.

- Our price target on Universal Display (OLED) shares of $150 is under review.

- We are issuing a Buy on and adding shares of Blue Apron (APRN) to the Tematica Options+ Select List, and setting a stop loss at 0.80.

- We continue to have a Sell rating on the shares of Veeco Instruments (VECO) and a short position on the Tematica Options+ Select List. Our stop price remains 13.60

Last week brought the March quarter to a close, and even though Friday’s personal income and spending data confirmed a slowing economy, it was the best quarter in nearly a decade for stocks.

The bulk of the double-digit gains across all of the major domestic stock market indices — the Dow Jones Industrial Average, S&P 500, Nasdaq Composite Index, and the Russell 2000 — came early in the quarter due to positive expectations for U.S.-China trade talks, even as the market shrugged off the federal government shutdown. As the quarter wore on, data pointed to a slowing global economy, with more pronounced weakness in China, Japan

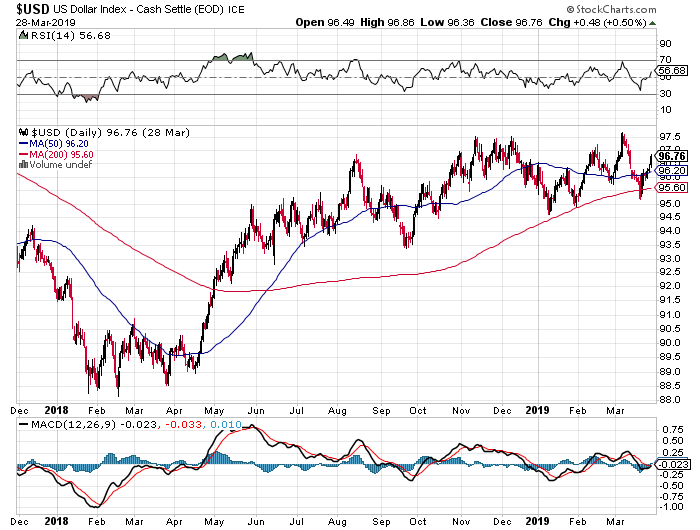

Companies are also contending with higher wage costs, due in part to minimum wage hikes, as well as certain higher input costs. And of course, there is the current trade war with China that is also presenting a headwind, as is the slowing economies in Europe and Japan, especially given the year-over-year strength in the dollar, as you can see in the chart below.

In sum, we’ve seen a number of these headwinds result in reduced earnings expectations for the current quarter, and we’re now beginning to see companies once again trim back expectations. Last Thursday night DowDuPont Inc. (DWDP) slashed its sales and profits forecasts, joining the ranks of Infineon Technologies AG (IFX), Samsung Electronics Co., Ltd., Osram

On Monday we received a slew of economic data that included the March Manufacturing PMI data for China, Japan, the eurozone and the U.S. as well as the March ISM Manufacturing Index and February Retail Sales figures. There were bright spots inside this sea of data, most notably the March ISM Manufacturing Index that surprised modestly to the upside and showed a pickup in orders and employment.

That positive report was tempered by the IHS Markit Manufacturing PMI for the U.S., which showed a month-over-month decline in March and hit its lowest level since mid- 2017. As that report noted, “New order growth has fallen close to the lows seen in the 2016 slowdown, often linked to disappointing exports, tariffs and signs of increasing caution among customers.” This trend points to continued slow growth ahead for the domestic economy, though the latest data as a whole still leave the U.S. as the fastest-growing economy compared to China, Japan and the eurozone.

As for the February Retail Sales Report, it once again missed expectations, declining 0.2% month over month. This marks the third flat to down sequential comparison for this data set in the last four months. Viewing the data on a year-over-year basis, retail sales for the month rose 2.1%, which confirms a slower but still growing U.S. economy. While we don’t want to put too sunny of a view on it, the February year- over-year comparison was ahead of the 2.0% growth pace of the trailing three months. Still, there was no question the year-over-year rate of spending in February slowed compared to January.

While we don’t want to put too sunny of a view on it, the February year- over-year comparison was ahead of the 2.0% growth pace of the trailing three months. Still, there was no question the year-over-year rate of spending in February slowed compared to January.

In my view, this looks to be setting up a volatile earnings season, with earnings guidance that is likely to disappoint and lead to downward revisions for the June quarter as companies reset expectations. We will continue to be prudent, longer-term focused investors that take our cues from our 10 investing themes and the confirming signals to be had.

Tematica Investing

As we put the March quarter in the rear-view mirror, the market will continue to look for hope in a U.S.-China trade deal but given the factors outlined above, I see greater risk to the downside, generally speaking, than upside, as we begin the March-quarter earnings season. The stalwart among them was Clean Living Leader Chipotle Mexican Grill (CMG), as its shares rose more than 60% during the first three months of the year. Digital Lifestyle Leader Netflix (NFLX) as well as New Global

The quarter wasn’t without its challenges given declines experienced at Aging of the Population Leader AMN Healthcare (AMN), but as I am seeing with my 87 year old father, the need for elder care is pronounced and bodes well for nursing demand in the coming years. We will continue to hold AMN shares. Another laggard is Dycom Industries (DY), better known as the Digital Infrastructure Leader, which is positioned to benefit from the 5G and gigabit network buildout. We’re entering the seasonally strong time of the year for Dycom, which also brings us closer to initial 5G launches from AT&T (T), Verizon (VZ), T-Mobile USA (TMUS) and others. As with AMN shares, we will continue to hold DY shares as well.

