WEEKLY WRAP: Is the Best of This Business Cycle Behind Us?

The week started off optimistically on Monday as the markets enjoyed a late-day rally, paring earlier losses as the S&P 500 managed to close slightly in the black. The energy sector was the winner of the day, while technology was the weakest, dragged down by the semiconductors, Apple and Apple suppliers. Perhaps Tim Cook ought to send Wonder Woman Gal Gadota basket of muffins at the very least for her attempt to help the company this week, inadvertent as it may have been. The Energy Select Sector SPDR (XLE) has broken out of the $66-$69 trading range that had persisted since early February, closing at just shy of $75 by Thursday’s close.

Monday the US Dollar closed at its highest level since mid-January and hasn’t looked back, breaking out of the trading range that had persisted for most of the year, rising well above its 50-day moving average with the 200-day within striking distance by Thursday’s close. While the greenback had been rather directionless over the past few months despite rising treasury yields, it looks to be finally catching up. The PowerShares DB Dollar Index ETF (UUP) has risen above its 200-day moving average for the first time in a year. A breakout for the dollar to the upside would be a significant headwind to the S&P 500 in the coming months as a stronger dollar would hurt exports. Conversely, it would be a boon for the smaller cap, Russell 2000.

Tuesday looked like a solid day in the pre-market action but ended up being a rough one as the 10-year Treasury yield reached over 3% for the first time in four years during intra-day trading, closing the day just below. The U.S. is not the only nation seeing rising rates, with the U.K., Germany and Japan as seeing rates moving higher. Caterpillar (CAT) started the day off strong after reporting both revenue and EPS results that beat expectations and raised guidance. Shares were up as much as 5% in the morning, which would have you thinking, “Pop open the Bollinger,” but then the CFO mentioned that they are thinking this might be peak earnings for the cycle. I’m thinking the post-earnings call debrief might have gotten a little testy in the C suite given shares traded in a range of over 11%, closing right around the lows of down 5.8%. The market has become so jittery that other industrials also took it on the chin after the CFO’s remarks, Deere and Co (DE) falling nearly 5.5% and Cummins (CMI) dropping over 4.5%.

The Technology sector was hit hard on Tuesday by Alphabet (GOOGL) shares which fell almost 5% despite a strong earnings report. Most of the major U.S. equity indices were heading towards a test of their 200-day moving average.

Despite the 10-year Treasury closing at a yield over 3% on Wednesday for the first time since 2014, the Dow Jones Industrial Average and the S&P 500 managed to eke out slight gains as the S&P 500 bounced off its 200-day moving average for the third time since February. The Nasdaq and Russell 2000 couldn’t quite get the motivation to move out of the red for the day.

By Thursday’s close most sectors remained in the red for the prior five trading days, with Industrials down the most (-3.4%) and only 4 sectors in the green (slightly). Energy was the strongest performer, up +1.3%, with the next strongest Utilities, up +0.9%. The Dow Jones Industrial Average, the S&P 500 and the Nasdaq all closed higher on Thursday, with the Nasdaq ending its five-day losing streak thanks to better-than-expected results from Facebook (FB) that drove the share price up 9.6%. The Dow closed above its 200-day moving average thanks to Visa (V), up 5.0% on strong earnings results that pushed the stock price to new all-time highs.

Friday saw Amazon (AMZN) deliver solid results with Q1 sales rising 43% year-over-year as well as solid EPS of $3.27 versus expectations for $1.25, which pushed shares up over 7% in early trading to new all-time highs. Equity markets began the day modestly in positive territory despite the better than expected GDP numbers.

The Economy

Monday’s economic data was a mixed bag. Existing home sales beat estimates, coming in at a 5.6 million seasonally adjusted annual rate versus expectations for 5.55m and prior reading of 5.54m. Absolute inventory levels and inventory levels as a percent of sales remain near the lowest levels on record. The Chicago Fed’s National Activity Index came in weaker than expected at 0.10 versus 0.28 expected. While February’s numbers were revised higher, the quarterly average for the index is slowing. On the plus side, Markit’s Flash Manufacturing PMI for the U.S. reached the highest level since September of 2014 in April.

Tuesday Richmond Fed Manufacturing Composite Index for March dropped to -3 from February’s +15 versus expectations for 16. The report showed broad declines for the month, with current shipments, new orders, a backlog of business, capacity utilization and local business conditions all flipping from expansion to contraction. Expected readings 6-months out was even worse, with nearly every category declining – overall a brutal report. On the plus side for the day, Case-Shiller home prices rose again, up 6.3% versus a year-ago with the 20-city composite rising 6.7% year-over-year. Overall the national price index is 8.2% above the 2007 peak and 11 of the 20 cities are above their prior cycle highs with 10 of 20 at new all-time highs. Perhaps rising home prices helped push the Conference Board Consumer Confidence reading up to 128.7 versus expectations for 126. The net percentage of consumers expecting income growth hit the highest level since 2001.

Wednesday brought initial jobless claims well below expectations, falling to their lowest level in 49 years. March’s durable goods came in above expectations, with the headline number at a gain of 2.6% versus expectations for 1.7%.

Thursday the US Census released preliminary durable goods manufacturing data, which supported the weaker data reported by the Richmond Fed on Tuesday. While new orders were strong, with total durable goods order up 2.6% month-over-month, ahead of forecasts for 1.6%, nondefense capital goods shipments were down 0.7% month-over-month, the worst since May 2016 for a metric that is widely considered the best indicator for business capital spending. The 3-month/3-month annualized rate dropped to 4.1%, the weakest since December of 2016 and a big drop from the roughly 15% rate in October 2017. To really rub it in, capital spending plans from regional Fed manufacturing surveys are also falling: the three we have so far, Empire, Philadelphia and Richmond, have seen a sharp decline in the next 6 months for the capital expenditure category.