Now let’s dig into several Thematic Leaders and Select List positions that made news over the last week.

Apple’s video and gaming efforts are interesting but not in the short-term

During the March quarter, Apple’s (AAPL) shares rebounded hard, rising just over 20%. Some of that climb was due to the excitement ahead of Apple’s services focused event last week, which candidly was largely as expected given prior news leaks. Leading up to the event we saw iPad, Mac and AirPod refreshes, but the event itself focused on Apple Card, Apple News+ and AppleTV+. The one surprise was the announcement of a streaming gaming service, which like AppleTV+ will debut later this year.

As such while they are positives for the Services business, they will have little impact on the company’s bottom line near-term. That said, Canaccord Genuity upped its price target to $230 from $185 this week. The reality of the situation is that as much as we like content and Apple is looking to use it to make its devices and ecosystem even stickier with customers inside the Digital Lifestyle, in the near-term the primary driver of the company’s profits will continue to be the iPhone.

- Our price target on Apple (AAPL) remains $225. A key point to that target is the eventual upgrade cycle tied to 5G and the iPhone, which given our Dycom comments above, increasingly looks like it will happen in the second half of 2020.

Frustrated with Del Frisco’s Restaurant Group, but holding steady

If you’re growing frustrated with this Thematic Leader, you are not alone. During the March quarter, DFRG shares fell roughly 10%, but the inter quarter swing was far greater than that. What’s weighing on the shares is lack of news on the company’s strategic review process. Per some reports, the company could be cleaved into two parts to different buyers, which if true would explain the pronounced timetable.

From a fundamental perspective, while overall restaurant traffic and other metrics fell in February according to data published by TDN2K, the bulk of that decline was at fast casual restaurants, to which we have no exposure. Digging into the data, we find fine dining was the best-performing industry segment during February for same-store sales growth. While I like such confirming data, as I noted above the DFRG share price will continue to be driven by any and all strategic review developments. This will continue to be our point of focus for now.

Our plan is to hold DFRG as the takeout story evolves further, but as we have said previously, odds are we will use a deal- related pop in the stock to exit the position.

- Our price target on shares of Living the Life Thematic Leader Del Frisco’s Restaurant Group (DFRG) remains $14.

Universal Display should continue to shine

Universal Display (OLED) shares shined bright during the first quarter rising easily more than 50%. Yesterday, there

These same reports also suggest Apple will have three different- size iPhones, measuring 5.42 inches, 6.06 inches

We’d also note the timing of these models and the display transition seem to coincide with the potential debut of a 5G iPhone. In light of the incremental RF chips the 5G model will contain, it makes sense that Apple would look to adopt this display technology for both

While we like seeing our investment thesis confirmed here, I’d note that not only have OLED shares climbed substantially over the last three months, but the transition to all organic light-emitting diode displays at Apple, and most likely others, is several quarters out. We will continue to be long- term investors in OLED shares. However, given market conditions and the upcoming earning season we could see OLED shares give some of its gains back in the near-term. We’ll continue to focus on the long-term opportunity not only in the smartphone market but in automotive and eventually the general illumination market.

- Our price target on Universal Display (OLED) shares of $150 is under review.

Tematica Options+

Jumping on Blue Apron shares for the Oprah trade

Normally at Tematica Options+ we’re using call options and other strategies, such as shorting shares, to drive superior returns. As we know, the more aggressive the play, the greater the risk. From time to time, there are opportunities to be had in the “basic” equity shares of a company, particulary when the share price is so low it’s akin to buying a call option.

That brings us to the shares of meal kit company Blue Apron (APRN), which I’ve been critical of in the past for a number of reasons. But from time to time, a trade can be had and such an opportunity looks to be rearing its head with APRN shares.

In December, Blue Apron inked a partnership with Weight Watchers International Inc. (WTWW), the company that these days

So why now?

Following a soft start to 2019 that led Weight Watchers shares to plunge more than 35% during the March quarter, WW is set to unveil a new “It Works” campaign featuring Oprah chatting with other WW members to congratulate them on their weight loss. In addition to featuring Winfrey, the campaign will reposition WW as a health and wellness company rather than one focused on dieting. To us, that means WW is looking to tap into our Clean Living investment theme.

In my view, this could cast Blue Apron in a new light and boost demand for its kits in light of the partnership with WW. Current expectations for Blue Apron are low, which means any modest surprise to the upside has the potential to goose the shares back to January levels.

As we add APRN shares to our trading book, we’ll set a stop loss at 0.80, and look to move it higher as the shares do the same.

- We are issuing a Buy on and adding shares of Blue Apron (APRN) to the Tematica Options+ Select List, and setting a stop loss at 0.80.

Infineon’s guidance cut affirms our short view on Veeco shares

Amid the recent, German lighting company Osram broke the news that its March quarter would miss expectations and cut its 2019 guidance. The reasons were market weakness in the automotive industry, general lighting and mobile devices that led to an inventory build, especially in China.

Here’s the thing, Osram’s prior guidance banked on new orders for the second half of the year picking up significantly. Now it seems that’s no longer being anticipated.

Given the inventory glut, there is a far greater probability that demand for the machines that manufacture

- We continue to have a Sell rating on the shares of Veeco Instruments (VECO) and a short position on the Tematic Options+ Select List. Our stop price remains 13.60