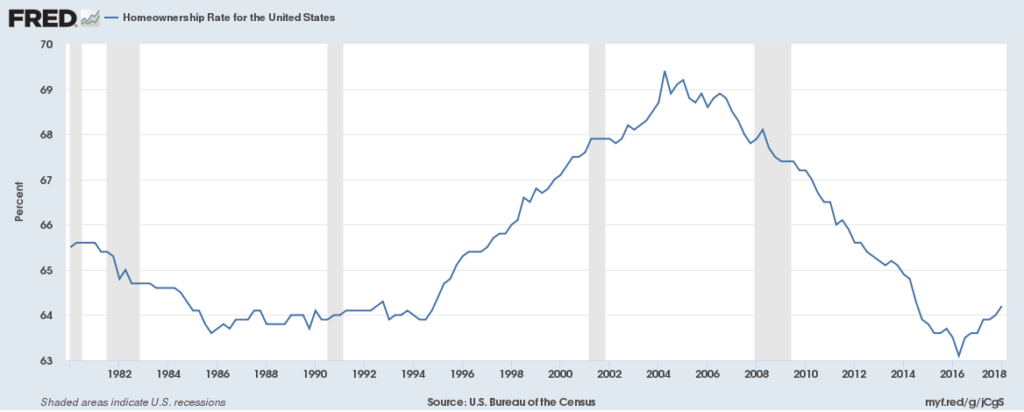

Thursday also brought data on quarterly home ownership rate, which has risen to 64.2% from its lowest level on record back in Q2 2016. The current rate is more in line with the normal levels seen in the 1980s to mid-1990s, before various policies pushed for higher and higher rates of home ownership, which ended so very well in the Great Recession.

Friday’s first estimate for GDP growth for the first quarter came in slightly better than expected at 2.3%, versus consensus estimates for 2.0%, but down from the 2.9% rate in the final months of 2017 and the slowest pace since Q1 of 2017. Let’s remember that 1Q 2018 figure, while a beat relative to the 1.8%-2.0% GDP forecasts for the quarter, was far lower than the initial forecasts for nearly 5.5%that were put forth back in February. Digging into the details, consumer spending was the weakest in more than four years, up only 1.1% following an increase of 4% in the prior quarter, which was skewed by forced spending thanks to the twin hurricanes in the South and fires in the West. Consumers spent less on food and drink and acquired fewer cars and less new clothes during the winter months. On the other end of the spectrum, the core Personal Consumption Expenditures price index, which excludes food and fuel prices due to their high volatility, saw its biggest increase in over 10 year, up 2.5%. The Labor Department’s Employment Cost Index was also release Friday, revealing accelerating wage growth with the year-over-year increase in private sector wages and salaries rising 2.9%

Earnings Season

Earnings so far this season have been quite strong, with an EPS beat rate at around 76.7% so far. Stock prices are initially moving up on the positive results but are often coming under serious pressure throughout the remainder of the reporting trading day. Perhaps the fact that earnings are by definition backward looking has something to do with this, and perhaps Caterpillar’s CFO is on to something. I say this because 3M (MMM) reduced its 2018 outlook and Lockheed Martin’s (LMT) raised outlook included almost all key metrics for the company save the closely watch operating cash flow line. PepsiCo (PEP:NYSE) shared that every one of its businesses was hit by cost inflation in 1Q 2018 due to higher raw-material input prices. Hershey (HSY:NYSE) echoed those comments as its gross margins came in below expectations due to a combination of higher input and freight/logistics costs.

While the later comments are likely to stir the drums of inflation hawks, I’d like to point out that looking at history, strong earnings results do not assure a strong economy going forward. In fact, many times in the past, S&P 500 companies have often delivered strong EPS results just before a recession:

Quarter Results What came next

2007 Q1 +14.0% Recession December 2007 – June 2009

2000 Q3 +15% Recession March 2001 – November 2001

1980 Q1 +12% Recession January 2000 – July 1980

1973 Q2 +27% Recession November 1973 – March 1975

The bottom line for this week is while earnings have been pretty fantastic, they are backward looking and many are starting to wonder if the best is behind us for this cycle, including the CFO of Caterpillar. Investors are not responding positively to earnings strength, as the average stock (as of the end of last week) has traded down over 0.8% from the open of the earnings reporting trading day, despite an earnings beat rate that has so far been the best since the turn of the century – talk about a “What have you done for me lately?” market mood. The employment situation is unlikely to get a whole lot better with unemployment at a near 50-year lows and structural changes in the American economy are limiting wage gain, which we will discuss in more detail in the coming weeks.

Looking ahead to next week, we will be closing the books on April and will have data coming in for March on Personal Income and Spending, Construction Spending and Factory Orders as well as data for April on the ISM Index, Auto and Truck Sales, ISM Services and the Employment Report. Next week we will also get March quarter earnings reports from the likes of McDonald’s (MCD) and Yum! Brands, Apple (AAPL), MasterCard (MA), Skyworks (SWKS), and Ferrari (RACE). What makes the week’s data stream a little more interesting is the Fed’s next FOMC rate decision lands during all of it. That’s right, Wednesday May 2, is the day and given the inflation-related comments above, I have a pretty strong feeling what the market will be focused on Wednesday at 2:15 PM ET.